When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

June 24, 2020

Fiat Lux

Featured Trade:

(HOW TO HEDGE YOUR CURRENCY RISK),

(FXA), (UUP),

(TESTIMONIAL)

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Biotech & Healthcare Letter

June 23, 2020

Fiat Lux

Featured Trade:

(WHY SEATTLE GENETICS IS ON FIRE)

(SEGN), (MRK), (TAK), (GSK), (BGNE), (RHHBY), (NVS), (PFE), (IMG)

It’s not all about the Coronavirus

Though the COVID-19 pandemic has claimed the lives of over 120,000 people and is causing the suffering of almost 1.3 million patients in the United States alone, cancer and heart disease remain the leading causes of death in the country.

The American Cancer Society journal estimates that there will be around 1.8 million cancer cases this year, with 606,520 of those resulting in deaths.

Needless to say, the continuously increasing incidence of this deadly disease has prompted a number of companies in the biotechnology and healthcare sectors to invest substantially in creating and developing drugs for cancer treatment.

Buoyed by this demand, biotechnology company Seattle Genetics (SEGN) has gained 40.1% in 2020 so far primarily thanks to its cancer drugs.

In fact, Seattle Genetics welcomed 2020 with a newly approved drug called Padcev, which the company developed alongside Tokyo-based Astellas Pharma to treat the most common type of bladder cancer.

Despite the pandemic, Padcev sales have been exceeding expectations and analysts are jacking up the sales estimates for this potent bladder cancer product.

Initially pegged to rake in roughly $10 million in quarterly sales, Padcev managed to beat the estimates by four- to fivefold with $34.5 million in the first quarter of 2020.

Since then, peak sales prediction for this drug has been increased to a whopping $2 billion, with its 2020 sales target to be around $221 million.

Approximately 80,000 new bladder cancer cases are diagnosed every year in the United States. Among these patients, 90% suffer from the urothelial type -- the kind that Padcev is formulated to address.

Adding to that, Padcev’s success can also be attributed to the fact that it’s the only FDA-approved product for this particular patient set.

Riding on the momentum of Padcev’s unchallenged success in the bladder cancer field, Seattle Genetics and Astellas are now looking to expand the drug’s indication to cover an even larger patient set.

If this works out, then Padcev opens a whole new slew of possibilities to the tune of an additional $5.8 billion to its revenue.

At the moment, Padcev is also not prescribed to patients in the earlier stages of the disease - a demand that Seattle Genetics aims to address with its collaboration with Merck (MRK) via the immuno-oncology’s powerhouse drug Keytruda.

Aside from its bladder cancer drug, Seattle Genetics is also actively making a name for itself in another field.

In April 2020, Seattle Genetics received another positive news from the FDA.

The company’s breast cancer drug Tukysa, which was expected to gain approval by August this year, received the green light four months earlier instead.

Tukysa is another potential blockbuster drug for Seattle Genetics, with the product’s peak sales estimated to reach $1.2 billion by 2030.

All these are actually pretty impressive considering that Seattle Genetics was a one-product biotechnology company just a year ago.

Its single product, Hodgkin lymphoma drug Adcetris, had a specially impressive 2019 because of label expansions.

The drug posted a 32% jump in net sales to reach $627.7 million in the US and Canada. For 2020, Adcetris’ sales is expected to grow somewhere between 8% and 12%.

Apart from expanding the use of both Adcetris and Padciv, Seattle Genetics is also looking into developing new antibody treatments specifically for patients with solid tumors and lymphomas.

It currently has several candidates undergoing clinical trials, with some of these potential treatments expected to go head-to-head against active competitors in the space, including Roche (RHHBY), Novartis (NVS), Takeda Pharmaceutical (TAK), Pfizer (PFE), and Immunogen (IMG).

Prior to the approval of Padcev and Tukysa, the major growth driver that augmented Adcetris’ earnings was the company’s royalty revenue.

In the fourth quarter of 2019, the biotechnology company raked in $72.3 million in royalty revenue. This is actually triple the amount it earned in the same period in 2018.

The main source of its royalty revenue at the time is the $40 million in milestone payment it received from Takeda.

The payment was triggered by the annual net sales of Adcetris that went beyond $400 million in Takeda’s territory.

The total royalty revenue was also supplemented by a milestone payment from GlaxoSmithKline (GSK) and an upfront payment from Seattle Genetics’ work with Beijing-based company BeiGene (BGNE).

In the first quarter of 2020, royalty revenues jumped to $20 million compared to the $16 million the company earned during the same period in 2019.

Once again, this growth was attributed to Adcetris’ sales and boosted by royalties from the company’s collaboration with Roche (RHHBY) on the latter’s lymphoma drug Polivy.

Seattle Genetics has consistently grown its revenue since 2011 when its first-ever drug Adcetris received approval. With the recent additions of potential blockbusters Padcev and Tukysa, the company’s financial picture looks brighter than ever.

One of the key factors in its success is that the company addresses significant patient sets, providing its investors with the confidence that it can attract physicians and patients on board.

The Hodgkin lymphoma drug market, which Adcetris has covered, is anticipated to grow by roughly $1.24 billion from 2019 through 2023.

The urothelial cancer drug market, where Padciv is currently king, is estimated to hit $3.6 billion by 2023, with a 23% compound annual growth rate.

Tukysa addresses another patient set with high demand as well, with reports showing that the spending on HER2-positive cancer is anticipated to jump by 54% to hit $9.89 billion by 2025.

CLVS is back to the entry price and I would like to take this as an opportunity to collect some call premium.

I am going to suggest you sell the front week $7.50 call on the stock.

