While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

August 26, 2016

Fiat Lux

Featured Trade:

(EMERGING MARKETS ARE BACK!),

(EEM), (ELD), (CEW), (TLT),

(TESTIMONIAL),

(CHINA?S LONG AND WINDING ROAD),

(FSLR), (YGE)

iShares MSCI Emerging Markets (EEM)

WisdomTree Emerging Markets Lcl Dbt ETF (ELD)

WisdomTree Emerging Currency Strat ETF (CEW)

iShares 20+ Year Treasury Bond (TLT)

First Solar, Inc. (FSLR)

Yingli Green Energy Holding Co. Ltd. (YGE)

Boy, did we have a great run in emerging markets during the 2000s!

A global commodity boom caused many of these markets to rise tenfold or more.

Go back to the earliest newsletters published by the Diary of a Mad Hedge Fund Trader in 2008, and you will find them chock full of recommendations to buy hard assets, emerging market ETFs, debt, and currencies.

As former colonies, many of these countries still base their economies on production of the precious and base metals, energy, and foodstuffs they once supplied the motherland.

And as a former correspondent for The Economist magazine covering this territory, I knew them well.

Then in 2011, the party abruptly ended, and a vicious five-year bear market ensued.

Oil peaked first, eventually nosediving some 82.5%, from $149 to $26.

Remember Dr. Copper, the only commodity with a PhD in economics? He gave up 57.9%.

And gold, that ultimate store of value for Armageddonists and conspiracy theorists everywhere? It plunged by 48.2%.

There are still a lot of unhappy American gold eagles sitting in bank deposit boxes around the country gathering dust, thanks to those ridiculous theories.

It didn?t help that a raging bull market in developed market government bonds sucked even more money out of these beleaguered countries.

The Emerging market debt ETF (ELD), collapsed by 32%. The emerging market currency ETF (CEW) dropped by 35.5%.

My long-term subscribers can already see where this is going.

The wonderful thing about all of these cross asset class declines is that they have a leveraged effect on each other.

So while the ishares MSCI Emerging Market ETF (EEM) fell by 38.9%, in dollar terms it declined by more than half.

Then a funny thing happened during the second week of January 2016.

Gold took off like a rocket.

It was closely followed by silver, oil copper, palladium, platinum, and iron ore. Only the ags failed to participate.

The bull market was back!

Portfolio managers were given a simple choice.

Should they chase developed market assets trading at all time highs with yields approaching zero. Or should they load up on emerging assets at decade lows with yields approaching 12%?

Yields that high can cover up a lot of mistakes and preserve principal.

If you voted for the latter, you deserve a brass ring.

Here we are some eight months later, and the emerging bull market is alive and well. In fact, it is about to take another substantial new leg upwards.

My money is on emerging market handily beating the major US stock indexes for the rest of 2016.

The reasons for this are many and complex.

For a start, the iShares MSCI Emerging Market ETF (EEM) is still cheap.

It has to rise by 21.6% just to get back up to its 2011 highs. As a laggard play, it is beyond reproach.

In emerging market debt, the positive carry is enormous.

The Wisdom Tree Emerging Market Local Debt Fund (ELD) is yielding 5.46%, some 390 basis points high than the ten year Treasury bond (TLT).

And if you want to go with individual rifle shots in single countries, you can earn as much as 11.90% in Brazil.

The ?lower for longer? philosophy of the Fed just shines a giant great spotlight on this paper.

And guess what happened while you weren?t looking?

Emerging market debt has ?emerged.?

Five years of balance sheet repair means their credit quality has improved.

Local credit markets have grown up too.

Once dominated by huge inflows and outflows from foreign investors, markets are now much more in balance, thanks to the rise of? local institutional investors and pension funds.

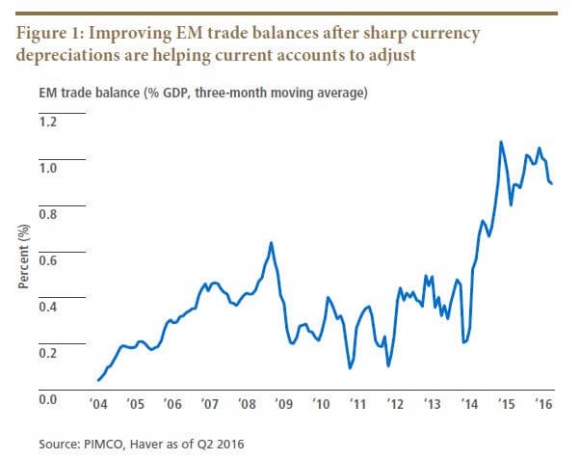

The fundamentals of these countries have been steadily improving.

Falling currencies gave them a competitive advantage that allowed? trade surpluses to dramatically improve.

Political stability is improving. During my journalist days, you used to be able to count on one good coup d??tat or revolution in the area a year. No more.

Many business friendly, pro trade governments have come into power, such as in Argentina, India and Peru.

