When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Technology Letter

September 24, 2021

Fiat Lux

Featured Trade:

(NOT THE SEXIEST TECH STOCK — BUT HIGHLY RELIABLE)

(EBAY)

Readers of this tech letter know that I have been wildly bullish on ecommerce company eBay (EBAY) precisely when vulture hedge fund Elliot Management acquired it in January 2019.

Alongside fellow activist fund Starboard Value LP, Elliott pressured eBay to revamp its operations. At their urging, the company pledged to sell off its Stubhub ticketing and its internationally-focused classifieds businesses, and replace its CEO.

My recommendation was spot on, and shares are up 220% since Elliot forced massive changes to first, the crappy management, and second, to the business model.

Luckily, those changes have staying power as Elliot exited their investment at the end of last year at then — all-time highs.

Elliot’s legacy will inherently be one of turning around eBay into what it is now, and I write to you today to say that eBay is coming into its own even after Elliot’s exit.

It’s not only about discontinued legacy tactics that led to low value, infrequent or one-and-done buyers.

Such an unsustainable strategy makes you want to tear your hair out.

But now, a fledgling buyer base is starting to evolve based on a re-optimized strategy.

These high-volume buyers are growing compared to a year ago and their spend on eBay is growing even faster.

This higher-quality mix of buyers increases value for sellers and will lead to improved health of eBay’s ecosystem over the long term.

Payments and Advertising initiatives continue to deliver a simpler product experience and meaningful benefits for sellers, buyers, and shareholders.

Managed Payments is now live in every market globally, and the transition is progressing faster than expected.

eBay management is now driven via a multiyear journey to become the best global marketplace for sellers and buyers, through a tech-led reimagination.

Their priorities are to grow the core, become the platform of choice for sellers, and cultivate life-long trusted relationships with buyers, by turning them into enthusiasts.

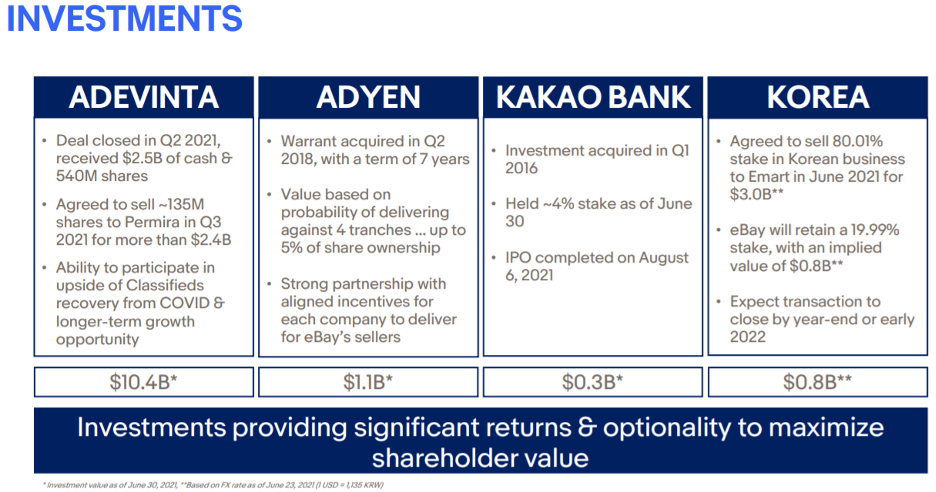

They finally completed the transition of eBay's Classified business, which was initiated by Elliot, to Adevinta.

This deal was originally valued at approximately $9.2 billion, but a closing in June had appreciated to $13.3 billion.

In June, eBay announced the sale of over 80% of their Korean business to Emart for approximately $3 billion, bringing together two leading e-commerce and retail companies that can unlock significant potential in Korea.

