While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

April 10, 2019

Fiat Lux

Featured Trade:

(A NOTE ON OPTIONS CALLED AWAY),

(TLT),

(NOTICE TO MILITARY SUBSCRIBERS)

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Hot Tips

April 9, 2019

Fiat Lux

The Five Most Important Things That Happened Today

(and what to do about them)

1) Apple Tops $200. Looks like the market is finally buying the services story. Stand aside for the short term. It’s had a great run, up 42% from the December low. I’m waiting for 5G until I buy my next iPhone, probably next year. Click here.

2) Trump Threatens $11 Billion Worth of European Trade, and the market hates it, down 200 points. Out of the frying pan and into the fire for traders? Endless trade wars aren’t good for investors. As for me, I buy all American, with three Tesla’s. Click here.

3) American Airlines Cuts Forecast, and the stock dives 3%, over missing airplanes. The Boeing saga is not over. Click here.

4) Bank of America Raises Minimum Wage to $20, by 2021. If you are a minimum wage employer your life is about to become very difficult. Avoid fast food companies like (MCD). Click here.

5) Q1 Earnings Season Starts on Friday, with the big banks taking the lead. Now it’s all about wait and see. Click here.

Published today in the Mad Hedge Global Trading Dispatch and Mad Hedge Technology Letter:

(ABBVIE’S BATTLE FOR ARTHRITIS DOMINANCE),

(USING MOMENTUM STOCKS TO CALL THE MARKET),

(MTUM)

(THE LEGACY TECH COMPANY THAT IS WORTH BUYING NOW)

(ADBE), (MSFT), (CRM), (AAPL)

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to the six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

April 9, 2019

Fiat Lux

Featured Trade:

(ABBVIE’S BATTLE FOR ARTHRITIS DOMINANCE),

(USING MOMENTUM STOCKS TO CALL THE MARKET),

(MTUM)

You would think that a company with 60% of the arthritis market would see a soaring stock price. But you would be wrong.

Based on its 2019 performance to date though, AbbVie (ABBV) seems to be on the brink of a disaster. From an impressive 54% gain way back in 2017, the giant pharma stock started to lose ground this year with its share price falling by double-digit percentages. Nevertheless, staunch believers of this stock remain steadfastly optimistic about the company's future.

Here are pretty good reasons why they might be right.

A lot of investors have been wary of AbbVie due to the company's dependence on their blockbuster drug, Humira, which is marketed as a treatment for rheumatoid arthritis, psoriatic arthritis, ankylosing spondylitis, Crohn's disease, ulcerative colitis, psoriasis, hidradenitis suppurativa, uveitis, and juvenile idiopathic arthritis. Since AbbVie derives 60% of its total revenue from the sales of this drug, it's understandable why its shareholders are getting nervous over its declining performance in the market along with the emergence of competitors across the globe.

Surprisingly, AbbVie isn't the least bit worried about Humira.

One of the main reasons for their confidence in Humira's continued dominance in the market is the fact that biosimilar drugs won't be available in the US until around 2023. Given that two-thirds of Humira's sales or roughly $20 billion of its global profits come from the American market, this timeframe gives AbbVie a couple more years to rake in profits from its top drug. In fact, Humira is projected to keep earning as much as $15 billion up until 2024.

Notably, AbbVie has been labeled as a ruthless competitor with its latest move to mark down Humira by up to 89%. This "market poisoning" tactic, as its critics would dub it, has resulted in exits from a number of competitors and would-be competitors aiming to target the Dutch market as well. Hence, Humira might just be able to assert a renewed monopoly in the European nation via their aggressive discounts.

On top of that, AbbVie has lined up a couple of potential blockbuster drugs to take the baton from their beloved Humira. Plaque psoriasis drug Risankizumab along with rheumatoid arthritis treatment Upadacitinib are anticipated to boost AbbVie’s revenues this year as well.

In fact, both treatments are expected to gain FDA approval this year. These drugs, which are estimated to bring in incremental yearly sales of approximately $10 billion, are expected to pick up additional approvals to cater to other autoimmune diseases as well. Using a back-of-the-envelope calculation to add these two potential blockbuster drugs, therefore, puts AbbVie’s incremental risk-adjusted sales at around $35 billion by 2025.

Meanwhile, the company’s other promising products such as blood cancer treatments Imbruvica and Venclexta as well as endometriosis drug Orilissa are doing good in the market.

AbbVie has been exploring the possibility of expanding the indications for Venclexta to cover chronic lymphocytic leukemia (CLL), multiple myeloma, and acute myeloid leukemia (AML). As for Orilissa, this drug is slated to become yet another blockbuster product for AbbVie as it attempts to win approval for the treatment of uterine fibroids. Should Orilissa succeed in this, AbbVie would be poised to become one of the leading companies in the women's health category.

With all these developments and consistent sales from AbbVie, the company is anticipated to post an earnings per share of $2.05 by the next earnings report. If that happens, then the figures would indicate a 9.63% YOY growth for the company.

