When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

January 12, 2022

Fiat Lux

Featured Trades:

(WHY GLOBALIZATION WORKS)

I am writing this to you from the Amtrak California Zephyr. Having got my Pfizer Covid-19 shots, it is now finally safe to ride public transport.

I am riding the rails in a first class sleeping compartment from Oakland, CA to Truckee, CA to reposition a car from my Lake Tahoe lakefront estate now that winter is over.

Pulling out of the station, I couldn’t help but notice the gigantic cargo ships from China and South Korea unloading containers by the tens of thousands.

Mountains of these containers dot the horizon.

The cranes that used to automatically unload them were the models for George Lucas’s AT walkers in Star Wars.

Having been a vociferous supporter of globalization since its dawn a half century ago, first during a decade spent as a reporter for The Economist magazine, and then as an investor, I will explain how our international trading system works, and especially why it works for us.

There was a polyglot of travelers from all over the world on my train.

Large groups of Chinese were led by flag-bearing guides.

Italian Millennials mobbed the bar.

A retired English couple strolled the observation car.

There was even the occasional American student backpacker repeating my own adventure from the 1960s.

And you know what? This disparate international group shared many things in common.

Most of them spent much of the day glued to iPhones or Androids run by US-designed apps.

Many were staying in accommodation organized by Airbnb.

Like me, they may have made the trip from and to the train station in an Uber cab.

They wore Levi Strauss blue jeans. American pop music pulsed through their earbuds. Probably half of them arrived in America on a Boeing jet financed by the US Export-Import Bank.

In short, they were all sending enormous amounts of money to US companies and shareholders in more ways than they could possibly count, without realizing it.

You never used to see tourists from most countries, like Russia, Spain, Portugal, Italy, or Ireland.

They were too poor.

Rapidly rising standards of living created by globalization changed all of that, creating an enormous new market for American products, especially technology ones.

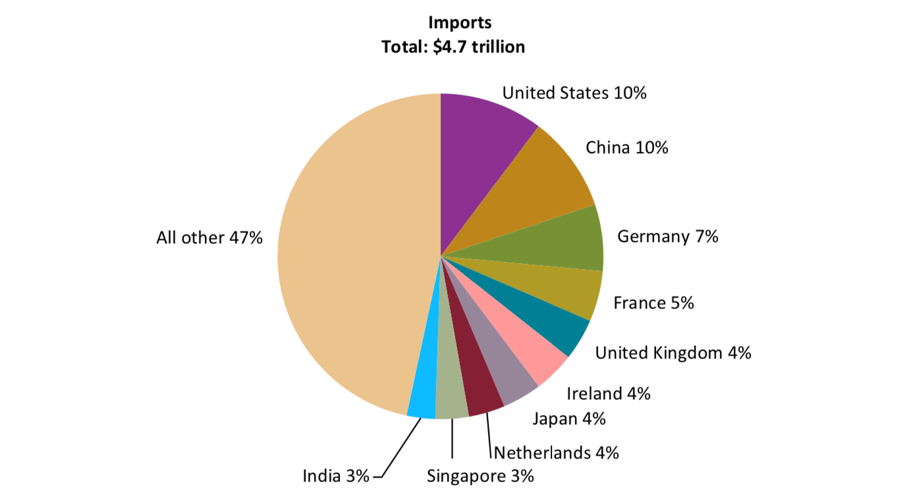

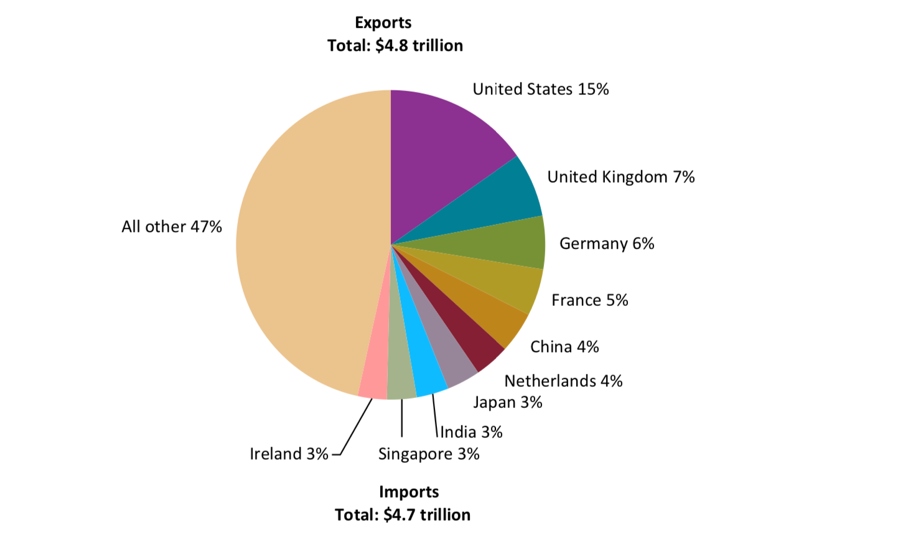

You can see some of this impact in international balance of trade statistics. In 2020, the US ran a trade deficit with the world of $689 billion.

