When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Bitcoin Letter

September 21, 2021

Fiat Lux

Featured Trade:

(UNDERSTANDING THE FOG OF WAR)

(BTC), (MSTR)

“Bitcoin is the beginning of something great: a currency without a government, something necessary and imperative.” — Said German-American billionaire entrepreneur and venture capitalist Peter Thiel

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

September 21, 2021

Fiat Lux

Featured Trade:

(WHAT EVER HAPPENED TO THE GREAT DEPRESSION DEBT?),

($TNX), (TLT), (TBT)

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Technology Letter

September 20, 2021

Fiat Lux

Featured Trade:

(CHECK OUT THE SCARCITY VALUE OF THIS TECH STOCK)

(MP)

Rare earth elements shaped modern society into what it is today — just take a look at the silky-smooth touch screens on our Android phones to the Air Force’s newest fighter jets — rare earths are the building blocks of these products.

America's only rare earth mine, Mountain Pass is owned and operated by MP Materials (MP).

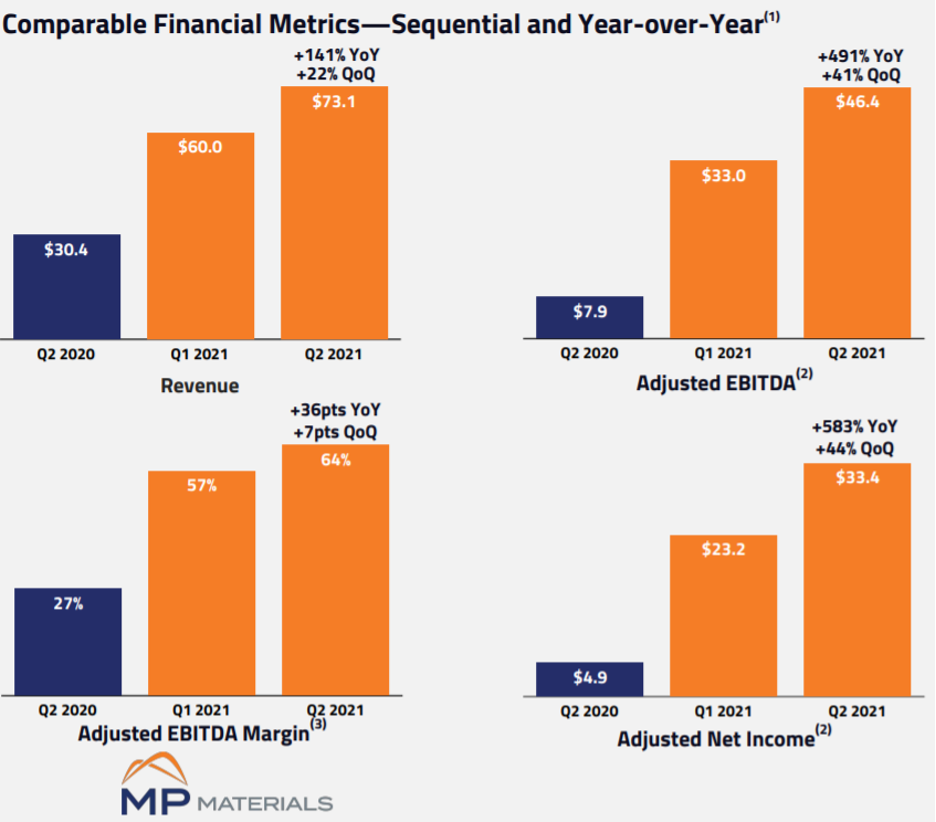

This open-pit mine of rare-earth elements on the south flank of the Clark Mountain Range, southwest of Las Vegas, Nevada supplied 15.8% of the world's rare-earth production last year.

It is the only rare-earth mining and processing facility in the United States, and it should be the bulwark of any long-term technology portfolio.

This is not a stock one should day-trade or even trade with a 4-week time horizon — put it deep inside your portfolio and watch it appreciate over the long haul.

One of the first things to know about rare earths is that their name is a bit of a misnomer. While their importance to consumer electronics, renewable energy, and national defense makes these materials very costly, rare earths are actually plentiful in the Earth’s crust.

