When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

July 21, 2022

Fiat Lux

Featured Trade:

(DECODING THE GREENBACK),

(THE TECHNOLOGY NIGHTMARE COMING TO YOUR CITY)

Mad Hedge Technology Letter

July 20, 2022

Fiat Lux

Featured Trade:

(HUMAN TESTING COULD START SHORTLY)

(NEURALINK)

Neuralink Corporation is an American neurotechnology company developing implantable brain-machine interfaces.

You would think this is straight out of science fiction, but mark my words that in our lifetime, we could all be operating digital Neuralink devices from our heads if Musk gets his way.

And he often does get his way.

Scary as it seems now, this will probably be the first of many artificial intelligence procedures to infuse humans with layers of artificial intelligence.

Musk believes humans will go the way of robot hybrid in the future because the natural development of competition is trending in that way and sadly, this direction in humanity is ultimately existential for every one of us.

Improvements in technology will periodically be announced and iterations will need to be adopted because software is upgraded.

As for today and now, testing on pigs has segued into testing on monkeys.

Pending FDA approval, Musk hopes to start testing Neuralink on humans with severe spinal-cord injuries like tetraplegics and quadriplegics in 2023.

Neuralink’s dramatically simplified design for an implant that hopes to create brain-to-machine interfaces is a big deal and partly because of the star power backing the project that can literally move mountains.

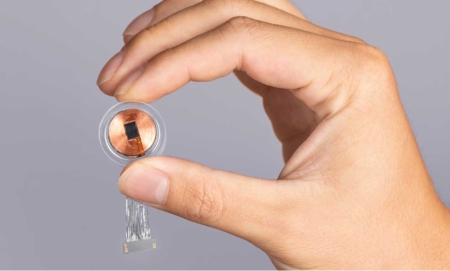

The previous design consisted of a bean-shaped device that would sit behind the ear, but now it is the size of a large coin, and it goes in your skull.

I expect the final iteration to be a millimeter wide.

The in-brain device could enable humans with neurological conditions to control technology, such as phones or computers, with mere thoughts.

The other use case is solving neurological disorders from memory, hearing loss, and blindness to paralysis, depression, and brain damage which is a tad more altruistic.

The current prototype – referred to as version 0.9 – measures 23 millimeters by eight millimeters and has 1024 electrode "threads" attached to it that are implanted into the brain.

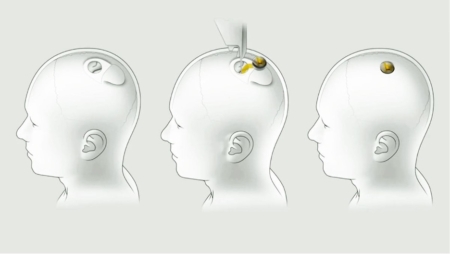

It is designed to replace a coin-sized portion of the skull and sit flush so it would be physically unnoticeable. It would be inductively charged the same way you would wirelessly charge a smartwatch or a phone.

The surgical robot, which is programmed to insert the neural threads safely into the brain, was done by US design company Woke Studios.

Woke Studio’s robot would be able to insert the link in under an hour without general anesthesia, with the patient able to leave the hospital right away.

The robot will eventually do the entire surgery – so everything from the incision, removing the skull, inserting electrodes, placing the device, and then closing things up.

It will be completely automated.

In 2021, humans still need to digest thoughts and carry out functions through actionable fingers into a phone interface.

Not only will physical devices be useless at that point, but they will also spawn a mega cloud storage business that is hooked straight to the mind.

It really is a gigantic step that will digitize, even if marginally ethical, and computerize humans.

Lately, reports in 2022 show that Neuralink killed eight monkeys during research experiments at UC Davis labs in California.

Neuralink has since denied accusations of animal cruelty and moved lab experiments to Fremont, California.

However, a recently filed lawsuit by Physicians Committee for Responsible Medicine (PCRM) follows up with those accusations of animal abuse.

No doubt this will delay any further testing with monkeys and delay the inevitable transition of brain-altered humans.

Musk also got one of his Neuralink executives pregnant and fathered twins.

Who said life was simple!

