While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Mad Hedge Technology Letter

April 11, 2019

Fiat Lux

Featured Trade:

(THE MEANS TO A FRIGHTENING END)

(AMZN), (FB), (GOOGL), (AAPL)

Global Market Comments

April 11, 2019

Fiat Lux

Featured Trade:

(THE UNITED STATES OF DEBT),

(TLT), (TBT), ($TNX),

Death of websites.

I love doing presentations to small businesses on my free time, partly to stay in touch with the pulse of the Davids who have the unenviable task of fighting uphill against the Goliaths.

It’s bad enough that the tech giants have scaled locally turning one’s local playground into a disadvantage.

The presentation is aptly titled "Content is King... But Only Through One’s Ownership" where the same parallels are explored and unpacked for my audience.

Proprietary Content – must be yours and you must own it on your own turf - your blog, your vlog, your app, and so on, it goes for everything.

Repurposing content on other platforms as a supplement to your own is one thing, but the moment you adopt an enemy platform as your main platform, that’s your coup de grâce.

SMEs (small businesses enterprise) believe it’s plausible to work with the higher ups, but don’t forget they have every incentive to cut you off from the fountain of youth.

One could say the best skill big tech has today is undermining their competition.

Facebook doesn’t allow posting content that criticizes Facebook, have you ever wondered why?

Website innovation has grinded to a halt because of the PageRank algorithm from Google, everybody is making websites the same, a top nav, descriptive text, a smattering of images and a handful of other elements arranged similarly.

Google’s algorithms and the self-regulating nature of their ecosystem have perverted the chance to have a unique online experience.

Most internet users have probably discovered that most websites don’t work well and the execution of them is lousy.

Many companies are not contributing enough resources to build out their site properly, or just don’t have the cash to fund it or a mix of the two.

About 95% of customer service calls originate from the company’s webpage because of payment problems, disfunction, misleading content, or simply because the website is down.

Ask any small business and they will tell you they deal with their domain being down for hours at a time because of some unknown server problem.

Not only is capitalism only working for a small group of Americans, but so are websites, such as massive companies like Amazon.com who have worked wonders with its e-commerce site.

Because the internet and namely websites are the key to building businesses, Silicon Valley is now using the concept of websites and their position as de-facto moderators to prevent others from developing proper websites, killing off the competition.

Alphabet is notorious for ranking their own products at the top of page one of any Google search.

Amazon has followed the same practice by sticking their in-house brands at the top of any Amazon search on Amazon.com.

And remember that none of this can be called “antitrust” because these borderline tactics offer consumers lower prices but that is only because consumers are brainwashed to believe Amazon offers the lowest price.

What if the same products are available for half of Amazon’s in-house brands, would Amazon volunteer to post their in-house brands on the second page, the graveyard of search results?

I would guess no.

Websites used to give businesses a chance, remember in the mid-90s when a website of any ilk was impressive as if someone was walking on water.

What can we expect next?

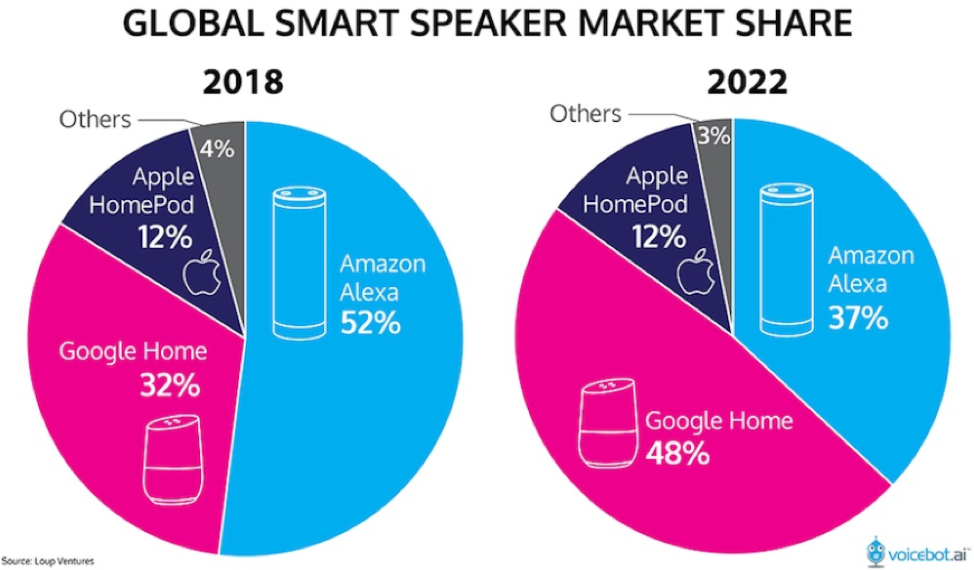

Amazon, Google, and Apple are taking their shows to artificial intelligence voice platforms.

