Altcoins won’t age well and 99% of them will vanish before our eyes. The way in which they exit also may or may not cause financial contagion.

We need to stop the arrogance already.

Let’s just default quickly to Occam's razor and back of the envelope math shows that we can’t have 1,000’s of these crappy digital currencies masquerading as real ones.

We need a few good ones and that’s it.

Sure, we have tried and tested Bitcoin (BTC) and Ethereum (ETC), but these other worthless pieces of code are hawked by mostly snake oil salesmen who are looking for a quick buck by preying on the naïve.

So don’t get greedy.

I hear many crypto enthusiasts tell me their strategy is to buy the cheapest and most obscure crypto possible and hope for a moonshot.

That’s a fools’ strategy and the money is better donated to cure world poverty.

So what am I really talking about?

The supposed stable coin UST and LUNA which was supposed to peg its value to the US dollar broke in a severe way as the algorithmic that was intended to uphold this balanced ratio went haywire.

10’s of billions of real dollars were wiped out from investors as the genius algorithms messed up in a big way.

This contagion has had the knock-on effect of dragging the price of Bitcoin and Ether down as many might assume a UST or LUNA holders might need to sell BTC to get some liquid currency.

It’s been a giant risk-off move for crypto in every nook of the asset class and even worse, a massive loss of confidence for the industry as a whole.

This was a gift to the detractors who say that crypto is run by a bunch of idiots or charlatans or something of that ilk.

The value of LUNA plunged on Wednesday as Terraform Labs creator Do Kwon laid out a plan to save its sister token, the stablecoin TerraUSD (UST).

In the last 24 hours, roughly $10 billion have been drained from LUNA. Its price has fallen 93% in that time from $32 to $2.25 per coin, with the price changing rapidly each minute. After skidding to a low of 30 cents per coin, UST has ratcheted up more than a quarter to 64 cents.

Down 30% in the last day after breaking its essential $1 peg over the weekend, UST trades at above 64 cents per coin while Terra’s LUNA token rebounded 61% to $2.25 after dipping below $1 at 9 a.m. New York time Wednesday.

In the first sniff of market turmoil, stablecoins have failed miserably and it also incentivizes government regulation to shut them down.

This of course gives ammunition to SEC Chairman Gary Gensler to move stablecoins under his jurisdiction.

He would kill the development in a second by pelting it with so many fees, bureaucracy, delays, hidden regulations, and obstructions that stablecoins will be swept into the dustbin of history.

The contagion has led to Bitcoin falling lower than $29,000 and we are getting dangerously closer to the $21,000 threshold where MicroStrategy (MSTR) will get a margin call.

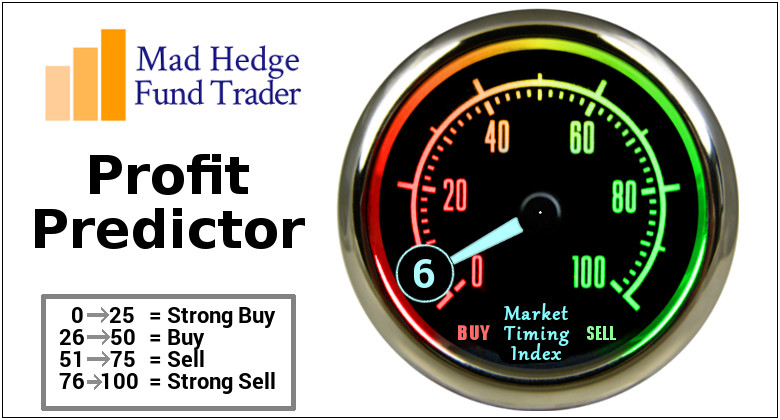

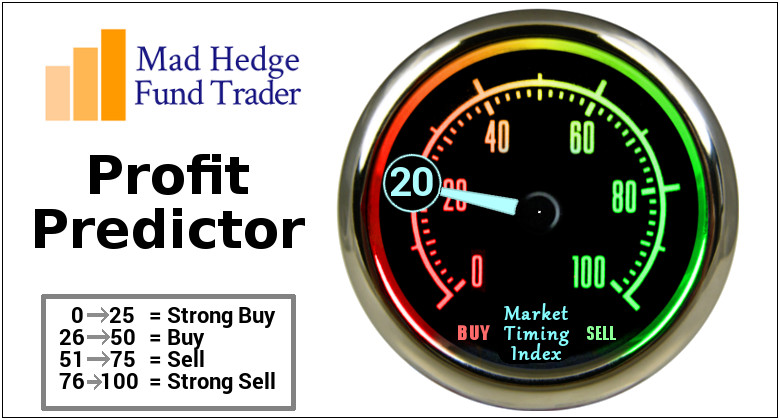

Sell every and any rally in Bitcoin, this loss of confidence can’t be understated and crypto has failed miserably to attract the incremental buyer in a rising rate environment.

Don’t catch a falling knife.