A friend of mine asked me what the Global Money supply was.

I just so happen to know that number. It is $100 trillion. That includes the world's total M2 money supply, all the physical cash in circulation plus deposits, promissory notes, and other liquid money instruments.

Writing for The Economist magazine in London for ten years, I still constantly update these numbers in my mind. This, after all, is the air we breathe and the language we speak.

Then it occurred to me that most people don’t know these mega numbers, so I thought I would give you a basic primer and some conclusions.

Enjoy.

$1 quadrillion – the value of all assets in the world, both financial and physical

$100 trillion – Global money supply

$150 trillion – the value of all global bonds and fixed income securities

$100 trillion – value of global stock markets

$47 trillion – US stock market capitalization

$30 trillion – the value of global real estate

$28.7 trillion – US National debt

$22.7 trillion – US GDP and end Q2

$20.5 trillion – US M2 money supply

$20 trillion – total value of US real estate

$14.4 trillion – GDP of China

$10 trillion – value of global physical gold holdings

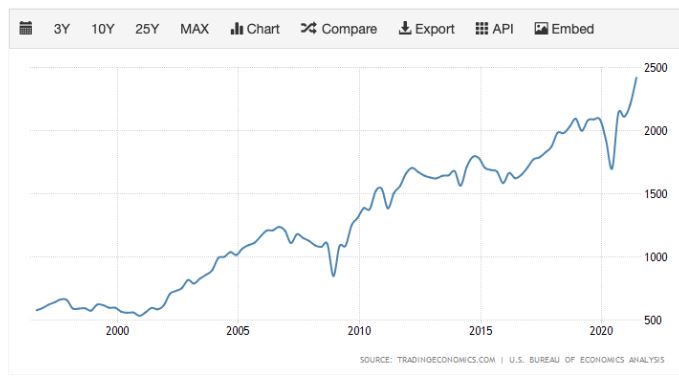

$10 trillion – 2021 US corporate profits

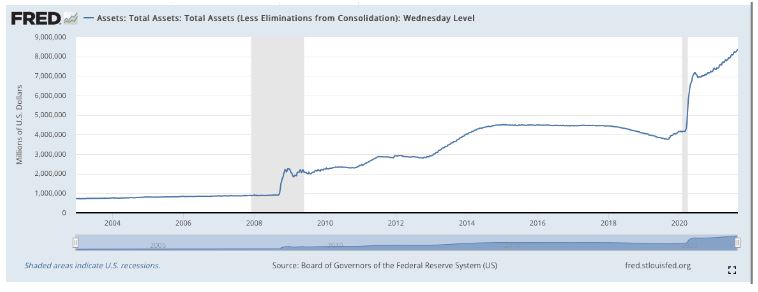

$8.3 trillion – US Federal Reserve balance sheet

$4.174 trillion – FY 2022 US Budget (click here for detail at https://www.govinfo.gov/content/pkg/BUDGET-2022-BUD/pdf/BUDGET-2022-BUD.pdf )

$3.1 trillion – 2021 US Budget deficit

$4 trillion – GDP of Germany

$2 trillion – value of all issued cryptocurrencies

$1.5 trillion – GDP of California

$1.4 Trillion – GDP of Australia

$1 trillion – GDP of Russia

Looking at this impressive list of numbers, there is one that leaps right out at you. That is the second to the last one, the value of cryptocurrencies, which is only $1 trillion, two-thirds of which is Bitcoin.

That is 0.1% of the value of all assets in the world, 1% of the global money supply, 2.1% of US stock market capitalization. In other words, Bitcoin accounts for only a tiny share of global assets.

Which leads one to an obvious conclusion. The next big movement in money will be out of the largest assets classes into the smallest ones. The most obvious target here is the $150 trillion in the value of all bonds and fixed income securities, most of which have negative yields, or yields close to zero.

Move even a small portion out of bonds into Bitcoin and its value has to double, triple, move up ten times, or even 100 times.

There are other screaming conclusions to be found in these numbers. The bond market (TLT) is toast and can only really go down from here. The same is true for the US dollar (UUP). Oh yes, and you want to buy the Australian dollar (FXA).

It gets better.

The US money supply is currently worth $20.5 trillion and is growing at a 30% rate. So, in a year it will be worth $26.65 trillion and in two years it will be worth $34.65 trillion.

The biggest factor expanding the money supply today is NOT the government, but the explosive growth of US corporate profits, at $10 trillion in 2021, which is essentially a bet on the future of everything.

Even if the Federal Reserve ends its quantitative easing program as is currently being discussed (the “taper”), that would only take $120 billion a month, or $480 billion a year out of the growth of liquidity, only 4.8% of corporate profits, a pittance really.

And US corporate earnings could continue growing at this ballistic for another decade or more.

That means that not only will global liquidity continue to increase, but it will also do so at an exponential rate. My bet is that a decent chunk of this ends up on cryptocurrencies and Bitcoin specifically.

Better strap on those Bitcoin positions now. If I am right this is going to happen fast.

I am keeping the $995 discount offer for the launch of the Mad Hedge Bitcoin Letter open an extra day. To take advantage of this one-time-only opportunity please click here.

US Corporate profits

Federal Reserve Balance Sheet