When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Bitcoin Letter

May 5, 2022

Fiat Lux

Featured Trade:

(COSTS SPIKE FOR NEW CRYPTO-SUPPORTED INTERNET)

(BTC), (NFT), (FB), (DAPP)

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

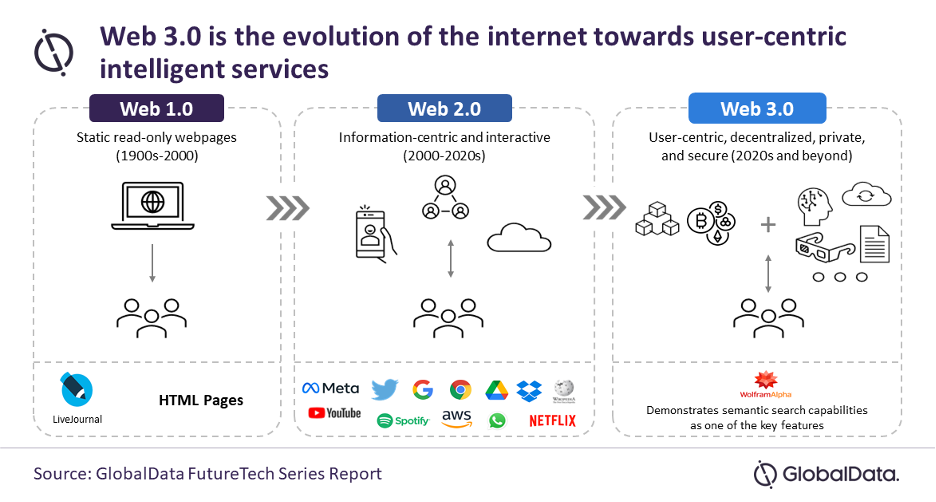

Advanced technologies such as cryptocurrencies and (non-fungible) tokens will play a leading role in Web 3.0, since they reflect a sense of ownership in decentralized blockchain networks.

Much of this is totally new and the programming and design behind it won’t be able to mesh well with what happened before.

Think of the latest hype of NFTs, or non-fungible tokens, which shifts the ownership of a certain form of money, which is the case with cryptocurrencies, to the ownership of many other digital assets, from artworks to memes and tweets.

Internet 2.0 programmers won’t be able to just seamlessly integrate into this new language and help develop this new world.

Web 3.0 enables the spread of cooperative governance frameworks for formerly centralized products.

There are few qualified Web 3.0 developers and they are able to ask for astronomical compensation for their service.

This won’t stop anytime soon as companies like Meta (FB), who have cash, are willing to throw money at this limited pool of developers.

There are many costs involved in being a Web 3.0 developer. The initial start-up cost is typically high, but this is offset by the increased flexibility it affords. As you build your portfolio of Web 3.0 projects, the costs will gradually decrease.

This technology would make the web more transparent and user-centric, while also opening the door for the blockchain. In the future, websites and apps could trade cryptocurrencies and other coins.

Becoming a Web 3.0 developer is not easy, but the rewards are well worth it. Those who have mastered the basics of the new framework can build an excellent website.

The cost of learning to become a Web 3.0 developer varies, but can be extremely high. After all, it takes a lot of time to build a successful business on this technology. There are also plenty of challenges involved with it.

The technology is not yet mainstream, but a handful of projects are attempting to build channels through the interoperability of blockchain networks.

You must have an understanding of web development, understand the trade-offs between different types of technologies, and be able to see trends and future directions in the industry.

A free course on Blockchain and cryptocurrencies can help you master the skills you need. Harvard University’s CS50 course will teach you the basics of computer programming, including data handling and Blockchain. Blockchain is crucial for Web3.0 developers because it is not only related to crypto coins, but can also run cutting-edge DApps and full backends.

The Web3.0 technology is a fast-growing field, and it is much like the dot-com era in the early 2000s.

A career as a Web3.0 developer is highly likely the best type of career to focus on for anyone getting into tech these days.

The risk-reward is skewed so much to the reward that many “full-time” developers are setting their workweeks at only a maximum of 24 hours per week or three days.

Not only that, web 3.0 developers are asking for starting salaries of $200,000 per year and if a company is interested in adding a 4th day of work, then that starting salary spikes to $300,000.

Remember these sums aren’t just it, these developers require a good amount of stock options.

Lastly, these web developers are refusing any job as “independent contractors” and won’t look at any offers that are anything other than a full-time employee with those implied rights.

Even under these terms, these web 3.0 developers have a line outside the door of companies willing to pay this type of compensation to get them in the door.

Web 3.0 is proposed to become the next iteration of the internet, but right now, the only people winning in this race are the people putting it together.

Until this new version of the internet comes online, companies won’t be able to fully monetize or onboard consumers.

This of course is important because crypto will be the medium of payment in this internet 3.0.

The lead up to that moment means that companies will need billions just to get a seat at the table.