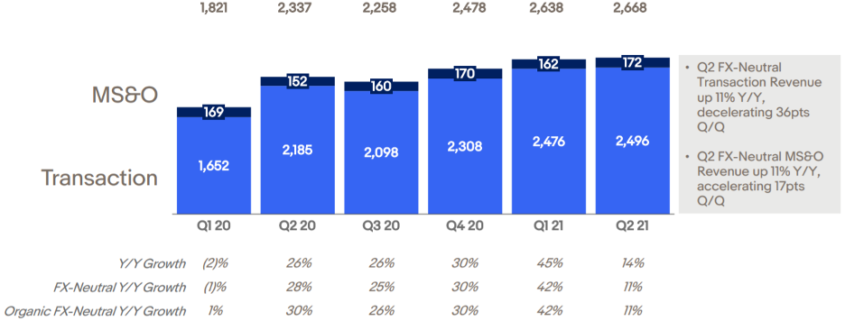

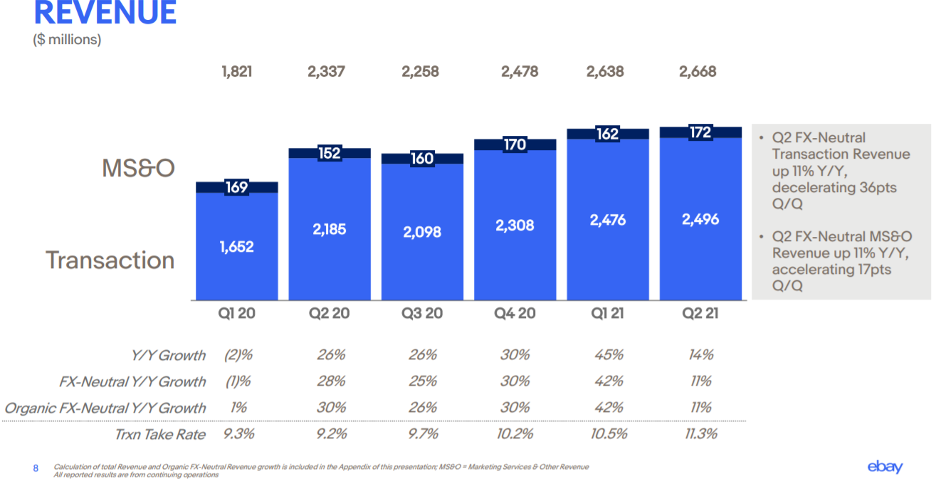

Revenue grew 11% driven by the acceleration in the Payments migration and advertising growth.

Luxury watches are also sustaining double-digit growth. Improved buyer trust is leading to strong cross-category shopping behavior similar to what eBay has experienced in sneakers. The next luxury category eBay is focused on is handbags.

They also expanded the My Garage feature to Canada, Italy, France, and Spain, which allows buyers to store their vehicle data, leading to a more tailored shopping experience. eBay plans to launch more technology-driven innovations in this category later this year to further build on their success.

