While the Global Trading Dispatch focuses on investment over a one week to six-month time frame, Mad Options Trader, provided by Matt Buckley, will focus primarily on the weekly US equity options expirations, with the goal of making profits at all times. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

January 29, 2018

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or RELIVING 1918),

(SPY), (GLD), (NEM), (TLT), (FCX), (BAC), (CAT),

(THE BIPOLAR ECONOMY),

(TESTIMONIAL)

Boy I never thought I’d relive 1918 again. We get both a bull market AND a flu epidemic.

The extent of the plague out here in California is nothing less than of Biblical proportions. Whole school districts are shutting down, people aren’t showing up for meetings, and daily newsletters are arriving at half their normal length, or not at all.

Over 100 have died from the flu in the Golden State, but not me! I guess I’m just too mean to die. The virus just lands on me and shrivels away from neglect.

Some $33.2 billion poured into equity funds the previous week, an all-time high. Party while you can, for it’s the next generation that’s going to have to pay the bill.

The markets are increasingly resembling the final melt up of the Dotcom boom, and we all remember how that one turned out! Of the eight blowout Januaries that have occurred in stock market history, six went on to deliver 20% gains. One can only hope.

The US wants a weak dollar. No! It wants a strong dollar. Weak, strong, weak strong, help! Clearly the government is of two minds over the direction of the greenback, with the president and the Treasury secretary painting dueling scenarios.

The foreign exchange markets are voting with their feet, taking the dollar down 10% in a year. Foreign capital flight from the US in fear of coming political instability is clearly an issue, as is Chinese dumping of its once $1 trillion holdings of US paper. Emerging markets, small caps, and Boeing (BA) and Caterpillar (CAT) love it.

The last time the US pursued an openly weak US dollar policy was under Nixon. As you may recall, gold soared from $34 to $900 after Tricky Dick took the US off the gold standard.

Not all is perfect here in Silicon Valley, with Apple (AAPL) performing a 4% swan dive, triggering my first stop loss of 2018. It won’t be the last.

First, the European Community announced a $1.25 billion antitrust fine against Apple’s chip supplying partner, QUALCOM (QCOM). Then Apple got hit by a raft of analyst downgrades for second quarter iPhone sales.

The third nail in the coffin for this trade was a presidential comment that he favored a strong dollar. This has the unfortunate effect of immediately devaluing about half of Apple’s earnings and accounted for the $3 plunge we got on Thursday.

Still, better to dig out a small hole instead of a deep one. Never underestimate the stupidity of other investors, especially those who read the wrong newsletter.

Our first report of Q4 GDP came in at a moderate 2.6 %, with housing showing overwhelming the greatest rate of growth at 11.6%. Gotta love all those positive housing pieces I have been sending you for the last several years.

As for the Mad Hedge Fund Trader Alert Service, we keep grinding up from one new all-time high to the next. We are up 2.40% in January, with a trailing 12 month return of 53.49%. Our eight year profit stacks up to 278.87%.

I have been going pedal to the metal on the debt explosion theme, with a double short in Treasury bonds (TLT), double longs in gold (GLD), (NEM), and a long in commodities (FCX).

And since were are clearly bored here with loads of time on our hands to think up mischievous thoughts, we are rolling out our new Mad Hedge Technology Letter in the coming week to take up the slack.

This week will be all about jobs data, which roll out in rapid succession from Wednesday morning.

We are now into Q4 earnings season so those should be the dominant data points of the coming weeks.

On Monday, January 29, at 10:30 AM, the week kicks off with the December Chicago Dallas Fed Manufacturing Survey, a read on business conditions in the Lone Star State. Lockheed martin (LMT) reports earnings.

On Tuesday, January 30 the Fed’s Open Market Committee Meeting starts a two-day meeting. At 9:00 AM EST a new S&P 500 Case Shiller CoreLogic National Home Price Index is released. Advanced Micro Devices (AMD), Pfizer (PFE), and McDonald’s (MCD) report earnings.

On Wednesday, January 31, at 10:00 AM EST, we get the first of the big jobs numbers with the January ADP Employment Report. Boeing (BA) and Microsoft (MSFT) report earnings.

