Sometime in the next week, the following headline will cross the wires: “Body of Silicon Valley Bank Risk Manager Washes up on California Beach.” It will be noted that the face was severely bruised, and not from the pounding it took from coastal rocks or some fish.

This was no suicide but in many respects, it was. To invest the bank’s principal assets from 1982 onward into long-dated Treasury bonds from 1982 to 2020 was a great idea when prices soared, and yields plunged from 13% to 0.33%. It was positively suicidal from March of 2020 when the (TLT) dove from $180 to $92.

I always wondered which sucker was buying all those billions of dollars worth of bonds I had been selling short all those years.

Now I know.

If you had guessed why Silicon Valley Bank might go under someday, you might have thought the extension of loans to too many fragile and untested technology and biotech startups was the cause. This was not the case. It was pure bad management by the bank, which deservedly wiped out all the equity investors in a mere 48 hours.

This is not a systemic risk, nor will it lead to a financial contagion. You can thank Dodd-Frank for that which assured that America’s top banks are as solid as the Rock of Gibraltar, with leverage ratios under 10.

The FDIC is currently holding an auction of (SVB) and the outcome will be announced Sunday night. A hundred banks would love to take over (SVB)’s franchise. The $175 billion in deposits will be made who immediately, most of whom are not insured because they exceed the FDIC ceiling of $250,000 per account. The incident will be shortly forgotten about.

But when you’re in combat and a bullet passes so close to your face that you can feel the heat and the sound of an angry bee, you don’t dismiss it lightly. Maybe next time, you won’t be so lucky.

I have been inundated by calls all weekend from subscribers on what to do about Silicon Valley Bank. If the sale goes through as planned, stocks should be up 500 points on Monday morning and you should do nothing but watch in awe. If the sale fails, stocks will plunge 1,000 points and you should be loading the boat with new longs, especially banks, which will be on fire sale.

Panic, crisis, I love it. The debacle even took Berkshire Hathaway (BRK/B) down on Friday because of its copious holdings of big bank shares. It all gives me a reason to get up in the morning.

However, this does put a serious dent in stock market psychology. When the country’s 17th largest bank goes bust, it doesn’t exactly spur you to bet the ranch on growth stocks with your retirement funds.

A test of the December market low is now firmly on the table, if not the October low. That’s especially true if Fed governor Jay Powell wants to go with the full 50 basis point rate rise on March 22.

At least the crisis finally got the Volatility Index ($VIX) out of the sub $20 doldrums, at one point pegging an intraday of $29 on Friday. We also got the Mad Hedge Market Timing Index to a six-month low of 17.

That means it is now the time to explore the wonderful world of 90-day Treasury bills, whose yields are now pushing 5.0%. That’s pretty competitive in a world where stocks yield on 2% and the potential principal risk is real.

These are issued every Wednesday with 17-week maturities and are backed by the full faith and credit of the US government. It’s as close to safety and a guaranteed return you will ever get. You buy them at a discount, and they mature at par.

If you buy a T-bill today at $98.75, it matures at $100 in three months, you get an effective annualized yield of 5.0%. You can buy these directly from the US Treasury, from your local banks, or securities houses.

Brokers never recommend T-bills because the commission is nil. They want you to keep your money in their bank which might pay 1%....or nothing at all and involve real credit risk. Just ask former MF Global customers who had to wait three years to get their money back.

Don’t expect to get a bond in the mail like you used to. All government securities have been digital since 2011. To learn more about T-bills, please click here.

I am told by the insiders who know that platinum (PPLT) could be the big precious metals play of 2023. The white metal has become the principal metal used in the manufacture of catalytic converts for conventional internal combustion cars of which 15 million a year are still made in the US.

There is rising demand from hydrogen fuel cells and the green hydrogen movement. The world’s second largest producer of platinum is Russia, whose supplies have been cut off. As a result, there is expected to be a 556,000-ounce shortage this year after two years of surpluses.

Just thought you’d like to know.

While markets crashed, investors have been jumping out of windows, and the world appeared to be ending, and the rain continuing incessantly, Mad Hedge continued on up tear with March up +3.37%.