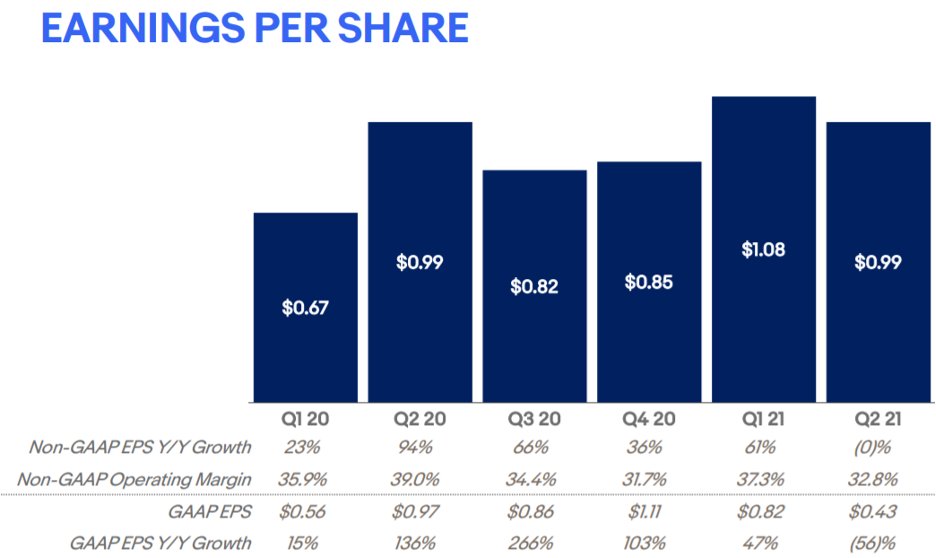

To sum it up, eBay delivered strong short-term results, ahead of expectations, while transforming the company for the longer term.

Obviously, the moves they are making at the top level to create over $20 billion of shareholder value give the company capital to intensely focus on growing the core.

Now the focus is laser-like to grow that central engine of ecommerce and the Covid bump forced a realization to the executive level here that it’s a no-brainer to double down at the core when the revenue runway is there.

To migrate into something else while the green, lush vegetation is right there for them to harvest would be nothing more than lunacy.

Management even felt confident enough to spin the cash from the Korean, Classified, and StubHub deals into an increased 2021 share buyback program to $5 billion for an initial $2 billion.

Granted that eBay isn’t a YOLO growth company to throw money at and its implied Q2 guidance between $2.58 billion and $2.63 billion of revenue growing 8% to 10% isn’t going to make you do cartwheels in the street, nor is the 11% Q2 revenue expansion, but this is a solid tech bet whose stock will grind up.

Management is also on a run of profitable deals that are meaningfully segueing into higher share buybacks.

Sometimes readers don’t need to focus on the sexiest tech stock, and just go with old reliable.

“The technology keeps moving forward, which makes it easier for the artists to tell their stories and paint the pictures they want.” – Said American Filmmaker George Lucas

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

September 24, 2021

Fiat Lux

Featured Trade:

(TESTIMONIAL)

(SEPTEMBER 22 BIWEEKLY STRATEGY WEBINAR Q&A),

(TLT), (TBT), (V), (AXP), (MA), (FSLR), (SPWR), (USO), (UNG), (PFE), (JNJ), (MRNA), (MS), (JPM), (FCX), (X), (FDX), (GLD), (UPS), (SLV), (AAPL), (VIX), (VXX), (UAL), (DAL), (ALK), (BRK/B), (BABA), (BITCOIN), (ETHEREUM), (YELL)

All my friends tell me that I’m the smartest person they know. All I’m doing is repeating back to them what I read in your newsletter, Thanks for all you do.

Tim

Lafayette, CA

Below please find subscribers’ Q&A for the September 22 Mad Hedge Fund Trader Global Strategy Webinar broadcast from the safety of Silicon Valley.

Q: When’s the United States US Treasury bond fund (TLT) going to go down?

A: When J. Powell tapers, which will be either today or in 6 weeks. That's the time frame we’re looking at now, and people are positioning now for the taper—that's why financials are taking off like a rocket. Buy those financials and don't expect too much from your tech stocks for the next few months.

Q: What do you think of adding corporate or municipal bonds to my portfolio?

A: Don’t do that on pain of death please; you will lose money. Corporate bonds will get slaughtered the second interest rates turn because they have the most exposure from a credit point of view to any downgrades resulting from rising interest rates. Better to keep your money in cash than buy bonds here. It was a great idea 10 years ago, but a terrible idea today. Just buy cash or buy extremely deep-in-the-money LEAPS which will get you a 10-20% per year return.

Q: What are the chances that the government defaults?

A: Zero, because corporate profits this year will increase from $2 trillion to $10 trillion, spinning off massive tax revenues for the government. The deficit will come down substantially in the future as a result. Keep expecting upwards surprises in profits and taxable revenues. That may be why the (TLT) is staying so high.