Global Market Comments

July 20, 2022

Fiat Lux

Featured Trade:

(I HAVE AN OPENING FOR THE MAD HEDGE FUND TRADER CONCIERGE SERVICE),

(SOME SAGE ADVICE ON ASSET ALLOCATION),

(TESTIMONIAL)

Well, it’s happened once again.

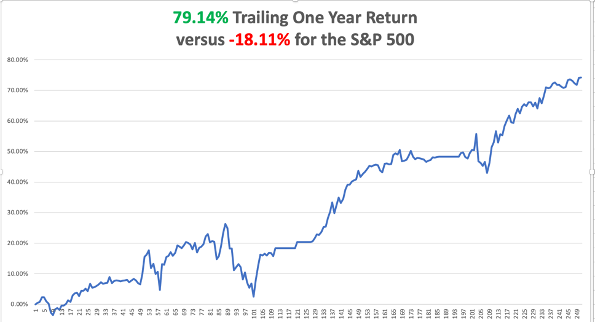

This time, I have two concierge members who have given me notice that they are cashing in their chips and retiring. They both clocked 1,000% returns this year, using maximum leverage and hammering every rally all year long. I coached them where I could.

That creates a fabulous opportunity for you as I now have a rare two Concierge slots to offer to my subscribers where I limit the service to only ten clients at any one time.

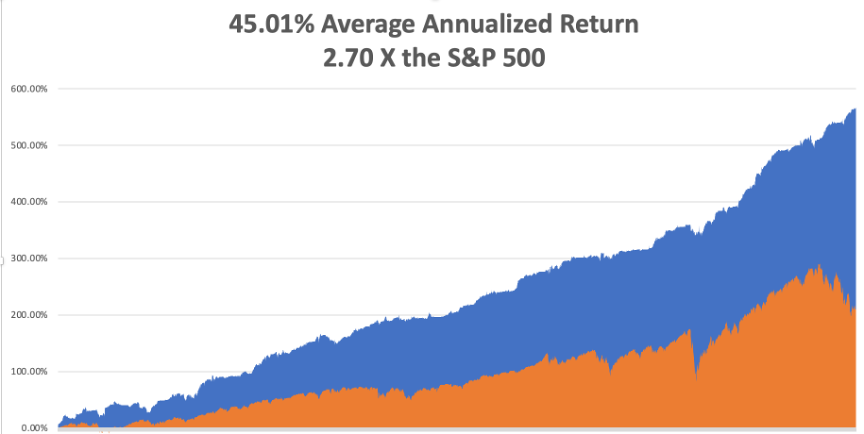

With a 79.14% trailing one-year return and 45.01% 14-year average annualized return, clients are beating down the door to join my Concierge service.

The goal is to provide high net-worth individuals with the extra degree of assistance they may require in managing diversified portfolios. Tax, political, and economic issues will all be covered.

It is also the ideal service for the small and medium-sized hedge fund that lacks the resources to support their own in-house global strategist full time.

The service includes the following:

1) A risk analysis of your own personal portfolio with the goal of focusing your investment in the highest return sectors for the long term.

2) A monthly phone call from John Thomas to update you on the current state of play in the global financial markets.

3) Personal meetings with John Thomas anywhere in the world once a year to continue our in-depth discussions, ever the pandemic ends.

4) You get my personal cell phone number so I can act as your investment 911.

5) Early releases of strategy letters and urgent trading information.

6) More detailed recommendations on LEAPS, or two-year call options on the best high growth names.

The cost for this highly personalized, bespoke service is $12,000 a year.

To best take advantage of my Mad Hedge Fund Trader Concierge Service, you should possess the following:

1) Be an existing subscriber of the Mad Hedge Fund Trader who is already well aware of our strengths and limitations.

2) Have a liquid net worth of over $500,000.

3) Possess a degree of knowledge and sophistication of financial markets. This is NOT for beginners.

To subscribe to Mad Hedge Fund Trader Concierge Service, please email Filomena at support@madhedgefundtrader.com. Please put “Concierge Candidate” in the subject line.

I look forward to hearing from you.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Mad Hedge Biotech and Healthcare Letter

July 19, 2022

Fiat Lux

Featured Trade:

(A RECESSION-PROOF STOCK)

(UNH), (CVS), (LHCG)

The economy isn’t built to be recession-proof. Generally, it follows a relatively predictable albeit irregular pattern called the economic cycle.

