When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Technology Letter

May 29, 2020

Fiat Lux

Featured Trade:

(TRUMP’S TWITTER ATTACK WILL GO NOWHERE),

(TWTR), (FB)

I am convinced that Facebook (FB) and Twitter and other social media platforms will suffer minimal damage as a result of the administration cracking down on social media platforms.

The executive order could make it possible for social media companies to become liable for content posted on their platform.

The issue came about after Twitter decided to fact check two of Trump’s tweets.

To read more about Twitter’s decision, click here.

Trump views the fact checks as a personal attack against him and a threat to his ambitions in the political arena.

Section 230 refers to Section 230 of Title 47 of the United States Code (47 USC § 230). It was passed as part of the controversial Communication Decency Act of 1996.

Section 230 says that “No provider or user of an interactive computer service shall be treated as the publisher or speaker of any information provided by another information content provider.”

To read more about the law from Harvard Law Review, click here.

Facebook’s CEO Mark Zuckerberg condemned Twitter’s action saying that social media companies shouldn’t be the “arbiter of truth.”

What I see is President Donald J. Trump putting a massive premium on his Twitter account as the focal point to disperse his opinions and thoughts in the run-up to the U.S. presidential election.

This could be the difference between winning or losing!

This election will be fought tooth and nail on digital platforms and in the realm of global social media, Twitter is one of the most important platforms which is why I am incredibly bullish on the stock.

U.S. Democratic nominee Joe Biden understands the role of digital media in the upcoming election the hard way by being forced to be rooted in front of a webcam instead of rallying the masses at in-person live events.

Unable to round the circuit is an outsized blow for Biden and his digital response to it will be measured up to the Republican’s controversial response to the health crisis.

Trump has Twitter at his disposal and is much more adept at wielding it for his personal and career interests than Biden.

This U.S. election could become a Twitter contest to an extreme degree.

Twitter intruding into Trump’s daily flow of tweets and the backlash resulting from it is a clear signal that Trump is adamant that he can say whatever he wants through his Twitter account and in his mind, that will springboard him to re-election.

Facebook has benefited the most from Section 230 by Zuckerberg building his tech firm into a $650 billion company. Google’s YouTube platform is another outsized winner too.

This is the very law that undergirds Facebook’s entire competitive advantage since the company doesn’t actually produce anything, not even its own content.

Remember that Facebook effectively profits off of other’s personal data by giving digital ad companies the ability to post ads to a specific audience of Facebook subscribers.

I understand that Zuckerberg doesn’t consider this selling personal data and the difference at most comes down to technical verbiage.

I believe it will not devolve to a litigious stage.

This is merely a hands-off warning by Trump who wants control over his Twitter account and destiny up until the November election without any distractions or tech firms playing boss.

Zuckerberg wants Twitter CEO Jack Dorsey to shut his mouth and continue with the status quo which would mean higher stock prices and extreme wealth generation for everyone involved.

The exorbitant costs associated with auditing content of over 2 billion people keep Zuckerberg up at night.

Artificial Intelligence cannot identify the next threat and its backdated database can only identify what was assumed malicious in the past.

There is simply no way to ensure that 100% of content flowing through these digital arteries is mainstream enough to be deemed acceptable and social media platforms would open themselves up to lawsuits.

The lead up to the 2020 U.S. presidential election will most likely experience record social media engagement and these powerful platforms like Facebook and Twitter are the last tech stocks investors should go bearish on in the short-term.

Trump’s panic at the Twitter fact check is a stamp of approval for Twitter and Facebook.

Buy them on the dip.