In managing my portfolio, I always bear in mind the wise words of Warren Buffett: "If you aren't willing to own a stock for 10 years, don't even think about owning it for 10 minutes." At the moment, AbbVie is sold at a bargain with shares trading at lower than eight or nine times its expected earnings. Looking at the company’s pipeline and history of aggressively protecting its moneymaking drugs, it’s clear that AbbVie is poised to provide a significant boost in anyone’s portfolio in the future.

Buy AbbVie on the next market selloff.

Mad Hedge Technology Letter

April 9, 2019

Fiat Lux

Featured Trade:

(THE LEGACY TECH COMPANY THAT’S WORTH BUYING NOW)

(ADBE), (MSFT), (CRM), (AAPL)

Adobe (ADBE) will muscle through the upcoming earnings recession.

Tech profits are facing a stiff profit contraction leading to a potential drop of 0.75% next earnings season.

The bulk of the softness will come from, you guessed it, Apple’s (AAPL) debacle selling iPhones in China, alerting investors to take waning sentiment into consideration.

Adobe is one of your safest bets in 2019 that will experience market dispersion due to the decelerating nature of the global economy.

I feel like a broken record saying the best tech companies to own at this point in the economic cycle are enterprise software stocks benefitting from the migration to digital with bullet-proof balance sheets.

But it must be said.

Shantanu Narayen, President and CEO of Adobe, brilliantly summed up the effects of Adobe’s software by saying, “Adobe is fueling the creative economy, driving the paper-to-digital revolution and enabling businesses to transform through our leadership in customer experience management.”

Adobe, headquartered in San Jose, California, epitomizes the type of software company lapping it up as smaller companies understand the only means of survival is violently pulling the technology lever, particularly juicing up revenue through applying enhanced software.

Shares have exploded over 350% in the past 5 years as small businesses are blown away by Adobe’s dizzying array of creative, marketing, and analytics software, just to name a few.

Adobe shares still have more room to run as the economic cycle has been effectively extended through external macro forces.

A few weeks ago, Adobe reported weak guidance cushioning forecasts down a half notch.

Investors need to understand that the market is grappling with a potential earnings recession on the horizon possibly smothering a large swath of the economy.

Instead of throttling shares on next quarter’s earnings, Adobe felt it was prudent to front run the earnings weakness inherently found in their own model and guide down now.

