“If you don't jump on the new, you don't survive.” – Said CEO of Microsoft Satya Nadella

Mad Hedge Hot Tips

February 4, 2019

Fiat Lux

The Five Most Important Things That Happened Today

(and what to do about them)

1) Is the Fed Pausing Because of Political Pressure or an Economy that is Falling Apart? Neither is a good answer for equity holders. Start cutting back risk while you can. There are lots of bids on the way up but none on the way down as December showed. Click here.

2) Factory Orders Nosedive 0.6% in November, the worst in a year. Funny how nobody wants to make stuff ahead of a recession.

3) Oil Prices Love the Venezuela Meltdown. But how high can prices go in the face of a fading economy? Watch out for the coming coup d’ etat. Click here.

4) New Junk Debt Issuance is Soaring. Do you think they’re trying to grab a seat before the music stops playing? Click here.

5) Exxon Pops on Earnings Beat. The rising price of Texas Tea is everything even though it is all hedged on (XOM)’s books. Gotta love that Venezuela crisis. Click here.

Published today in the Mad Hedge Global Trading Dispatch and Mad Hedge Technology Letter:

(THE MARKET FOR THE WEEK AHEAD, or FROM PANIC TO EUPHORIA),

(SPY), (TLT), (AAPL), (GLD),

(WHY AMAZON IS TAKING OVER THE WORLD),

(AMZN)

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

February 4, 2019

Fiat Lux

Featured Trade:

(THE MARKET FOR THE WEEK AHEAD, or FROM PANIC TO EUPHORIA),

(SPY), (TLT), (AAPL), (GLD),

What a difference a month makes!

In a mere 31 days, we lurched from the worst December in history to the best January in 30 years. Traders have gone from lining up to jump off the Golden Gate Bridge to ordering Dom Perignon Champaign on Market Street.

However, not everything is as it appears. The suicide prevention hotline on the bridge has been broken for years, and you can now pick up Dom Perignon at Costco for only $120 a bottle.

Clearly, investors are enjoying the show but are keeping one eye on the exit. Perhaps that’s why gold (GLD) hit an 8-month high as nervous investors Hoover up a downside hedge against their long positions.

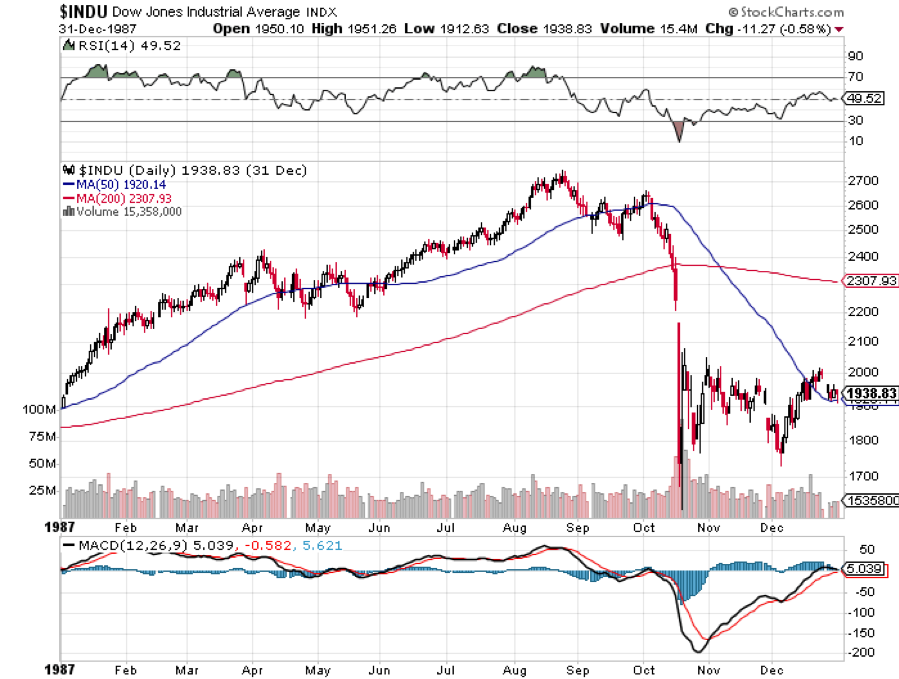

In fact, it has been the best January since 1987, with a ferocious start. The problem with that analogy is that I remember what followed that year (see chart below). After a robust first nine months of the year, the Dow Average (INDU) broke the 50-day moving average. It looked like just another minor correction and a buying opportunity.