“A founder is not a job, it's a role, an attitude.” – Said Co-Founder and CEO of Twitter Jack Dorsey

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

May 29, 2020

Fiat Lux

Featured Trade:

(JOIN THE JUNE 4 TRADERS & INVESTORS SUMMIT),

(THE CONTINUING DEATH OF RETAIL),

(AMZN), (WMT), (M), (JWN),

(TESTIMONIAL)

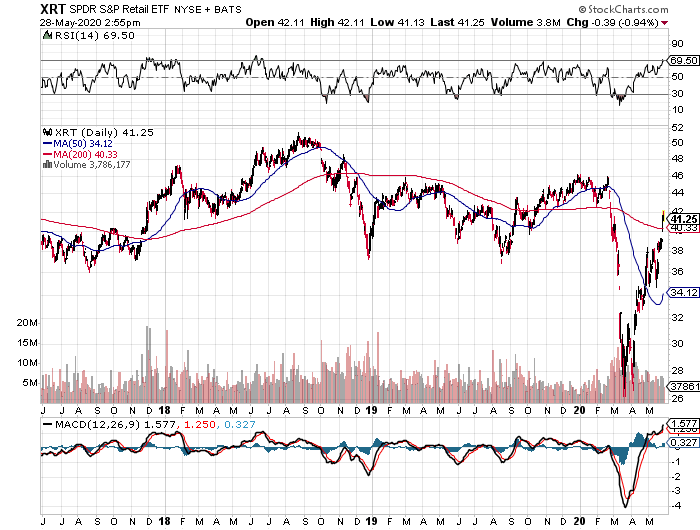

If you had to pick the biggest loser of our ongoing pandemic and the trade wars, it would be the retail industry (XRT). Higher costs which can’t be passed on, rising minimum wages, lower selling prices, and a massive inventory glut is not what money-making is all about.

Now, take all of those problems and drop your revenues by half, thanks to the pandemic. A future where touching, feeling, and trying on things before you buy them is about to become an extravagant luxury.

The stocks have delivered as expected, providing one of the worst-performing sectors of the past three years. Half of them probably won’t even make it until Christmas.

In fact, Sears and Macy’s have announced more store closings nationwide. The overhead is killing them in a micro margin world devoid of window shopping customers.

So, I stopped at a Walmart (WMT) the other day on my way to Napa Valley to find out why.

I am not normally a customer of this establishment. But I was on my way to a meeting where a dozen red long stem roses would prove useful. I happened to know you could get these for $10 a dozen at Walmart, 60% cheaper than anywhere else.

After I found my flowers, I browsed around the store to see what else they had for sale. The first thing I noticed was that half the employees were missing their front teeth.

The clothing offered was out of style and made of cheap material. It might as well have been the Chinese embassy. Most concerning, there was almost no one there, customers OR employees.

The Macy’s downsizing is only the latest evidence of a major change in the global economy that has been evolving over the last two decades.

However, it now appears we have reached both a tipping point and a point of no return. The future is happening faster than anyone thought possible. The pandemic has forced business evolution to move at hyper fast forward and the Death of Retail is no exception.

I remember the first purchases I made at Amazon 20 years ago. I personally knew the founder, Jeff Bezos, from my Morgan Stanley days. The idea sounded so dubious that I made my initial purchases with a credit card with only a low $1,000 limit. That way, if the wheels fell off, my losses would be limited.

And how stupid was that name, Amazon, anyway? At least he didn’t call it “Yahoo” because it was already taken.

Today, I do almost all of my shopping at Amazon (AMZN). It saves me immense amounts of time while expanding my choices exponentially. And I don’t have to fight traffic, engage in the parking space wars, or wait in line to pay.

It can accommodate all of my requests, no matter how bizarre or esoteric. A WWII reproduction Army Air Corps canvas flight jacket in size XXL? No problem!

A used 42-inch Sub Zero refrigerator with a front door ice maker and water dispenser? Have it there in two days, with free shipping at one fifth the $17,000 full retail price.

So I was not surprised when I learned that Amazon accounted for 25% of all new online sales in 2019 in a market that is already growing at a breathtaking 20% YOY.

In 2000, after the great “Y2K” disaster that failed to show, I met with Bill Gates Sr. to discuss his foundation’s investments.

It turned out that they had liquidated their entire equity portfolio and placed all their money into bonds. It turned out to be a brilliant move, coming mere months before the Dotcom bust and a 20-year bull market in fixed income which only peaked two months ago.