Some periods of growth can typically last for several years before reaching its peak. What comes after is a period of contraction—aka a recession—before the economy once again moves towards another expansion.

Needless to say, periods of recession can be really brutal for investors. During this time, cyclical stocks or businesses that are highly sensitive to the economic cycle tend to be hit the hardest.

Meanwhile, certain stock market segments are relatively immune to these cycles. These companies provide investors with stocks that are nearly recession-proof, allowing them to buy and hold while awaiting the end of economic turmoil.

Among these companies, healthcare stocks are some of the most recession-proof options for investors.

After all, people can’t exactly suspend most healthcare needs. When you are sick, you have no choice but to visit the doctor and purchase medication.

Within the healthcare sector, health insurers appear to be beating the market recently.

When the pandemic began, health insurers had to adjust some aspects of their operations.

Reduced spending on non-essential medical care is an obvious change. However, this was counterbalanced by the increased costs of other procedures. These changes brought about by the pandemic greatly benefited the health insurance industry.

The emergence of more technological innovations and inflation are the primary reasons behind the increase in healthcare spending.

As these costs continue to accumulate and rise, an increasing number of clients will rely on health insurance companies as a hedge.

This is one of the key factors why the health insurance market worldwide is projected to grow by 4.6% annually from $2.8 trillion in 2020 to an impressive $3.9 trillion by 2027.

With a market capitalization of roughly $483 billion, UnitedHealth Group (UNH) is considered the largest health insurer across the globe.

For comparison, the second biggest health insurer is CVS Health (CVS) with a market capitalization of $123 billion, or about one-fourth the size of UNH.

Thanks to UNH’s sheer size and the positive industry outlook, the health insurance company is estimated to deliver 14.6% earnings growth annually over the next five years.

In its second-quarter earnings report, the company topped estimates of $5.21 per share and delivered $5.57 instead.

Its revenue of $80.3 billion was also above the earlier forecast of $79.7 billion.

This promising growth potential could be the main reason UNH announced a 13.8% per share rise in its quarterly dividend during its last earnings report.

Riding this momentum, UNH is expected to move forward with the $5.4 billion acquisition of LHC Group (LHCG) within the year.

As the first company within its segment to post earnings this quarter, UNH will be the “bellwether for the group.”

Although there’s a possibility that this health insurer’s report could be the best news in the sector, the overall outlook for its peers still remains positive.

It can be stressful and unnerving to even consider investing in the stock market at the moment. Considering that the S&P 500 is down 18% this year, it feels like a terrible time to buy stocks. But, that couldn’t be further from the truth.

Despite the fact that there are unquestionably some weak businesses in existence, there are also a great number of strong businesses with the capacity for long-term expansion and growth.

Accumulating shares of quality companies during a recession can position you for substantial long-term returns.

UNH’s performance is aligned with recent observations: the healthcare sector has been largely outperforming the market in 2022.

Amid the turbulent macroeconomic climate, this industry has managed to survive and even thrive.

While health insurers are not exactly risk-free, UNH's diversified business model enables it to withstand any economic downturn. Therefore, it would be prudent to buy the dip.

Mad Hedge Bitcoin Letter

July 19, 2022

Fiat Lux

Featured Trade:

(HOW TO PLAY CRYPTO USING AN ETF)

Don’t get me wrong — I understand the precarious nature of Bitcoin today and we could be set for a bear market rally for an asset class that has been much maligned.

Cryptocurrencies have a reputation for being difficult to understand, so don’t be embarrassed if you’re befuddled — I felt the same way the first day I tried to understand this stuff.

The Harris Poll earlier this year found that 61% of people who had heard of cryptocurrencies still had little or no understanding of how they work.

How Do I Buy Bitcoin?

Conventional wisdom has it that the most likely route is a Bitcoin online exchange.

Create an account — enter a payment method.

Reputable exchanges will require information such as bank account details or a debit or credit card.

Then proof of identity is required such as a driver’s license, ID or passport.

After verification, purchase Bitcoin by transferring it to a personal hot wallet and buy and sell the asset!

Remember that these accounts coming directly from bitcoin brokers aren’t insured and aren’t secure.

Therefore, a better way to mitigate risk is by going through a Bitcoin ETF on the U.S. public markets with an official broker registered with the Security and Exchange Commission (SEC).

