While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

October 3, 2019

Fiat Lux

Featured Trade:

(GOOGLE’S MAJOR BREAKTHROUGH IN QUANTUM COMPUTING),

(GOOGL), (IBM)

(AI AND THE NEW HEALTHCARE),

(XLV), (BMY), (AMGN)

The first major industry to be fundamentally disrupted by artificial intelligence will be healthcare, America’s last 19th-century industry.

Major diseases are being cured at such a dramatic pace that if you can survive the next decade, chances are you can live forever.

DNA is the software of life and spending $3 billion to decode it by 2003 was the best investment the U.S. government ever made.

These are the opinions expressed by longtime friend Dr. Ray Kurzweil. These ideas may seem like the ravings of a mad lunatic. However, Kurzweil long ago became used to such criticisms. The funny thing is, his very long-term predictions have a nasty habit of coming true.

For Kurzweil is the head of engineering at Google (GOOG), the co-founder of the Singularity University, and an early AI evangelist.

The outer shell of the human brain, the neocortex, is where we do all of our higher thinking, problem-solving and imagining. It first appeared in our pre-mammalian ancestors some 200 million years ago.

The neocortex enjoyed a sudden growth spurt 2 million years ago for reasons no one understands. Maybe that’s when we came out of the trees. This gave homo sapiens a huge advantage over all other life forms on earth.

The next step in our intellectual evolution will be carried out by AI. By connecting our neocortex to the Internet, we will improve our intelligence by a billion-fold. Imagine everyone you come in contact with is a billion times smarter than they are today.

Ironically, such advances in human bionic connections have been greatly advanced by our recent wars in the Middle East, which created large numbers of quadriplegic veterans desperate for contact with the outside world.

Defense research dollars have poured in to meet this need. Last year, I saw a classified video of a disabled soldier operating a computer just by thinking about keystrokes.

Kurzweil calls such a connection the Singularity, where humans and computers become one. He envisions this taking place on a large scale by the mid-2040s.

We already know how this will affect civilization because the billion-fold improvement in intelligence is already available in our hand in the form of a smartphone. All that is missing is the human/machine connection.

Over the past 1,000 years, human life expectancy has improved fourfold, from 19 to 80. As a result, a raft of new diseases has appeared only in the past century that show up late in life, such as cancer, diabetes, arthritis, Parkinson’s disease, and dementia.

The problem with this is that a millennium is but a nanosecond in the course of human evolution. Human T-cells have not had the time to evolve to fend off an attack from a cancer cell, which is why the disease is ravaging the human race today. Cancer rates are up exponentially from the 19th century.

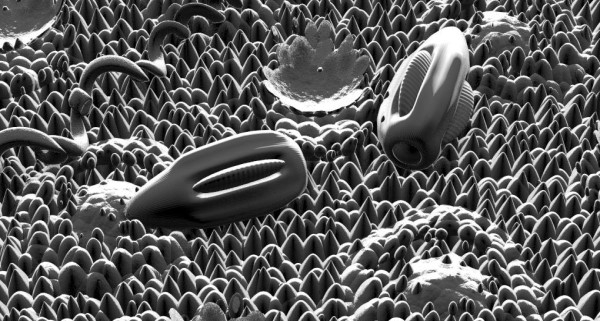

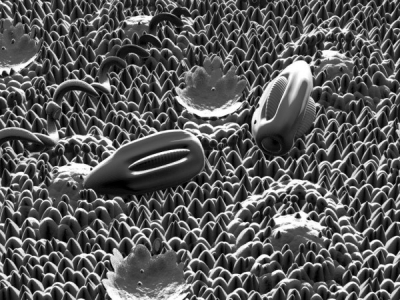

Fortunately, there is a way to speed up the evolutionary process. Microscopic nanobots the size of red blood cells can be designed to go after specific cancers, and then injected in swarms in your bloodstream to attack them.

Such technologies require precise manufacturing at the atomic level and will be available in the early 2030s. I have seen pictures of such nanobots myself under an electron microscope in the scientific literature.