At 2:00 PM we get the Fed decision on interest rates. The outlier is for them to announce a surprise 25 basis point rise to heat off a superheating economy.

Thursday, January 25 leads with the 8:30 EST release of the Weekly Jobless Claims. At 9:45 AM we learn the PMI Manufacturing Index, a leading indicator of private sector business activity. The weekly EIA Petroleum Status Report is out at 11:00 AM EST. Alphabet (GOOGL) and Apple report earnings.

On Friday, January 26 at 8:30 AM the January Nonfarm Payroll Report it out.

Then at 1:00 PM, we receive the Baker-Hughes Rig Count, which has started going ballistic. ExxonMobile (XOM) reports earnings.

As for me, I'll be taking off for the Wynn Hotel in Las Vegas this weekend, where I understand a large number of rooms have suddenly become available.

But $7.5 million for a manicure? It sounds a little steep to me. I can get them at home for $15. I guess location is everything, and it depends who’s asking!

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

January 26, 2018

Fiat Lux

SPECIAL STEM CELL ISSUE

Featured Trade:

(JOIN THE MAD HEDGE TECHNOLOGY LETTER PRODUCT LAUNCH)

(THE STEM CELLS IN YOUR INVESTMENT FUTURE)

(CELG), (TMO), (REGN)

I'll do anything to postpone aging, as regular readers of this letter already know.

So when my doctor told me that she could extend the life of my knees by ten years with a stem cell injection, I was all for it.

You better pay attention too.

Stem cells, along with CRISPR gene editing, are two hyper accelerating medical technologies that promise to cure your ills, extend your life, and make you fabulously rich along the way.

Have I got your attention?

When my doc confirmed that she was already getting spectacular results from her other elderly patients, such as the dramatic regrowth of knee cartilage, it was like pushing on an open door.

Yes, these are the famous well worn 65-year-old knees you have heard so much about that hike and snowshoe 2,000 miles a year with a 60 pound backpack.

My doc is no lightweight. She is the orthopedic surgeon for the US Ski Team at Lake Tahoe, which is why I sought her out in the first place.

As a UCLA trained biochemist, I have known about stem cells for most of my life. They only left the realm of science fiction a decade ago.

Early sources of stem cells relied on stillborn human fetuses, creating a religious and political firestorm that lead to severe restrictions, a funding drought, or outright bans.

During the 2000's, California was almost the only state that permitted stem cell research.

Since then, the technology has developed to the point where they can be easily harvested throughout the human body.

Easy, except when the source is the bone marrow in your own hip.

"You may feel a slight twinge," said my doctor, as she flushed the air out of a gigantic horse needle the width of a straw. "I only have to hammer this needle into your hip bone 20 or 25 times to get the marrow I need."

This was definitely NOT in the literature I had been provided.

I said, "Don't worry, Marines are immune to pain."

"Does that work" she asked.

"No, not really," I replied, grimacing.

I felt every single blow, and tried to imagine myself on a far away tropical island.

Once she obtained the 10cc she needed, she popped it into a small centrifuge to separate the stem cells (clear) from the red blood cells (red).

She then used an ultrasound machine to precisely inject my own stem cells at the exact right spot in both of my knees.

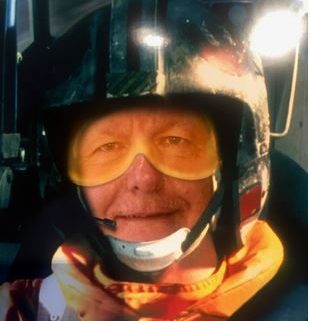

Being the true journalist that I am, I took pictures throughout the entire procedure with my iPhone X (see below).

The problem with advanced, experimental treatments is that they are not covered by your health insurance. Still, I thought $2,000 for ten years of extra life for both knees was a bargain.

Stem cells are undifferentiated cells that can transform into specialized cells such as heart, neurons, liver, lung, skin and so on, and can also divide to produce more stem cells.

You can think of stem cells as chemical factories generating vital growth factors that can help to reduce inflammation, fight autoimmune disease, increase muscle mass, repair joints, and even revitalize skin and grow hair.

Goodbye Rogaine!