SMEs could at least throw hail marys on standard internet searches with visual screens, but once content migrates over to voice platforms owned by Silicon Valley, then its game, set, and match.

For instance, a local business such as Joe’s Furniture Moving Business who, with the internet and visual screens, is searchable through search engines and can be even located on Google Maps with a concrete address.

Once we migrate the lions share of content to voice platforms over the next 15 years, Google Home, Apple HomePod, or Amazon Alexa could easily choose to remove Joe’s Furniture Moving Business information because they make more money offering you information of a moving service they own or have a stake in.

The advent of 5G will refine the voice technology and enhance the machine learning techniques needed to complete the migration of content.

Once the world crosses an inflection point where the technology and volume of content on smart speakers outweigh the hassle to use a keyboard or mobile screen, this effectively makes these smart speaker manufacture Gods of the World because they will own the voice-based internet.

They will be the gatekeepers of all global information, business, and development in the world and we will need to satisfy their algorithms to get our own content uploaded on their voice platforms.

And because of the nature of voice, users cannot see what else is out there, users will only hear what these companies tell us offering an outsized opportunity to manipulate the user experience generating more dollars for these powerful platforms.

By the end of 2019, 74 million Americans will be using smart speakers, giving these smart speaker firms adequate data to fine tune their products.

Eventually, all Americans will be forced to use it or will not be able to function, similar to the effects of a laptop, email, and smartphone combination now.

Once these voice platforms become ubiquitous, websites will be deemed irrelevant – consumers will simply have a choice of Google Home, Amazon Alexa, and Apple HomePod and blindly trust what they tell you is in your best interests.

Pick your poison.

That’s right, users won’t control content in about 15 years, a scary thought, and now you understand why these companies will even give their voice A.I. platforms for free if they have to and probably will in the future.

“It’s the first inning. It might even be the first guys up at bat. We're on the edge of the golden age [of AI].” – Said Amazon Founder and CEO Jeff Bezos when talking about Amazon Alexa

Mad Hedge Technology Letter

April 10, 2019

Fiat Lux

Featured Trade:

(TAKE A 2020 RAIN CHECK WITH SYMANTEC)

(SYMC), (FTNT), (PANW),

If you said I am going to the well too many times with this enterprise software theme, I would say you are out of your mind.

Next up is Symantec Corp. (SYMC) who offers global cybersecurity products, services, and solutions, and will be a primary beneficiary of the acceleration of network security products that expanded 12.6% YOY in 2018 and a secondary beneficiary to the migration to enterprise software.

The uptick in gorging cybersecurity products helps reflect the strongest industry metrics since analytics started tracking cybersecurity figures.

As more corporations take the leap of faith and splurge on data centers to house digital secrets, cloud service providers will store corporate data on these massive server farms and perimeter protection software is needed to guard against trojan horses and other malware.

This development has led to a vibrantly healthy market for firewall products, a traditional cybersecurity tool applied to block access to portions of a corporate network from the outside internet.

Firewall products weren’t shy registering 16.3% YOY growth to $2.4 billion in Q4 2018.

Advanced threat protection products used to find more sophisticated and modern offshoots of malicious software exploded to $416 million in Q4 2018, up 19.1% YOY.

Where does it stop?

Nobody knows, but the internet is becoming more of a chaotic free-for-all, and corporations existing for the sheer purpose of maximizing shareholder value will need to dole out an extra layer or two of digital protection.

Remember executive careers can be ruined from corporate cyberespionage these days and being the guy who lets the North Korean cyber army through the front door to fleece proprietary data isn’t a great pitch for a future executive gig.

The thorny Huawei issue has also heightened awareness of this sensitivity of security issues demonstrating how American tech prowess can be looted in a zero-sum cross-border game.

Internet users have also experienced a sudden balkanization of the web by totalitarian governments ready to weaponize the internet where they see fit while clamping down on freedom of expression on expressions that aren’t favorable to the interests above.

The orange alert climate has forced corporations to rush into cybersecurity products and my two favorite companies in this sphere are Palo Alto Networks, Inc. (PANW) and Fortinet, Inc. (FTNT).

