When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

April 14, 2023

Fiat Lux

Featured Trade:

(APRIL 12 BIWEEKLY STRATEGY WEBINAR Q&A),

(GLD), (GDX), (GOLD) (MSFT), (JPM), (BAC), (C), (BRK/B), (TLT), (FLIN), (EPI), (INDA), (FXI), (UNG), (FRC)

CLICK HERE to download today's position sheet.

Below please find subscribers’ Q&A for the April 12 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from Incline Village, CA.

Q: Should I “Sell in May and go Away”

Why wait until May? Up 49% YTD, we’ve already picked the low hanging fruit for 2023. The market is now at the top end of the range in the face of a weakening economy. Maybe there is another 100 points of upside potential in the market versus 400 points of downside risk. The markets have pulled forward not only the first quarter’s performance, but possibly that for the entire year. That’s what an $18 (VIX) is telling you. The game from here is to buy the next bottom in big technology stocks for an explosive second half move up to (SPY) $4,800. This is a short-term call only. Keep all your one- and two-year LEAPS. The market won’t fall enough to justify a round trip in these illiquid positions.

Q: How do I avoid assignment risk with these call spreads and put spreads?

A: You don't want to avoid it. You want to be exercised early on the short leg of your call spreads because it allows you to take 100% of the profits well before expiration day. Some people were getting called on the banking call spreads last week because dividends were imminent and I had to explain how lucky they were. The reason hedge funds call away these options is that they want to buy the stock one, two, or three days before the stocks go ex-dividend, so they can get an immediate payoff and then get rid of the position. In the case of JP Morgan (JPM), they paid out a $1 dividend on Monday last week, so we had a lot of exercises right before that. All you have to do is call your broker (they’re not allowed to do this unless you call them), tell them to exercise your long option to meet your short, and you’re out of the position at max profit and you get the money immediately. So that is the issue. Only stocks that pay dividends or interest get called away, so the high dividend things like the banks or the iShares 20 Plus Year Treasury Bond ETF (TLT) will get called away. Zero dividend stocks almost never get called away unless someone is trying to cover a short in aftermarket hours. My experience is that only 1% of your positions ever get called away.

Q: What are your thoughts on the bottom for United States Natural Gas Fund (UNG) and what will trigger the reversal on it?

A: The bottom is somewhere around here—we’re very close to or even below some of the historic bottoms for natural gas over the last 20 years, which is around $2/MM BTU for natural gas. We could bounce around here for a while. The trigger for the recovery will be a stronger economic recovery in China, which is the world's largest natural gas importer. When the Ukraine War broke out, a lot of that gas got diverted to Germany. Those contracts are now expiring and we’re in a position now where we can start re-exporting that gas to China. They’ll take all we can produce. So that should be positive for Nat Gas. Also, because of the damage caused by the explosion at the Cheniere Energy (LNG) export facilities in Texas, our capacity to exported was impaired for many months. Those are coming back online now. This is why you look at Nat Gas now, and is why I put on a two-year LEAPS instead of a one-year.

Q: Would I go into cash with my favorite stocks?

A: Yes, for the short term. No, for the long term. All of my stocks are great long-term holds, but if you’re day trading or weekly trading or monthly trading, now is not a bad place to go cash so you have lots of dry powder on the next meltdown, especially with 90-day T-bills giving you 5%.

Q: Should we purchase gold bullion as a small percentage of our portfolio?

A: Better to buy gold stocks like SPDR Gold Trust (GLD), VanEck Gold Miners ETF (GDX), and Barrick Gold (GOLD) and Newmont Mining (NEM). Gold bullion is expensive to store, is heavy, takes up a lot of space in your safe deposit box, and it can be stolen—that is the problem with physical assets. I prefer the financial assets, the gold miners, to the underlying metal, which should perform at 4x the rate of actual gold.

Q: Have you changed your December 2024 view on bank stocks?

A: No.

