While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to the six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to the six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Mad Hedge Hot Tips

February 25, 2019

Fiat Lux

The Five Most Important Things That Happened Today

(and what to do about them)

1) Merger Fever Hits the Gold Industry, with Barrick Gold (GOLD) taking a run at Newmont Mining (NEM), the world’s first and second largest producers. It’s all about efficiencies of scale. Take this as a long-term bottom in gold prices. Click here.

2) China Tariff Hike Postponed Indefinitely, and Chinese stocks love it. Import duties stay at 10%, instead of rising by 25% starting on Friday. We knew it was never going to happen. Some 95% of the China trade deal is now already priced into the market. Click here.

3) GE Sells Biotech business for $21 Billion, They’re selling off the crown jewels to salvage the balance sheet. Stock loves it, up 11%. Click here.

4) Most Economists See Recession by 2021, at the latest. That really means it will really start in late 2020. Sell those rallies. You don’t want to be left standing when the music stops playing. Click here.

5) Wholesale Inventories Rising Sharply, up 1.1% in another recession indicator.

Published today in the Mad Hedge Global Trading Dispatch and Mad Hedge Technology Letter:

(THE MARKET FOR THE WEEK AHEAD, or THE BEST OF TIMES AND THE WORST OF TIMES),

(SPY), (TLT), (TLT), (VIX), (KHC), (MAT), (MMT), (GLD)

(THE CLEANEST INTERNET PLAY OUT THERE),

(GDDY), (WIX), (CSCO)

My Pick Won Best Picture!

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Mad Hedge Technology Letter

February 25, 2019

Fiat Lux

Featured Trade:

(THE CLEANEST INTERNET PLAY OUT THERE),

(GDDY), (WIX), (CSCO),

Check out GoDaddy (GDDY).

It’s a general bet on more people using the internet.

This trade dovetails nicely with my broader thesis of the dramatic migration to digital.

Brick and mortar stores will have no choice but to create a unique website and one of the most prominent web hosting services is GoDaddy.

The Mad Hedge Technology Letter is even powered by its services.

Lately, I’ve been all about this digital migration mantra and we are in the early innings of this seminal trend.

I gave you Cisco (CSCO) as a hot pick which is a bet on an increase in enterprise software business.

This is more of a question of how fast than if or when.

Are you ready for 5G?

The technology is on the verge of rolling-out to select cities around the US, and it will juice of web usage simply because users can navigate around more in a smaller time window.

GoDaddy was established by fellow Marine Bob Parsons in Baltimore 22 years ago and before GoDaddy, Parsons sold off his financial software services company, Parsons Technology to Intuit for $65 million.

He then launched Jomax Technologies which later morphed into GoDaddy in 1999 when employees were collaborating to change the company name and someone jokingly shouted out, "How about Big Daddy?"

Sadly, when the company found out that domain name had already been registered, Parsons replied, "How about Go Daddy?" and that was that.

What do I like about GoDaddy’s financials?

Better than expected profitability.

EPS forecasts were beaten handily with the company posting 24 cents, almost a double of the forecasted 13 cents.

Estimates of $693.5 million for the top line were marginally beaten by $2.3 million.

The company gave positive all-important guidance indicating robust momentum.

The firm is expecting $3 billion in 2019 sales and that is after doing $2.23 billion of sales in 2017.

Management has kept sales growth strong with a 3-year sales growth rate of 19%.

Customer renewal strength and higher average revenue per user (ARPU) growth is resonating with investors, and fused with higher operating margin could propel this firm’s shares higher.

ARPU mushroomed to $148.00 up 7% YOY while total customers rose 7% bringing the total customer base to over 18.5 million.

In 2018, over 1 million new customers were lured into the ecosystem.

The reason for this successful rise in domestic ARPU is enhanced site and product experiences, interactions focused on details and conversational marketing.

In a tech climate where a good portion of company outlooks are tepid at best, GoDaddy didn’t mince its words offering a better than expected positive outlook.

The financials look solid but allow me to explain a little more about its core products.

Almost 35% of websites on the internet is already constructed using WordPress’s platform and GoDaddy is the biggest host of paid WordPress at the end of last year.