There is a more elegant way to describe this trade. We are in fact running a massive goods deficit, where foreigners send us $290 billion a month worth of stuff and we give them paper in return, US dollars, which has been steadily depreciating in value for the past 50 years.

Who is the big winner here? The US consumer, i.e. you and I. Sounds like a good deal to me. Without this inflow of cheap goods the US, inflation rate would be at least double or triple what it is now.

Subtract our $402.8 billion surplus in services, which includes, financial services, education, patents, and other intellectual property, and that brings our current account deficit down by more than half to only $488.5 billion. Some 78.6% of private sector US GDP is now accounted for by services.

But that doesn’t tell the whole story.

Trade data completely miss the enormous number of products and services that are now given away FOR FREE in exchange for the chance of earning some uncertain revenue at some future date.

In a pre-Internet, pre-globalized world, a service like the Diary of a Mad hedge Fund Trader covering so many asset classes and individual stocks real-time might have cost $100,000, if not $1 million.

And you know what? It would have been worth it!

Multiply this effect on a global scale and you see what I am talking about.

Give up your name, email address, and phone number and you can obtain almost any kind of online service for nothing. And as far as I know, no government agency has any measurement of this whatsoever.

Needless to say, the United States is far and away the leader in this immeasurable field.

By the way, this might also be the reason why the published productivity data has been so poor, despite the fact that US GDP has grown by 20% since 2009. Everywhere I look, productivity is skyrocketing, including my own.

It also might be the reason why Amazon continuously sports a nosebleed valuation. Much of what they provide is FREE, and therefore immeasurable.

Of course, globalization wrought havoc on your life if you went into it with the wrong job in the wrong industry and an inadequate skill set.

Blue-collar workers tied to textiles, shoes, toys, and other low value-added manufacturing were toast, as their jobs fled offshore.

If you didn’t retrain or adapt, you became an angry, mostly white man.

As my friend, New York Times columnist Tom Friedman, likes to say, “Average doesn’t cut it anymore.”

However, while the jobs are gone, the bulk of the profits stayed here in the US. American companies offshored the $2 an hour jobs (mass assembly), but kept the $150 an hour ones (design and marketing).

As my friends in the Chinese government never fail to point out, if they build the iPhone for $100 and we sell it for $1,000, we are the big winners, not them.

They believe we are perpetuating 19th century colonialism by making wage slaves of their workers.

They are correct.

Globalization enables the US dollar to continue as the world’s reserve currency, as almost all international trade is conducted in the buck.

That is one of the greatest free lunches of all time.

It enables the US government to indirectly control the global economy through its own monetary policy. Some half of all of the $22 trillion in US government debt is owned by foreigners.

When sanctions forced Iran to drop out of the international trading system, what did they get? A Great Depression that cut their GDP by 25%. You can’t run a country of 80 million with oil barter deals, gold, and bitcoins alone.

There are also the huge defense benefits that globalization brings us.

Back in the early days, the main reason to steer a country into capitalism was to prevent it from going communist, and therefore becoming an enemy.

Grow your allies and shrink your enemies, and your defense costs shrink dramatically, raising our friends’ standards of living.

That is what has happened on a massive scale.

Increased trade also boosted foreign standards of living, therefore creating a growing market for American goods and services.

This was the whole point of the World Trade Organization, NAFTA, the Trans-Pacific Partnership.

Humans rarely bite the hands that feed them. They are also highly unlikely to set fire to their paycheck or bomb the sources of income.

Make a foreigner a millionaire, and you turn him into a pacifist. I have seen this unfold time and again over the past half century, be it in China, Russia, Vietnam, Cambodia, and most recently in Iran.

Create an embedded base of businessmen in any country who are getting rich off of you, and international relations invariably improve.

Any system based on greed is guaranteed to succeed.

A side benefit of all of this is that stock markets for up forever.

Since globalization started in earnest in 1951, the Dow Average has risen from $239 to $21,800, a prodigious gain of some 92-fold.