I cannot say that Symantec is a better company than these two, it wouldn’t be true because their model doesn’t have the super growth trajectory when you analyze them head to head.

But this year should be an improvement on last year and I see room to the upside.

Every important metric will improve, aided by a return to better-calibrated execution, stabilization in business mix, and the benefit of revenue already on the balance sheet.

Operating margins slightly beat guidance with a 32% upswing last quarter and strong cash flow from operations of $377 million in the third quarter meant the company is more profitable.

Enterprise Security chipped in with revenue of $616 million, $31 million above the high end of the guidance range, and after a turbulent first half of 2018, Enterprise Security is back to organic growth of 3%.

And the main reason this company won’t be a massive winner is because of the lack of top-line growth indicating expansion in fiscal 2019 of only 1.5% in total revenue comprising of relatively flat revenue for Enterprise Security and 3% growth for the Consumer Digital Safety division.

Not good enough in the tech world of today.

Remember that the Consumer Digital Safety division contributes 49% to the top line while Enterprise Security only makes up 15%.

I believe this amounts to serious weakness in their business model because it should be the other way around to take advantage of the fast-growing enterprise business market and the even better margins.

The sluggish growth has hit shares with the chart flat as a pancake if you string it out the past 5 years with undulation in between.

The top line growth from 2017 to 2018, went from $4.02B to $4.83B and was a revelation, yet management has begged for more time with its prognosis of flat revenue for 2019.

Symantec will compensate for the lack of revenue growth with slightly better profitability maintaining a 30% operating margin, and predicting cash flow from operations for fiscal year 2019 to be in the range of $1.25B to $1.35B, a nice bump from the total cash flows from operations of $950 million in fiscal year 2018.

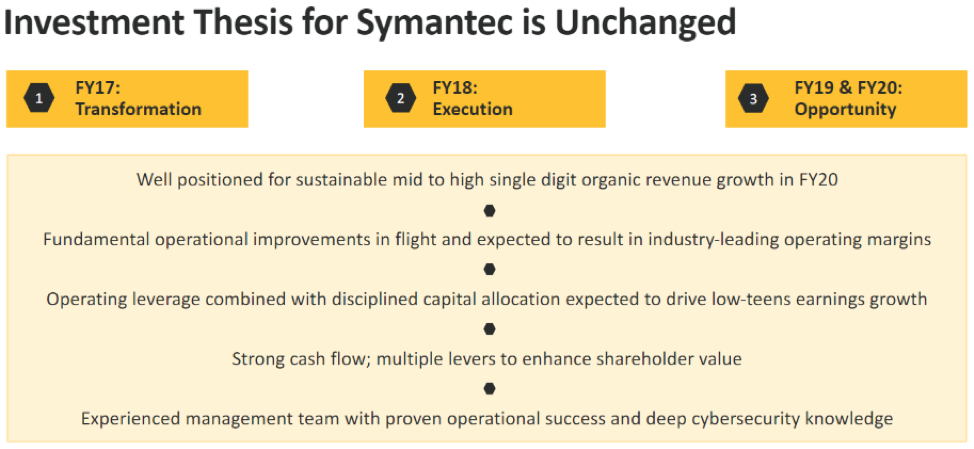

The catalyst to share appreciation is hidden in between the lines with management hyping up 2020 as the period when Symantec gets its mojo back with mid-single digit growth, with the Enterprise Security segment particularly benefiting from organic revenue expanding in the mid to high single digits from 2019.

A roll-off from existing contract liabilities will boost the Consumer Digital Safety segment but will not demonstrate any meaningful organic revenue growth projected to be unchanged at the low to mid-single digits YOY.

This sets up nicely for 2020 – the company expects a boost in operating margins to mid-30s and expected EPS growth in the low double digits with cash flow from operations benefitting from the 2019 restructuring, transition and transformation effort.

In short, they had a poor 2018 and Symantec’s management is telling investors to allocate downtime to fix the firm - growth will be missing this year, but they will be more profitable than last year, albeit with flat revenue.

The jury will be out in 2020 which is when they promised to have all their ducks in a row.

Even though they aren’t promising double-digit revenue growth in 2020, the high single-digit growth could see shares slowly grind up for the rest of this year.

This is another example of how legacy companies get stuck digging themselves out of a sinkhole before they can hyper-energize their profit model.

They are still in a holding pattern and I am neutral to slightly bullish on Symantec shares.

“There are only two types of companies: those that have been hacked and those that will be.” – Said American Lawyer Robert Mueller in 2012

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.