GoDaddy’s supported WordPress offering automates the entire process of operating a secure WordPress website making it easy to use and highly popular to its customer base.

The role GoCentral's, GoDaddy’s flagship DIY website building product, plays is expanding as its numerous features increase and efficient performance is a consistent highlight for the firm.

The journey started in 2017 when GoDaddy established this service as a simple website building tool.

Concrete foundations were set and this service was integrated across a myriad of relevant third-party platforms while boosting product functions that are seeing outsized growth.

Daily entrepreneurs can now produce robust websites and carry out syndicate marketing across the e-commerce landscape.

The tandem of WordPress and GoCentral are growing subscriptions more than 40% YOY.

North America and Canada are the main revenue drivers, but international business is a wide-open opportunity waiting for management to pick off whether that's Latin America, Asia, or even in the Middle East.

The strategy for Europe is extracting the capability and product portfolio of North America, whether it be conversational marketing or features like security, backup, malware scans, plug-ins, and proactively migrate it to Europe because the model in America is obviously working and using that model will be a great development point.

Mexico and Brazil possess great growth potential and Asia continues to be about customer adds because the willingness to pay is different.

Competitor Wix (WIX) lately announced a shift in strategy, removing Domain Connect, and some of the low-end products and saying that they're going to come after WordPress.

But Chief Executive Officer of GoDaddy Scott Wagner is not worried about this nascent threat and is sure that this is the case of GoDaddy is in control of its own destiny than Wix being a viable threat.

As long as the company reinvests in its offerings and maximizes the user experience, Wix has a long way to go to compete with WordPress and are substantially smaller than GoDaddy.

And as GoDaddy keeps working on offering great value propositions and expanding the ecosphere with integrated and high-quality software, the stock is bound to jump further.

The momentum is palpable with this website hosting service a top player in its industry.

Wait for a pullback to buy some shares.

“You got to go down a lot of wrong roads to find the right one.” – Said Founder of GoDaddy Bob Parsons

Global Market Comments

February 25, 2019

Fiat Lux

Featured Trade:

(THE MARKET FOR THE WEEK AHEAD, or THE BEST OF TIMES AND THE WORST OF TIMES),

(SPY), (TLT), (TLT), (VIX), (KHC), (MAT), (MMT), (GLD)

It is truly the best of times and the worst of times. And it's not a stretch to apply Charles Dickens’ line from the Tale of Two Cities to the stock market these days.

On the one hand, stocks have just delivered one of the sharpest rallies in market history, up a staggering 20% in nine weeks. Everyone is swimming in money once again. It is the kind of move that one sees once a generation, and usually presages the beginning of long term bull markets.

On the other hand, the bull market in stocks is nearly ten years old. Some 13 months ago, the market traded at a lofty multiple of 20X, but earnings were growing at an incredible 26% a year. Today, multiples are at a very high 18X, but earnings growth is zero! This only ends in tears.

Furthermore, the low level of interest rates with the ten year US Treasury bond (TLT) at a subterranean 2.65% suggests that we are on the verge of entering a recession. Warning: bonds are always right.

Of course, it is speculation of a ‘beautiful” trade deal with China that has been driving share prices higher on an almost daily basis. Unfortunately, 90% of the deal has already been discounted in the market. We could be setting up the biggest “Sell on the news of all time.”

If instead, we get a delay of 45-90 days while details are hashed out, markets could move sideways for months. That would be death for Volatility Index (VIX) players which have already seen prices collapse this year from $36 to $13. A return visit to the $9 handle is possible. Yes, the short volatility trade is back in size.

Far and away the most important news of the week was that the Fed Pause Lives! Or so the minutes from the January FOMC meeting imply. Lower interest rates for longer offer more benefits than risks. Less heat from the president too.

Perhaps this is response to economic data that has universally turned bad. Durable Goods dove 1.2%, in January in a big surprise. Recession, here we come!

Europe is falling into recession, and they will likely take us with them. February Eurozone Manufacturing PMI fell to 49.2, a three-year low. You obviously haven’t been buying enough Burberry coats, Mercedes, or French wine.

It was a very rough week for some individual stocks.

The Feds subpoenaed Kraft Heinz (KHC), and stock dove 27% over accounting problems. Warren Buffet took a one-day $4 billion hit. What is really in that ketchup anyway besides sugar and red dye number two? Avoid (KHC).