The problem is that much like oil or gas, these metals can only be found in select locations around the world, hidden away inside mineral deposits that did not form with country borders or trade wars in mind.

MP has a mission to achieve restoring the full rare earth supply chain in the United States.

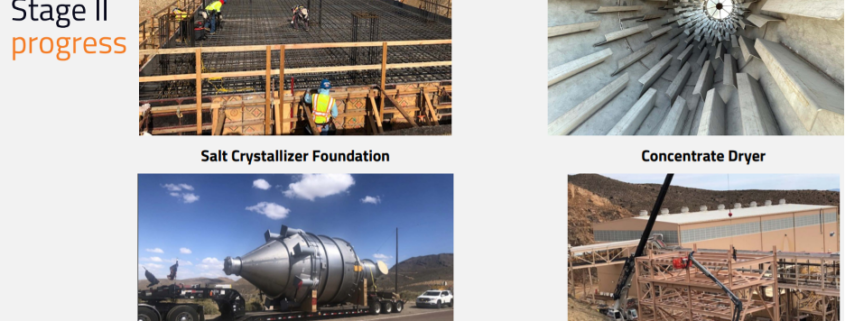

We are at the point where the Stage II project, the optimization of the Mountain Pass site, is moving beyond today's profitable concentrate production to separating rare earth oxide.

The success is critical to the global industry and supply chain security since today nearly 90% of all rare earth separation is done in China.

To contribute additional layering on why the global backdrop makes me highly bullish, I would like to analogize today's pandemic shock with the 1973 oil shock.

The ultimate takeaway is that an unexpected and significant global economic supply shock can end up reverberating for decades, not months.

In fact, the misunderstanding of transitory or short-lived events downplays the effects to the long-term cost structures.

Rare earths have experienced a rapid shift in psychology around prices in the supply chain meaning substantially higher and that’s here to stay.

Rising prices and fear of oversupply have become a further self-fulfilling prophecy across the economy.

The pandemic shock has happened under the backdrop of an already weary geopolitical environment with respect to supply chain security.

This industry has been crushed by demand backlogs for some things that stretch into next year and of course that assumes limited incremental demand in the coming months and no acceleration from an infrastructure bill.

I believe that if you do the math on some of the quantities implied by these projected investments, shortages and shocks are here to stay for quite some time despite the hundreds of billions of dollars of projected investment across new and legacy OEMs on EVs alone in the next few years.

Truthfully, I can say with audacity that at some point in the next five years, we will see at least one major global household name auto original equipment manufacturer (OEM) as well as many other small ones, fail or need a bailout due to failure to gain access to a critical material.

The last scaled and vertically integrated domestic magnet producer ceased operations and relocated to China in 2003.

Needless to say, MP is taking a concrete step towards representing a full rare earth supply chain in the United States.

Long term, are there other incremental potential customers aside from the EV supply chain expressing more interest in supply agreements?

It's broad based — not just EVs — I can tell you this with conviction.

Other spots of demand include wind turbines, drones, and many types of IoT (industry of thing) products.

I would highlight the industrial customers as chomping at the bit to get a solid pipeline of rare earths into their workshops — to get their engineers testing it in real time — it’s just not happening with this dearth of supply.

Then when you step back further and understand the semiconductor shortage — it’s a major headache — created chaos in terms of many tech companies not able to meet production deadlines simply because they have to stop production.

Investors should double down in terms of supply chain security, the first mover advantage is nothing to diminish for MP, and they are partnering with the U.S. Department of Defense due to rare earths being a national security issue.

They often host the DoD to discuss these critical issues and for the potential of future funding.

Therefore, for investors, the idea of investing in MP should be more about can I buy this whole company rather than just buying a few shares because their strategic position, tech knowhow, and revenue pipeline has a sort of unrelenting stranglehold that isn’t mirrored anywhere else in the U.S. tech ecosphere.

Then after one considers that the Chinese dilemma of protecting U.S. tech interests isn’t going anywhere anytime soon, investors must feel that any major dip in MP shares can be considered a premium buying opportunity into one of the building blocks of U.S. tech and pretty much the entire world at this point.

“I’d rather be seen as evil than incompetent.” — Said German-American billionaire entrepreneur and venture capitalist Peter Thiel

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.