The market ended up plunging 42% in weeks including a terrifying 20% capitulation swan dive on the last day. I tried actually to buy the stock at the close that day. The clerk just burst into tears and threw the handset on the floor. I didn’t get filled. Since the tape was running two hours late, NOBODY got filled on any orders entered after 12:00 PM.

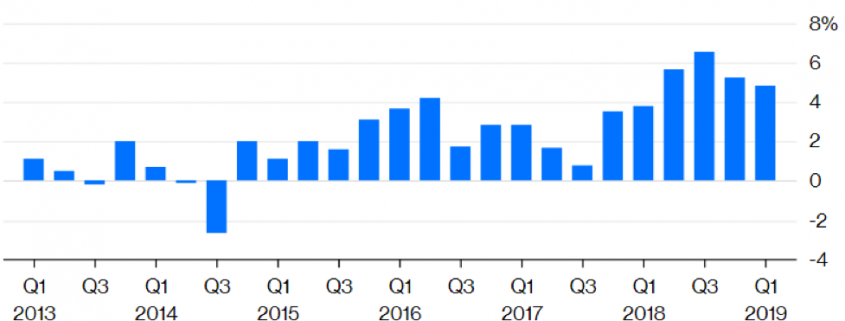

It doesn’t help that markets have been rising in the face of a collapsing earnings picture. Look at the chart below and you’ll see that after peaking out at an annualized 26% a year ago in the wake the passage of the new tax bill, earnings have been rolling over like the Bismarck on their way to zero.

If you own stocks anywhere in the world, this chart should have made the hair on the back of your neck stand up. It’s almost as if the tax bill was delivering the OPPOSITE of its intended outcome.

How multiple expansion will we get in the face of fading earnings? How about none? How about negative!

A totally red-hot January Nonfarm payroll Report on Friday at 304,000 confirmed that the economy was still alive and well, at least on a trailing basis. Headline Unemployment Rate rose to 4.0%.

The Labor Department said that the government shutdown had no impact on the numbers because federal employees were furloughed and not unemployed. Tomato, tomahto.

However, 175,000 workers were laid off in the private sector and that is why the Unemployment Rate ticked up to a multi-month high. Noise from the shutdown is going to be affecting all data for months.

That’s also why part-time workers jumped 500,000 in January. A lot of federal employees started working as Uber drivers and pizza delivery guys to put food on the table without a paycheck.

Further confusing matters was the fact that December was revised down by 90,000.

Leisure & Hospitality led the way with 74,000 new jobs, followed by Construction with 52,000 and Health Care by 42,000 jobs.

The shutdown is over, but how much did it cost us? Standard & Poor’s says $6 billion but the restart costs will be greater. More recent estimates run as high as $11 billion.

Weekly Jobless Claims were up a stunning 53,000, to 253,000, an 18-month high. While government workers can’t claim, their private subcontractors can, hence the massive shutdown-driven jump.

Bitcoin hits a new one-year low at $3,400. Some $400 billion has gone to money Heaven since 2017. Only $113 billion in market capitalization remains. I told you it was a Ponzi scheme. US coal production hits a 39-year low as it is steadily replaced by natural gas and solar. Could there be a connection? Talk about data mining.

Earnings were mixed, with some companies coming out hero’s, others as goats.

Apple (AAPL) slightly beat expectations with revenues at $84.31 billion versus $83.97 billion expected, and earnings at $4.18 per share versus $4.17 expected. Guidance going forward is very cautious of a slowing China.

Good thing I saw the ambush coming and covered my short two days ago. A penny beat is the most managed earnings I have ever seen. To warn about earnings and then surprise to the upside is classic Tim Cook.

December Pending Home Sales cratered, down 2.2% in December and 9.8% YOY. Despite the dramatically lower mortgage interest rates, buyers fled the crashing stock market.

“PATIENCE” is still the order of the day at the Federal Reserve with its Open Market Committee Meeting ordering no interest rate rise. It was a trifecta for the doves. The free pass for stocks continues. That’s why I covered all my shorts starting from last week. Even a blind squirrel occasionally finds an acorn.

