When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

January 11, 2023

Fiat Lux

Featured Trades:

(TESTIMONIAL)

(A BUY WRITE PRIMER)

(AAPL)

Dear John,

I’m taking the plunge since your performance has been phenomenal.

I have been a subscriber for many years … mainly with my face pressed up against the window looking in and watching your performance figures rack up at a staggering pace.

I was busy running my business and could not dedicate the time needed to trade your recommendations in the timely manner required

As of January 1st, I took the plunge and retired, and am now trading full-time.

I just started doing options in earnest last week … prior to that I traded shares but was primarily focused on my business

With my focus on trading this year, I am going to religiously follow all that you do and take advantage of the resources that you offer.

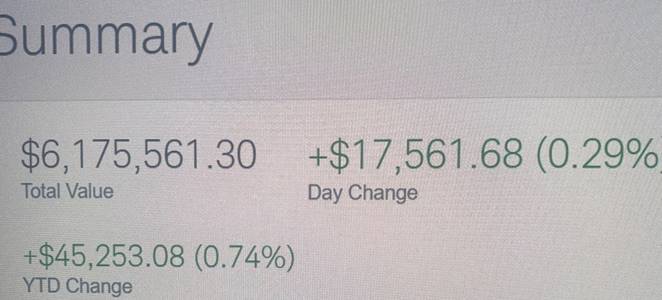

Below is one of my trading accounts, the one dedicated to option trading, showing two recent positions put on … I am starting with small positions as I know I will make mistakes on order entry, etc. Come February I will ratchet it up to sizable option positions

I missed your (TSLA), (TLT), (WMP), and (GOOGL) plays, as the market moved before I could get the orders in, but I did buy (TSLA) and (TLT) shares. So far, so good!

In retirement, I spend time between Palm Beach and Chicago … if you are ever nearby happy to buy you dinner.

Bill

Chicago

Tuesday morning

January 10, 2023

Hello everyone,

Bed Bath and Beyond – a popular pitstop for those who are looking for a luxury look in sheets and towels and special decorative pieces – is now struggling to stay afloat. As of February 26, 2022, Bed Bath & Beyond had about 32,000 employees. In August, last year it cut about 20% of its corporate and supply chain workforce and closed about 150 of its stores. This week it is in the process of cutting costs by an additional $80 to $100 million, with some of those savings coming from a reduced workforce. A town hall meeting will be held on Wednesday to discuss its future. Unfortunately, the outlook is looking very grim for this company.

These are challenging times for many of us. And the Fed does not escape facing barriers of its own to stabilize the economy. Powell has stressed that he may have to make politically unpopular decisions to get the job done. Both sides of politics have been critical of Fed actions, but the Fed is outside political control and hence can act independently to stabilize prices. Just sit with the fact that we may have inflation for longer than most expect.

Have you heard of Chat GPT?

It’s an artificial intelligence interface, which was developed by San Francisco-based Open AI and is backed by Microsoft and LinkedIn co-founder Reid Hoffman. The chatbot can generate detailed responses, hold a conversation, and answer questions just like a human. Is it a challenge for Google? Maybe, in the future.

Microsoft plans to invest $10 billion in Open AI.

It seems like all customer service will become robotic in the future. That may make business more efficient and cost-effective, but it also makes the relationship between the customer and the business very depersonalised.

Those businesses that keep some element of human interaction with their clients will be seen as dinosaurs, but celebrated and lauded for challenging the trend.

Happy mid-week.

Don’t forget to sign up for the Hawaii strategy luncheon. Looking forward to seeing you all there.

Cheers,

Jacque

“Motivation is what gets you started…”

Mad Hedge Biotech and Healthcare Letter

January 10, 2023

Fiat Lux

Featured Trade:

(NEVER TOO LATE TO BE GREAT)

(AMGN), (BMY), (JNJ), (REGN), (GE), (GEHC)

When share prices are falling, it’s definitely tempting to believe that they’ll continue to go lower. It’s as irrational as when investors felt that share prices could only go up, as many thought back in early 2021.

But, the fear of a worsening market and economy is one of the primary reasons why so many high-quality businesses are struggling or are not getting traded at better valuations.

Amid the broader market getting crushed, the healthcare industry held its ground during last year's turbulent period. The Health Care Select Sector SPDR ETF (XLV) only slid by 3.5% in 2022, which isn’t as bad as the 19% drop in the S&P 500.