Mr. Gates (another Eagle Scout) mentioned something fascinating to me. He said that unlike most other foundations their size, they hadn’t invested a dollar in commercial real estate. Today, that looks like a prescient move in the extreme with 60% of mall tenants skipping their rent.

It was his view that the US economy would move entirely online, everyone would work from home, emptying out city centers, and rendering commuting unnecessary. Shopping malls would become low rent climbing walls and paintball game centers.

Mr. Gates’ prediction may finally be occurring. In the San Francisco Bay area, the only employed people are those who are telecommuting.

Even before the pandemic, it was common for staff to work Tuesday-Thursday at the office, and from home on Monday and Friday. Productivity increases. People are bending their jobs to fit their lifestyles. And oh yes, happy people work for less money in exchange for personal freedom, boosting profits.

The Mad Hedge Fund Trader itself may be a model for the future. We are entirely a virtual company, with no office. Everyone works at home in four countries around the world. Oh, and we all use Amazon to do our shopping.

The downside to this is that whenever there is a snowstorm anywhere in the country, it affects our output. Two storms are a disaster, and at three, such as last winter, we grind to a virtual halt.

The main thing I am worried about is the Internet in the Philippines which is unable to handle the tenfold increase in demand since the start of the pandemic. They don’t have our infrastructure. If you wonder why your customer support at any company has suddenly gotten poor, that is the reason.

You may have noticed that I can work from anywhere and anytime (although sending a Trade Alert from the back of a camel in the Sahara Desert was a stretch), so was sending out an Alert while hanging on the cliff face of a Swiss Alp. But they both made money.

Moroccan cell coverage is better than ours, but the dromedary’s swaying movement made it hard to hit the right keys.

The cost of global distribution is essentially zero. Profits go into a bonus pool shared by all. Oh, and we’re hiring, especially in marketing.

It is happening because the entire “bricks and mortar” industry is getting left behind by the march of history.

Sure, they have been pouring millions into online commerce and jazzed up websites. But they all seem to be poor imitations of Amazon, with higher prices and worse service. It is all “hour late and dollar short” stuff.

In the meantime, Amazon has soared by an eye-popping 56% since the March 23 low and is one of the top-performing big-cap stocks of 2020. There is now a cluster of Amazon analyst forecasts targeting the $3,000 mark, including me.

And here is the bad news. Bricks and Mortar retailers are about to lose more of their lunch to Chinese Internet giant Alibaba (BABA), which is ramping up its US operations and is FOUR TIMES THE SIZE OF AMAZON!

There’s a good reason why you haven’t heard much from me about retailers. I made the decision 30 years ago never to touch the troubled sector.

I did this when I realized that management never knew beforehand which of their products would succeed and which would bomb, and therefore, were constantly clueless about future earnings.

The business for them was an endless roll of the dice. That is a proposition in which I was unwilling to invest. There were always better trades.

I confess that I had to look up the ticker symbols for this story, as I never use them.

You will no doubt be enticed to buy retail stocks as the deal of the century by the talking heads on TV, Internet research, and maybe even your own brokers, citing how “cheap” they are because the prices are so low.

Never confuse a low stock price with “cheap.”

It will be much like buying the coal industry (KOL) a few years ago, another industry headed for the dustbin of history. That was when “cheap” was on its way to zero for almost every company. Don’t buy the next coal company.

So the next time someone recommends that you buy retail stocks, you should probably lie down and take a long nap first. When you awaken, hopefully the temptation will be gone.

Or better yet, go shopping at Amazon. The deals are to die for.

To read “An Evening with Bill Gates Sr.,” please click here.

Thanks for the great newsletter and advice. I truly enjoy it. You are one of a kind!

Credits to you as my financial navigator, as I am finally making some serious money after years of doing it the hard and wrong way.

Kind regards

Rolf

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Biotech & Healthcare Letter

May 28, 2020

Fiat Lux

Featured Trade:

(ASTRAZENECA’S WASHINGTON FREEBIE)

(AZN), (MRK), (PFE), (JNJ)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.