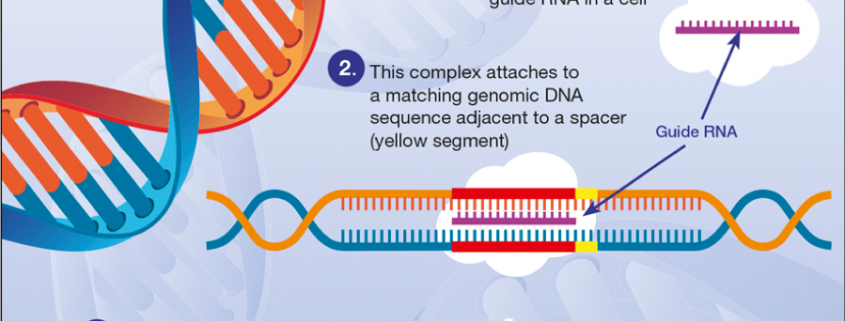

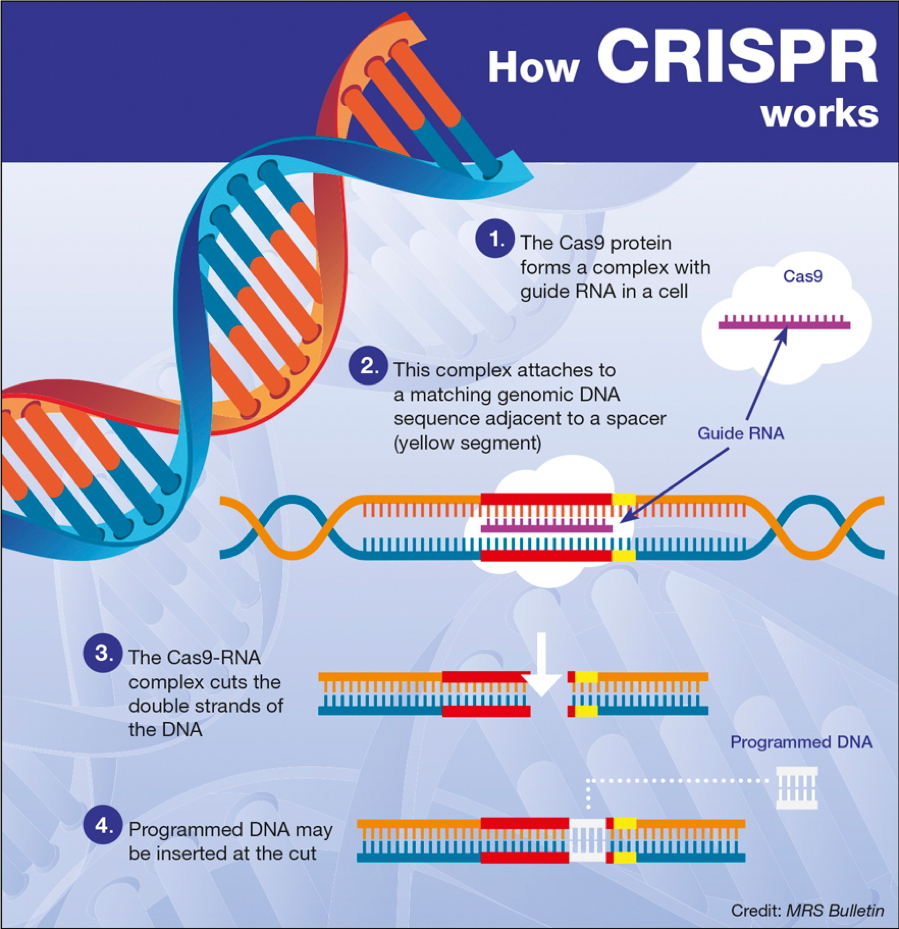

Alternatively, with some diseases, such as diabetes, all we need to do is to reprogram our software (DNA) to produce more insulin. This can be done with monoclonal antibodies, whereby a length of bad DNA is excised and a good one installed.

By the end of 2017, the Food and Drug Administration had approved nearly 100 such molecules to deal with a whole range of genetic diseases. Click here for the list.

Such advances will soon lead to what Kurzweil calls “Longevity Escape Velocity,” where advances in medical research are taking place faster than the natural aging process. Then we will only have to deal with senescence cells, which are internally programmed to turn themselves off at a certain age. Presumably, monoclonal antibodies will be able to turn these back on as well.

Of course, the investment implications of all of this will be prodigious. Perhaps, that’s why the shares of the entire healthcare sector (XLV) and big pharma (XPH) have been on an absolute tear for the past two years.

I believe that technology and healthcare stocks will overwhelmingly be the major outperformers over the next two decades. We are seeing the profits from these revolutionary advances sill into companies such as Pfizer (PFE), Bristol Myers Squibb (BMY), and Merck (MRK).