Q: Is it true that Warren Buffet thinks the banking crisis is not over?

A: Yes it is, but it will be confined to smaller banks, which are losing their deposits to larger banks like JP Morgan (JPM), Bank of America (BAC), Citibank (C), and Berkshire Hathaway (BRK/B). It’s the regional banks that are going to have a much more difficult time rolling over real estate loans that are coming due. You have a $1.5 trillion of commercial real estate loans coming due in the next year, and these loans originally were taken out at 0% or 2% or 3%. They’re now going to have to refinance at 7%, 8%, 9% or 10%, and that will create a problem because a lot of their borrowers don’t qualify for their loans anymore. That’s going to be a drag but it’s going to hit the Midwest in one-off situations that can be easily ring-fenced. The net effect of the regional banking crisis is going to be to suck money out of the middle part of the US and park it on the coasts where the big banks are, mostly on the east coast.

Q: Based on your view, the market is due for a short-term correction, would you keep long-term LEAPS on the banks?

A: Absolutely yes. First off the banks have already had their correction, thanks to the regional banking crisis. If you have any downside in banks it will be minimal, the upside is maybe 10x greater than the downside in banks. So yes, you keep your LEAPS, and that’s why you have long-term LEAPS—to take the long-term view and just forget about them, don’t even look at them day to day because they won’t change. The time value on those long-dated options is so great that you get very little day-to-day movement in the actual price.

Q: How are you going to be successful with AI?

A: Well you hire only the absolute best software engineers, which we have here in San Francisco and Silicon Valley. How to invest in AI is much harder; there are no pure AI plays. Microsoft bought the frontrunner for $13 billion, ChatGPT, and any other participants in cutting edge AI are all giant companies where it’s just a small part of their business. However, down the road, like in a year or two or three, you will be invited to buy pure AI spinoffs at tremendously inflated multiples, and that will be the only way to get in. That might be the top for the stock. I’ve only seen this happen like 100 times before, why should AI be any different? The best way to benefit from AI is to use it yourself, just like when Microsoft brought out Office—there was no way to get a pure play on Microsoft Office other than buying Microsoft (MSFT) itself. You did a lot better using the apps for your own business and your own investment styles. The big view on AI is that it will double the value of all existing companies that you already own by cutting costs and improving service value. That part of my Dow 240,000 call.

Q: Do you like Chinese solar stocks?

A: No, China has its own unique political risks which I don’t want to get involved with right now. And even the solar companies in the US are hugely overbought. Great long-term businesses for all of these companies, but the stocks have already discounted a decent chunk of that, there are better fish to fry, like bank stocks for example. The best way to play China is to buy the surrounding emerging countries (EEM) it buys from, not China itself.

Q: I hear that India is the next China. How best to play it?

A: That’s true, India is the next China; but it won’t grow at the peak rate that China did in its best days in the 2000s, which is a growth rate of around 13% a year. India might do half of that, and the simple answer is that China is a dictatorship and could order what they needed to do to max out growth. India is a democracy and can’t do things like arbitrary land seizures or big infrastructure projects and so on. So, that will cut the growth rate in India by half but that’ll still be double America’s long term growth rate, which is a mature economy. And the ETFs to play there in India are (FLIN), the (EPI), and the (INDA). Those are three good index ETFs in India.

Q: Do you expect a 2.5% US Treasury yield by year-end?

A: Yes, and in fact we’ve already done half of that move from the 4.60% yield that we have at the peak last October. So yes, the trend is our friend, and the hard thing to do in the bond market is to get into it, because everybody in the world is now expecting lower interest rates.

Q: What options spreads would you do on the iShares 20 Plus Year Treasury Bond ETF (TLT)?

A: Well here, none, because we’re at a high for the year, but wait for a $5 point selloff and then do $5 points in-the-money. That’s what I do like clockwork, don’t even think about it. If we drop more that $5 I’ll just buy more.

