When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

March 4, 2021

Fiat Lux

Featured Trade:

(THE BARBELL PLAY WITH BERKSHIRE HATHAWAY),

(BRKA), (BRKA), (BAC), (KO), (AXP), (VZ), (BK) (USB),

(TLT), (AAPL), (MRK), (ABBV), (CVX), (GM), (PCC), (BNSF)

It’s time to give myself a dope slap.

I have been pounding the table all year about the merits of a barbell strategy, with equal weightings in technology and domestic recovery stocks. By owning both, you’ll always have something doing well as new cash flows bounce back and forth between the two sectors like a ping pong ball.

After all, nobody gets sector rotation right, unless they have been practicing for 50 years, like me.

Full disclosure: I have to admit that after 50 years of following him, I love Buffet. He was one of the first subscribers to my newsletter when it started up in 2008. Some of his best ideas have come from the Mad Hedge Fund Trader, like buying Bank of America for $5 in 2008.

Oh, and he hates Wall Street for constantly fleecing people. Ditto here.

In reading Warren Buffet’s annual letter (click here for the link), it occurred to me that his Berkshire Hathaway (BRKB) shares were in effect a one-stop barbell investment.

For a start, Warren owns a serious slug of Apple (AAPL), some $120 billion worth, or 2.5% of the total fund. That gives (BRKB) some technology weighting. It cost him only $20 billion. The dividends he received entirely paid for the initial cost. So he owns 4% of Apple for free.

I remember the battle over the initial “BUY” five years ago. Warren fought it, insisting he didn’t understand the smart phone business. In the end, he bought Apple for its global brand value alone.

That is Warren Buffet to a tee.

The next five largest publicly listed holdings are Bank of America (BAC), Coca-Cola (KO), American Express (AXP), and Verizon Communications (VZ). These are your classic domestic recovery sectors. And with a heavy weighting in other banks (BK) (USB), Buffet is effectively short the bond market (TLT), another position I hugely favor.

Also included in the package is a liberal salting of pharmaceuticals, Merck (MRK) and AbbVie (ABBV). He has a small energy weighting with Chevron (CVX). He even has a position in old heavy metal America with General Motors (GM).

Berkshire is also one of the world’s largest property & casualty insurance owners. Its current “float” is $138 billion. You all know his flagship holding, GEICO. And the gecko mascot isn’t going anywhere as long as Warren lives. It was Warren’s idea.

It all seems to work for Warren. In 2020, he earned a staggering $42.5 billion. All told, Berkshire’s businesses employ 360,000, second to only Amazon (AMZN), and is the largest taxpayer in the United States, accounting for 3% of government revenues. Berkshire is also the largest owner of capital goods & equipment in the US worth $156 billion, topping (AT&T).

Many of Warrens's early 1956 $1,000 investors are millionaires many times over….and over 100 years old, prompting him to muse if ownership of his shares extended life.

Warren’s annual letter, which he spends practically the entire year working on, is always one of the best reads in the financial markets. There isn’t a better 50,000-foot view out there. He also admits to his mistakes, such as his disastrous purchase of Precision Castparts (PCC) in 2016 for $37 billion, which later suffered from the crash in the aerospace industry. In 2020, Buffet wrote off $11 billion of that acquisition.

He can do worse. In 1993, he bought the Dexter Shoe Company for $433 million worth of Berkshire stock. The company went under, but the Berkshire stock today is worth $8.7 billion.

Buffet’s letters always refer back to some of his “greatest hits,” today legends in the business history of the United States: GEICO, Furniture Mart, Berkshire Hathaway Energy, and See’s Candies, one of the largest employers of women in the US using 150-year-old recipes. Its peanut brittle is to die for.

In 2009, Buffet snatched away from me BNSF for a song, now the most profitable railroad in the country, an amalgamation of 360 railroads over 170 years. I say “snatched away” because it was my favorite railroad trading vehicle for decades until he bought the entire company. I hear its trains run by my home every night as a grim reminder.

Another benefit to owning (BRKB) is that Buffet is far and away the largest buyer of his own shares, soaking up $25 billion worth in 2020. And he is buying the shares of other companies that are also aggressively buying their own shares, like Apple ($200 billion with last year). It all sounds like the perfect money creation machine to me.

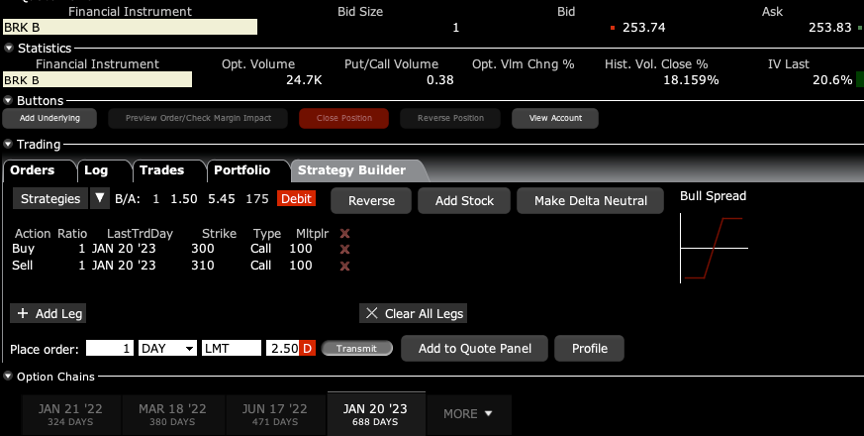

It gets better. Berkshires “B” shares trade options, meaning you can buy LEAPS (Long Term Equity Anticipation Securities), which by now, you all know and love. I’ll run some numbers for you.