Tesla reported another profit for the second consecutive quarter, and the company is about to reach escape velocity. Model 3 production in 2019 is to reach 75% of the total output and we can expect a new pickup truck. A second factory in Shanghai will take the “3” to over a half million units a year. That $35,000 Tesla is just over the horizon.

Why are all major companies reporting good earnings but cautious guidance? Are they reading the newspapers, or do they know something we don’t? Not a great sign of a continuing bull market. Sell the next capitulation top.

This week was a classic example of how the harder I work, the luckier I get, and I have been working pretty hard lately.

I came out of a near money Apple (AAPL) put spread at cost, then rolled into a far money put spread just before the stock sold off. That little maneuver made me $1,030 in two days.

Then, I spotted a perfect “head and shoulders” top in the bond market set up by a three-point rally in the (TLT). When the red hot January Nonfarm Payroll report printed the next day at 5:30 AM PCT, bonds immediately gave back a full point.

It was all enough to boost my performance to a new all-time high after a hiatus of two months. Those who recently signed up for my service must think that I am some kind of freakin' genius! They’ll learn the truth soon enough.

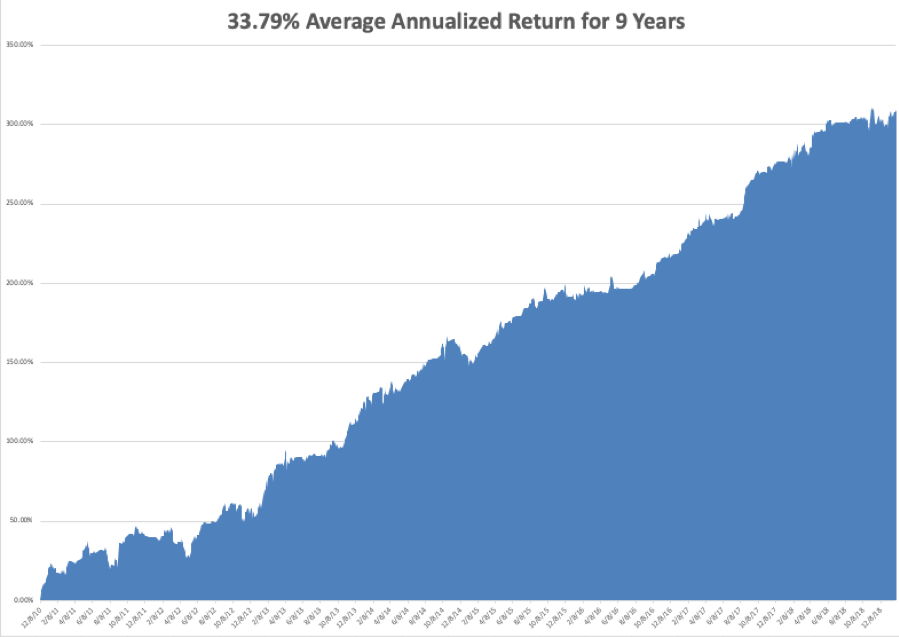

My January and 2019 year-to-date return soared to +9.66%, boosting my trailing one-year return back up to +29.24%. The is my hottest start to a New Year in a decade. Sometimes you have to make a sacrifice to the trading gods to get rewarded and that is what December was all about.

My nine-year return climbed up to +309.80%, a new pinnacle. The average annualized return revived to +33.79%.

I am now 80% in cash, short the bond market, and short Apple.

The upcoming week is still iffy on the data front because of the government shutdown. Some government data may be delayed and other completely missing. Private sources will continue reporting on schedule. All of the data will be completely skewed for at least the next three months. You can count on the shutdown to dominate all media until it is over.

Jobs data will be the big events over the coming five days along with some important housing numbers. We also have several heavies reporting earnings.

On Monday, February 4 at 10:00 AM, we get the much delayed December Factory Orders. Alphabet (GOOGL) reports.

On Tuesday, February 5, 10:00 AM EST, we learn the January ISM Non-Manufacturing Index.

On Wednesday, February 6 at 8:30 AM EST, the November Trade Balance is published.

Thursday, February 7 at 8:30 AM EST, we get Weekly Jobless Claims. December Consumer Credit follows at 9:30 AM and should be a humdinger. Intercontinental Exchange (ICE) reports.

On Friday, February 8, at 10:00 AM EST, Wholesale Inventories are out. The Baker-Hughes Rig Count follows at 1:00 PM.