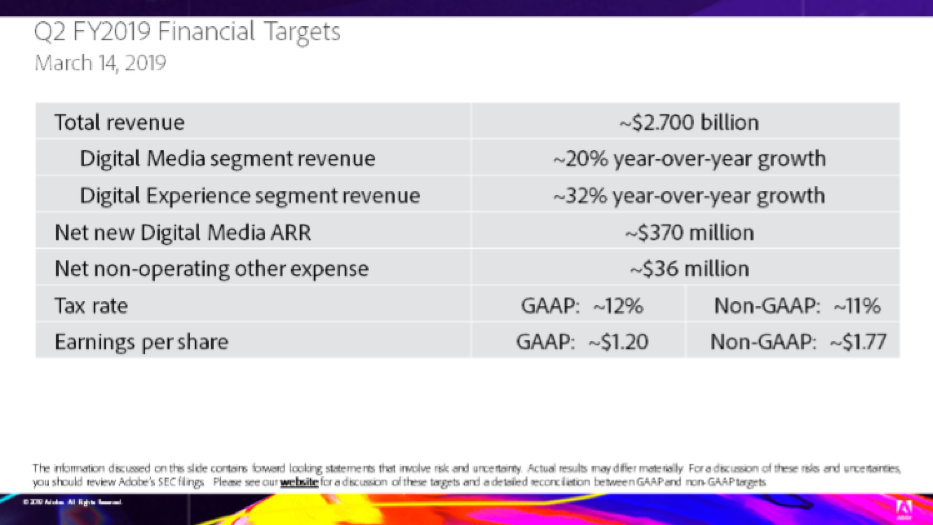

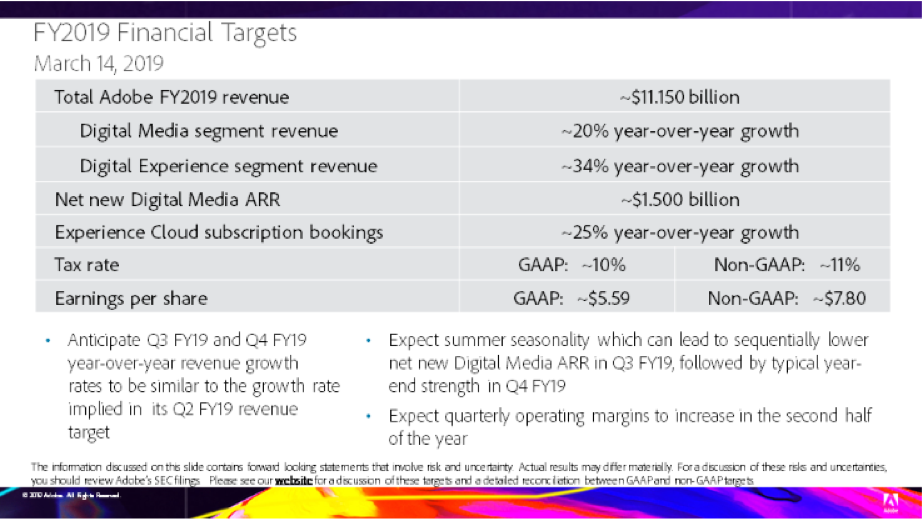

For the year 2019, Adobe forecasted earnings of $7.80 a share on sales of $11.15B with Digital Media Annual Recurring Revenue (ARR) of approximately $1.5B.

The street forecasts earnings per share of $7.77 on sales of $11.16 billion this year.

The guides weren’t venomous by a long shot and will have no material effect, just a small blip on the radar making Adobe a great bet for beating next quarter’s earnings if they maintain the planned trajectory of expected growth.

Shares have made back up the $10 drop from the subsequent consolidation after the Q1 report, and I suspect that Adobe will run away to new highs going into next quarters earnings report.

It helps that Adobe is blowing away revenue records left and right and announced an audacious project to partner up with Microsoft (MSFT) to mutually bolster sales and marketing software capabilities to take on Salesforce (CRM).

LinkedIn integration will allow Adobe customers to find potential customers for business goods.

If the LinkedIn ad campaign flourishes, the customer will be able to use Microsoft's Dynamics 365 sales software to close the deals.

The precursor to this initiative was Adobe acquiring B2B software firm Marketo for $4.75B last year laying the groundwork for the LinkedIn partnership.

Integrating Magento within the existing Experience Cloud accounts was a meaningful contributor, and Marketo delivered solid results in their full quarter debut under the Adobe portfolio of assets.

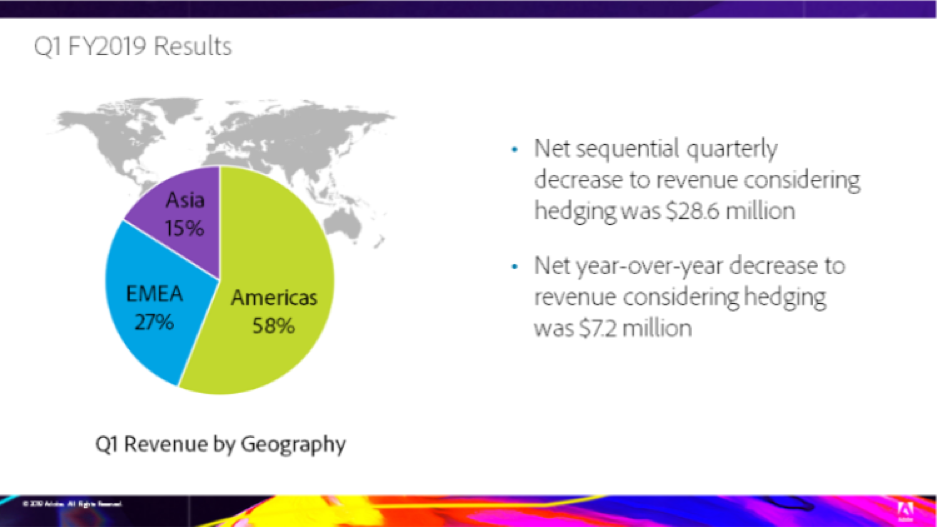

In Q1, Adobe pocketed $2.6B in revenue, a 25% improvement YOY resulting in $1.01B of cash flow from operations.

About 91% of revenue stemmed from a recurring source, and Adobe’s biggest division, the Creative division, grew to $1.49B, a 22% YOY improvement.

The $1.49B contributed by the Creative segment comprised of about 2/3 of total quarterly revenue.

The achievement was attributed to new net adds across all offerings, along all geographical fronts, and a ramp-up in subscription-based packages.

Other catalysts were average revenue per user (ARPU) increases, particularly in markets where price optimizations were introduced last year and service adoption including continued momentum with Adobe Stock, which again achieved greater than 20% YOY revenue growth.

The impact of lost deferred revenue stemming from the acquisitions of Magento and Marketo will absorb itself throughout the year creating a tailwind resulting in quarterly operating margins increasing in the second half of the year.

Adobe and Microsoft have proved that dangling useful legacy products such as Adobe’s PDF viewer and Microsoft Office have been perfect gateways into other software upsells like Adobe’s Photoshop and Microsoft’s Azure cloud products.

They have effectively harnessed the same road map to achieve success and don’t apologize for it.

Adobe didn’t have to reset expectations last quarter, but with their highest-grade software growing in the mid-20% and a chance to guide down because of the expected earnings recession, why not take the carrot offered to you?

The software firm is optimally positioned to overperform for the rest of the year, every selloff should be met with furious dip buying for this best of breed software.

I am bullish Adobe.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.