When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

October 31, 2018

Fiat Lux

Featured Trade:

(WHAT IS AMERICA’S TRUE NATIONAL DEBT?)

(TLT), (AMLP), (JNK), (MUB)

(TESTIMONIAL)

Mad Hedge Technology Letter

October 31, 2018

Fiat Lux

Featured Trade:

(IBM’S PUTS ON A RED HAT)

(RHT), (IBM), (AMZN), (MSFT), (GOOGL), (ORCL)

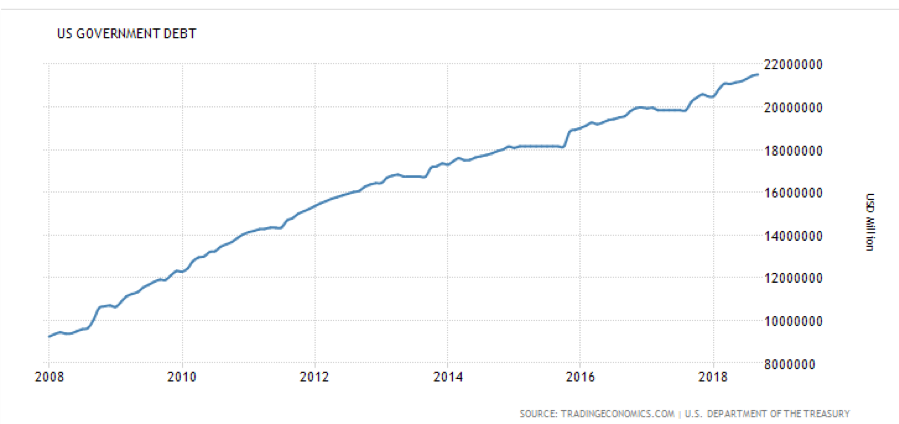

Not a day goes by without someone carping about the national debt to me which now stands at $21.6 trillion.

Since President Obama came into office on January 20, 2010, it skyrocketed.

Are we all going to hell in a handbasket? Eventually, yes.

While it is true that the national debt has increased by some $10 trillion over the past ten years, there is less than meets the eye.

Much less.

That includes the $4 trillion purchased by the Federal Reserve as part of its aggressive five-year monetary policy known as “quantitative easing”.

It also includes another $1 trillion of Treasury holdings by dozens of other federal agencies such as Fannie Mae, Freddie Mac, and Sallie Mae.

So, the net federal debt actually issued during Obama’s two terms is not $9 trillion, but $4 trillion.

That’s a big difference.

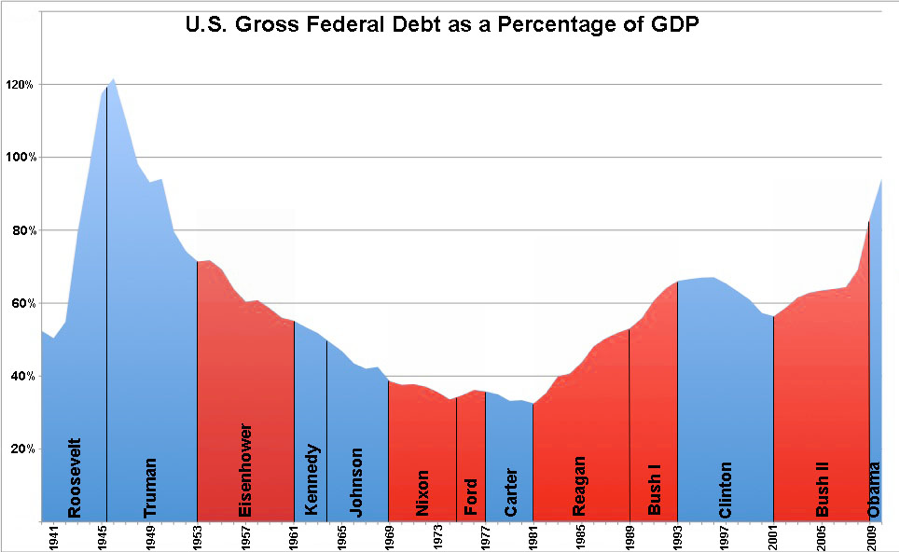

These numbers would make Obama one of the most fiscally conservative presidents in US history (see tables below).

And he pulled off this neat trick despite US tax revenues utterly collapsing in the aftermath of the Great Recession.

What the Treasury has in effect done is taken one dollar out of one pocket and put it in the other, 5 trillion times.

There has been no change in the nation’s true indebtedness or net worth as a result of these transactions.

In fact, these bonds were never even really issued. They only exist on a spreadsheet, on a server, on a mainframe, somewhere at 1500 Pennsylvania Avenue, NW, Washington DC.

And here is the real shocker.

The Treasury can cancel this debt at any time.

