Mad Hedge Biotech & Health Care Letter

October 17, 2019

Fiat Lux

Featured Trade:

(DUMPSTER-DIVING IN BIOTECH),

(ABBV)

AbbVie Inc (ABBV) has transformed into one of the industry leaders in the biotech world, showing off a notable top-line growth and providing competitive dividends ever since its launch as an Abbott Laboratories (ABT) spinoff in 2013.

Despite its growth, AbbVie’s shares fell by a crushing 20% in the past year. This caused the company’s net value to trade at less than eight times forward earnings making it a blue-chip biopharma stock that could be bought for next to nothing!

What could be causing investors to sidestep this leading biotech?

The primary reason is the dwindling sales of AbbVie’s longstanding blockbuster drug, Humira. Despite its dominance in the market today, this arthritis medication is nearing its twilight years and is anticipated to eventually succumb to competition.

The threat to Humira’s dominance in the market is a huge deal for AbbVie particularly because of its heavy dependence on the drug’s revenue. In 2018 alone, the arthritis medication contributed approximately $20 billion to the $32.7 billion annual sales of the entire company.

Humira’s status in the United States is secure until its patent expires in 2023. Unfortunately, the drug doesn’t enjoy similar protection in international markets as biosimilar competition has already challenged its presence in the European Union. This has actually hit AbbVie’s performance as global sales showed a 28% decline in the past year.

Meanwhile, AbbVie’s blood cancer treatment Imbruvica is fighting off aggressive competitors in the market. At the moment though, investors remain optimistic about Imbruvica. The drug has been reported to achieve strong growth rates, generating roughly $4 billion in yearly revenue.

With this performance, Imbruvica is projected to hit a peak of $7 billion in sales. Although the medication is projected to perform well in the hematology space, the growing number of programs geared towards creating a similar treatment remains an ongoing threat to the company.

On a positive note, AbbVie has been active in beefing up its product portfolio. So far, three promising mega blockbusters are anticipated to boost the declining sales of the company, namely, psoriasis drug Skyrizi, uterine fibroids medication Orilissa, and rheumatoid arthritis treatment Rinvoq. All three have been recently approved and are expected to be the new growth products that could keep AbbVie on top of its game.

So far, Skyrizi has only contributed $48 million in sales. However, the psoriasis treatment is expected to reach $5 billion in profits in the coming years. Pitching in to boost AbbVie’s immunology assets is Upadacitinib, a drug that the company hopes to market as the next Humira and has been submitted for priority review. If all goes well, Upadacitinib is projected to rake in as much as $6 billion in peak sales.

While these treatments are pegged as promising additions to AbbVie drug portfolio, the biotech firm took another major step towards the expansion of its product line through its acquisition of Allergan (AGN) earlier this year. Although this move ensures that more products are queued to its pipeline, the deal with the Botox-maker could pose concerns for AbbVie’s balance sheet as the terms include the absorption of Allergan’s long-term debt worth $19.6 billion.

Nonetheless, AbbVie is still an interesting stock for a lot of investors. Perhaps one of the reasons for the lingering interest in the biotech company is its current dividend yield of 6.51% -- an impressive number especially if you consider the fact that AbbVie is still in its growth phase. Since 2017, its dividend showed an increase from $0.64 quarterly to reach $1.07 quarterly in 2019.

Another reason could be its valuation. As of this writing, the stock is trading at $75.83. Taking into account its adjusted earnings per share in 2018 of $7.91 and a P/E ratio of 8.2, this is already a pretty low price for any company that’s not experiencing a decline in revenue but extremely cheap for a company that has the potential to hit a 15% profit growth and 41% increase in adjusted earnings per share.

Overall, AbbVie is really a tempting stock for investors particularly dividend investors due to its high dividend yield and growth rates. However, the decline of Humira sales remains worrisome especially if you consider how dependent the company is on the drug.

Either way, AbbVie stock is really cheap at the moment and from a valuation perspective, there’s no substantial growth estimate priced in the stock to date. Basically, it all boils down to how much trust you want to put on a company with a proven track record but with high debt levels.

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

October 17, 2019

Fiat Lux

Featured Trade:

(UPDATING THE MAD HEDGE LONG TERM MODEL PORTFOLIO),

(USO), (XLV), (CI), (CELG), (BIIB), (AMGN), (CRSP), (IBM), (PYPL), (SQ), (JPM), (BAC), (EEM), (DXJ), (FCX), (GLD)

I rarely make changes to the Mad Hedge Long Term Model Investment Portfolio.

This is my shot at recommending portfolios of assets and individual stocks that investors never have to touch. You just put your money in, and don’t cash in until you hit your retirement age of 65 or 70.

After all, changes in the drivers of our $22 trillion economy rarely occur. Trends usually last for decades.

However, this year is completely different. The rate of change in the drivers of our economy is changing so fast that the whole idea of “long term” is becoming a distant relic. Not to update my portfolio would have been irresponsible.