No toys for Mattel (MAT) which saw the worst stock drop in 20 years on the back of poor earnings and worse guidance. Another leading indicator of a weak economy. Barbie isn’t putting out.

It wasn’t all bleak.

Walmart (WMT) delivered online sales up 46% in Q4. Are they the next FANG? Same-store sales jump at the fastest pace in ten years on soaring grocery sales. The Wall family certainly hopes so. Buy (WMT) on dips.

Gold hit a ten-month high, and we are long. The new supercycle for commodities has already started. Get on board before the train leaves the station. Buy (GLD).

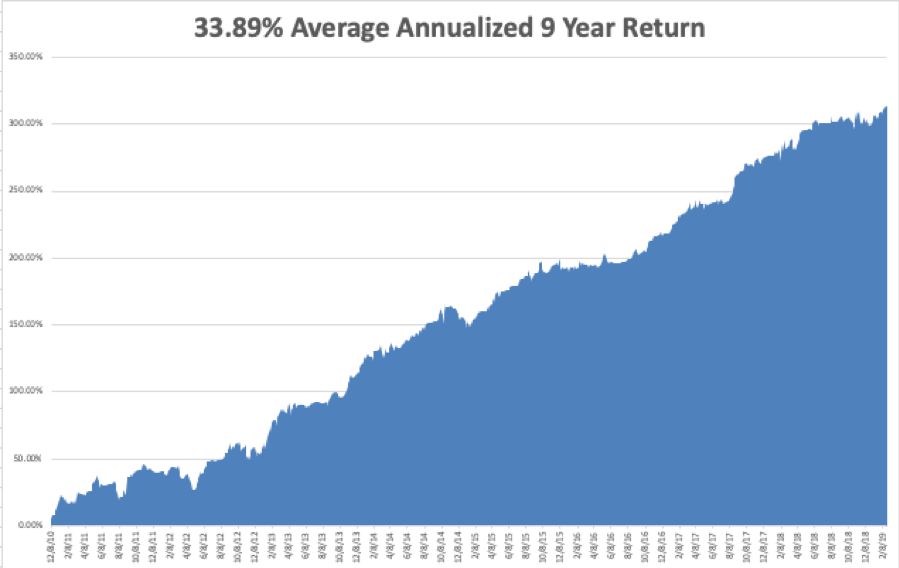

February has so far come in at a hot +4.07% for the Mad Hedge Fund Trader. My 2019 year to date return ratcheted up to +13.55%, boosting my trailing one-year return back up to +27.54%.

My nine-year return clawed its way up to +313.69%, another new high. The average annualized return appreciated to +33.89%.

I am now 80% in cash, 10% long gold (GLD), and 10% short bonds (TLT). We have managed to catch every major market trend this year loading the boat with technology stocks at the beginning of January, selling short bonds, and buying gold (GLD). I am trying to avoid stocks until the China situation resolves itself one way or the other.

It’s real estate week on the data front. An additional data delayed by the government shutdown is trickling out.

On Monday, February 25, at 8:30 AM EST, the Chicago Fed National Activity Index is out.

On Tuesday, February 26, 8:30 AM EST, January Housing Starts are published. At 9:00 the latest Case Shiller Corelogic National Home Price Index is published.

On Wednesday, February 27 at 10:00 AM EST, January Pending Home Sales are updated.

Thursday, February 28 at 8:30 AM EST, we get Weekly Jobless Claims. We also get an updated estimate on Q4 GDP. At 10:00 AM Fed governor Jerome Powell speaks.

On Friday, March 1 at 8:30 AM, we get data on January Personal Spending delayed by the government shutdown. The Baker-Hughes Rig Count follows at 1:00 PM.

As for me, I’ll be watching the Academy Awards on Sunday night. As I grew up near Hollywood, have dated movie stars my whole life, and even appeared as an extra in a couple of movies, I have always felt close to this industry.

My first pick for Best Picture is Green Book since I recall traveling through the deep south during this period. It was actually much worse than portrayed by the film. Roma is the favorite, but I thought it was boring. I guess I’m not the politically correct art film type.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.