They can just decide to use one set of figures on the plus side of the balance sheet to offset an equal amount on the negative side, and poof, the debt is gone forever, and the national debt is suddenly only $16 trillion.

It wouldn’t even require an act of Congress. It could simply be carried out through a presidential order.

And we have seen a lot of those lately.

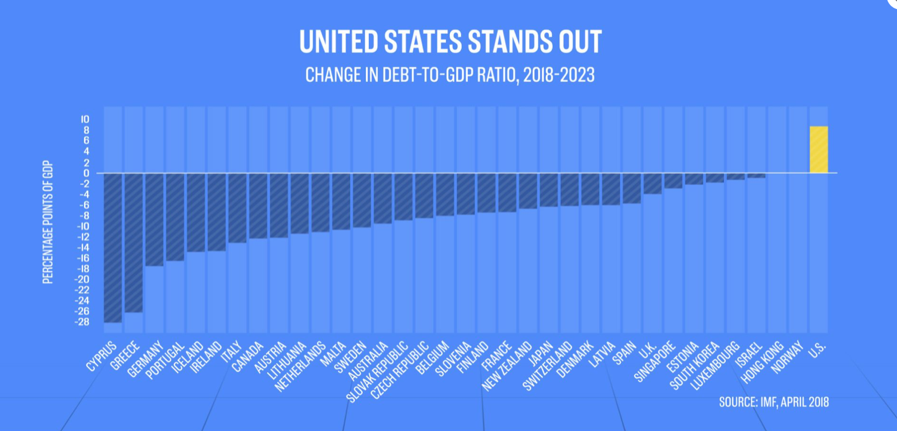

That would give America one of the lowest debt to GDP ratios in the industrialized world.

I actually recommended that the White House use this ploy to get around the last debt ceiling crisis.

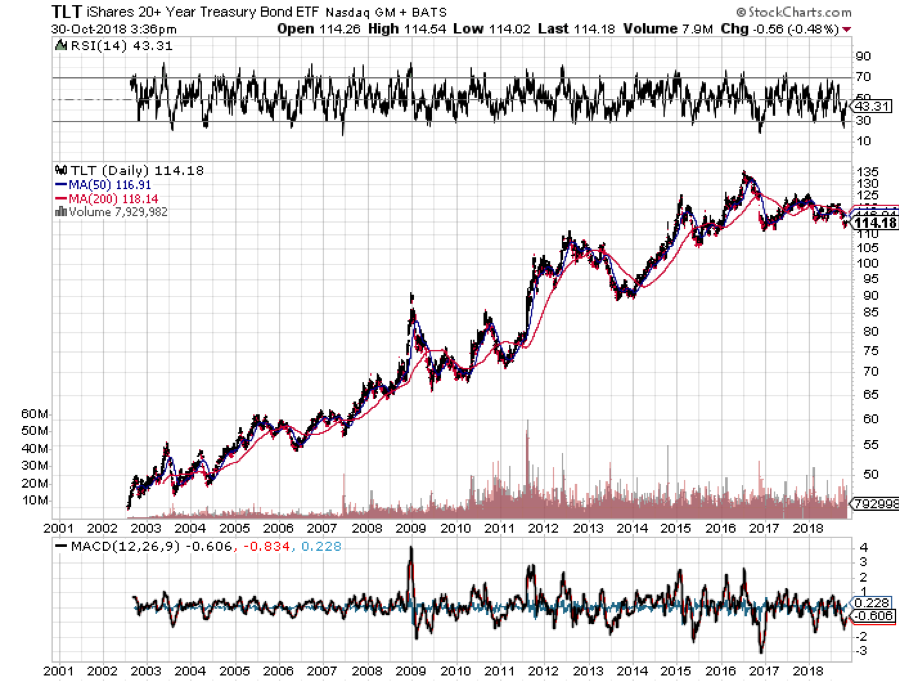

All of this sounds nice in theory. But how would markets respond if this were the true state of affairs in the debt markets?

Ten-year US Treasury bond yields would stay stubbornly low around $3.10%.

Prices for marginal debt securities in emerging markets (ELD) would boom.

Am I ringing any bells here people? Do these sound like debt markets you know and love?

A half-century of trading has taught me to never argue with Mr. Market. He is always right.

By keeping its bonds, the Fed has a valuable tool to employ if it ever senses that real inflation is about to make a comeback without having to raise the overnight deposit rate.

It simply can raise bond market rates by selling some of its still considerable holdings.

“FED SELLS BOND HOARD.”

How do you think risk markets would take that headline? Not well, not well at all.

There are other reasons to keep the $5 trillion in phantom Treasury bonds around.

It assures that the secondary market maintains the breadth and depth to accommodate future large-scale borrowing demanded by another financial crisis, Great Recession, or war.

Yes, believe it or not, governments think like this.

I remember that these were the issues that were discussed the last time closing the bond market was considered.

