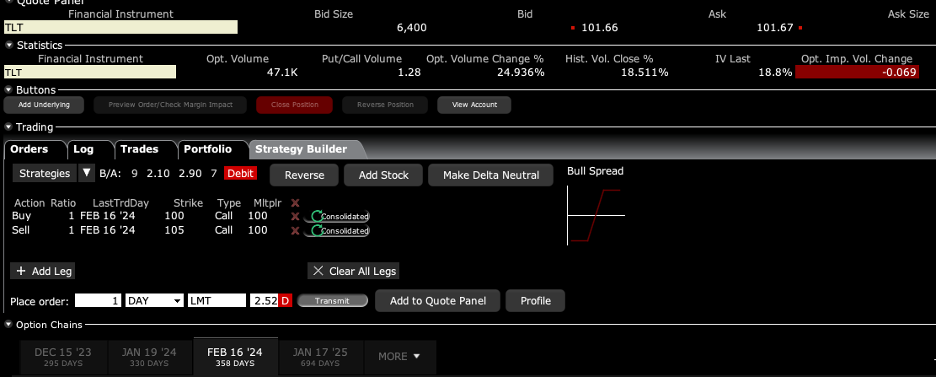

BUY the United States Treasury Bond Fund (TLT) February 2024 $100-$105 at-the-money vertical Bull Call debit spread LEAPS at $2.50 or best

Opening Trade

3-1-2023

expiration date: February 16, 2024

Number of Contracts = 1 contract

A $10 selloff in the (TLT) is a great entry point for a LEAPS. This is a gift from the US House of Representatives which is threatening to throw the entire government bond market into default by summer.

If you are a trader, default threats are where you BUY bonds.

While the chance of winning a real lottery is something like a million to one, this one is more like 10:1 in your favor. And the payoff is a double in little more than a year. That is the probability that (TLT) shares will rise by only 3.32% over the next 12 months.

The logic behind this LEAPS is fairly simple.

After keeping interest rates too low for too long, then raising them too far too fast, what does the Fed do next? It then lowers interest rates too far too fast. In other words, a mistake-prone Jay Powell will keep on making mistakes. That’s what you get with a Fed chair who only has a degree in political science.

The rate of interest rate rises has been the most rapid in history and is certain to trigger a recession in 2023. When the recession hits, demand for money will dry up and interest rates will collapse. Yields on ten-year US Treasury bonds that bottomed at 0.32% in 2020 and reached a peak of 4.46% in October will easily fall back down to 2.50% by the time this LEAPS matures. That’s where we were last April and will take the (TLT) at least back up to $120.

I am using the very conservative $100-$105 strike price in case bonds continue bouncing along a bottom before turning in a few months. If a double in a year is not enough for you, perhaps you should consider another line of business.

I am therefore buying the United States Treasury Bond Fund (TLT) February 2024 $100-$105 at-the-money vertical Bull Call spread LEAPS at $2.50 or best.

Don’t pay more than $3.00 or you’ll be chasing on a risk/reward basis.

I am going out to only a February 16, 2024 expiration because I think this trade will work fairly quickly with a 2023 recession, even a mild one. Please note that these options are illiquid, and it may take some work to get in or out. Executing these trades is more an art than a science.

Let’s say the United States Treasury Bond Fund (TLT) February 2024 $100-$105 at-the-money vertical Bull Call spread LEAPS are showing a bid/offer spread of $2.00-$3.00, which is typical. Enter an order for one contract at $2.00, another for $2.10, another for $2.20, and so on. Eventually, you will enter a price that gets filled immediately. That is the real price. Then enter an order for your full position at that real price.

A lot of people ask me about the appropriate size. Remember, if the (TLT) does NOT rise by 3.32% in 12 months, the value of your investment goes to zero. The way to play this is to buy LEAPS in ten different names. If one out of ten increases ten times, you break even. If two of ten work you double your money, and if only three of ten work, you triple your money.

You never should have a position that is so big that you can’t sleep at night, or worse, need to call John Thomas asking if you should sell at a market bottom.

There is another way to cash in. Let’s say we get half of your double in the next three months which, from these low levels, is entirely possible. Then you could earn half of the maximum potential profit in months. You can decide whether to keep the threefold return or go for the full five-bagger. It’s a nice problem to have.

Notice that the day-to-day volatility of LEAPS prices is miniscule since the time value is so great. This means that the day-to-day moves in your P&L will be small. It also means you can buy your position over the course of a month just entering new orders every day. I know this can be tedious but getting screwed by overpaying for a position is even more tedious.

Look at the math below and you will see that a 3.32% rise in (TLT) shares will generate a 100% profit with this position, such is the wonder of LEAPS. That gives you an implied leverage of 30:1 across the $100-$105 space.

If you want to get more aggressive you can buy the United States Treasury Bond Fund (TLT) February 2024 $115-$120 out-of-the-money vertical Bull Call spread LEAPS for $1.00, giving you a potential profit of 400%. I can do this trade and sleep at night. I’m not so sure about you.

Only use a limit order. DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES. Just enter a limit order and work it.

This is a bet that the (TLT) will not fall below $105 by the January 17, 2024 options expiration in 12 months.

Here are the specific trades you need to execute this position:

Buy 1 February 2024 (TLT) $100 calls at………….………$7.00

Sell short 1 February 2024 (TLT) $105 calls at….………$4.50

Net Cost:………………………….………..........………….….....$2.50

Potential Profit: $5.00 - $2.50 = $2.50

(1 X 100 X $2.50) = $250 or 100% in 12 months.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled from Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video on “How to Execute a Vertical Bull Call Debit Spread” by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.