When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

November 18, 2021

Fiat Lux

Featured Trade:

(A NEW THEORY OF EQUITIES)

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Technology Letter

November 17, 2021

Fiat Lux

Featured Trade:

(THE TESLA OF PICK-UP TRUCKS)

(RIVN), (AMZN), (TSLA)

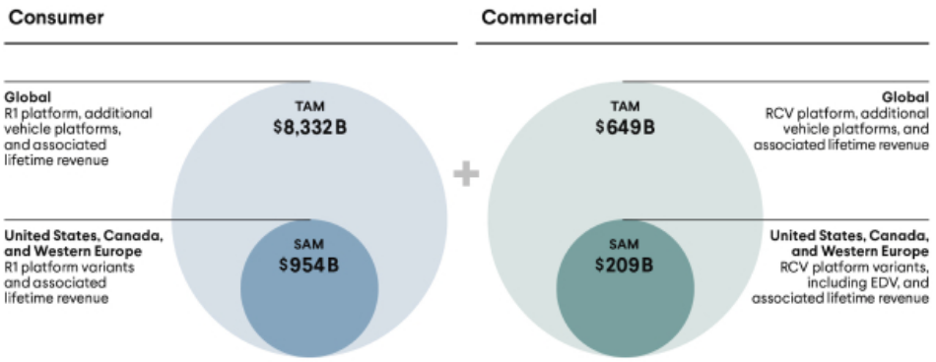

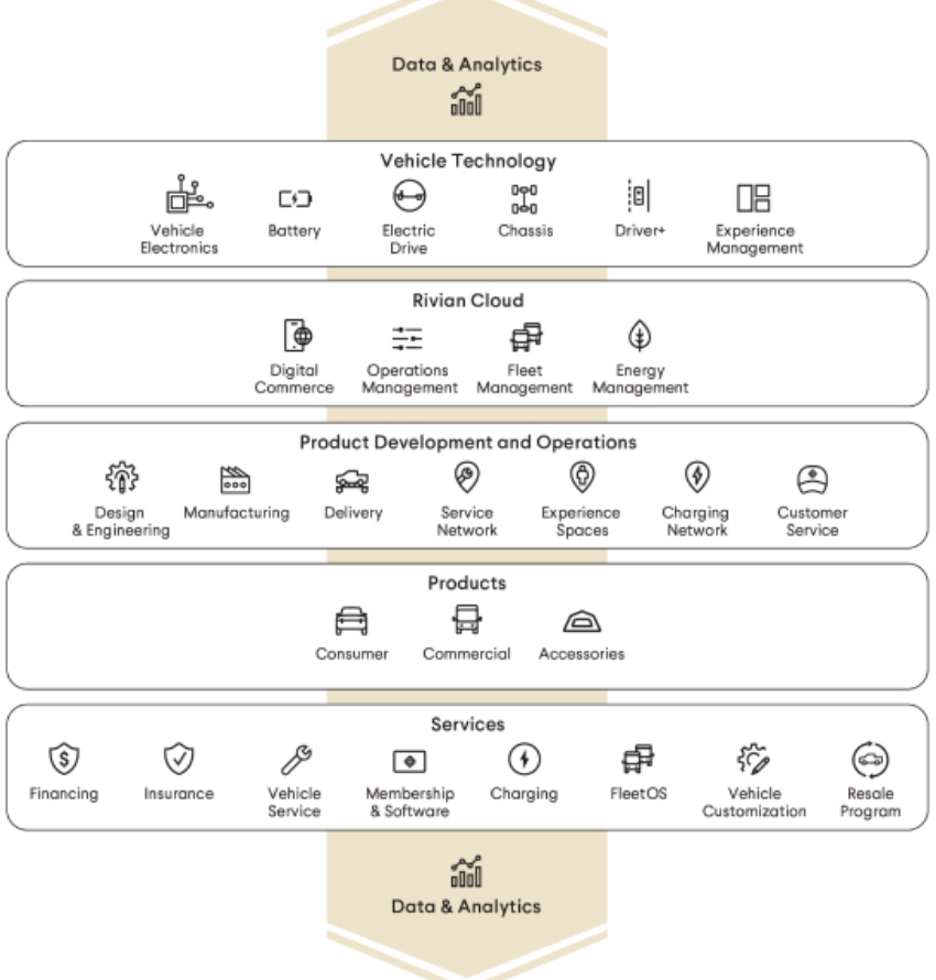

Rivian Automotive Inc. (RIVN), the California-based EV company, touched $153 billion in market valuation making Rivian the largest U.S. company with zero revenue.