As for me, I’ll be sitting down with a case of Modelo Negro and a big bag of Cheetos to watch the commercials during the Super Bowl with my family. (My dad played for USC Varsity in 1948). I never forgave the Rams for defecting from Los Angeles, and Boston is too far away to care about.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Are We in for a Repeat?

Mad Hedge Technology Letter

February 4, 2019

Fiat Lux

Featured Trade:

(WHY AMAZON IS TAKING OVER THE WORLD),

(AMZN)

Amazon, being the best publicly traded company in America, has more than one way to skin a cat.

That is what I took away during the mixed bag of an earnings call.

The road forward for most companies are defined by one maybe two unforgiving directions that the company has no choice but to migrate down through no fault of their own due to market forces.

Amazon operates in a different universe and the breadth of optionality for Amazon is breathtaking.

They have chosen to try to spike their future core business which has traditionally proven to pay dividends within three years or less.

Investors have always allowed Amazon to revert back to the reinvestment blueprint for added profitability - profits should reaccelerate once more in 2020.

Take into consideration that 2018 was a “light” year in Amazon’s reinvestment cycle in which Amazon only grew its fulfillment and shipping square footage by 15% and its headcount by 14%.

Amazon has used this playbook before. The warehouse efficiencies that benefited margins in 2018 was a direct result of massive capital expenditures into robot technology in the preceding years before that.

Amazon guided weakly on top line growth because of several regulation quagmires in India.

The Indian government began banning foreign online retailers from selling products from marketplace vendors that they have an equity stake in, leading Amazon to shelf items from its Indian site including its popular Echo speakers.

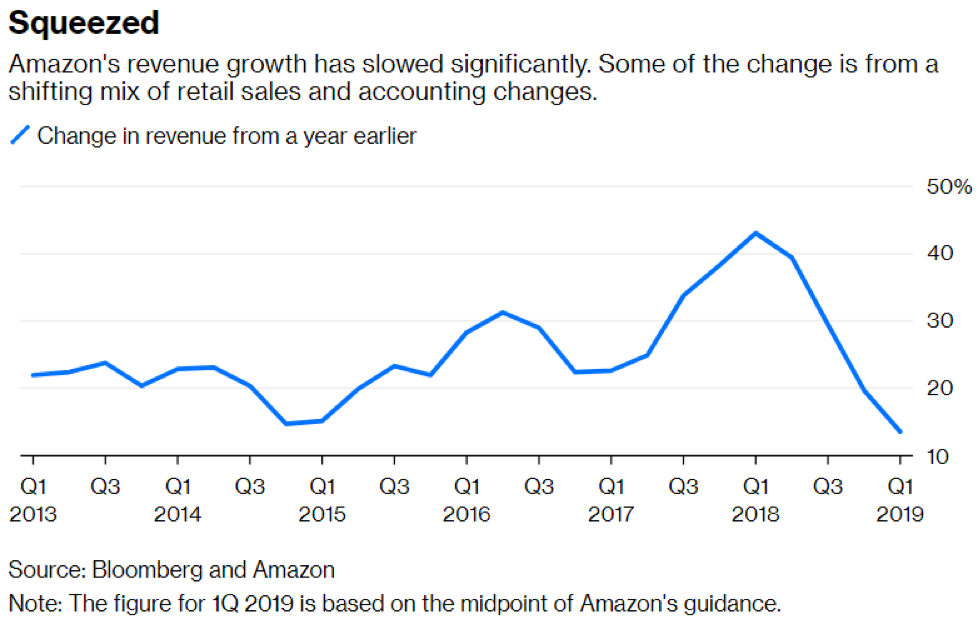

The $72.38 billion translating into 20% YOY fourth quarter revenue growth was its weakest since 2015.

They still have some work to do with physical stores, mostly Whole Foods, which saw a dip of 3% YOY in revenue.

Investors shouldn’t worry too much about this because Amazon can quickly switch back and ramp up revenue expansion when need be.

India is what China was 15 years ago and will morph into its own consumer supergiant with a population to service Amazon sales in the future.

Even with these headwinds that could frustrate operating margins and top-line revenue, Amazon still has some robust drivers in its portfolio in the form of cloud division Amazon Web Services (AWS) that grew 45% YOY and its advertising business which will perpetuate 50% YOY growth trajectory going forward.