That was at the end of the Clinton administration in 1999 when paying off the entire national debt was only a few years off.

But close down the bond market and fire the few hundred thousand people who work there, and it could take decades to restart.

This is what Japan learned in the 1960’s.

It took the Japanese nearly a half-century to build the bond infrastructure needed to accommodate their massive borrowings of today.

The Chinese are learning the same thing as they strive to construct modern debt markets from whole cloth. It is not an overnight job.

One of the most common questions I get from foreign governments, institutional investors, and wealthy individuals in my international travels is “What will come of America’s debt problem?”

The answer is easy. It will all go to debt heaven. It will disappear.

US government finances are now worsening at a pretty dramatic pace (see more charts and tables below).

The budget deficit has doubled from the Obama low of $450 billion to $900 billion in only two years. Debt has exceeded GDP for the first time since WWII. New government bond issuance is rocketing and will crush the market any day now.

However, there is a way out of the looming financial disaster.

A massive demographic tailwind kicks in during the 2020s as 85 million Millennials grow up to become big-time taxpayers.

In the meantime, the last of the benefit-hungry baby boomers finally die off, eliminating an enormous fiscal drag.

“Depends” and “Ensure” prices will crater.

The national debt should disappear by 2030, or 2035 at the latest. The same is true for the Social Security deficit. That’s when we next have to consider firing the entire bond market once more.

That is what happened to the gargantuan debt run up by the Great Depression, the Civil War, and the Revolutionary War.

Government debt always goes to debt Heaven either through repayment during the period of demographic expansion and economic strength, or via diminution of purchasing power caused by inflation.

That’s why we have governments to pull forward economic growth during the soft periods in order to even out economic growth and job creation over the very long term to accommodate population growth. Pulling forward growth during strong economies as the administration is now doing only ends in tears.

The French were the first to figure all this out in the 17th century. They were not the last.

History doesn’t repeat itself, but it certainly rhymes.

I just stumbled across your writing and I love it!

I have been reading it all weekend. The more I read, the more I have this weird sensation in my frontal cortex. I believe it used to be called "thinking" before the new world order arrived. Almost stimulating....like the stuff before decaf...

What a fresh perspective you provide! You challenge my preconceived notions from CNN, and that is scary.

Please keep up the good work.

Yours Truly,

Ron

What took you so long, Ginni?

That was my first reaction when I heard International Business Machines Corporation (IBM) was making a big strategic shift by purchasing open source cloud company Red Hat (RHT) in a landmark $34 billion deal.

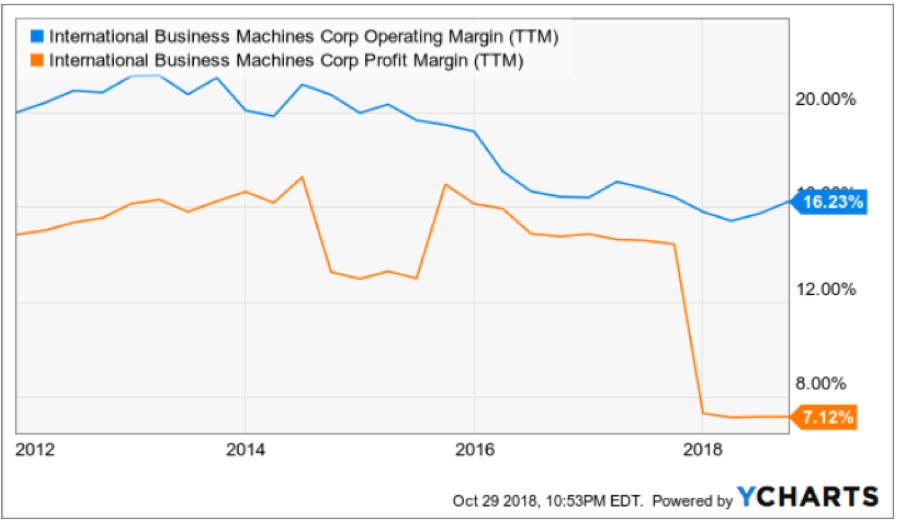

Ginni Rometty, IBM’s CEO since 2012, has presided over persistent negative sales growth and has done zilch for investors to conjure up some type of lasting hope for this company.

Not only has Rometty failed to grow the top line, but with an underwhelming 3-year EPS growth rate of -2%, the execution and performance haven’t been there as well.

Somehow and someway, she has maintained an iron-clad grip on her job at the helm of IBM and her legacy at IBM will be wholly determined by the failure or success of this Red Hat acquisition.

IBM shares sold off on the news as shareholders digested this bombshell.

Rometty took a hatchet to share buybacks and suspended them for 2020 and 2021 alienating a segment of their loyal shareholder base.