Q: Do you expect Natural Gas (UNG) to be higher by the end of the year for the current price?

A: Absolutely, yes, 8 months is more than enough time to get China online again and buying all the natural gas they can get their hands on unless they invade Taiwan.

Q: Any interesting LEAPS on First Republic Corporation (FRC)?

A: You can buy the July 2023 $22.500$25 vertical bull call debit spreads LEAPS for 60 cents and see it expire at $2.50 in 15 months. With an incredible implied volatility at 177% that’s the furthest option maturity that is trading. I think the better trade here is just to buy the stock. You’re going to be limiting your upside with a LEAPS. With a “BUY” in the stock here, you’re looking at 2, 3, 4 times upside potential in a recovery—and remember this thing’s trading at $14, it used to be trading at $100 a month ago. So, don’t limit your upside with an options trade on something that’s clearly extremely oversold after a 90% down-move in a month. That's a rare situation. Full disclosure: I own (FRC). I bought some at $15 and I bought more at $12, just as a go-crazy trade—but I know the (FRC) bank and the management.

Q: How to buy Natural Gas?

A: You buy (UNG), the ETF, to make it really easy. Just remember you have a -35% one-year contango on that so it’s got to go up more than 35% in a year for you to make money.

Q: Any risk of holding banks and brokers through earnings?

A: I would say not much. If they announce surprise losses, they’ll be small. The first quarter was actually a very good quarter for banks and brokers because they made tons of money on their options business, where the volumes have doubled. And the banking crisis didn’t really kick in during the first quarter, at least from a business point of view. So, I don’t expect downside surprises—if there are, it will be small ones, not worth selling and trying to get back in because you’ll just end up paying a higher price.

Q: Are we building new nuclear plants?

A: No, but we had the first expansion in 7 years of the exiting Vogtle plant in Georgia which added a new reactor. The real demand will come from new designs of nuclear plants and the US modernizing its nuclear weapons designs. All of the nuclear fuel that we bought from the Soviet Union after its collapse 30 years ago has all been used up. It ran all of the nuclear power plants in the US for 20 years. That has run out and the prospects of resupplying from Russia now are zero.

Q: Do you foresee China invading Taiwan?

A: Never going to happen. If China (FXI) does invade Taiwan they 1.) lose their entire foreign food supply from the US and 2.) lose all their trade with the US that they need to earn the money to pay for food from other sources like Australia and Russia. So, never going to happen, but they will keep bluffing all year, as they have done continuously since 1949.

Q: Could commercial real estate be a problem for large insurance companies?

A: Only if the default rate goes up; and again, it’s going to be a case-by-case basis where they invested—is it Manhattan or San Francisco where the vacancy rates are at all-time highs at 30%, or is it the Midwest, where the credit quality has deteriorated the most, and is looking at the higher default rates? What is more likely is that interest rates will fall sharply by 2024 bailing these companies out.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com , go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH or TECHNOLOGY LETTER then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

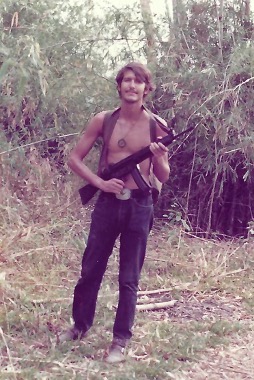

1976 in Laos

“Men are more easily governed through their vices than through their virtues,” said Napoleon Bonaparte.

Mad Hedge Biotech and Healthcare Letter

April 13, 2023

Fiat Lux

Featured Trade:

(SMOOTH SAILING THROUGH ROUGH WATERS)

(NVO), (LLY), (SNY)

Even in the toughest of times, some stalwart companies manage to maintain their footing and keep making strides. Novo Nordisk (NVO) has taken this feat to heart by continuing its success despite facing numerous market speed bumps—making it one resilient company worth considering.