Some other highlights were outperformance in voice tech with Amazon CEO Jeff Bezos gloating that “Echo Dot was the best-selling item across all products on Amazon globally, and customers purchased millions more devices from the Echo family compared to last year.”

In hindsight, the report wasn’t bad considering Q4 is the quarter Amazon usually diverges the most with expectations because of the sky-high expectations of the Christmas season.

Digital advertising is already a $12 billion-plus annual business and earned Amazon over $3 billion last quarter.

These lucrative businesses give Amazon more leeway into combatting headwinds that slow down its e-commerce engine.

The e-commerce side of business changes rapidly causing capital to be earmarked for reinvestment as others catch up to its latest iteration of Amazon.com.

That being said, operating income margins are still over 4% and for the business model Amazon is trotting out, it is still a healthy number.

Not only that, AWS’ margins still remain intact at a robust 29%.

Consumers will agree with you admitting they can visibly notice the e-commerce platform improving over time.

The mixed results dinged shares 4% and I would classify this as a positive down day considering that from peak to trough, Amazon gained 35% after the December sell-off.

If these earnings came out in December, I would not have been shocked with a 15% haircut, but this speaks volumes to how tech shares have been resilient.

And tech earnings, for the most part, have been encouraging relative to expectations.

The change in rules has bred uncertainty in its Indian operation and management will wait for the dust to settle to carve out a plan ahead, but this is small potatoes in the larger picture because of the cash cow that is rich western countries.

To sum things up, Amazon’s services and e-commerce platform is still humming along, but growth is tapering off just a tad.

Amazon plans to juice up their business model by reinvesting into their model extracting the bounty in the years ahead.

The lead up to this will be a broad-based harvest resulting in stock price acceleration.

Do not forget we just went through a global growth scare, and I still believe that if the overall market will rise, the tech sector will need to participate with the bigger names carrying a substantial load.

An even more positive signal are the likes of Facebook, Apple, and Netflix buoying nicely, boding well for short-term price action.

This all means that Amazon should be a buy on the dip company with its long-term growth story more attractive than any other tech name, and by a wide margin.

Margins could come down temporarily in the spring and summer offering weakness for investors to buy into.

Amazon is truly a multi-dimensional beast that uses its capital wisely to create red hot businesses that never existed before.

Such is the magnitude of innovation at Amazon to the point that I would argue that Amazon is the most innovative American company today, period.

I sit on the edge of my seat to see what Amazon does next and you should too.

The easiest way to play this is to buy and hold shares for the long term on any major ephemeral stock offloading because they dominate like any other company in their field in relative terms.

Amazon will be back above 2,000 later in 2019 or early 2020.

“One of the huge mistakes people make is that they try to force an interest on themselves. You don’t choose your passion; your passion chooses you.” – Said CEO of Amazon Jeff Bezos

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to the six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Mad Hedge Hot Tips

February 1, 2019

Fiat Lux

The Five Most Important Things That Happened Today

(and what to do about them)

1) January Nonfarm Payroll Surprises at 304,000. However, December was revised down by 90,000, so the market response was muted. The headline unemployment rate rises to 4.0%. Is the bottom in? Click here.

2) Weekly Jobless Claims Up a Stunning 53,000 to 253,000, an 18-month high. While government workers can’t claim, their private subcontractors can, hence the massive shutdown-driven jump. Click here.

3) US Coal Production Hits a 39-Year Low, as it is steadily replaced by natural gas and solar. A 19th-century energy source meets a 19th-century fate. Avoid (KOL) like the plague, buy Tesla (TSLA). Click here.

4) Amazon Appalls, with record earnings but surprisingly weak guidance. Stock dives $90. Buy the dip. This is only a short-term hickey. There is a double in Amazon from here, despite the divorce. Click here.

5) Why are all Major Companies Reporting Good Earnings but Cautious Guidance? Are they reading the newspapers, or do they know something we don’t? Not a great sign of a continuing bull market. Sell the next capitulation top.

Published today in the Mad Hedge Global Trading Dispatch and Mad Hedge Technology Letter:

(THE DEATH OF KING KOL),

(KOL), (PEA),

(THE BRAVE NEW WORLD OF ONLINE RETAILING),

(SNAP), (GPRO), (APRN), (SFIX)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.