As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

May 19, 2016

Fiat Lux

Featured Trade:

(10 REASONS WHY STOCKS ARE ABOUT TO ROLL OVER),

(SPY), (QQQ), (IWM), (VIX),

(TESTIMONIAL),

(WELCOME TO THE DEFLATIONARY CENTURY),

(TLT), (TBT)

SPDR S&P 500 ETF (SPY)

PowerShares QQQ ETF (QQQ)

iShares Russell 2000 (IWM)

VOLATILITY S&P 500 (^VIX)

iShares 20+ Year Treasury Bond (TLT)

ProShares UltraShort 20+ Year Treasury (TBT)

I hate to be a Debbie Downer here, but the writing on the wall couldn?t be more clear.

The Fed minutes, released at 2:00 PM this afternoon, greatly increased the probability of a Fed rate rise in June. That set the cat among the pigeons.

Higher interest rates are terrible news for stocks, except the long-suffering financials.

It focused a great, bright spotlight on the many reasons shares should go down, including:

1) Talk of an interest rate hike from my former Berkeley economics professor, Federal Reserve Chairman Janet Yellen, is ramping up. If they pull the trigger, you can chop 10% off of the stock market in a week. Yes, central banks DO make mistakes.

2) Corporate earnings are falling. Look no further than the disaster that are retail stocks (M), (TGT), (JCP).

3) At 19 times 2016 earnings, stocks are at decade highs in terms of valuations. Fear of heights anyone. Don the oxygen masks!

4) The calendar is hugely negative. No one ever makes fast money investing in May. Buy stocks today, and you may not break even until next year. Try explaining that one to your boss, your investors, and your next executive outplacement professional.

5) A monster rally in the bond market is predicting an imminent ?RISK OFF? move in global risk assets. Try whistling past the graveyard.

6) So is the near straight line rally in gold stocks (ABX), (GDX), (GLD).

7) Only a rare coincidence of global supply disruptions, like in Canada, Iraq, Libya, Nigeria, and Venezuela, has gotten oil up this high. When production comes back on stream, watch Texas tea roll over to test new lows, taking stocks with it.

8) If England leaves the European Community after its June 23 ?Brexit? referendum, you can kiss the global economy goodbye, including ours. Last time I checked, the polls were 43% to 42% in favor of staying, far too close for comfort. Book that European vacation now before the continent implodes.

9) Turn on the TV or open your Twitter account and you get a hand grenade thrown at you from a presidential candidate. Stocks would rather hide out in a bomb proof bunker.

10) According to my vintage Rolex wristwatch, this bull market is seven years, two months, nine days, four hours, three minutes and 47 seconds old. Sounds pretty geriatric to me.

Watch Out! They Bite!

My husband wanted me to tell you that, as a retired Marine, he understands completely. ?The more you sweat in training, the less you bleed in war. ?Gratefully, for us, you have done a lot of sweating over the years! ?

Cheryl

Oregon

Ignore the lessons of history, and the cost to your portfolio will be great. Especially if you are a bond trader!

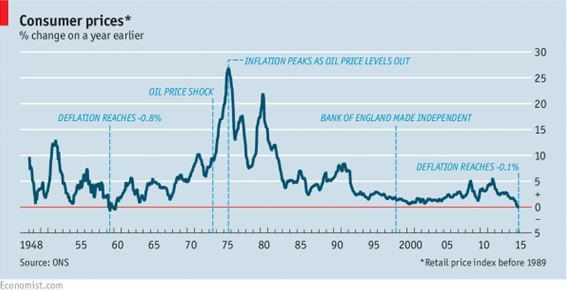

In Britain they celebrated something unusual last year. The government reported the first year on year decline in consumer prices in 54 years (see chart below).

In fact, prices for the things they buy day to day were 0.1% lower than they were 12 months before.

Meet deflation, up front and ugly.

If you looked at a chart for data from the United States, they would not be much different, where consumer prices are showing a feeble 0.4% YOY price gain. This is miles away from the Federal Reserve?s own 2% annual inflation target.

We are not just having a deflationary year or decade. We may be having a deflationary century.

If so, it will not be the first one.

The 19th century saw continuously falling prices as well. Read the financial history of the United States, and it is beset with continuous stock market crashes, economic crisis, and liquidity shortages.

The union movement sprung largely from the need to put a break on falling wages created by perennial labor oversupply and sub living wages.

Enjoy riding the New York subway? Workers paid 10 cents an hour built it 120 years ago. It couldn?t be constructed today, as other more modern cities have discovered. The cost would be wildly prohibitive.

The causes of 19th century price collapse were easy to discern. A technology boom sparked an industrial revolution that reduced the labor content of end products by ten to hundredfold.

Instead of employing a 100 women for a day to make 100 spools of thread, a single man operating a machine could do the job in an hour.

The dramatic productivity gains swept through then developing economies like a hurricane. The jump from steam to electric power during the last quarter of the century took manufacturing gains a quantum leap forward.

If any of this sounds familiar, it is because we are now seeing a repeat of the exact same impact of accelerating technology. Machines and software are replacing human workers faster than their ability to retrain for new professions.

This is why there has been no net gain in middle class wages for the past 30 years. It is the cause of the structural high U-6 ?discouraged workers? employment rate, as well as the millions of millennials still living in parents? basements.

Instead of steam and electric power, it is now the internet, cheap computing power, global broadband, and software that is swelling the ranks of the jobless.

What?s more, technology gains are now going hyperbolic to a degree never seen before in civilization.

To the above add the huge advances now being made in healthcare, biotechnology, genetic engineering, DNA based computing, and big data solutions to problems.

If all the diseases in the world were wiped out, a probability within 30 years, how many jobs would that destroy?

Probably tens of millions.

So the deflation that we have been suffering in recent years isn?t likely to end any time soon. In fact, it is just getting started.

Why am I interested in this issue? Of course, I always enjoy analyzing and predicting the far future, using the unfolding of the last half century as my guide. Then I have to live long enough to see if I?m right.

I did nail the rise of eight track tapes over six track ones, the victory of VHS over Betamax, the ascendance of Microsoft operating systems over OS2, and then the conquest of Apple over Microsoft. So I have a pretty good track record on this front.

For bond traders especially, there are far reaching consequences of a deflationary century. It means that there will be no bond market crash, as many are predicting, just a slow grind up in long term interest rates instead.

Amazingly the top in rates in the coming cycle may only reach the bottom of past cycles, around 3% for ten-year Treasury bonds (TLT), (TBT).

The soonest that we could possibly see real wage rises will be when a generational demographic labor shortage kicks in during the 2020?s. That could be a decade off.

I say this not as a casual observer, but as a trader who is constantly active in an entire range of debt instruments.

So the bottom line here is that there is additional room for bond prices to fall and yields to rise. But not by that much, given historical comparisons. Think of singles, not home runs.

It really will be just a trade. Thought you?d like to know.

Try This at Your Peril

Try This at Your Peril

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.