When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Biotech and Healthcare Letter

January 20, 2022

Fiat Lux

Featured Trade:

(A NO-BRAINER DIVIDEND CONTENDER UP FOR GRABS)

(AMGN), (ABBV), (GILD), (REGN), (JNJ)

To say that biotechnology stocks haven’t been performing well as of late is an understatement.

Over the past 12 months, the SPDR S&P Biotech Exchange Traded Fund (XBI) has recorded an over 30% loss and is anticipated to reach its 52-week low soon.

Investors have been pulling back from biotechnology stocks for several reasons like threats of drug pricing reforms in the US, the ever-increasing interest rates, and of course, the lure of rapid-growth assets such as cryptocurrencies.

Nevertheless, all is still not lost for the biotechnology sector.

The industry, in its entirety, continues to move forward with unprecedented innovations.

These groundbreaking discoveries, in turn, offer a myriad of untapped, top-value markets that will bode well for long-term investors.

This means that savvy investors would do well to make the most of this broad selloff in a highly promising segment.

One way to determine quality names in this volatile sector is to choose dividend-paying stocks.

After all, dividends are excellent sources of passive income. Apart from that, these can easily boost your portfolio if you plan to reinvest your money.

Basically, regardless of your investment strategy, choosing dividend-paying businesses can be really helpful in reaching your goals.

Among the names in the biotech industry, one that looks promising these days is Amgen (AMGN).

While Amgen’s dividend yield isn’t as high as the likes of AbbVie (ABBV) and Gilead Sciences (GILD), this pioneering biotechnology company is still a promising investment.

Recently, Amgen reported another dividend increase of 10.2%, indicating a rise from $1.76 to reach $1.94 per quarter, with the subsequent dividend expected to be payable by March 2022.

This results in an annual dividend of $7.76 and a respectable dividend yield of 3.41%.

More impressively, Amgen has been paying out dividends since 2011 and boosted its dividend not only annually but with an 11.97% in CAGR over the past 5 years.

Given the company’s history and growth trajectory, Amgen’s earnings growth rate annually in the next 5 years is estimated to be 6%, while its yearly dividend hike rate is projected at 7%.

At first glance, it’s easy to dismiss Amgen’s current standing.

In the third quarter of 2021, the company’s total revenue only reached $6.7 billion, indicating a measly 4% rise year-over-year.

A potential reason for this underwhelming growth is the pending patent cliff for some of its key products and the threat of biosimilars taking over Amgen’s target markets.

For example, cancer medication Neulasta reported a 25% decline in its sales year-over-year to contribute only $415 million in the third quarter.

Needless to say, this kind of disheartening top-line growth is partly responsible for the stock’s sluggish performance in the market lately.

However, other products in the company’s portfolio have reported much better performances than Neulasta.

There’s osteoporosis treatment Prolia, which rose by 15% year-over-year to contribute $803 million in the same period.

Even cholesterol drug Repatha showed off a 33% growth to record $272 million, while arthritis medication Otezla’s sales climbed by 13% to rake in $609 million.

On top of these, Amgen has also succeeded in developing new products that can easily provide additional revenue streams.

One of the most promising recently approved products is advanced non-small-cell lung cancer (NSCLC) treatment Lumakras, which received the US FDA green light last year.

Although there are many approved drugs for this condition, Lumakaras is the first and only treatment that targets specific mutations among non-squamous NSCLC patients.

This translates to 13% of patients suffering from that particular condition.

This is a massive market for Amgen.

Back in 2019, lung cancer was identified as the leading cause of cancer deaths in the United States.

At that time, the total was 139,603 individuals, which made up 23% of all the deaths attributed to the condition. Among the lung cancer deaths, 84% were identified to be of the NSCLC category.

So, if you put everything in perspective, the 13% patient population that Amgen exclusively holds equates to a big opportunity.

In addition, the European Union already approved Lumakras as well. This opens up yet another massive market for the treatment.

In the third quarter of 2021, Lumakras only delivered $36 million in sales. With the recent approvals and broadening of markets, this drug’s revenue is projected to rise quickly.

Aside from these products, Amgen has been working on expanding its pipeline. To date, the company has over 20 ongoing Phase 3 clinical trials.

Moreover, Amgen has decided to take a page out of the books of biosimilar developers.

As the company witnessed its own products get pummeled by biosimilars in the market, Amgen has opted to cannibalize sales of a wide range of treatments that lost their patent exclusivities.

