When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

December 12, 2019

Fiat Lux

Featured Trade:

(WEDNESDAY FEBRUARY 3 BRISBANE, AUSTRALIA STRATEGY LUNCHEON)

(PLEASE SIGN UP NOW FOR MY FREE TEXT ALERT SERVICE NOW),

(BRING BACK THE UPTICK RULE!)

Earlier this year, my customer support office spent the entire day taking calls from readers who missed my Trade Alert to buy the iShares Barclays 20+ Year Treasury Bond Fund (TLT) March 2019 $126-$129 in-the-money vertical BEAR PUT spread at $2.40 or best. A few days later, it was worth a $4,000 profit.

The bond market completely fell apart afterwards, taking the spread up from $2.40 to $2.70 within minutes.

And I should warn you, this kind of instant blowout result is not unusual at the Mad hedge Fund Trader, as long-time followers of my service will tell you.

Having Trade Alerts that move so fast into the money is a good problem to have.

Subscribers to the Text Alert Service received messages on their cell phones within seconds worldwide and thus were able to act immediately on my perfectly timed Trade Alerts.

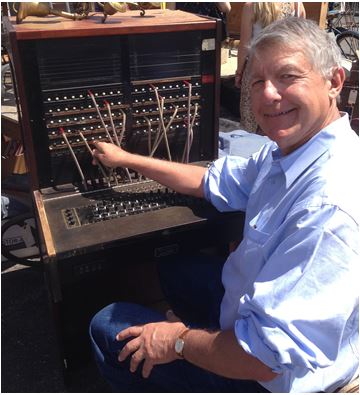

Every time I see this happen, I am amazed that I lived this long to see this technology develop. It’s all really great…. when it works.

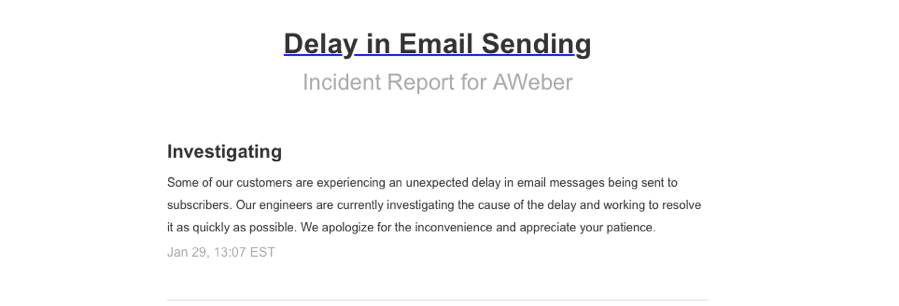

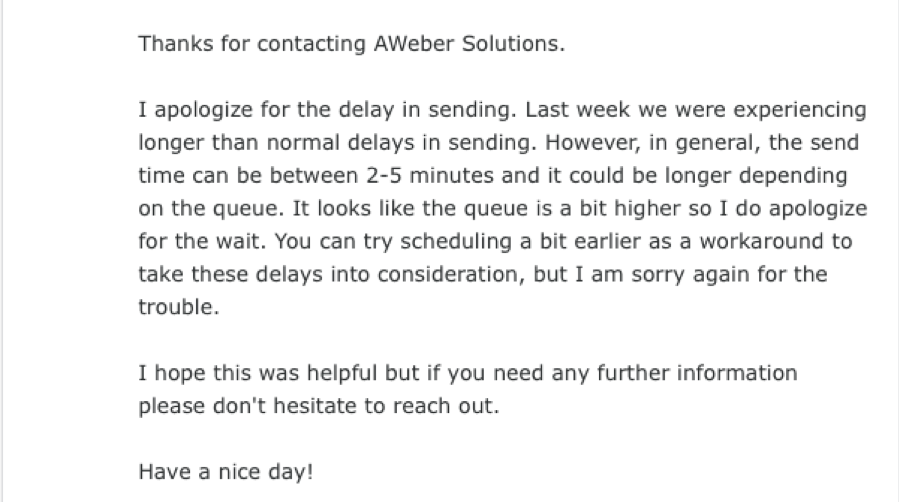

This eliminates frustrating delays caused by traffic surges on the Internet itself, and by your local server. Because our email application, Aweber Solutions, is unable to invest fast enough to keep up with the growth of their own business, we are encountering more frequent delays in our emails (see messages below).