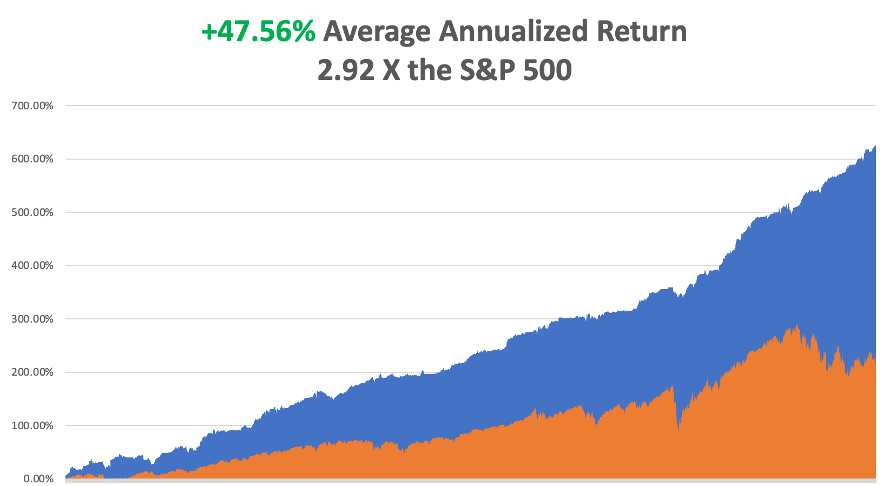

My 2023 year-to-date performance is now at an eye-popping +29.23%. The S&P 500 (SPY) is up +1.56% so far in 2023. My trailing one-year return maintains a sky-high +85.09% versus -13.13% for the S&P 500.

That brings my 15-year total return to +626.32%, some 2.98 times the S&P 500 (SPX) over the same period. My average annualized return has recovered to +47.56%, another new high.

My short positions in (TSLA) and (NVDA) kicked in big time last week, even though some said I was “Mad” to do these. In the meantime, my longs barely budged. That leaves me 20% long, 40% short, and 40% in cash.

Nonfarm Payroll Report hot at 311,000. The Headline Unemployment Rate rose from 3.5% to 3.6%, still at a 53-year low. The broader U-6 “discouraged worker” came in at 6.8%. Leisure & Hospitality were up 175,000, and Health Care 54,000. Revisions for the past two months were -34,000. All in all, the market viewed this as a slightly positive report. That’s one big number off our backs with the inflation report due on Tuesday.

Jay Powell Lays an Egg, at least if you own stocks. Say goodbye to the soft landing and a 50 basis point hike is now looking like a sure thing. Good thing all my longs are double-hedged.

JOLTS Jolts, at 10.8 million for February, much hotter than expected. That's how many job openings remained unfilled, some 7% of the total workforce. It sets up a potentially frightening Nonfarm Payroll Report on Friday.

ADP Comes in Hot, creating 242,000 private sector jobs in February. Leisure & Hospitality led with 83,000, followed by Financials at 62,000. Brace yourself for Friday.

Some 60% of Stocks Above 200-Day Moving Average, proving that we are already six months into a new bull market. The next big dip is the one you buy. Give this selloff another week and I will start looking for more long side plays to max out my portfolio. The Armageddon crowd is going to be driving Uber cans by summer.

The Great Retirement Flight Inland is Continuing. Retirees on the coasts are selling homes and buying new ones for cash in the Midwest and south and still have enough money left over to never work again. Those in the top 10% of income earners can save $347,000 with the “retire and relocate” strategy. The problem is that locals are getting prices out of their own markets. The trend is turning red states into purple ones, as has already happened in Nevada and Arizona, which are no longer cheap.

Used Car Prices are Soaring Again, up 4.3% in January and February, the largest such gain in 2009, according to Cox Automotive. Is this setting up a scary inflation print for March 14? The stock market thinks so.

China Set’s Hot 5% Growth Target for 2023, as “zero covid” ends and herd immunity takes over. It may cost 4 million lives, but it’s worth it. Most importantly, China announced hope for a peaceful reunification with Taiwan, which takes war off the table for this decade. It’s another nail in the coffin of American underbears proclaiming a lost decade.

Oil Companies are Playing the Short Game, milking their companies for all the profits they can get at the expense of long-term capital investment, and ignoring massive tax subsidies to do so. Last year oil companies reaped a stunning $128 billion in profits, juiced by the Ukraine War which took Texas tea prices to $132 a barrel. That’s what you do when your industry may disappear in a decade. But if there is no US recession and China’s reopening accelerates, we may have to visit $100 a barrel. Buy (UNG) on dips, up 40% in two weeks.

EV Makers Running Up Against Supply Shortages. To meet ambitious production forecasts metals production has to triple quickly. I’m talking copper, aluminum, silver, chromium, and lithium. Tesla has already locked up much of the existing long-term supply because it knew ten years ago it would be someday producing 20 million cars a year. The others didn’t.

Tesla Cuts Prices Again, for the second time in a month, dropping the Model X below $100,000 for the first time. The goal is to drive EV competition out of business before they gain a foothold on Tesla’s 64% market share. What Tesla loses in profits, it can make up in volume.