This strategy has already delivered rewards, with the company reporting at least $2 billion in annual sales from its biosimilars in 2021.

For 2022, Amgen has three more biosimilars under development and is looking into poaching the likes of Regeneron’s (REGN) Eylea and Johnson & Johnson’s (JNJ) Stelara as well.

Despite the pandemic, Amgen has managed to extend its dividend growth streak to reach 11 consecutive years. This makes this biotechnology company an impressive Dividend Contender.

Overall, I consider this company a solid buy and an excellent long-term investment. It’s not simply an undervalued pick for value investors but also an outstanding choice for dividend investors.

Mad Hedge Bitcoin Letter

January 20, 2022

Fiat Lux

Featured Trade:

(PAY FOR YOUR HOUSE IN BITCOIN)

(BTC), (MILO)

Crypto continues to benefit from higher adoption rates and although it doesn’t filter down to the price of Bitcoin (BTC) immediately, it bodes well for the long term.

I am even surprised myself with how Bitcoin has transformed from a speculative asset into something more sustainable.

There have been several events that have also hastened the adoption of crypto and one of the transformational events was the advent of Bitcoin ETFs that are accessible for the average investor.

This was never the case before as people were highly confused about how to participate.

The next monumental shift on the verge of sweeping up another avalanche of new capital is the integration of crypto into the American property market.

Most Americans’ net wealth is tied to their home and, United Wholesale Mortgage – the second-largest US mortgage lender – announced a move to crypto payments last August.

However, despite widespread popular sentiment for the initiative from potential customers, the company gave up on the idea shortly afterward.

The regulatory uncertainty alongside market volatility was cited as the two main headwinds.

Nonetheless, the trend is moving in favor again as the first bitcoin mortgage offering was announced on Tuesday: confirming that while the regulators lack drafting a framework.

A real estate fintech company Milo announced the launch of the world’s first crypto mortgage: enabling borrowers to leverage their bitcoin holdings to buy real estate in the United States.

CEO of Milo Josip Rupera said that customers could obtain bitcoin-backed loans by using their bitcoin holdings as collateral for purchasing a property.

Customarily, first, customers needed to sell their crypto balance for a down payment by converting it into fiat currency.

However, Milo now allows US citizens and foreigners to qualify for a US-based mortgage based on their BTC holdings.

This is another indicator of BTC being massively valued as a form of alternative payment.

Milo offers crypto loans and has promised to expand their debt offerings to BTC holders.

Milo’s clients will be able to pledge their bitcoin to purchase property and finally qualify for a low-interest rate 30-year crypto mortgage.”

The company clarified earlier that ‘no dollar down payments’ would be required to finance the mortgage: making the procedure faster and more efficient. However, an obvious question pops up again: what about the sharp movements in the price of bitcoin acting as collateral?

Similar to other crypto loans, the crypto-mortgage would be launched with a margin-call component.

Milo would then underwrite the customer, evaluate the property, validate other aspects of creditworthiness, and ultimately facilitate a successful transaction.

If, however, the crypto drops in value, the borrower would be subject to the deficit amount if the assets are underwater.

Milo would allow the borrower to pay in fiat currency or pledge more crypto to adjust the margin account to its minimum maintenance margin.

Attaching itself to the coattails of the most stable asset in America could act as the panacea of crypto’s evils.

Expert bang on saying crypto is a poor store of value, well, if it's used to underpin an American house, then that argument goes out the window.

Making a path from Bitcoin to real estate debt is genius.

Milo has been planning this business since last year. The goal was to allow crypto holders to bypass the complex hassle with traditional banks and lenders, which barely consider crypto as an asset class. Instead, the company aimed to offer an alternative route to buy real estate.

Milo estimates that the crypto mortgage market could be worth tens of billions of dollars soon.

The marriage of mortgage lending and crypto would be the elixir to finally kill that volatility that many don’t like about this asset.

There’s nothing more stable about a physical home and the U.S. property market underpinning crypto is essentially the holy grail of the crypto industry into how this asset can really mainstream into every part of the U.S. economy.

Until then, accepting heightened volatility is part and parcel of crypto, and crypto settling in the $40,000 range shows that crazy fluctuations aren’t as common as they used to be.

To check out more about a crypto-backed mortgage or if you are thinking about taking out a crypto-backed mortgage, go to Milo’s homepage by clicking here.