Q: I need a customized LEAPS on a stock.

A: We do those for our concierge customers. If you’re interested, then email Filomena at customer support at support@madhedgefundtrader.com.

Q: What brand of shot did you get?

A: Pfizer (PFE).

Q: The Government is showing no sign of balancing a budget and the hole will only get deeper; what are your thoughts?

A: I agree, and that’s why I'm short the (TLT). All we need is a taper to really get some juice under that trade; we really don’t need that much. Ten-year US Treasury yields are now around 1.30% and we only need the yield to get up to about 1.70% for us to make a maximum profit on our positions. One taper hint and it could get us up to those levels.

Q: Why is Visa (V) dropping so much?

A: Fear of being replaced by Bitcoin. This is the big thing dragging all three credit card companies down, including American Express (AXP) and master Card (MA). That's why I have not added a Visa position among my financials in this go around.

Q: How can the Fed unwind their balance sheet and normalize interest rates to a historical average of 4-5%?

A: Quite easily: quit buying bonds. They’re still buying $120 billion/month worth. Technology has accelerated with the pandemic and we all know this is highly deflationary. I expect the next peak in interest rates to be only 3% or 3.5%, not the 6% we saw in the last peak in interest rates in the 2000s. So yeah, bonds are going to go down but not back to 2000’s level.

Q: Thoughts on the Johnson & Johnson (JNJ) shot?

A: No thank you. If you get to choose, Moderna (MRNA) is now producing the best immunity data on a year-to-date basis if you’re starting out from scratch. Some people are mixing, they start out with Pfizer and then get Moderna. They get a worse reaction because the Moderna initial reaction shot sees the Pfizer vaccine as a new virus, so you may get a small flu as a result of that.

Q: What is the put spread you’re recommending on the TLT?

A: The May 2022 $150-$155 vertical put spread. That is the sweet spot now on the short side on (TLT) LEAPS. You should earn a 115% profit in eight months on this trade if interest rates remain unchanged or fall.

Q: Do you expect the ProShares Ultra Short 20 year+ Treasury ETF (TBT) to make it to $20 this year?

A: Yes, I do; $16 to $20 isn’t that much of a move. Remember, the (TBT) is a two times short ETF.

Q: Are you recommending bank stocks?

A: Yes, Morgan Stanley (MS) and JP Morgan (JPM) are two of the best. They will lead the yearend rally starting from here.

Q: When do you expect the semiconductor shortage to end?

A: End of next year, or maybe even 2023, because what all the analysts keep underestimating is that the end of shortages is based on companies getting the chips they want today. The actual issue is that companies are designing billions of chips into their products at an exponential rate, and what they’ll need in a year from now is far higher than most people realize. The semiconductor shortage is much more structural than people realize—that's my theory. They don’t throw up a $2 billion fab overnight. So, this will keep going on for a while and be a drag on economic growth.

Q: Are you sure we won’t see $100 oil (USO)?

A: With oil, you're never sure about anything, although I highly doubt it. We’d have to have monster economic growth in China to get oil up to $100 a barrel. Right now, China is going the other way.

Q: What’s your view on the debt ceiling? Will it give us a good buying opportunity?

A: Probably not, our good buying opportunity was yesterday or Monday. These debt crises are always one minute before midnight solutions. They always get solved. Never underestimate the ability of Congressmen to spend money in their own district. So, I don’t think that would create a stock market crash like it might have done 20 years ago.

Q: What about Freeport McMoRan (FCX)?

A: It’s taking a dip here because of a possible real estate crash in China, and of course China is the world’s largest buyer of copper for apartment construction. I’m kind of taking a break here on Freeport McMoRan and US Steel (X) until we learn a little more about the China situation. They did move to start a bailout today. Let’s see if that continues.

Q: When will the airlines come back?

