When I first arrived in Japan in 1974, international investors widely expected the country to collapse, a casualty of the overnight quadrupling of oil prices from $3 per barrel to $12, and the global recession that followed.

Japanese borrowers were only able to tap foreign debt markets by paying a 200 basis point premium to the market, a condition that came to be known as ?Japan Rates.?

Hedge fund manager, Kyle Bass, says that the despised Japan rates are about to return. There is nothing less than one quadrillion yen of public debt in Japan today.

A perennial trade surplus powered high corporate and personal savings rates during the eighties and nineties, allowing these agencies to sell their debt entirely to domestic, mostly captive investors.

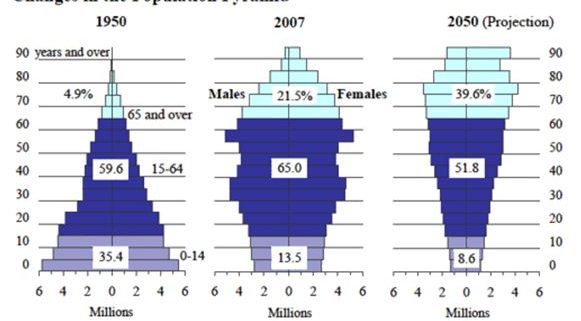

Those days are coming to a close. The problem is that the working age population in Japan has peakedd, and the country is entering a long demographic nightmare (see population pyramids below).

This year, the Ministry of Finance will see ?40 trillion in receivables, the same figure seen in 1985, against ?97 trillion in spending. Interest expense, debt service, and social security spending alone exceed receivables.

The tipping point is close, and when it hits, Japan will have to borrow from abroad in size. Foreign investors all too aware of this distressed income statement will almost certainly demand big risk premiums, possibly several hundred basis points. That?s when the sushi hits the fan.

To top it all, no one in living memory in Japan has ever lost money in the JGB market, so expectations are unsustainably high.

Both the JGB market and the yen can only collapse in the face of these developments. I know that the short JGB trade has killed off more hedge fund managers than all the irate former investors and divorce lawyers in the world combined.

But what Kyle says makes too much sense and the day of reckoning for this long despised financial instrument may be upon us. How much downside risk can there be in shorting a ten-year coupon of negative -0.11%?

Is Kyle trying to show us the writing on the wall?