Not only do public stocks provide additional security as a bitcoin trading vehicle, but ETFs are an aggregation of crypto asset tracking data points reducing the volatility even more.

Unregulated crypto exchanges come with a higher understanding of operational and systemic risk and not everyone wants to venture into the arid Wild West without a horse or water.

If you trade with an official brokerage registered with the SEC, you are covered by Federal Deposit and Insurance Corporation (FDIC) insurance for up to $250,000 per account holder in a financial institution.

If there are joint owners, then the account is insured for up to $500,000 ($250,000 for each owner).

The FDIC is a U.S. government agency so, in effect, these accounts are federally insured.

There is also another layer to this — you are covered by Securities Investor Protection Corporation (SIPC).

SIPC is a U.S. government creation but not an agency of the U.S. and insures all brokerage accounts up to $500,000, but only up to $250,000 for cash in such accounts that are intended to be used for securities transactions.

Cash in brokerage accounts only for the purpose of earning interest is not protected. While SIPC has been established by Congress, it is funded by all of its member brokers/dealers.

In many cases, SIPC protects against unauthorized trading or theft in the account.

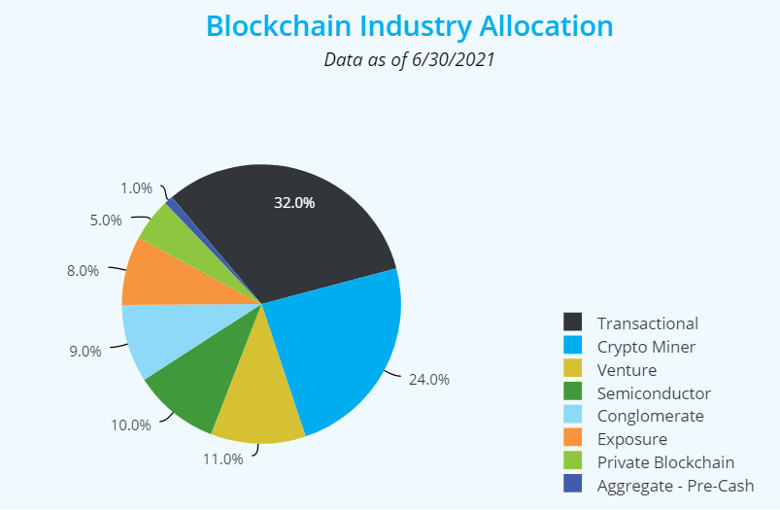

My favorite crypto ETF is Amplify Transformational Data Sharing ETF (BLOK) which has morphed into one of the best crypto ETFs on the market since its inception.

BLOK is an actively managed ETF that seeks to provide total return by investing at least 80% of its net assets in equity securities of companies actively involved in the development and utilization of blockchain technologies.

BLOK’s biggest two positions are Bitcoin proxy MicroStrategy (MSTR) and a Canadian crypto mining company called Hut 8 Mining Corp (HUT).

I have already shot out a MicroStrategy trade alert to new readers and am incredibly bullish on the company.

However, this ETF encompasses more than MSTR offering broader exposure to firms related to Bitcoin, crypto miners, and software companies that are heavily into crypto.

Hut 8 engages in industrial-scale bitcoin mining operations. It also owns and operates 38 BlockBoxes in Drumheller, Alberta, and 56 BlockBoxes in Medicine Hat, Alberta.

BlockBoxes are one of the most powerful and cost-effective bitcoin mining units available on the market.

BLOK doesn’t track bitcoin 1:1, but it does mimic the price action relatively closely albeit with less extreme swings.

Controlling excess volatility is something you should be happy about.

BLOK also has an expense ratio of 0.71% which isn’t too expensive for those who want to buy and hold the ETF and not trade the derivative.

Buying BLOK is most likely the best way to ensure safe trading under the framework of the SEC, but I understand others have a higher risk profile which is also welcome.

To understand more about the ETF BLOK, click here.

(https://amplifyetfs.com/blok.html)

Although crypto has entered a crypto winter of sorts, it should be worth a trade from low levels. At least BLOK guarantees that you will be liquidated from your position and not frozen like some of these unregulated crypto exchanges.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.