So please find the new Mad Hedge Long Term Model Portfolio by clicking here. You must be logged into your account to gain access. There you can download an Excel spreadsheet containing the entire portfolio.

Here are my comments on the changes.

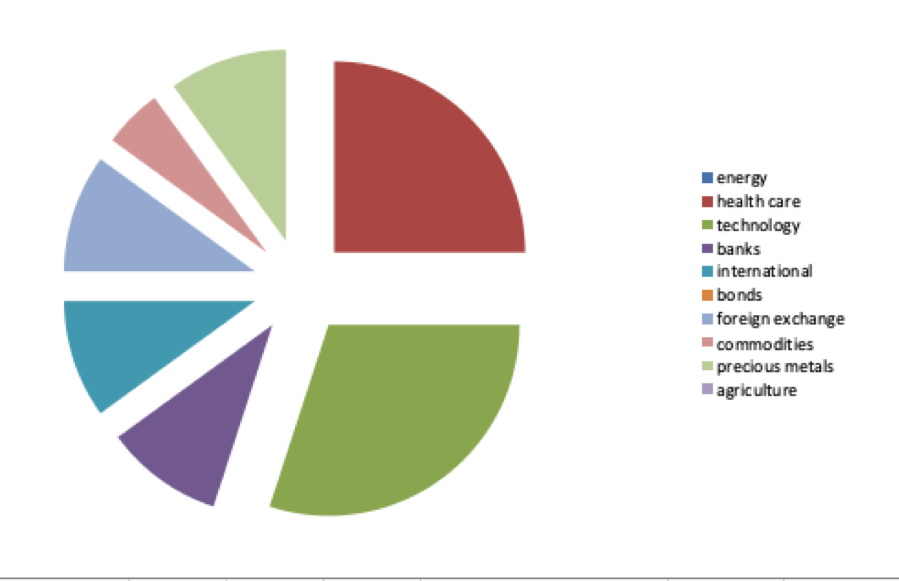

I have taken my energy weighting (USO) from 10% to zero. With falling demand and rising supply from fracking and alternatives, it is hard to see that any investment in the area will do well. When Saudi Arabia wants to get out of the oil business, as it was with its ARAMCO IPO, so do you. Eventually energy prices will approach near zero.

I am increasing my allocation to biotech healthcare (XLV) from 20% to 25%, which I believe will become one of the two dominant sectors of the 2020s. Scientific advancement is accelerating on all front, creating enormous profit opportunities. This is why I launched the Mad Hedge Biotech and Healthcare letter.

I am also increasing my weighting in technology from 25% to 30% as their share of the global economy expands significantly. I am changing the mix here, taking our holding in legacy IBM (IBM) and adding PayPal (PYPL) and Square (SQ), betting on the future of fintech.

I am maintaining my share of banks at 10%, betting on an eventual resurgence in interest rates and the growth of the US economy. JP Morgan Chase (JPM) and Bank of America (BAC) are looking good and are selling below book value.

I am keeping my international exposure at a low 10%. But I am doing a substitution, dumping Europe and adding the iShares MSCI Emerging Markets ETF. (EEM) has been down for so long that it has essentially already discounted the next recession.

As for bonds, I am cutting my allocation from 10% to zero. With a ten-year US Treasury bond yield at 1.72%, the risk/reward for this entire asset class on a long-term basis is terrible. Adding $1.5 trillion in new debt every year will come back to haunt this market.

I am cutting my short position into the foreign exchange market from 20% and flipping to a long of 10%. As long as the US has the world’s highest major currency interest rates, the downside will be limited. However, the end of the Brexit saga will also be hugely Euro positive.

Regarding commodities, I am keeping my 5% holding in Freeport McMoRan (FCX), which has already fully discounted the next recession. You need to have some cash in areas that will explode coming out the other side of the next short recession, and this is one of them.

I am also reentering the gold market on the long side with a 10% weighting. Gold (GLD) is a hedge against the next recession and is also a play on China moving a major portion of its reserves out of US Treasuries and into precious metals.

Staying out of agriculture completely has been one of the smartest things I have done in recent years. I have even stopped covering it in my newsletters. It has been a major trade war victim as I expected. But it is also suffering from hyper-accelerating technology, which is delivering ever large amounts of crops at very lower prices. Here zero stays zero.

So, that’s it. Make your reallocations and go back to sleep. I’ll wake you up at the end of 2020.

Energy - 0%

Healthcare - 25%

Technology - 30%

Banks - 10%

International - 10%

Bonds - 0%

Foreign Exchange - 10%

Commodities - 5%

Precious Metals - 10%

Agriculture - 0%

Total - 100%

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

October 16, 2019

Fiat Lux

Featured Trade:

(A NOTE ON ASSIGNED OPTIONS OR OPTIONS CALLED AWAY),

(MSFT)

(DECODING THE GREENBACK),

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.