The great news is that it’s not too late to get into the game. Some healthcare stocks, particularly those in the biopharma segment, still look reasonably priced. In aggregate, the prices of these S&P 500 pharma stocks are at multiples of earnings, approximately 10% below compared to the S&P 500’s about 16 times.

The key reason this sector performed well despite the economic turmoil and financial crises is the continuous demand for its services. Regardless of the situation, people will still have to shell out money for health insurance, medications, and vaccines.

That means profits in the healthcare industry continue to be stable amid challenging times. It also means that with the current financial climate, with skyrocketing inflation and interest rates, this sector holds the potential to shine even brighter.

In fact, the healthcare industry has become a favorite defensive segment. In particular, its Pharma-biotech sector is turning into a stand-out in the market.

Amgen (AMGN) is one company in the pharma-biotech sector that continues to look promising. Based on its performance, a conservative estimate of its compounded EPS growth over the next three years is 6%.

This figure could increase depending on Amgen’s ability to launch new products, which appears to be already on its way with the release of a potential blockbuster courtesy of its obesity drug.

This giant pharma-biotech, with a market capitalization of over $144 billion, also boasts an extensive product portfolio, including several therapies.

Its immunology treatments, marketed as Enbrel and Otezla, along with its bone health drug, Prolia, are only three of the nine products in Amgen’s lineup that are on track to become blockbusters.

For context, a blockbuster is a drug or treatment that can generate a minimum of $1 billion in revenue yearly.

Apart from these treatments, the company has 38 more candidates queued in varying phases of clinical development in its pipeline. The list includes biosimilar competitors for existing megablockbusters—drugs that rake in at least $5 billion in sales annually—such as Johnson & Johnson’s (JNJ) Stelara and Regeneron’s (REGN) Eylea.

Another excellent stock in this segment is Bristol Myers Squibb (BMY). Looking at its trajectory and performance, the company’s compounded annual EPS growth until 2025 is estimated at 13%.

Like Amgen, this number could quickly rise as well as BMY replaces its older products with new and more profitable candidates.

To date, the company has several top-selling drugs in its portfolio, including blood clot treatment Eliquis, which raked in over $9.1 billion in sales in only the first nine months of last year. Within that same time frame, BMY’s cancer drug Opdivo also generated another $6 billion in revenue.

Actually, BMY didn’t record a bad period in 2022, with its shares climbing by more than 15%. Given its track record, the lineup of candidates in clinical development, and its penchant for mergers and expansion via acquisitions, the business is anticipated to keep growing in 2023.

Meanwhile, another healthcare giant was born recently. General Electric (GE) just finalized the spinoff of its healthcare division called GE HealthCare Technologies (GEHC).

With a market capitalization of $25.5 billion, GEHC is coming out swinging. It’s anticipated to slowly become a significant mover in the segment, potentially surpassing Siemens Healthineers (SHL).

It’s understandable to be wary of investing more money considering the turbulent financial and economic situation not only in the United States but also across the globe. However, when you wait too long to buy quality stocks, there’s always the danger of missing out on their inevitable rally.

While these quality healthcare stocks are in no way cheap, they nonetheless hold massive potential and are still reasonably priced for their value.

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

January 10, 2023

Fiat Lux

Featured Trades:

(TESTIMONIAL)

(A NOTE ON ASSIGNED OPTIONS, OR OPTIONS CALLED AWAY)

(TLT), (TSLA), (MSFT)

Hi John,

Merry Christmas and Happy New Year to you and your family.

Thanks for your friendship and congratulations on your Mad Hedge Fund Service, which is simply phenomenal. I could list hundreds of your accomplishments and achievements. I suggest a three-year TV series on Netflix about you. Even that may not be enough to catch all of your adventures and thrills.

However, let me focus on just one golden nugget you give to all of us: Living life to the fullest. You do this truly amazingly and with such style and grace. Wow! Seeing and hearing about your accomplishments and adventures challenges us to be more than we are and to become less complacent and routine.

Thank you for allowing me to be a small part of your life. Be safe on the trails. Remember, one day missed because the weather is not safe is not a crime. We still have the light on for you here in Colorado.

Enclosed please find two pounds of our best homemade chocolate fudge and another two pounds of our best pecan pralines. May they give you the energy to move forward.

John

Colorado Springs, CO

“It is fine to have the longest view in the room, as long as the thing at the end of the

vista is a gigantic hill of money,” said John Lanchester of the New Yorker magazine.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.