A: They’ll come back when business travel returns, which I think could be next year. If you eliminate the virus completely, these things double easily. That's the bet you’re making. Let’s see if the covid boosters work, the childhood shots work, and then you can take another look at Delta (DAL) and Alaska (ALK).

Q: If Bitcoin gains mass adoption, does that put banks out of business just like electric vehicles are making oil obsolete?

A: No, not if the banks go into the Bitcoin business. And the banks actually have the cash, resources, and infrastructure to take over the Bitcoin area once the technology matures. And the corollary to that is that the oil industry is that the majors have the infrastructure, the manpower, and the capital to take over the alternative energy business if they choose to do so and oil goes to zero, which it eventually will. The proof of that is the largest investor in all the Silicon Valley energy startups are Saudi Arabian venture capital funds. They’re huge investors in solar here. If Saudi Arabia has a lot of oil, they have even more solar. Believe me, I’ve been there.

Q: Will a lack of inventory and rising interest rates end the bidding wars on houses soon?

A: Only if you consider 10 years soon. That is how long it will take for the sizes of different generations to come into balance, the Millennials (85 million) versus the Gen Xers (45 million). That’s when the housing bubble will end, but that won’t be for another decade. We still have a structural shortage of new home construction (about 5 million units a year) because all the home builders who went bust in the financial crisis in 2008/2009 and never came back—all of that new construction is still missing. And the surviving ones haven’t increased production to meet that shortfall because they want to manage their risk. Eventually, they will and that probably will be the next top, but that’s really 2030 type business.

Q: What about Federal Express (FDX)?

A: Labor shortages. It's hitting (UPS), (FDX), the Post Office, and DHL too—all the couriers.

Q: When do you think gold (GLD) and silver (SLV) rise back to 2,000?

A: I am avoiding gold and silver as long as Bitcoin has buyers. The action in Bitcoin is 10x the movement you get in gold and that’s attracted all the speculative capital in the market, draining all interest from gold, which hit a new six-month low just last week.

Q: What’s your buy target for Apple (AAPL)?

A: I would say if you can get it at $135, that would be a gift. We did get close to $140 at the lows this week; that’s when you start nibbling, and then you double up again at $135. I doubt Apple is going down more than 10% in this cycle. There are too many people still trying to get into it. And they’re still the largest buyer of stock in the world. They only buy one stock, their own.

Q: I never got any IPath Series B S&P 500 VIX Short Term Futures ETN (VXX) alerts.

A: That's because we never sent any out. (VIX) has become an incredibly difficult game to play, accumulating positions for months and then trying to get out on a one-day spike that lasts a few minutes. The insiders have too much of a house advantage here, who only play from the short side. There are too many better fish to fry.

Q: What about the Apple electric vehicle?

A: I’ll believe it when I see it; I've been hearing about this for something like seven years. My guess is that Apple is more likely to supply consoles and parts to other EV makers and help them get into the game with software and so on. I think that will be Apple's role in all of this.

Q: How much has China Evergrande Group stock fallen?

A: It’s a really illiquid stock in China so we never got involved in it. I think it’s down more than half. Even the professional short-sellers like Jim Chanos and Kyle Bass, have been targeting that stock for 10 years are now screaming they’re vindicated. Of course, they lost fortunes in the meantime. So, I'll pass on that one.

Q: What about stop losses on LEAPS trades?

A: I don’t really run LEAPS portfolios or issue stop losses. The idea is to run these into expiration, and we’ve never had one expire out of the money, although I may break that record if TLT doesn’t turn around in the next three months.

Q: How would autonomous trucking impact rail transportation?

A: They’re two totally different things. Trucking companies like Yellow Corporation (YELL) carry smaller cargo for local deliveries or small long-distance deliveries. 7Some 70% of all railroad traffic is coal going to China, and the rest is bulk commodities like wood chips, iron ore, etc. Trucks don’t carry any of that, so they’re totally separate businesses. But, if we went totally autonomous on trucking, it would make all the main trucker companies massively profitable, as they get rid of their drivers. Right now, every trucking company in the US has a driver shortage.