Here is the trade:

Sell to Open (1) June 26th - $7.50 Call for every 100 shares you own.

You should be able to sell them for $.25 per every option.

This will bring the call premium collected on this position to 50 cents per share.

If the calls are assigned this Friday, the return will be 9.4% for less than a month.

Of course, this alert only applies to you if you own shares in CLVS.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

June 23, 2020

Fiat Lux

Featured Trade:

(HERE ARE THE FOUR BEST PANDEMIC-INSPIRED TECHNOLOGY TRENDS),

(AMZN), (CHWY), (EBAY), NFLX), (SPOT), (TMUS), (ATVI), (V), (PYPL), (AAPL), (MA), (TDOC), (ISRG), (TMDI)

By now, we have all figured out that the pandemic has irrevocably changed the course of technology investment. Some sectors are enjoying incredible windfalls, while others are getting wiped out.

The digitization of the economy has just received a turbocharger. It has become a stock pickers market en extemus.

The good news is that we are still on the ground floor of trends that have a decade to run, like working from home, more online food purchases, and a rise in touchless payments. This means there's a huge upside for investors willing to make big bets on what’s expected to become some of the most important technologies in the years ahead.

Covid-19 is a wake-up call to accelerate trends that have been around for years and are now greatly speeding up. The pandemic seems to have triggered a new survival instinct: innovate fast or die. Let me list some of the frontrunners.

1. E-commerce

E-commerce is the No. 1 shelter-in-place beneficiary by miles, as a combination of stay-at-home orders, reduced spending on dining, and government stimulus have sent Americans in search of other ways to spend their money. Even though Covid-19 restrictions are now being eased, the e-commerce industry should still see about 25% growth across all of 2020.

The estimated $60 billion spent by consumers from their stimulus checks has also been a tailwind. While the world is now re-opening, we expect these buckets of available dollars to remain e-commerce tailwinds for the foreseeable future as we expect adjusted retail and travel spend to decline an aggregate of 18% in and for as much as half of all small retail stores to potentially close this year.

When Amazon shares were at $1,000, I wrote a report calculating that its breakup value was at least $3,000 a share. It looks like Amazon may hit that target before yearend….without the breakup.

Want to know the winners? Try Amazon (AMZN), Chewy (CHWY), and eBay (EBAY).

2. Digital Entertainment

The Covid-19 pandemic has also left more Americans in search of digital, at-home entertainment, a trend that’s delivered a huge push for companies like Activision Blizzard that develop online games. New users, time spend gaming and in-game purchases are only accelerating and spell even more lasting benefit for game developers.

Content names like video streaming site Netflix (NFLX), as well as bandwidth and connectivity companies including Comcast (CMCSA) and T-Mobile (TMUS), are names to focus on.

This increased use of high bandwidth applications is likely to continue post-COVID-19 and has the impact of similarly increasing the demand for bandwidth and connectivity. This increases the value of upstream assets in the infrastructure sectors like fiber-based wireline broadband networks and nascent 5G build-outs.

Names to play the space: Netflix (NFLX), Spotify (SPOT), T-Mobile (TMUS), Activision Blizzard (ATVI).

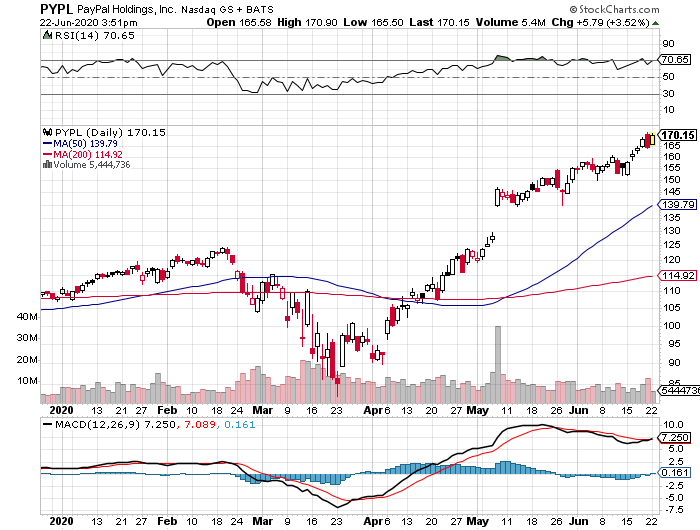

3. Touchless payments

Another trend the stock market still underappreciated is a generational surge in contactless payments, which has recently seen a jump higher amid Covid-19 fears and efforts to minimize physical contact. Companies like Visa (V), Mastercard (MA), and PayPal (PYPL), already integral to the payments world, should be major beneficiaries in the years ahead.

The market assumes that COVID-19 related adoption of digital payments is a near-term benefit for payment service providers, offsetting some of the consumer spending headwinds. However, digitization of payments is part of a multi-year secular growth driver, with COVID-19 as just the latest accelerator.

Names to play the space: Visa (V), PayPal (PYPL), Apple (AAPL), and Mastercard (MA).

4. Telemedicine

Healthcare is one of the most inefficient industries left in the United States. I call it a 19th century industry operating with 21st century technology. While progress has been made, those massive stacks of paper records are finally disappearing, there still is a long way to go.

These days, even doctors don’t want to see patients in person, as they may contract the Coronavirus. Far better to see them online, which could address 90% of most patients. Teledoc (TDOC) does exactly that (click here for my full report).

So does Intuitive Surgical (ISRG), maker of DaVinci Surgical Systems, which enables remote operations for a whole host of maladies. Titan Medical (TMDI) is another name to look at here.

Names to play the space: (TDOC), (ISRG), (TMDI).

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.