When you are young, you have oodles of these cells, which is why kids so rarely die from dread diseases.

However, as you age, your exposure to too much sunlight at the beach, too many chemicals in the food and water you eat and drink, and natural background radiation degrades your DNA and reduces your stem cell supply.

Supplies of stem cells diminish as much as 100 to 10,000-fold in different tissues and organs. Welcome to old age, and eventually death.

The procedure I underwent is called Autologous Adult Stem Cells Treatment.

The great thing about it is that since you are using your own cells, the risk of rejection or infection is minimal. And they are free!

This approach has become the must go to treatment for the wealthy seeking to repair aging, sagging parts of their bodies.

They are often sold with vacation packages in exotic third world countries where regulation and medical mal practice suits are non existent.

The fact that the treatments are now becoming widely available in the US testifies to its effectiveness.

Do any search on stem cell treatments, rejuvenation, or life extension and you will find hundreds and hundreds of private clinics offering to do so for high prices.

California leads the nation with 109 clinics (including 18 in Beverly Hills alone), followed by New York and Texas.

Just follow the money.

The market is now on fire, and is expected to reach $170 billion by 2020.

As a result, a number of breakthroughs in longevity are just around the corner.

The industry is now branching out into fields considered unimaginable just a few years ago. I'll cover some of the highlights.

Imagine using your own stem cells to repair not only your knees, but any other organ. This is already being done in the lab with animal trials.

In Japan they are growing human eyes from scratch, including lenses, corneas, and lenses.

At Stanford, stem cells are bringing dramatic improvements in stroke victims.

At USC they are deployed to bring rapid repairs to those with severe spinal chord injuries.

A number of private firms have sprung up to facilitate banking of your own stem cells through cryogenic freezing, such as Lifebank. Just harvest them when you are young for future use.

Better yet, get born to wealthy parents who will pay to have your birth placenta and umbilical chord frozen, the two richest sources of stem cells known.

The key term to search for your investment strategy is Mesenchymal Stem Cells, the major stem cells for cell therapy, or MSC's.

These cells have the ability to differentiate into vital cells that can be used to cure autoimmune disease, cardiovascular disease, liver disease and cancer.

There are now several hundred clinical trials involving these cells underway.

A more adventurous strategy is to buy the stem cells of others and have them injected into yourself, a procedure known as parabiosis.

A company in Monterey, CA named Ambrosia is doing exactly this for $8,000 a patient. The goal here is to reverse aging across every major organ system.

Of course, I'm thinking there's got to be a trade here.

Not so fast.

Almost all stem cells efforts are now confined to the research labs of major universities, or are buried inside of large biotech and drug companies.

A few researches have spun off to set up their own private companies with substantial venture capital backing.

That said, there are a few peripheral listed plays.

Celgene (CELG) is one of my favorites, and is an early entrant in the field. They are using placenta derived cells to cure a whole host of diseases, which you can find listed on their site by clicking here.

Thermo Fischer Scientific (TMO) provides a range of tools and supplies scientists need to pursue stem cell research (click here for their site).

Regeneron (REGN) is using stem cells to pursue a broad range of serious medical conditions, including ophthalmology, cancer, rheumatoid arthritis, asthma, atopic dermatitis, pain and infectious diseases. Click here to visit their site.

There is one problem with the entire sector. We have a new president who has opinions on drug companies, which on occasion have lead to traumatic one day declines in these shares.

So these may be next year investments, instead of next week ones.

And how are my knees doing? I knew you would ask.

A little swelling in my knees went away in a day. I sat funny for a few more days, thanks to my bone marrow extraction.

It will take about six months before any real growth in new cartilage in my knees can be measures with an MRI scan, which I have scheduled. I'll let you know those results in a future letter.

But you know what?

My knees have not hurt an iota, despite my regular tortuous exercise regime. And I thank that, right there, is a win.

And if it works, my doctor wants to extract fat cells from my middle, known as Adipose Cells, and inject their stems cells, into my knees.

Talk about killing two birds with one stone!

This Won't Hurt a Bit

"Have a seat at the table, or you'll end up on the menu," said a confidential friend of mine in the Trump administration.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.