“When we launch a product, we're already working on the next one. And possibly even the next, next one.” – Said Current CEO of Apple Tim Cook

Global Market Comments

May 5, 2022

Fiat Lux

Featured Trade:

(A NOTE ON OPTIONS CALLED AWAY)

(TLT), (BRKB), (SPY), (CCJ), (GLD)

Mad Hedge Biotech and Healthcare Letter

May 4, 2022

Fiat Lux

Featured Trade:

(A PICK AND SHOVELS BUSINESS POISED TO EXPLODE)

(TMO), (CRSP), (MRNA), (BNTX), (A), (DHR), (ILMN)

There’s never a wrong time to begin investing. In 2021, the markets generated positive buzz when things started to heat up again.

That same optimism has recently transformed into bearishness following the decline in share prices.

Nevertheless, there’s still good news.

Given the lower valuations, investors can now get more bang for their buck.

In the past two years, we’ve experienced so many unprecedented events. Among the most heavily affected by the pandemic is the life sciences sector.

One of the biggest names in this field is Thermo Fisher Scientific (TMO).

With a market capitalization of roughly $200 billion, it’s no longer accurate to describe this as an under-the-radar company. TMO has received minimal fanfare among investors despite its massive size for decades.

A key reason for this is its lowkey steady execution of a well-established or tried-and-tested strategy.

Although it lacks the pizzazz of more exciting companies these days like CRISPR Therapeutics (CRSP), Moderna (MRNA), and BioNTech (BNTX), TMO has rewarded its investors with substantial returns.

Over the last 40 years, TMO has recorded an annual growth rate of 16.5%, hitting a 27,000% return in total by 2021.

In fact, TMO came off a strong 2021.

Its sales grew by 22% from 2020 to report $39.2 billion. While acquisitions played significant roles in the company’s growth, the 17% organic revenue growth of TMO served as its primary growth driver behind its solid numbers in 2021.

Even its COVID-19-related sales, particularly its testing products, contributed to reach $9.2 billion.

Looking at TMO’s business model, it’s evident that the company offers investors great exposure to the entire healthcare field via a single investment only.

That is, TMO is a broad business. It covers practically all life sciences solutions, analytical tools, specialty diagnostics, lab items, and even clinical, biotechnology, and pharmaceutical services.

Spanning the entire industry, such portfolio of products and services allow TMO to confidently go toe-to-toe against industry heavyweights like Agilent Technologies (A), Danaher (DHR), and Illumina (ILMN).

Actually, all of its segments grew last year, with TMO showing off quicker revenue increases than its competitors in the previous five years.

Hence, it is no surprise that TMO expects its numbers to climb in 2022. For this year, the company’s projected revenue is estimated to rise by at least 7% to reach $42 billion.

TMO strategically leveraged more significant acquisitions to build its diverse and deep portfolio today.

In 2011, the company spent $3.5 billion to buy Sweden’s blood-testing firm Phadia and cleverly maneuvered a relatively cheap deal to also grab chromatography company Dionex for only $2.1 billion.

In 2013, TMO bought a fast-growing genetic testing company called Life Tech for $13.6 billion.

At that time, Life Tech was the leader in this field and already possessed the technology to become a front-runner in the personalized medicine space.

In 2016, it shelled out $4.2 billion for electron microscopy company FEI and dropped another $7.2 billion in 2017 to buy pharmaceutical contract manufacturer Patheon.

To date, TMO’s most substantial deal is its $17.4 billion acquisition of contract research business Wilmington’s PPD.

This particular deal created a gateway between the biopharma giant and other drug developers, with TMO boosting its services segment focused on its biotechnology and pharmaceutical clients.

Between 2019 and 2021, the pharmaceutical and biotechnology market has experienced a promising over 20% growth.

This field is expected to grow to an additional $20 billion in 2022, following the growing interest in the industry in this post-pandemic era.

There is another emerging sector within the pharmaceutical and biotechnology market: the precision medicine and gene sequencing field.

Taking into consideration the growing demand for the products and services from this space, this market is estimated to reach roughly $1.6 trillion by 2030.

This makes TMO’s PPD acquisition timely, as it would allow the company to gain a bigger market share and expand its reach across the globe.

Furthermore, the previous acquisitions would bolster the company’s hold on the current market and ensure its position as a first-mover in potential groundbreaking innovations in the biotech and pharma sector.

Considering its expansion strategies and growth history, TMO doesn’t seem to be stopping anytime soon.

While the environment for mergers and acquisitions did become a bit more restrictive these days, there are still several potential buyout targets that could deliver favorable returns. So, we might hear about another TMO-linked acquisition sometime soon.

Overall, TMO is a healthcare stock offering robust and stable growth and a promising future regardless of economic downturns.

Moreover, its pick-and-shovels play makes it an excellent stock that looks poised to sustain its momentum and is well-positioned for global expansion. Hence, it would be wise to buy the dip.

Global Market Comments

May 4, 2022

Fiat Lux

Featured Trade:

(I HAVE AN OPENING FOR THE MAD HEDGE FUND TRADER CONCIERGE SERVICE),

(SOME SAGE ADVICE ON ASSET ALLOCATION)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.