“Bitcoin is a swarm of cyber hornets serving the goddess of wisdom, feeding on the fire of truth, exponentially growing ever smarter, faster, and stronger behind a wall of encrypted energy.” – Said CEO of MicroStrategy Michael J. Saylor

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

January 20, 2022

Fiat Lux

Featured Trades:

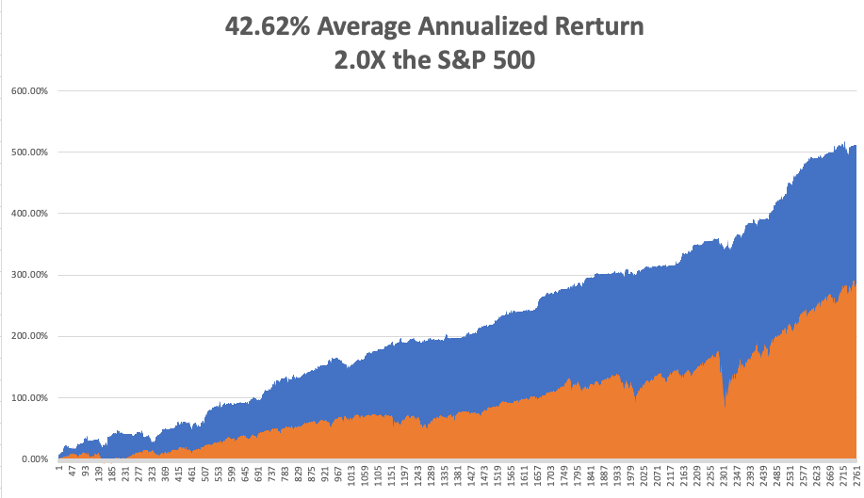

(HOW THE MAD HEDGE MARKET TIMING ALGORITHM TRIPLED MY PERFORMANCE)

I couldn’t believe my eyes.

Upon analyzing my performance data for the past year, it couldn’t be clearer.

After three years of battle testing, the algorithm has earned its stripes. I started posting it at the top of every Mad Hedge newsletter and Trade Alert three years ago, and will continue to do so in the future.

Once I implemented my proprietary Mad Hedge Market Timing Index in October 2016, the average annualized performance of my Trade Alert service has soared to an eye-popping 42.62%.

As a result, new subscribers have been beating down the doors trying to get in.

Let me list the high points of having a friendly algorithm looking over your shoulder on every trade.

*Algorithms have become so dominant in the market, accounting for up to 80% of total trading volume, that you should never trade without one

*It does the work of a seasoned 100-man research department in seconds

*It runs real-time and optimizes returns with the addition of every new data point far faster than any human can. Imagine a trading strategy that upgrades itself 30 times a day!

*It is artificial intelligence-driven and self-learning.

*Don’t go to a gunfight with a knife. If you are trading against algos alone, you WILL lose!

*Algorithms provide you with a defined systematic trading discipline that will enhance your profits.

And here’s the amazing thing. My algorithm completely nailed the big rotation out of tech and into value stock last September.

My Mad Hedge Market Timing Index also correctly predicted the outcome of the 2020 presidential election.

You saw this in stocks like US Steel (X), which took off like a scalded chimp the week before the election and quickly tripled.

When my and the Market Timing Index’s views sharply diverge, I go into cash rather than bet against it.

Since then, my Trade Alert performance has been on an absolute tear. In 2022 we earned a ballistic 90.02% compared to a paltry 18% gain for the Dow Average.

Here are just a handful of some of the elements which the Mad Hedge Market Timing Index analysis in real-time, 24/7.

50 and 200-day moving averages across all markets and industries

The Volatility Index (VIX)

The junk bond (JNK)/US Treasury bond spread (TLT)

Stocks hitting 52-day highs versus 52-day lows

McClellan Volume Summation Index

20-day stock-bond performance spread

5-day put/call ratio

Stocks with rising versus falling volume

Relative Strength Indicator

12-month US GDP Trend

Case Shiller S&P 500 National Home Price Index

Of course, the Trade Alert service is not entirely algorithm drive. It is just one tool to use among many others.

Yes, 50 years of experience trading the markets is still worth quite a lot.

I plan to constantly revise and upgrade the algorithm that drives the Mad Hedge Market Timing Index continuously as new data sets become available.

Obviously, in light of the recent stock market crash, a ton of new valuable data is available for which my algo can mine.

It’s All About the Inputs

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.