When I joined Morgan Stanley some 35 years ago, one of the grizzled old veterans took me aside and gave me a piece of sage advice.

“Never buy a Dow stock”, he said. “They are a guarantee of failure.”

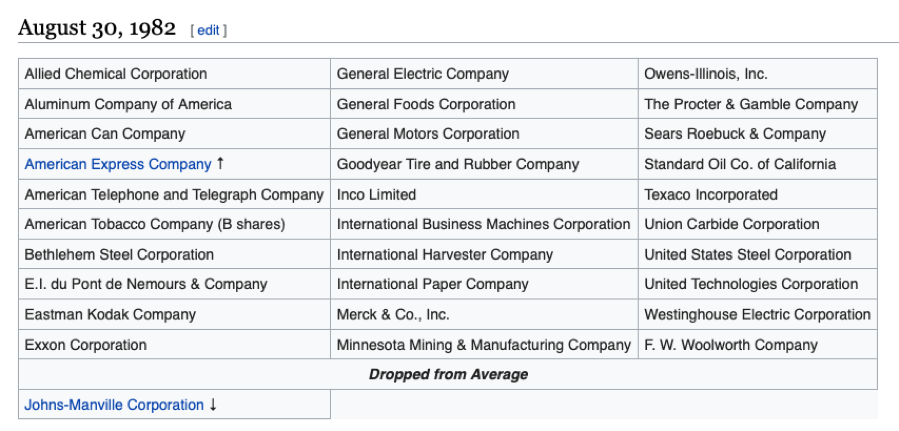

That was quite a bold statement, given that at the time the closely watched index of 30 stocks included such high-flying darlings as Eastman Kodak (EK), Sears Roebuck & Company (S), and Bethlehem Steel (BS). It turned out to be excellent advice.

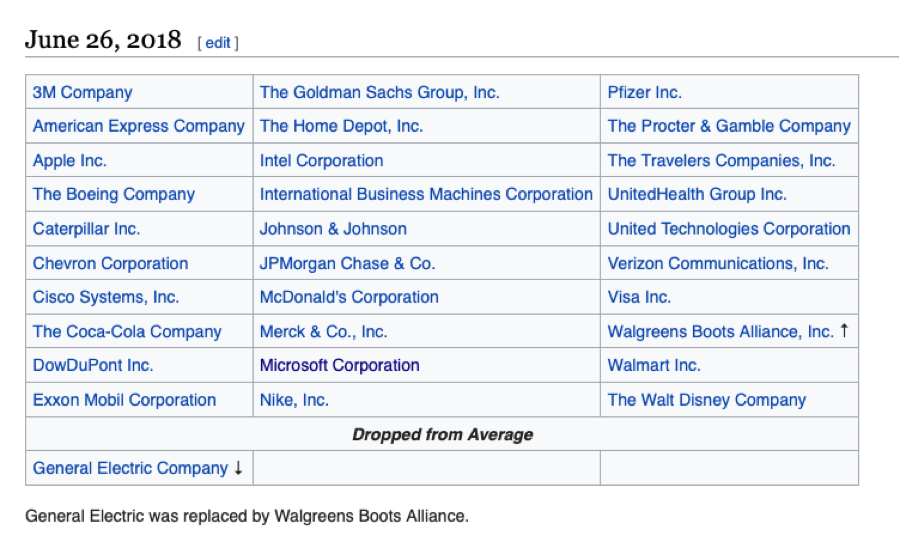

Only ten of the Dow stocks of 1983 are still in the index (see tables below), and almost all of the survivors changed names. Standard Oil of California became Chevron (CVX), E.I du Pont de Nemours & Company became DowDuPont, Inc. (DD), and Minnesota Mining & Manufacturing became 3M (MMM).

Almost all of the rest went out of business, like Union Carbide Corporation (the Bhopal disaster) and Johns-Manville (asbestos products) or were taken over. A small fragment of the old E.W. Woolworth is known as Foot Locker (FL) today.

Charles Dow created his namesake average on May 26, 1896, consisting of 12 names. Almost all were gigantic trusts and monopolies that were broken up only a few years later by the Sherman Antitrust Act.

In many ways, the index has evolved to reflect the maturing of the US economy, from an 18th century British agricultural colony, to the manufacturing powerhouse of the 20th century, to the technology and services-driven economy of today.

Of the original Dow stocks, only one, US Leather, vanished without a trace. It was the victim of the leap from horses to automobile transportation and the internal combustion engine. United States Rubber is now part of France’s Michelin Group (MGDDY).

American Tobacco reinvented itself as Fortune Brands (FBHS) to ditch the unpopular “tobacco” word. National Lead moved into paints with the Dutch Boy brand. It sold off that division when the prospects for leaded paints dimmed in 1970 (they cause mental illness in children).

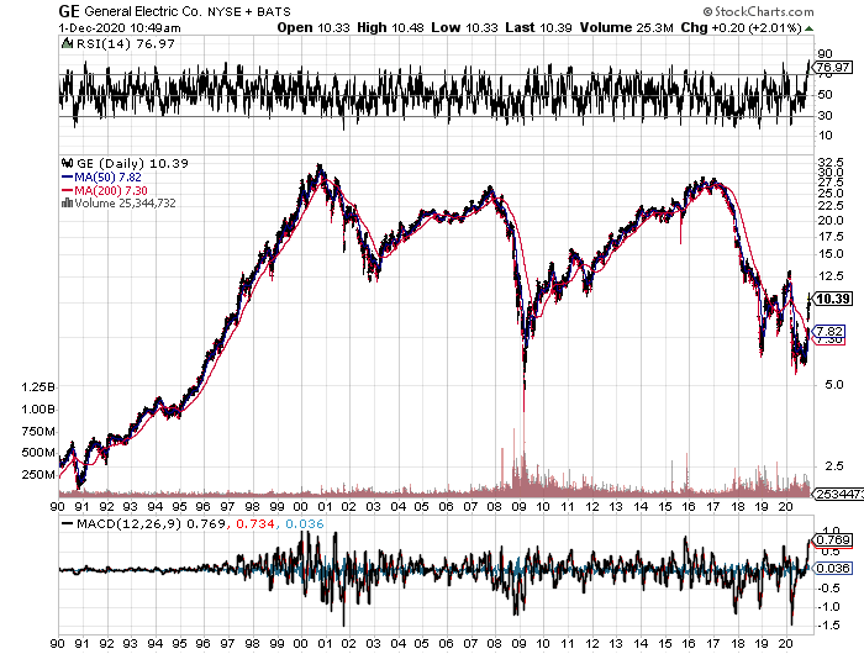

What was the longest-lived of the original 1896 Dow stocks? General Electric (GE), originally founded by light bulb inventor Thomas Edison. It went down in flames thanks to poor management and was delisted in 2018. It was a 122-year run. Today, it is one of the great turnaround challenges facing American Industry.

Which company is the American Leather of today? My bet is that it’s General Motors (GM), which is greatly lagging behind Tesla (TSLA) in the development of electric cars (99% market share versus 1%). With a product development cycle of five years, it simply lacks the DNA to compete in the technology age.

What will be the largest Dow stock in a decade? Regular readers of the Mad Hedge Fund Trader already know the answer.

Sears: Not the Path to Wealth and Riches