Novo Nordisk, a veteran player in the pharmaceutical industry, has been consistently delivering impressive financial results. In 2022, the company's net sales increased by a remarkable 26% year over year, amounting to approximately $25.5 billion. However, it's worth noting that currency exchange rate fluctuations may have played a role in this growth.

The company continues to showcase impressive financial performance, with net sales surging by 26% to $25.5 billion in 2022. Even after accounting for currency exchange rate fluctuations, the pharmaceutical company's revenue still jumped by a commendable 16%. Additionally, Novo Nordisk's net profit increased by 16% to $8 billion, solidifying its position as a top-performing player in the industry.

Moreover, Novo Nordisk remains a prominent contender in the diabetes drug arena, capturing almost a third of the market share as of November 2022.

Novo Nordisk's market dominance in diabetes drugs owes much to its portfolio of effective and innovative products like Rybelsus, Ozempic, and the recently approved Wegovy. This dynamic trio has been instrumental in driving the company's sales growth and maintaining its edge in the competitive pharmaceutical industry.

Ozempic has been a critical player in Novo Nordisk's revenue stream, bringing in over a third of the company's total revenue at just under $8.9 billion last year.

Novo Nordisk's market exclusivity for Rybelsus and Ozempic remains intact, giving the Danish pharmaceutical company a few more years to maximize its potential.

Both drugs are injected weekly and heavily marketed in the U.S. With patent expirations in China in 2026, followed by Europe and Japan in 2031, and the U.S. in 2032, Novo Nordisk is likely to maintain its strong position for a while yet.

As for Wegovy, the newcomer in the obesity care market contributed just 3% of the company's total revenue, with $930 million in sales for 2022. However, with its recent approval for chronic weight management by the FDA and in the UK, the potential for growth and expansion is promising.

In its 2022 annual report, Novo Nordisk announced that it controls over half the global market for GLP-1 drugs, with a market share of 54.9% in 2022, up from 52.7% in 2021. Its primary competitors include Eli Lilly's (LLY) Trulicity and Sanofi-Aventis's (SNY) Adlyxin, which exited the U.S. market at the end of 2022.

Overall, the international diabetes market seems to favor Novo Nordisk, with its market share rising from 29.3% to 31.9% from 2020 to 2022.

The company is projected to continue its success, with sales and operating profits expected to increase in the 13% to 19% range at CER in 2023, according to its annual report. Analysts' average estimate of $30.1 billion in 2023 revenues aligns with this projection, representing a 16.7% increase at CER.

Leveraging this dominance, the company is further strengthening its position in the diabetes market, a disease affecting over 415 million people worldwide, and the numbers continue to grow. According to the Centers for Disease Control and Prevention, there will be over 500 million patients by 2040.

For instance, its recent announcement of the positive results of its Phase 3b Pioneer Plus clinical trial of Rybelsus is a further testament to its ability to innovate and stay ahead in the diabetes treatment arena. The trial showed a statistically significant reduction in blood sugar levels, indicating the potential for a more intense treatment option for type 2 diabetes patients.

Meanwhile, Obesity, a major risk factor for diabetes and other health problems, also presents a significant market opportunity for Novo Nordisk.

In fact, the company's revenue from these treatments doubled in the previous year, propelling its overall sales to an upward trajectory for the past half-decade.

Needless to say, Novo Nordisk is showing no signs of slowing down, and its strong position in the diabetes and obesity treatment market is poised to fuel its growth for the foreseeable future. I suggest you buy the dip.

Global Market Comments

April 13, 2023

Fiat Lux

Featured Trade:

(THE MAD HEDGE SUMMIT VIDEOS ARE UP),

(THE BULL CASE FOR BANKS),

(JPM), (BAC), (C), (WFC), (GS), (MS)

CLICK HERE to download today's position sheet.

Banks have become the call option on a US economic recovery.

When the economic data runs hot, banks rally. When it’s cold, they sell off. So, in recent months bank share prices have been melting up.