However, all the healthcare advances in the world are not going to help you if you keep eating cheeseburger for lunch every day. One study I always like to cite took place during WWII when the global food supply shrank dramatically, and everyone was put on a strict mandatory diet. The incidence of every major disease fell by 30%.

At the end of the day, plenty of sleep, healthy eating, and exercise will always remain the greatest life extenders. Kurzweil himself has been an ardent vegetarian for most of his life.

As for me, I rather have a good steak once a month and settle for living only to 120.

Keep renewing those newsletter subscriptions!

The Next Cancer Cure?

Mad Hedge Biotech & Health Care Letter

October 3, 2019

Fiat Lux

Featured Trade:

(GETTING ON BOARD THE GENE-EDITING REVOLUTION),

(CRSP), (VRTX)

I love buying straw hats during snowstorms, Christmas ornaments in January, and the latest outdoor equipment in October when the best quality gear is for sale at incredible discounts.

Such a bargain is to be had right now with CRISPR Therapeutics (CRSP), which has been at the forefront of the gene-editing revolution from day one. And I actually know how this works.

After decades of false starts and controversial experiments, genetic treatments are now starting to paint a credible and promising picture of their benefits. With the first-ever gene therapy treatment receiving approval in 2017 and the first RNA interference (RNAi)-based drug getting the greenlight in 2018, the biotech world appears to be ready for the next big thing: CRISPR gene editing.

Crispr technology has the potential to offer a cure for diseases such as multiple sclerosis and even cancer. Apart from its healthcare benefits, this technology can also be utilized in the agriculture industry. A possible application of it is to synthesize chemicals including fuels and plastics. Crispr can be used to store data as well.

Well, that’s what the investors in this revolutionary technology are hoping to accomplish anyway -- so much so that the market cap of pioneering company CRISPR Therapeutics (CRSP) has soared to an incredible $2.7 billion.

Although CRISPR Therapeutics has been experiencing an upward trajectory in 2019, shareholders of this stock since its inception in 2013 have been through quite a rollercoaster ride as the company’s first drug candidate only managed to enter clinical trials this year.

While cash burn is obviously a legitimate fear, CRISPR Therapeutics actually has a massive mound of cash pile. Hence, the future (or the next five years, at least) of this red-hot growth stock won’t be a problem for the company as long-term prospects look promising.

One of the most aggressive supporters of CRISPR Therapeutics is Vertex Pharmaceuticals (VRTX), which recently splurged $175 million in an upfront cash payment to fund the development of the biotech company’s study on a gene-editing therapy called CTX001.

This method is designed to help patients suffering from rare genetic blood disorders beta-thalassemia and sickle cell disease. Aside from these blood diseases, Vertex expanded the collaboration to also cover muscle disorders commonly known as Duchenne muscular dystrophy and myotonic dystrophy type 1. Earlier in 2019, the FDA granted a Fast Track designation for CTX001.

Despite minimal information on CRISPR’s pipeline, a lot can be deduced from the behavior of its investors alone. Looking at the roster of the company’s largest shareholders, it’s quite noticeable that a whopping 42% belongs to institutional investors.

Since institutions tend to prefer more established companies compared to smaller ones, the presence of these investors in CRISPR signifies a positive outlook for the stock. A quick caveat though -- the downside of this is for the stock to turn into a “crowded trade” due to the number of institutions that own it. That makes its share price sensitive to the biotech market and to the on-again, off-again IPO market.

Meanwhile, insider ownership for CRISPR Therapeutics amounts to $51 million -- a fact that could signify the earning potential of this stock and the promising future it holds. Some shareholders would consider this as a real positive sign as the heavy presence of the board members in the share registry ensures that their interests align with that of the shareholders.

So, what’s the bottom line here? While CRISPR’s shares at one point jumped by an astounding 72% this year, there’s no indication that the stock is slowing down anytime soon. That is if no clinical setback hinders the company’s forward march. Given the potential of the technology and its healthy cash pile ready to fund its future endeavors, this development biotech is anticipated to be worth tens of billions in terms of future revenues.

The global clamor to embrace revolutionary medical treatments is something we can’t ignore, particularly due to the northward rise of the biotech sector. With CRISPR Therapeutics promising that the initial clinical trials are only there to whet investors’ appetites, it’s exciting to be part of a technology that could actually change the landscape of the medical profession.

Buy CRISPR Therapeutics on the dip. Now is a great place to start scaling in with a one-third position.

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.