I can tell you one thing about this move – it smells of desperation and it won’t vault IBM into the conversation of Amazon (AMZN) Web Services or the Microsoft (MSFT) Azure.

The biggest winner of this deal is Red Hat’s CEO Jim Whitehurst who has been dangling the company for sale for a while.

Alphabet (GOOGL) was in the mix and had the opportunity to snag a last-second deal, but it never came to fruition.

The 63% premium IBM must pay for a company who only grew quarterly sales 14% YOY and quarterly EPS by 10% is expensive, but that is where we are with IBM.

Clearly overpaying was better than doing nothing at all.

IBM continues to hemorrhage sales and stopping the blood flow is the first step.

Rometty was responsible for the utter failure of artificial intelligence initiative Watson whose terrible management was a key reason for its implosion.

Analyzing this historic company gave me insight into the pitiful causing me to write a bearish story on IBM last month. To read that story, please click here.

Not only was the agreed price exorbitant, but Red Hat’s stock was trending south even before the interest rate induced sell-off rocked the tech sector of late.

Red Hat missed on sales revenue forecasts and offered weak guidance.

It could be the case that Whitehurst was actively seeking a buyer because he felt that Red Hat would go ex-growth in the next few years.

Red Hat was rumored to be on the market for quite a while looking to fetch a premium price for a company starting to stagnate with its visions of grandeur growth.

Rometty’s career-defining moment is high-risk and high-reward and is born out of being cornered by leading tech companies leaving IBM in their dust.

The deal finally allows IBM to return back to sales growth which will occur two years later, and Rometty will finally have that monkey off her back for now.

But the bigger question is will Rometty still have her job in two years if this experiment becomes toxic.

My guess is that Red Hat CEO Jim Whitehurst is automatically the next in line for the IBM throne if Rometty missteps, and piling on pressure will force IBM to evolve or die out.

And even though they will return back to growth, 2% growth is no reason to do cartwheels over.

The real work starts now and it will take years to turn around this dinosaur.

On the brighter side, the massive deals instantly improve sentiment that was flagging for years and puts IBM back on the map.

The synergies between IBM and Red Hat could be robust.

Red Hat can surely help IBM become a higher-quality hybrid cloud solutions company.

Models like this are the industry standard as luring a company into your cloud is one thing, but being able to cross-sell a plethora of extra add-on software services in the cloud is the necessary path to raising profitability.

IBM also inherits a slew of talented software engineers that it can mobilize for innovative cloud products. Red Hat’s products such as JBoss middleware and the OpenShift software for deploying applications in virtual containers could make IBM’s hybrid cloud more appealing and could help retain customers with the additional offerings.

Doubling down on the software side of the business was a strategy I pinpointed at the Mad Hedge Lake Tahoe conference and deals like this highlight the value of this type of assets.

There is a hoard of legacy tech companies like Oracle (ORCL) that is in dire need of such strategic injections and fresh ideas.

This won’t be the last deal of 2018, other cloud deals could shortly follow.

On the other side of the coin, hardware deals have turned rotten quickly with stark examples such as Hewlett-Packard’s (HPQ) $25 billion acquisition of Compaq, Microsoft’s $7.2 billion disastrous buy of Nokia’s mobile handset business and Google’s unimpressive $12.5 billion deal for Motorola Mobility that they later unloaded to Chinese PC company Lenovo.

Investors must be patient if IBM has any chance of completing this turnaround.

Listening to Rometty talk about this deal clearly reveals that she is hyping it up for something way bigger than it actually is.

Let’s not forget that Rometty’s tenure as CEO began in 2012 when IBM shares were trading north of $200 and she has presided over the company while the stock got pulverized by almost 30%.

It pains me that she is the one given the chance to turn the company around after years of underperformance.

Let’s not forget that at the end of 2017, IBM only had a 1.9% share of the cloud infrastructure, about 25 times smaller than Amazon Web Services.

The costly nature of the deal could also put a dent into IBM’s dividend, alienating another swath of its hardcore shareholder base.

Historically, IBM has had minimal success with transformative M&A and the industry competitors dominating IBM magnify the poor management performance headed by Rometty.

Rometty declaring that this deal means IBM will be “no. 1 in hybrid cloud” is overly optimistic, but this is a move in the right direction and could keep IBM spiralling out of control.

A return to sales growth might help stem the bleeding of its downtrodden share price, but Amazon and Microsoft are too far ahead to catch.

Investors will need to wait and see if the synergies between IBM’s and Red Hat’s products are meaningful or not.

“Growth and comfort do not coexist.” – Said CEO of IBM Ginni Rometty

“Every geopolitical crisis in the world is squarely pointed at the heart of Europe right now, be it terrorism, the collapse of Europe, or the currency crisis, and that means it’s focused on Chancellor Angela Merkel of Germany,” said my friend Ian Bremmer, of the political consulting firm, Eurasia Group.

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.