There isn’t a company in the world that isn’t playing around with AI right now.

Think of the Internet, Microsoft Office, and Netscape Navigator all coming out on the same day. That is what is happening right now with AI.

The gold rush has started.

So, I instructed my programming staff to do the same.

And we found what everyone else is finding. Some of the results are ridiculous, some are hilarious, while others are kind of interesting. That last part is key.

That’s why the net net of all of this is that the value of almost every company that uses AI has tripled overnight. It will take a long time for the stock market to catch up with this reality, maybe a decade.

This explains why the earliest and largest AI users have seen their shares move up in practically a straight line since January 1.

Alphabet (GOOGL) has been using AI for 30 years, and Tesla (TSLA) and Facebook (META) for 20.

Mad Hedge has been using it for ten years, and we used it to double our average annualized performance from 26% to 49%, as you may have noticed.

A friend of mine now uses AI to answer all his email. As a result, his correspondents told him he has recently been a rude bastard. AI answered the emails correctly, but not quite the same as you or I would.

My staff found an ap called Midjourney which can be downloaded inside the Discord Chat app. You can take a picture of anyone, add one word, and the ap will modify the picture to reflect the input of the new word. To have some fun, we started with the basic John Thomas portrait, which you have seen a thousand times.

If you added the word “WWII Pilot” what you get is kind of interesting.

Try instead adding the word “Conquistador” and what you get is ridiculous.

Try adding “Flintstones” and the result is hilarious.

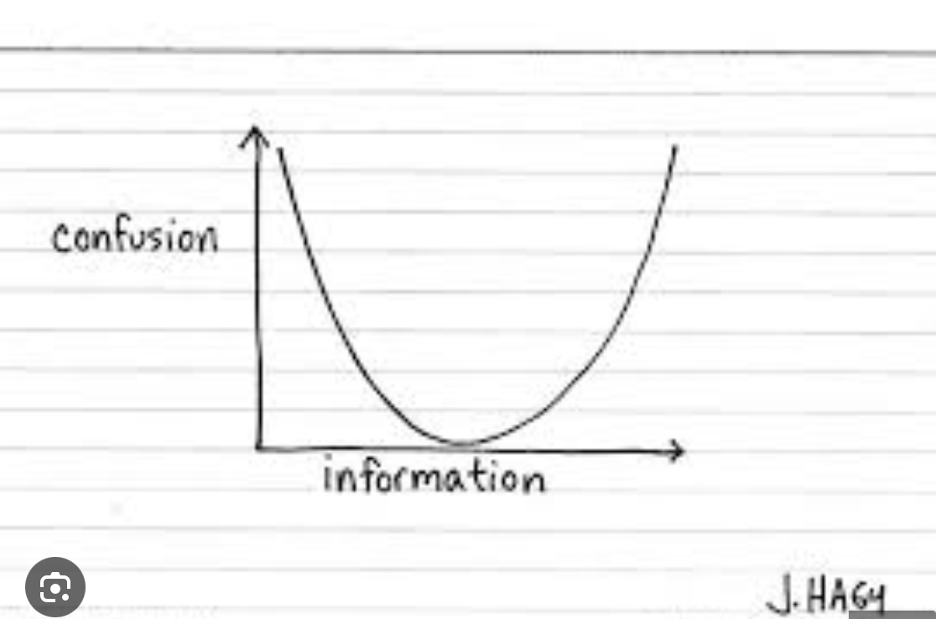

As you can see, it is still early days in the AI game. But it is what will take the Dow average from $36,000 to $240,000 over the next decade.

I can tell you that the financial newsletter business has been one of the earliest adopters of AI. After all, they use tools, data, and aps to convince people they are stock market experts when they really know nothing about it.

Many of the people I have spoken to who are early users of AI say its initial output is only just a starting point which can be eventually edited and refined into something usable. As a writer for 60 years who has spent countless hours staring at a blank page, I can tell you that alone is incredibly valuable. And that may be AI’s greatest contribution, to get us off our duff’s and eliminate writer’s block.

No doubt there is an AI stock bubble in progress. But Bitcoin has to soar from ten cents to $76,000 before it really got deep into bubble territory. You could get the same result with AI.

Come to think of it AI is really like the first humans who discovered fire.

You heard it here first.