Bitcoin must be treated as a sell-the-rally asset at this point.

I am not giving up on crypto, but I must acknowledge what is happening in the markets.

Suffering from a broad-based risk aversion move with investors dumping literally everything is something that happens when investors need to meet margin calls.

It’s not about Bitcoin at this point, it’s just caught up in the wash, as asset prices around the world readjust to the new Central Bank policies.

The market is looking through the tailwinds crypto possesses from store of value, inflation hedge, limited supply, and an alternative asset to the US dollar.

It doesn’t matter in the heat of the battle and when everything sells off.

Bitcoin hitting the very lower limit of $30,000 means that investors aren’t ready to ditch the dollar for this high-flying digital currency.

In fact, the US dollar has held up quite strongly in the face of trillions of debt issuance.

Look around the globe and the US dollar has absorbed the Fed’s action in stride reflecting little depreciation stemming from the decision to pump massive amounts of liquidity into the system.

The dollars’ strength means that the transition into digital currencies will take longer than first estimated.

Bitcoin won’t take over in one day, but it will experience a gradual adoption phase with the bruises to show for it.

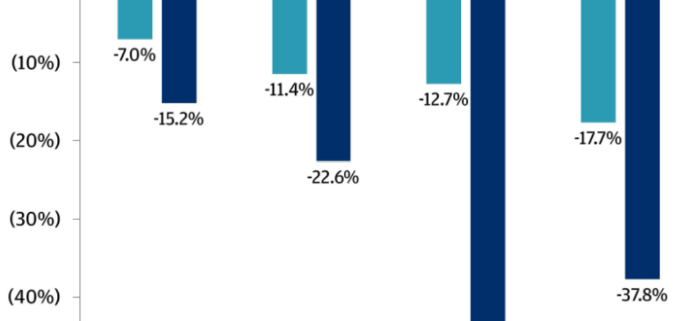

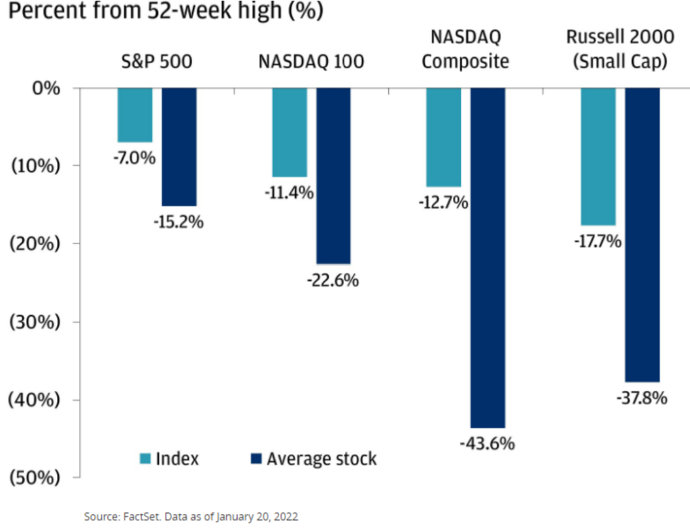

With Russia's move to ban crypto assets lighting the fuse of the latest plunge, Bitcoin's price moves have become closely linked to technology shares, which have slumped on rate hike fears.

The culmination of Netflix warnings of sagging growth triggered another wave of risk aversion in the markets hitting crypto again to knock it down deep into the lower $30,000 range.

In the short term, traders need to play Bitcoin from the $40,000 level and sell rallies until conditions change.

Ethereum, one of the hottest digital coin trades that have soared in popularity thanks to the non-fungible token (NFT) boom, has halved down to the mid-$2,000 level.

Bitcoin, even with its massive underperformance, is still outperforming the minnows of cryptocurrency.

On the horizon, sadly, plans of 4 rates hikes is generally going to cause more pain for risk-on assets, and especially crypto as investors have been conditioned to sell crypto at the first sight of trouble.

On the derivatives side, about 200,000 positions were liquidated in the last 24 hours, totaling more than $800 million in losses and growing according to Coinglass.

Forced liquidations enhanced the selloff and there have been few dip buyers who are waiting out for healthier macro signaling.

For the past two weeks, most of the funding rates in crypto futures have leaned to the short-seller side according to data from The Block Research.

Many retail traders that got into Bitcoin at the peak are now rushing to sell everything and even institutional money are looking at raising cash through the sale of Bitcoin.

I do believe that Bitcoin is still in the midst of a secular bull market, but sentiment and conditions must settle before we reignite the bull case.

Inflation is still a secular tailwind for Bitcoin and other crypto’s, but not in an environment of a panicking Fed who has made a policy misstep.

The altcoin picture is gloomy with Ethereum sidechain Polygon’s (MATIC) token down 36% and Cardano’s (ADA) token is down 61% since their all-time highs in September, when the latter project announced the launch of their smart contracts.

Altcoins suffered drawdowns as steep as 90-99% during the 2017-2018 crypto cycle and the same could happen as investors rush to safer assets.

Naturally, the biggest category of altcoin losers is meme coins.

Dogecoin (DOGE) is now nearly 80% down from its all-time high last May, despite a recent tweet from Tesla CEO Elon Musk that temporarily sent DOGE up as much as 33%.

Shiba Inu (SHIB), another dog-themed coin that gained 1,607% last year, is down 71% from its all-time high.

Sell the rallies at $40,000.