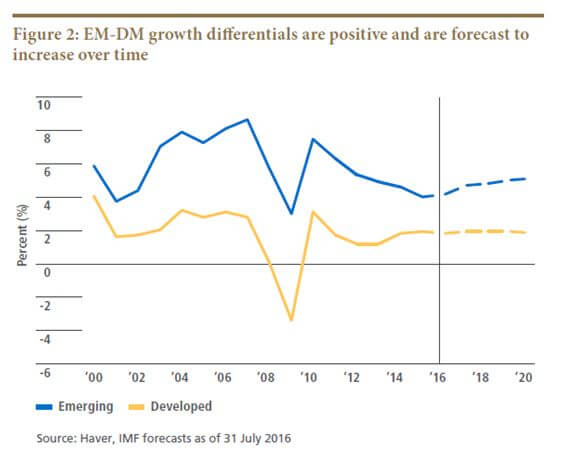

Emerging market GDP growth rates are still double those found in developed markets.

Markets themselves are improving. Spreads for stocks and bonds are now much tighter in emerging markets and liquidity has improved. They are ?roach motel? markets no more, where you can check in, but you can?t check out.

Get this one right, and the cross asset class hockey stick effect we saw on the downside will work just as well on the upside.

In short, there is a lot more to the emerging market dollar than there used to be. It is just a matter of time before financial markets figure this out.

Looking for the Next Bull Market

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

August 25, 2016

Fiat Lux

Featured Trade:

(MAD OPTIONS TRADER DELIVERS A 214.71% PROFIT IN 27 MONTHS),

(WHY I SOLD SHORT THE EURO),

(FXE), (EUO), (TLT), (TBT), (SPY),

(TAKING A BITE OUT OF STEALTH INFLATION)

CurrencyShares Euro ETF (FXE)

ProShares UltraShort Euro (EUO)

iShares 20+ Year Treasury Bond (TLT)

ProShares UltraShort 20+ Year Treasury (TBT)

SPDR S&P 500 ETF (SPY)

I have recently heard from several subscribers of my new Mad Options Trader (MOT) service that they have earned enough in their first three weeks to cover it's cost FOR THE NEXT SEVERAL YEARS!

?Whiz?, who runs MOT for me, has certainly had a hot hand, with almost every trade turning immediately profitable.

At the request of several members, I have therefore conducted an audit of the long term trading performance of the Mad Options Trader.

The numbers blew my mind.

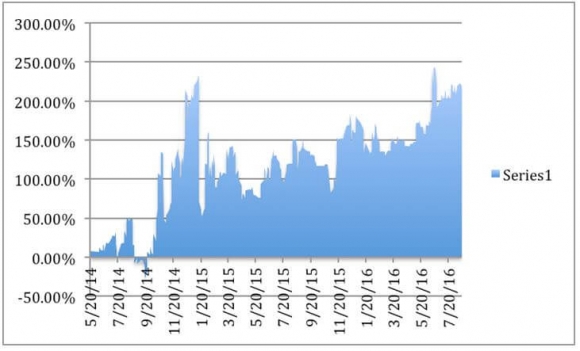

Since May 20, 2014, the Mad Options Trader has delivered A STUNNING 214.71% PROFIT, net of fees.

This is during a period when the overall market performance was essentially zero.

That is far better than my own numbers, but then ?Whiz? is much more aggressive and using more leverage over a shorter time frame than I am.

Chalk my cautiousness up to my advanced age. I am too old to start over again as a junior trader at Morgan Stanley, as if they would have me back.

Still, you now have your choice of winners, Mad Options Trader up +214.71% in 27 months, or Mad Hedge Fund Trader up +201.65% in 69 months.

You are spoiled for choice. It doesn?t get any better than that in the trading world.

I take great pleasure in pointing out that Whiz and I provide the only trade mentoring services that publish audited performance on a daily basis.

NONE OF THE OTHERS DO BECAUSE THEY ALL LOSE MONEY!

Believe me, if they HAD decent performance to report, it would be in your inbox every morning. Their silence speaks volumes.

I should take this opportunity to remind you that your free subscription to the Mad Options Trader expires in only one week, on August 31.

After that, the service will only be available as a $1,500 upgrade to your existing Mad Hedge Fund Trader service.

Nancy is taking orders now. You can email her directly with your request at support@madhedgefundtrader.com.

SPECIAL NOTE: Because of the urgency and frequency of the Mad Options Trader Alerts, you absolutely MUST sign up for our text message service.

