Chegg (CHGG) is toast.

That is what artificial intelligence has done to their business model and we are in the early innings.

The company said to kiss growth goodbye.

Artificial intelligence is already putting a massive dent in some industries.

Education has changed dramatically in the past generation where more than half of Americans say a 4-year degree is not worth the price of admission anymore.

Now, moving forward, the little value extracted in terms of workable knowledge in the classroom is effectively zilch as generative artificial intelligence will do the job of a million university teachers for free.

There simply is no use case for taking geography studies or getting a basket weaving degree from Wesleyan College.

It doesn’t make sense anymore.

The scary thing is this is just the beginning and other industries are about to get t-boned as well.

Only the nimblest will survive.

Workers need to retrain, network, and preserve and expand skill levels.

Shares of virtual language-learning company Duolingo fell 9% while American depositary receipts tied to shares of London-based Pearson fell 12.5%.

Chegg offers subscription-based academic services that help students with writing and math assignments as well as study materials.

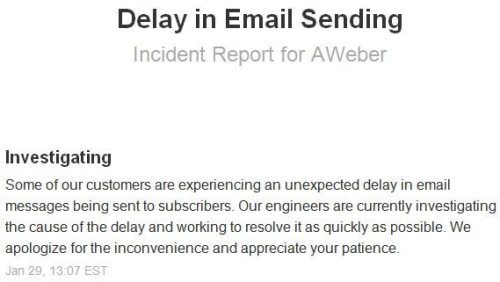

Management said the company didn’t see a significant effect on its business from ChatGPT until March, when the company behind the product, OpenAI, launched GPT-4.

Chegg said the popularity of ChatGPT among students is affecting its customer-growth rate.

The red alarm from Chegg and the subsequent selloff are among the most glaring indications that this isn’t some cute niche thing that can be downplayed or diminished.

AI is coming for most white-collar jobs and workers should be scared if not mortified.

Many of the job losses will occur in big corporations and America has some of the biggest and most profitable.

The tailwind for corporate management is that they don’t need to pay benefits or social payments to AI so big cost savings that will fall down to the bottom line.

Wall Street will be applying this technology to the utmost too.

To say this technology is transformative doesn’t do justice to the word transformative.

This isn’t going to be an all tides lift all boats scenario.

Bloomberg news noted that nearly 40% said that children currently in elementary school will be best off with a job in health care if they want to avoid being displaced by artificial intelligence.

What about tech?

There will be serious winners and losers as this shakes out. It’ll be like a slow-motion car crash for workers while tech firms profit in real-time.

Technology stocks will hollow out similar to how we see the behemoths pull ahead lately muscling out smaller companies with their solid balance sheets.

This has essentially become a 7-stock tech sector.

Tech companies will absolutely be chomping at the bit to fire computer engineers whom many command in excess of $150,000 in pre-tax gross salary.

Of course, the lower-level computer engineers will be thrown by the wayside first then slowly the terminations will reach higher up the value chain.

If a computer engineer wants to survive in the future, they will need to dive into generative artificial intelligence themselves which will easily offer the highest salaries in technology.

AI is now the new bitcoin and the best talent will flood that space. It’s easy to see how starting salaries with start with a 3 and end with 5 more numbers.

As for tech investors, this shows that getting into these little micro tech stocks is more and more treacherous as the landscape has dictated a hard future ahead.

That is why I tripled up on a bearish position in Zoom technologies (ZM). All big tech companies have some sort of version of video conferencing tech and it is easy to replicate. Stay with the strongest during this bank crisis.