If we are falling into a recession, then unloading banks here is the right thing to do. If we’re not, and this is really a fake out, then you are looking at the buying opportunity of the decade for banks.

I fall in the latter camp.

There also is a huge sector rotation issue staring you in the face. Where would you rather put new money, stocks at all-time highs trading at ridiculous multiples, like energy stocks, or a quality sector in the bargain basement?

Big institutions have already decided what to do and are buying every dip in financials.

Banks certainly took it on the nose in 2022. Loan default rates soared, demanding a massive increase in loan loss provisions.

Much more stringent accounting rules also kicked in known as “Current Expected Credit Losses.” That requires banks to write off 100% of their losses immediately, rather than spread them out over a period of years.

So what happens next?

For a start, fall down on your knees and thank that Dodd-Frank, the Obama-era financial regulation bill, was passed.

Banks carped for years that it unnecessarily and unfairly tied their hands by limiting leverage ratios to only 10:1. Morgan Stanley reached 40:1 going into the Great Recession and barely made it out alive, while ill-fated Lehman Brothers reached a suicidal 100:1 and didn’t.

That meant the banks went into the pandemic with the strongest balance sheets in decades. No financial crisis here.

Thanks to government efforts to bring the pandemic hit to the economy to a quick end, generous fees have been raining down on the banks from the numerous loan programs they helped to implement, such as PPP.

And trading profits? You may have noticed that options trading volume is up a monster 100% so far in 2023. That falls straight to the banks’ bottom lines. If you’re wondering why your online trading platform keeps crashing that’s why.

I list below my favorite bank investments using the logic that during depressions you want to buy Rolls Royces, Teslas, and Cadillacs at deep discounts, not Volkswagens, Fiats, or Trabants.

JP Morgan (JPM) – is the crown jewel of the sector, with the best balance sheet and the strongest customers. It has over reserved for losses that are probably never going to happen, stowing away some $25 billion in the last quarter alone.

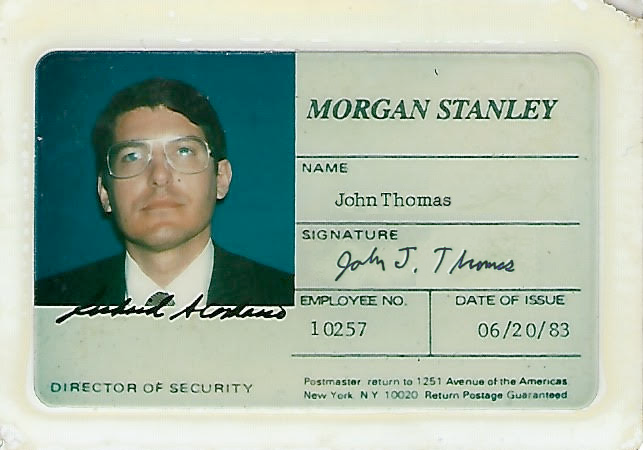

Morgan Stanley (MS) - Brokerage-oriented ones like Morgan Stanley (MS) and Goldman Sachs (GS) are benefiting the most from the explosion in stock and options trading. Morgan’s focus on asset management has made it the first pick among investors demanding a high multiple. I’ll pick my former employer (MS), where I once accounted for 80% of equity division profits.

Bank of America (BAC) - is another quality play with a fortress balance sheet.

Citigroup (C) – is the leveraged play in the sector with a slightly weaker balance sheet and a more aggressive marketing strategy. It seems like they’re always trying to catch up with (JPM). This is the high volatility play in the sector.

And what about Wells Fargo (WFC) you may ask, the cheapest bank of all? This year, it has shaken off hair suit because of its many regulatory transgressions, before, during, and after the financial crisis so I’ll give it a miss.

Here's My Pick

“Men and nations behave wisely once they have exhausted all the other alternatives,” said the late Israeli deputy prime minister Abba Eban.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.