Exuberance can take you this far, but the company will need to show investors sales after the pixie dust wears off.

I understand that part of the narrative is that this could be the next Tesla (TSLA), and back of the napkin math shows us if it is a certain percentage of Tesla going forward then it would be certain billions of dollars.

The $150 billion valuation is too fast too soon, but when traders grab a hold of this rocket, all they need to do is add a little fuel.

It does speak loudly to investors that there is excess liquidity ebbing and flowing in the financial system where a stock can go this high just based on potential.

Let’s see the damn car first!

Granted, the car looks fantastic based on internet reviews, and if they do become the Tesla of pickup trucks, then anything that means reversion in the stock will be muted.

Word on the street is that only employees are driving the truck around now and the greater public should start receiving their Rivian orders at the end of 2021 or 2022.

EV peer Lucid Group Inc. also rallied intensely closing up 24% and eclipsing the valuation of Ford in the process. Lucid is now a $91 billion company, compared to Ford’s $79 billion.

Rivian will also need to compete with the upcoming European EV behemoths with Volkswagen that is Europe’s largest automaker with about 10 million vehicle deliveries per year, making it the global number two behind Toyota Motor Corp.

Rivian’s trucks are called the R1T and an electric SUV — R1S.

They forecast annual production will hit 150,000 vehicles at its main facility by late 2023.

At one point, Rivian was worth more than almost 90% of S&P 500 companies, including stocks like Goldman Sachs Group Inc., Boeing Co., Citigroup Inc., Starbucks Corp.

Rivian also benefited from Tesla’s Founder Elon Musk selling big tranches of stock which gave EV investors the green light to pile into Rivian even if it’s not for the long term.

Pricing for Rivian’s models starts around $70,000, and each features a base driving range of more than 300 miles on a full charge.

The hope is that mass affluent truck shoppers won’t be able to get enough of Rivian. Remember, the Ford F-150 is the best-selling vehicle in the country. In fact, the top six automobiles in the U.S. by sales are either pickup trucks or SUVs.

Amazon’s 20% stake in the company is the stamp of approval for many investors on the fence and they have already ordered 100,000 units for delivery by the end of 2030.

I could easily see Amazon ramping up orders quickly if they like the quality of the first two models.

Whether the stock should be $150 billion with 0 sales or not, is not really the full story of Rivian.

With only a narrow snapshot of what’s really going on, the high valuation is more a story of the momentum of the market in November that has seen big tech rejuvenate.

Rivian merely just got caught up in the updraft.

I am not diminishing the company, but they will need to demonstrate consistent earnings to build those long-term holders of the stock and I do believe they can do it.

The specs of the car look and feel like a Tesla and if they can replicate 80% of the quality with their first iterations, socially, they could catch on fire and become the new hip car to the masses.

This does set the stage for a critical first earnings report where the first sales will be thoroughly dissected with a fine-tooth comb and possible offer an entry point to investors after people realize this isn’t a $150 billion company yet.

Remember that it took Tesla years to stabilize their volatile stock, and Rivian might have to go through the same right of passage to be legit.

Rivian has the potential to become the #2 behind Tesla and that’s worth $90 billion right there, it’ll be interesting to see what pans out after that.

As for buying the stock, wait for a big sell-off then slowly scale in.

“Invention is by its very nature disruptive. If you want to be understood at all times, then don’t do anything new.” – Said Founder and CEO of Amazon Jeff Bezos

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.