Q: United Airlines (UAL) pilots are now ordered to get vaccinated.

A: I think within months to hold a job anywhere in the US, you will have to get vaccinated. They do not want you in the office without a vaccination. Jobs are not worth risking lives, and we hit 2,000 deaths again yesterday. The corporations are taking the lead, not the government. The exception will be the politically motivated companies, like the My Pillow Guy; I doubt they'll ever require vaccinations at My Pillow. And there are a few other companies such as Hobby Lobby that are also anti-vaxers. But all public transport companies, hospitals, etc., are going to say get vaccinated or get out—it’s very simple.

Q: Should I buy Berkshire (BRKB) here?

A: Yes, it’s a great entry point, even if you can't get my price. Go higher in the strikes or go farther out in maturity.

Q: Is copper metal (CPER) a buy here?

A: Probably long term, but short term will be subject to the whims of the Chinese real estate crisis if there is one.

Q: Won’t Natural Gas (UNG) outperform in the power grid since all EVs must be charged?

A: Not if the grid is 100% electric. Natural gas still has carbon in it, although only half as much as oil or gasoline. I think even natural gas eventually gets phased out because you can expect solar panels to improve by 80% over the next ten years. At that point, any other energy source won’t be able to compete—oil, natural gas, you name it. And that is why you don’t see any long-term money going into carbon energy sources.

Q: Iron ore has just gone from $200 to $100, why are you bullish?

A: Yes, Because it has just gone from $200 to $100. Eventually, China recovers, despite a short-term financial and housing crisis. Buy low, sell high—that’s my revolutionary new strategy.

Q: What are your thoughts on Bitcoin vs Ethereum?

A: I think Ethereum will outperform Bitcoin because it has a more modern technology. It’s only six years old, vs 12 years for Bitcoin. It’s also more efficient, using less energy in its production. In fact, we did get a double in Ethereum in August as opposed to only a 50% move in Bitcoin.

Q: Do you have any concerns on holding the financials through earnings in October?

A: No, I think the results will be fantastic, and I want to be long going into those.

Q: What does the current situation with China mean for Alibaba (BABA)?

A: Keep your stocks, you’ve already taken the hit—down 53%. The next surprise is that China quits beating up on capitalism and these things will all recover bigtime. However, any options you may have could expire before that happens. So, keep the stocks, get rid of the options, salvage whatever time value you can, and then wait for China to start doing the right thing.

Q: What are the best solar stocks?

A: First Solar (FSLR) and SunPower (SPWR), which have both done great.

Q: If bonds are a no-no, and governments are getting more indebted than ever, who will buy them?

A: Governments. The only buyers of bonds now are non-economic buyers. Those would be governments, central banks, and banks who are required by law to own certain amounts of bonds to meet regulatory capital requirements. No individual in their right mind is buying any bonds here at all, nor is any financial advisor recommending them.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last ten years are there in all their glory.

Good Luck and Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Mad Hedge Bitcoin Letter

September 23, 2021

Fiat Lux

Featured Trade:

(DIFFERENT WAYS TO PLAY CRYPTO)

(BTC), (GBTC), (GLD), (AAPL)

One might postulate that the price of bitcoin and Chinese housing has no relevant correlation with each other.

Think again!

Granted, Chinese citizens aren’t denominating their mortgages in bitcoin to snap their ritzy Shanghai townhouses overlooking the Bund.

I don’t mean that.

But Bitcoin is an asset just like stocks, bonds, and commodities and is exposed to one-off events that shake out the financial system.

What’s brewing in the Middle Kingdom?

Chinese biggest property builder Evergrande teeters on the brink of financial devastation.

Add it up, Chinese bank deposits are $35 Trillion, more than 2x the US.

Would any Chinese financial crisis lead to an epic flight to fiat alternatives?