With (BRKB) now trading at $254, you can buy the January 2023 $300-$310 call spread for $2.50. If the shares close anywhere over $310 by the 2023 expiration, the position will be worth $10.00, giving you a gain of 300%. And you only need an appreciation of $56, or 22% in the shares to capture this blockbuster profit, giving you upside leverage of an eye-popping 13.63X in the best run company in America.

See, I told you you’d like it.

This is how poor people become rich. In fact, my target for (BRKB) is $300 for end of 2021 and $400 for 2022, right when the two-year LEAPS expire.

One question I often get about Berkshire is what happens when Warren Buffet goes to his greater reward, not an impossible concept given that he is 90 years old.

I imagine the shares will have a bad day or two, and then recover. Buffet has been hiring his replacements for a decade or more, and he handed off day-to-day operation years ago (I didn’t want to move to Omaha, no mountains).

When that happens, it will be the best buying opportunity of the year. And another chance to load up on those LEAPS.

Mad Hedge Technology Letter

March 3, 2021

Fiat Lux

Featured Trade:

(U.S. CHIP SHORTAGE IS REAL)

(WDC), (AMD), (MU)

Yes, the price is going up. And no, I am not talking about monthly grocery bills, but the price of semiconductor chips that help operate iPhones and will power autonomous driving vehicles.

The situation is so dire that US President Joe Biden signed an executive order calling for a supply chain review of semiconductors and IT technologies.

Yes, it’s that bad.

The drastic and imminent chip shortage is impacting a wide swath of tech firms we cover here at the Mad Hedge Technology Letter.

The order will also “facilitate needed investments to maintain America’s competitive edge and strengthen U.S. national security.”

Biden’s proactive decision to sign the executive order comes on the heels of several top U.S. semiconductor executives persuading US President Joe Biden earlier this month to resuscitate domestic chip manufacturing with “substantial funding” as part of the White House’s economic recovery and infrastructure plan.

In the fact sheet for the executive order, the White House said supply chains for semiconductors and advanced chip packaging technologies will be among four key areas where federal agencies will be directed to commence a 100-day review.

The White House acknowledged a massive underinvestment in semiconductor production that has caused manufacturing to shift abroad.

The critical issue was emphasized by U.S. semiconductor executives in a recent joint letter to Biden.

The US has leaned on foreign manufacturing for many products in the past 50 years, but semiconductor chips are the ones that could force US tech companies into a losing position and offer a pathway for Chinese tech firms to seize their chance as top dog.

The 100-day supply chain review will also look at critical minerals, including rare earths that are used for a variety of products, as well as large-capacity batteries and active pharmaceutical ingredients.

The shortages of chips and other components are a very real issue that can have a material impact on several adjacent industries, including bioinformatics companies and mechanical parts manufacturers that rely on simulation and modeling applications.

How does this affect chip companies?

Let’s take a look at one, Western Digital (WDC).

Shares are trading higher on signs of improving pricing in the flash-memory market.

I am short-term bullish on Western shares because a meaningful memory-chip price rise is in the cards for both flash NAND and DRAM.

A blast from the past Silicon Valley dinosaur that began as a disk-drive manufacturer, Western diversified into flash-memory products via its 2016 acquisition of SanDisk.

Encouraging NAND pricing also benefits Micron Technology (MU), which makes both NAND and DRAM chips.

The most important takeaway from my channel checks is that despite increased attempts by cloud and enterprise customers to lock in prices for second-half delivery, end contract numbers aren’t reflecting any good deals for the end buyer.

Manufacturers are convinced with their newfound pricing power and will wield it to full effect.

Expect significant price increases until the shortage is cured, and this could result in many end projects being shelved because of funding issues.

For semi chip firms, a bountiful harvest will make 2021 earnings report glisten in the form of meaningful expansion in margins, which have been under pressure since 2018.

My initial prediction is that prices will rise 5% to 10% from the fourth quarter—and that pricing for the second quarter is tracking up another 10% or more sequentially making it a 20% rise in less than half a year.

Memory manufacturers like Micron (MU), AMD (AMD), Samsung, and Western Digital (WDC) are in line to overperform in 2021.

“My goal wasn't to make a ton of money. It was to build good computers.” – Said Co-Founder of Apple Steve Wozniak

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.