To sign up for the Trade Alert Service, please email Filomena direct at support@madhedgefundtrader.com

Time is of the essence in the volatile markets. Individual traders need to grab every advantage they can. This is an important one.

Good luck and good trading.

Hook Me Up to John Thomas

Mad Hedge Biotech & Healthcare Letter

December 12, 2019

Fiat Lux

Featured Trade:

(THE STAMPEDE INTO BIOSIMILAR DRUGS),

(BIIB), (NOVN), (REGN), (ALXN), (NITE), (PFE), (AMGN), (MRK)

It’s been roughly a year since Biogen (BIIB) tightened its partnership with Samsung Bioepis and the Massachusetts-based biotech giant handed over an additional $100 million to funnel new programs to its own growing biosimilars pipeline.

On top of the upfront payment, the South Korean company is also eligible to gain up to $210 million depending on milestones achieved plus a $60 million fee if Biogen chooses to exercise its option in Europe. This comes in the heels of the $700 million it paid Bioepis in 2018 in an effort to boost its stake to 49.9% in their joint venture in the biosimilar space.

How has that gone?

In return, Biogen brought home two new ophthalmology biosimilars. One is a knockoff of Novartis AG’s (NOVN) prized Lucentis and the other is Regeneron Pharmaceuticals’ (REGN) top-selling Eylea. The terms of the recent deal give Biogen the exclusive commercialization rights worldwide.

Here’s a quick summary of the differences between biosimilars and generics.

Generics are identical versions of brand name products that lose patent protection. Biosimilars are considered as brand name products. However, these are highly similar to those existing branded drugs available in the market. The competitive edge of biosimilars against the “original” brand name products is the fact that they can deliver equivalent results at cheaper alternatives.

This latest update on Biogen’s partnership with Bioepis is dubbed as the “second wave” of biosimilar candidates joining the Biogen lineup. Aside from the Lucentis and Eylea biosimilars, Alexion Pharmaceuticals (ALXN) red blood cell treatment Soliris is also expected to join this batch.

Apart from that, the company can also commercialize a number of anti-tumor necrosis factor drugs in China with the list including plaque psoriasis drug Imraldi, rheumatoid arthritis treatment Benepali, and Crohn's disease medication Flicabi. Both companies have left their options open to potentially expand their current agreement in Europe for an additional five years.

Biogen’s first aggressive foray in the eye diseases sector was signified by its acquisition of clinical-stage gene therapy company Nightstar Therapeutics (NITE) earlier this year. At the time, the smaller company has already attracted attention for their research on rare retinal disorders.

Despite the promising announcements though, some investors remain wary of this growth direction Biogen has decided to pursue.

A commonly voiced concern is the issue of the production timeline, especially since neither biosimilar drug from the new deal has actually completed clinical trials to prove their efficacy compared to the reference drugs. At this point, the Lucentis biosimilar is in Phase 3 testing while the Eylea copycat is still in the preclinical phase. Patent issues are notable roadblocks as well.

Regardless of the issues, Biogen appears to be set on this track. Even before the “second wave” was implemented, the company has already presented a convincing lineup of biosimilars. A look at its third quarter earnings report showed that the biosimilars lineup managed to generate almost $184 million during that period alone, with copycat versions of Enbrel, Remicade, and Humira taking the lead in sales.

The biosimilars movement remains strong among biotech and pharmaceutical companies. Unlike in the generic drug sector, the leaders of the biosimilar movement are also the big names in the “branded” products market.

In fact, biotech heavyweights eagerly jumped at the opportunity to become frontrunners in the move to cut down on the staggering costs of branded medicine. Novartis has quickly developed its biosimilars arm, with Sandoz AG quickly taking over the European market.

Pfizer’s (PFE) partnership with South Korean biosimilar developer Celltrion Healthcare as well as its $17 billion acquisition of generic injectable pharmaceuticals producer Hospira in 2015 signify its plans to emerge as a strong contender in this sector. Even Amgen (AMGN) and Merck & Co. (MRK) have cranked up notable biosimilar development programs to join the race.

Needless to say, the biosimilar rush is all the rage right now. Big biotech companies have already learned their lesson on how the generic drugs business practically took over the pharmaceutical market, growing to almost 90% of overall prescriptions filled but only accounting for less than 30% of the total expenses. Plus, it’s also clear that big money is being made from blockbuster biologics.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to the six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.