Does nobody recognize that this is a planned liquidity drain of the property market in China by the CCP?

All escape "exits" have already been shut. You can't even buy paper gold in China either - forget Bitcoin!

So I don’t believe that the potential disorderly selling of Chinese flats or the bust of a major property developer would end up boosting the price of Bitcoin because the Chinese government has made it abundantly clear that bitcoin is a red line for its citizens.

If there is a 20% dip in Chinese property prices — Chinese would believe that’s a once-in-a-century buy the dip type of event.

That doesn’t mean that some won’t try to sell on the down low and get their money out of China through hell or high water.

Some certainly will — China made it clear they didn’t want their citizens investing in overseas assets — I know of the odd millionaire spinning out a random credit card to put a down payment on a house in Vancouver.

What this does scream is policy error big time — an overtightening that could result in a hard landing that is ruinous for global growth.

That would be the worst-case scenario and I would put that at 10%.

Why is this company systemically important?

Evergrande was once China’s darling real estate developer. Now, it is gagging on debt.

It was founded in 1997 by Xu Jiayin. It has completed around 1,300 commercials, residential and infrastructure projects and supposedly employs upwards of 200,000 people.

The company’s success came because it was aligned perfectly for the parabolic boom in real estate that has been driven by the last two decades of staggering Chinese growth, growth for a country that is unparalleled in all of modern human history.

The tragedy in all this is that 1.5 million Chinese have put deposits down on homes that haven’t been built and this is more often than not their entire life savings.

Most likely, it is them who will hold the bag and lose their deposit.

Better them than me.

For a soft landing to happen, the Chinese government must pull out all the bells and whistles.

Even though I categorize this as a quasi-gray swan, opposed to a solid black swan, it is highly likely that it won’t spill over into the broader market, and if we do get a large bitcoin dip, bitcoin buyers finally are gifted a cheaper price to enter bitcoin.

These opportunities are few and far between recently, at least in 2021, and I can guarantee that MicroStrategy CEO Michael Saylor is already ginning up his next bitcoin purchase usually done with his own company's corporate paper.

Limiting the fallout will be easily done if the Chinese government flood the right channels with liquidity, plugging the holes before they become unpluggable kinda like our own debt ceiling mess.

The larger issue is to ponder — is this the tip of the iceberg?

The silence and a lack of major actions from policymakers is making everyone nervous, but most likely they are sorting it out behind the scenes.

The response so far has been largely limited to the People’s Bank of China, which injected a net 90 billion yuan into the banking system. It added another 100 billion yuan on Saturday.

Evergrande has been mired in $300 billion worth of liabilities, more than any other property developer in the world. It’s a beast in China’s high-yield dollar bond market, accounting for about 16% of outstanding notes.

A lackluster response to an already expensive market could be costly, with real estate accounting for 40% of household assets in China. Data last week showed home sales by value slumped 20% in August from a year earlier, the biggest drop since the onset of the coronavirus early last year.

Isolating Evergrande is almost a point of emphasis for the Chinese Communist Party and the mission is to harangue them as a scapegoat for sky-high property prices.

They are the fall guy.

This is more of a political show than anything else — a show of power — letting the world know that this economic pain is nothing to even bat an eyelid about.

Bitcoin, perceived as a riskier asset along the risk curve, is not immune from a sell-off and a flight to safety has taken prices down around 10%.

I have full faith in the Chinese government and its authority to nip this in the bud, and around the $40,000 level, the price of Bitcoin should offer resistance.

If Bitcoin holds $40,000 and a resolution to this is announced, expect a 10% surge in Bitcoin prices.

This should not be treated as anything more than a standard 5% equity drop that is equivalent to a 10% crypto drop in prices.

Book some of those gaudy profits you made in the first half of the year to drop your cost basis while deploying capital at lower levels.

THE AFTERMATH OF GOLD MINING IS DEVASTATING

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.