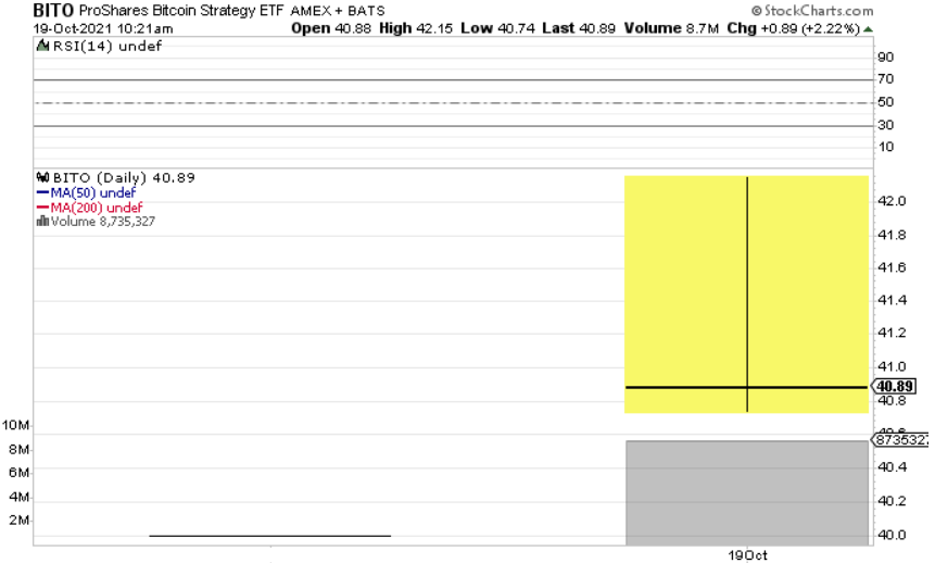

(BITO) — remember that ticker symbol — it’s the first Bitcoin ETF listed in the U.S.

After a nearly decade-long campaign to get crypto onto a legitimate exchange — the wait is finally over.

The desire for an ETF specifically began in 2013, and in the eight years since, nervous traders have watched the Securities and Exchange Commission reject numerous applications.

“2021 will be remembered for this milestone,” says ProShares CEO Michael Sapir. For investors still on the fence about dabbling in the unregulated cryptocurrency market, he adds that his company is giving them “convenient access to Bitcoin in a wrapper that has market integrity.”

Bitcoin hit a six-month high and was within striking distance of its all-time peak giving a thumbs up to a new U.S. ETF that started trading today.

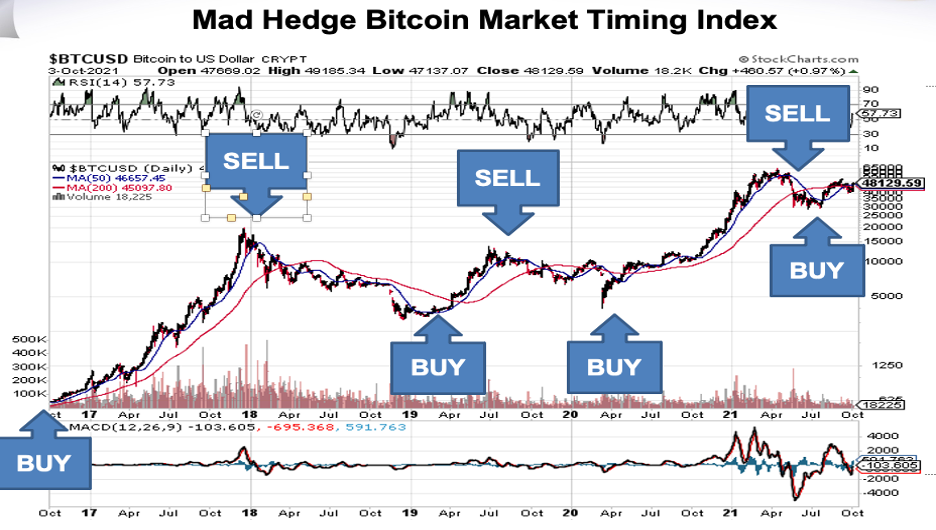

Bitcoin has risen by some 40% which could see billions of dollars managed by pension funds and other large investors flow into the sector.

ETFs are securities that track an asset and can be bought or sold on a stock exchange.

Many institutions are banned or not authorized from buying assets that aren’t insured and assets on crypto exchanges like Binance and Kraken aren’t insured by the federal government.

This definitely makes it a whole lot simpler to just open a vanilla E-trade account and pour money into a Bitcoin ETF, then ta-da, you own part of the Bitcoin story.

Not only will this benefit institutions, but retail traders will be able to sleep well at night if they decide to pull the trigger on this ETF, also the ease of buying is up there as another major bonus.

Just be aware that this fund will not invest directly in Bitcoin, rather in Chicago-traded futures, and so there won’t be a 1:1 correlation of the market price.

In general, this fortifies sentiment around any cryptocurrency asset giving a signal that adoption rates are exploding, and the future in-flow pipeline is robust.

So we have seen a rising tide lift all boats with other currencies doing well in the short-term like Ethereum.

Crypto ETFs have launched this year in Canada and Europe amid surging interest in digital assets. VanEck and Valkyrie are among fund managers pursuing U.S.-listed ETF products, although Invesco on Monday dropped its plans for a futures-based ETF.

Just take for instance Invesco QQQ ETF — which offered diversification among the top tech names at a time when investors already had the ability to invest in tech stocks.

It saw inflows of $36 billion in the ETF's first year.

I expect the same type of fund flow into this Bitcoin ETF.

From a regulatory perspective, this offers more clarity from the SEC that they are willing to accommodate Bitcoin ETFs that are tied to the Bitcoin futures.

SEC Chairman Gary Gensler recently reiterated that the crypto sector needs to be more heavily policed, and I believe this is all bark and no bite with many politicians and elites already fully invested in crypto assets.

I believe Gensler will continue to tell us how important it is to regulate the industry, but I doubt he wants to be the one that kills the golden goose that lays the golden eggs.

In other words, it’s too big to kill at this point as we surge past the $1.2 trillion market cap for all crypto assets.

Just another funny fact, Gensler once taught a class at MIT’s Sloan School of Management called “Blockchain and Money.”

We could even guestimate that Gensler is highly supportive of Bitcoin on a personal level.

Another side note, Grayscale, the world's largest digital currency manager, is planning to convert its Grayscale Bitcoin Trust into a spot bitcoin ETF, and that application was filed this morning.

If one thought this was the first and last Bitcoin ETF product to grave the public markets, let me tell you, when it rains — it pours.

All these companies understand first-mover advantage is vital.

Look at today and Invesco QQQ Trust (QQQ), the de-facto Nasdaq ETF is still one of the leaders of the tech trade.

Many involved understand, there is a big difference from becoming the 2nd Bitcoin compared to the 50th Bitcoin ETF and a race against time is happening as we speak to get products into the bloodstream.

As for investors, we just pick the winner and the first one is ProShares Bitcoin Strategy ETF (BITO).