The word “metaverse” is a popular word recently and it has to do with a world almost from science fiction.

It refers to a future version of the internet accessed through immersive technologies such as virtual reality and augmented reality headsets.

Metaverse could supposedly be a $13 trillion market by 2030 according to a prominent research firm.

The internet built around decentralized technologies and virtual worlds is a novel idea.

The definition of the metaverse goes beyond sticking to virtual worlds, like gaming and applications in virtual reality.

A comprehensive vision of the metaverse includes smart manufacturing technology, virtual advertising, online events like concerts, as well as digital forms of money such as cryptocurrencies like bitcoin.

The metaverse could see 5 billion unique internet visitors by the end of the decade, funneling trillions of dollars in revenue in this next-generation of the internet.

This isn’t the only source labeling the metaverse and web3 a trillion-dollar opportunity. In research published in December, Goldman Sachs put a $12.5 trillion number on the space, in a bullish outlook that assumed one-third of the digital economy shifts into virtual worlds and then expands by 25%.

But so far, the metaverse has been a cash guzzler with not much to show for it.

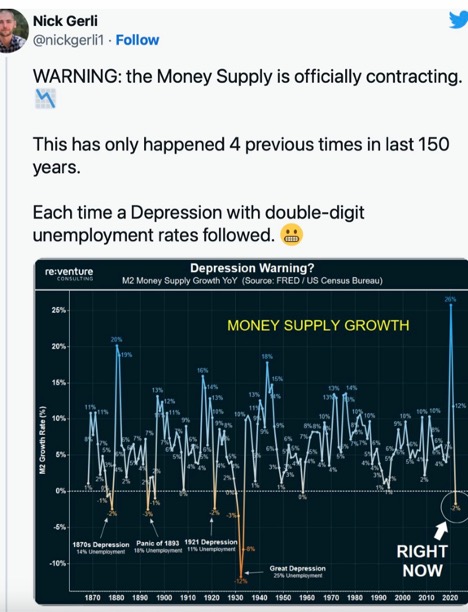

With a huge amount of money already flowing into companies addressing the space and not much revenue, companies face years of poor revenue showing.

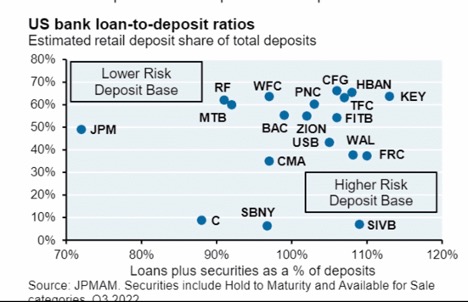

Unit economics wasn’t about to turn the corner at all with all signs showing that the Metaverse has stalled, but the bank contagion at Silicon Valley Bank (SIVB) means that many employees from metaverse projects simply won’t get paid their salary.

That’s how the momentum has been demonstrably pushed back lately.

Call the Metaverse dead in the short term.

What are the Metaverse risks?

Besides funding drying up like the Sahara desert in the short term - it doesn’t stick because it’s only tolerable for a few minutes.

There’s definitely a real risk that the metaverse never goes from the “fake it until you make it” to the real killer app that every consumer is clamoring for.

Just take for instance the art of a business meeting.

One might argue that using VR for meetings is less enticing than familiar technologies such as Zoom.

Would you rather see a real version of someone on a video or a fake avatar of someone up close?

The metaverse could turn out to be just hype and nothing more because the leaders of these companies building it are surrounded by yes-men who tell them it’s a great idea.

Many analysts have mentioned that Meta’s version of the virtual now is “terrible.”

Many also chime in saying “it’s been tried many, many times over the past four decades and it's never worked."

Even if Meta does improve on the technology and it does become more advanced, it still could be turn out to be mediocre.

If many can remember, we were already supposed to have self-driving cars 3 years ago and that never happened.

A lot of this failed technology has a tendency to just fall by the wayside never to be talked about again or regurgitated with a new headline.

I am not a believer of the Metaverse and you can bet your hard-earned bacon that these bank blowups means that metaverse and crypto employees will be more focused in the short term of how to pay rent and put food on the table than figuring out how to trap the rest of us in a virtual world.

Even if the salary is issued for employees of crypto firms, web3 firms, and metaverse firms by another third party saving their bacon, I can guarantee that no cash burn company will be funded to lose money in the short term.