Tesla Is Remaking the Car Insurance Market, charging drivers on their actual driving history, which they collect already. If you drive like a little old lady, it can run as little as $180 a month. If you drive like Mad Max, it’s more, but not as much as a conventional car insurance company. Rates change monthly depending on your driving record. Parked in a garage gives you a perfect score of 90 and it drops from there. It’s all about reducing the total cost of a Tesla car. Not such a bad deal if you let their computer do all the driving. What will Tesla disrupt next?

Was Q4 2022 the Bottom of the Real Estate Market? That’s what Compass CEO Robert Reffkin thinks. Bidding wars came back with a vengeance in January and a lot of markets were cleaned out of inventory. Mortgage interest rates losing an unusual 200 basis point premium over US Treasuries would really set this market on fire.

Biden Budget Rattles Wall Street Cage, proposing to take capital gains up from 20% to 35% and tanking the market. It’s a total unwind of the Trump tax cuts and then some, which added $2 trillion to the national debt. Most of this is a pipe dream and I would be amazed if it rose above 22%. Most interesting is the Defense spending rise to $880 billion, which is nearly the GDP of Russia, causing them to sweat bullets there. During the last 40 years, $50 trillion in wealth has moved from the bottom 80% to the top 1% according to a Rand Corporation think tank study mostly tax free, the largest and fastest such wealth transfer in human history.

Can I please get my local real estate tax deduction back, which Trump picked from my pocket in 2018?

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. The economy decarbonizing and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, March 13 at 7:00 AM EST, Consumer Inflation Expectations are out.

On Tuesday, March 14 March 14 at 8:30 AM EST, the Core Inflation Rate and CPI for February are announced.

On Wednesday, March 15 at 7:00 AM EST, the Producer Price Index and Retail Sales are released.

On Thursday, March 16 at 8:30 AM EST, the Weekly Jobless Claims are announced. So are February Building Permits.

On Friday, March 17 at 8:30 AM EST, the University of Michigan Consumer Sentiment Indicator is released.

As for me, working in Japan as a journalist during the early 1970s a lot of the principal figures of WWII were still living and I got to meet some pretty amazing people.

One of the most fascinating was Tokyo Rose, whose real name was Iva Toguri, and who I was invited to interview during a book tour of Japan for her memoirs. By then, she was in her 60s and the weight of the years had clearly shown upon her.

Tokyo Rose was notorious as the radio personality who broadcast propaganda on radio to US troops in the Pacific to demoralize them and encourage them to stop fighting.

Both my dad and uncle Mitch were regular listeners on Guadalcanal and Bougainville. I can testify that even today, entertainment choices on these remote islands are still minimal. The men said they listened because the music was good, which our own Armed Forces Radio lacked.

Toguri was a second-generation Nisei born in California to Japanese immigrant parents. She graduated from UCLA intending to become a medical doctor. When a relative in Japan became ill, she traveled there to care for her. The Japanese attacked Pearl Harbor shortly after she arrive and she was trapped.

Initially, she was harassed by the secret police as a potential spy as she refused to give up her American citizenship. She couldn’t even speak Japanese or use chopsticks. Locals threw rocks at her. Even her parents couldn’t help because they had been sent to an internment camp at Gila Bend, Arizona.

It was starvation that drove her to respond to an ad in the newspapers looking for a native English speaker for NHK, the Japanese national broadcast radio.

It wasn’t long before the highly educated and intelligent Toguri had her own one-hour program broadcast nightly called “Zero Hour.” Along with the latest jazz records, she announced American ships sunk, planes shot down, battles lost, and anything else to show the futility of war with Japan.

The show was so popular that NHK ramped it up to a major effort. They hired a dozen “Tokyo Roses” and broadcast on multiple high-powered frequencies from Tokyo, Manila, and Shanghai.

When US troops landed in Tokyo after the war, she was one of the first arrested. In and out of jail, she wasn’t allowed to return to the US until 1949. On arrival, she was promptly arrested by the FBI for treason. The radio commentator Walter Winchell had launched a national campaign against her with backing from the American Legion and from former US POWs in order to boost ratings.

After a lengthy trial, she became only the seventh person convicted of treason in US history and was sentenced to 10 years in prison. She was released in 1955.

She received a presidential pardon from President Gerald Ford in 1976 after it was shown that most of the evidence presented against her at trial had been fabricated by the US government. She had been the victim of inflamed postwar emotions. Tokyo rose was more a concept than a real person, and the term was never actually broadcast on Japanese radio.

I have met a lot of people like Iva Toguri over the years, in the wrong place at the wrong time, or just plain unlucky. She was used and abused by the establishments in both Japan and the US. It’s a lesson on the capriciousness of life.

Iva Toguri passed away in 2002 in Los Angeles at the age of 90.

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Tokyo Rose then and Later When I met Her