And you wondered why?

Globalization is the mechanism through which America is paid the dividend for all of the good deeds it has done and inventions it has created for the past century.

I am thinking about the construction of the Panama Canal, Lend Lease, and the Marshall Plan, as well as the transistor, memory chip, microprocessor, personal computer, Windows, the Internet, online commerce, the iPhone, and social media.

That is why globalization is a win-win-win for everyone.

There are really only two true communist countries left in the world, Cuba and North Korea, which never joined the international trading community. They also happen to have the planet’s lowest standard of living.

And Cuba will become totally capitalist within two years. Just give them a million iPhones, get them talking, and see what happens. Castro will become just another neighborhood in South San Francisco.

So why end a trading system from which America and its people have profited so mightily?

That is a very good question, one that someone might ask the former president.

AT-AT Walkers from Star Wars

“Consumers are going to do best and that is consume,” said Brian Jacobsen of Wells Fargo.

Mad Hedge Technology Letter

January 12, 2022

Fiat Lux

Featured Trade:

(JUMP OFF THE ROKU BANDWAGON)

(ROKU), (GOOGL), (AMZN)

Many “experts” have been advising investors to buy the dip in Roku (ROKU) since it dropped to $370 from the peak of $480 it reached in July 2020.

These experts kept banging the drum to buy the dip on Roku as it slid to $350 then $320.

The calls for dip-buying continue as Roku nosedived to $280 then most recently on a downgrade, Roku fell all the way to $177.

Painful as it feels to be an investor in Roku, this is not the time to double down on high-tech growth stocks.

Growth tends to usually overshoot to the upside as investors give a pass to growth for losing money and selectively put a premium on high growth rates.

But that deal is only valid in a low-interest rate environment and what we are witnessing is the reverse happen as investors are bolting from Roku like stallions out the back of a stable.

At a micro level, there is somewhat distaste at the ever-increasing competition Roku is facing and the lack of growth prospects overseas.

Overseas is usually the growth engine for many of these streaming cohorts, but the dilemma here is that margins are lower because of a poor purchasing power profiles for the median consumer overseas.

That’s not to say it’s easy to succeed in the U.S. — hardly so.

However, Roku’s business in the United States has been highly successful, but the issue here is that the market is getting somewhat saturated and since the stock market is priced based on future cash flow, where does the incremental buying come from to save Roku’s stock?

Roku faces a perilous uphill challenge to convince the incremental platform user to install its Roku stick at a time when Amazon (AMZN) and Google (GOOGL) are using their greater clout and sharper elbows to get rid of the tech peons.

Amazon reported sales of over 150 million Fire TV devices recently. Roku has over 56 million active accounts, although it’s not a direct comparison because Amazon’s figure counts sold devices and includes Fire TV devices that are not being used.

There is no possible way that Roku can secure 50% of the market here and 40% would be a stretch capping its ceiling.

Another leery signal came when smart television maker TCL who have partnered to make the Roku smart TV decided to jump ship to Google.

This could represent a red flag as these bigger companies have the capacity to poach talent, know-how, and convince suppliers to jump ship with a more lucrative contract for a larger install base.

This could be the first point of contact that could eventually lead to Google buying out TCL and cutting off Roku from a source of a hardware supplier.

TCL has now claimed to be one of the biggest sellers of sets featuring Google’s connected TV operating system and the partnership will take precedence over anything Roku is involved with.

In the short term, readers need to stay away from Roku as we need more commentary on how it plans to shake off Google and Amazon and how it plans to navigate a perceived saturation in its domestic business while underperforming overseas.

Granted, it’s intimidating to go up against Google and Amazon because there are less tools available in the tool kit in terms of stacking resources and convincing consumers that they are indeed a higher quality product.

Long term, I don’t see it for Roku.

Short term, it’s dicey at best.

This stock promises to be volatile in the next three months and actively trading this stock will probably mean selling sharp rallies and avoiding dips.

The first-mover advantage was stellar for a while and Roku rode that donkey up the mountain of success, but now as reality sets in and the first-mover advantage dissipates, they need a miracle or should just negotiate to sell itself while the stock price is still near $200.

It’s sink-or-swim at this point.

“I have a secret project which adds four hours every day to the 24 hours we have. There's a bit of time travel involved.” – Said CEO of Google Sundar Pichai

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Biotech and Healthcare Letter

January 11, 2022

Fiat Lux

Featured Trade:

(A GOOD STOCK TAINTED WITH CYNICISM)

(BIIB), (LLY), (RHHBY), (SAVA), (PRTA), (SAGE)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.