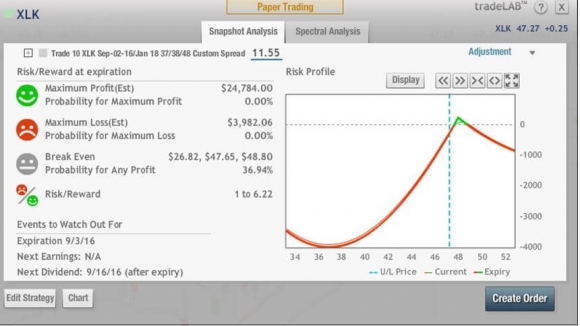

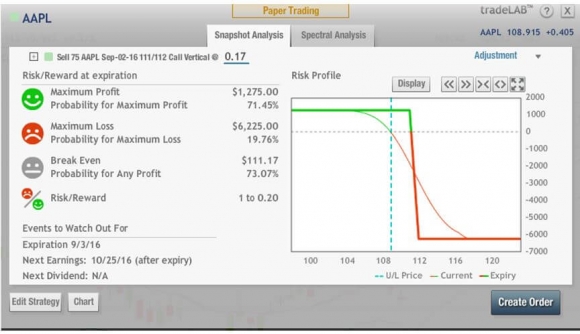

For risk profiles of some of MOT?s recent trades, please see the charts below.

The ?Mad Options Trader service focuses primarily on the weekly US equity options expirations, with the goal of making profits at all times.

The trading will take place in the S&P 500 (SPX), major industry ETF?s like the Financials Select Sector (XLF), and large capitalized single names, such as Facebook (FB), JP Morgan Chase & Co. (JPM), and Apple (AAPL).

Matt is my old friend and fellow comrade in arms of Top Gun Options, one of the best performing trade mentoring outfits in the industry.

Matt?s performance works out to an eye-popping average of 7.92% a month, and annualizes out to an incredible 95.11% a year.

Matt, a native of New Jersey, joined the Navy straight out of college, and rose to become an F-18/A fighter pilot. He attended the famed Top Gun school in Coronado, California. During the second Iraq War, Matt flew 44 combat missions.

Matt left the service in 2006, and immediately entered the hedge fund industry. A rapid series of promotions eventually took him to Peak6 Investments, L.P., a prominent Chicago hedge fund.

There, he soaked up the most crucial elements of technical market timing, fundamental name selection, risk control, and options trade execution.

These are the multiple skills that have enabled Matt to post such a blockbuster performance.

Matt, known to his friends by his old pilot handle of ?Whiz?, is an incredibly valuable addition to the Mad Hedge Fund Trader team. I have appointed him Head of Options Trading.

I have known for some time that fortunes were being made in the weekly options expirations, where stories of tenfold returns are not unheard of. It is a strategy that is perfectly suited to these highly volatile, uncertain times, with most options positions expiring within four days.

Matt allows us to fill that gap in our product offerings.

The Mad Options Trader provides essential support for the active trader and will include:

1) Instant Trade Alerts texted at key technical levels. Alerts will be sent out on the opening and closing of every filled position.

2) Weekly Market Strategy Webinars held every Monday at 1:00 to 1:30 PM ET to give you a head?s up on the week ahead.

3) A weekly Live Trading Room held every Tuesday from 9:00 to 10:30 AM ET to give followers active real time trading experience.

4) Specialized Training Webinars on how to best execute Matt?s trades.

What I love about Matt is that he eats his own cooking.

Many of the Trade Alerts he recommends are executed in his own personal retirement account with real dollars.

From September 1, The Mad Options Trader will be available as a $1,500 per year upgrade to The Diary of the Mad Hedge Fund Trader or Global Trading Dispatch, the core research and trade mentoring service of the Mad Hedge Fund Trader.

Good Luck and Good Trading,

John Thomas

Publisher and CEO of The Mad Hedge Fund Trader

?I Only Hire the Best Talent

Sometimes during the heat of battle, I am unable to send out Trade Alert Updates, giving the logic behind my positions.

Yesterday was one of those days.

In rapid succession, I knocked out short positions in the Euro (FXE), (EUO), US Treasury bonds (TLT), (TBT), and the S&P 500 (SPY), (SH), (SDS). I would have bought the (VXX) if I?d had more time.

All three positions are making money today, the Euro hugely so.

I think the fix is in. Fed vice chairman Stanley Fischer showed his hand a couple of days ago, when he remarked about the Fed?s economic targets needed for a rate rise drawing near.

Fed speakers will talk up the chance of an interest rate rise all the way until their September 20-21 Federal Open Market Committee (FOMC) meeting. They will then do absolutely nothing.

By then, all of our positions should have expired at their maximum profit point.

So until then, you can expect the entire yield play space to trade sideways best case, or get battered worst case. That?s all we need for this position to work. Today, they are getting battered.

Higher interest rates are great news for the US dollar and terrible for all other currencies.

Interest rate differentials are far and away the largest driver of foreign exchange markets. It sets up a great carry trade whereby traders can short Euros against the greenback and earn a large positive spread.

In the meantime, Europe will continue to signal that their rates will stay lower for longer.

Their economy is far too feeble to do otherwise. Now the Euro strength of the past two months is substantially eating into their exports.

Rising dollar : falling Euro sounds like a trade to me.

The same logic applies to the (SPY) and (TLT) trades, both of which will be damaged by rising rates.

In addition, the technical outlook for the Euro looks particularly dire. Look at the charts below, and you see a head and shoulders top within another head and shoulders top.

Not good, not good.

A dive below $1.10 for the Euro is a chip shot and is already well underway. A break below $1.00 is possible, but not until 2017.

I just thought you?d like to know.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.