When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

June 29, 2023

Fiat Lux

Featured Trades:

(SATURDAY, AUGUST 5, 2023 ROME, ITALY STRATEGY LUNCHEON)

(MY 2022 LEAPS TRACK RECORD),

(FCX), (PANW), (RIVN), (NVDA), (BRKB), (JPM), (MS), (VRTX), (TLT), (GOLD), (SLV), (TSLA)

CLICK HERE to download today's position sheet.

Recently, I have been touting a 2022 track record of +84.63%.

I have a confession to make.

I lied.

In actual fact, my performance was far higher than that. In reality, I generated a multiple of that +84.63% figure.

That is because my published performance is only for my front-month short-term trade alerts. It does not include the LEAPS recommendations (Long Term Equity Anticipation Securities) issued in 2022, the details of which I include below.

LEAPS have the identical structure as a front month vertical bull call debit spread. The only difference is that while front-month call spreads have expiration dates of less than 30 days, LEAPS go out to 18-30 months.

LEAPS also have strike prices far out of-the-money instead of deep in-the-money, giving you infinitely more upside leverage. LEAPS are actually synthetic futures contracts on the underlying stock.

Of the 12 LEAPS executed in 2022, eight made money and four lost. But the successful trades win big, up to 1,260% in the case of NVDIA (NVDA). With the losers, you only write off the money you put up.

And you still have 18 months until expiration for my four losers, ample time for them to turn around and make money. In the case of my biggest loser for Rivian (RIVN), Tesla launched an unprecedented EV price way shortly after I added this position. Never take on Tesla in a price war. Black swans happen.

Of course, timing is everything in this business. I only add LEAPS during major market selloffs as the leverage is so great, over 20X in some cases, of which there were four in 2022.

If you would like to receive more extensive coverage of my LEAPS service, please sign up for the Mad Hedge Concierge Service where you can excess a separate website devoted entirely to LEAPS. Be aware that the Concierge Service is by application only, has a limited number of places, and there is usually a waiting list.

Given the numbers below, it is easy to understand why most professional full-time traders only invest their personal retirement funds in LEAPS.

To learn more about the Mad Hedge Concierge Service, please contact customer support at support@madhedgefundtrader.com

2022 LEAPS Track Record

Date Position Cost Price Profit

9/27/2022 (FCX) January 2025 $42-$45 Call spread LEAPS $0.65 $1.26 94%

9/28/2022 (PANW) January 2025 $306.67-$313.33 Call spread LEAPS $0.80 $4.42 453%

9/28/2022 (RIVN) January 2025 $75-$80 Call spread LEAPS $0.50 $0.06 -88%

9/29/2022 (NVDA) January 2025 $270-$280 Call spread LEAPS $0.50 $6.80 1,260%

9/30/2022 (BRK/B) January 2025 $420-$430 Call spread LEAPS $1.00 $1.95 95%

10/3/2022 (JPM) January 2025 $175-$180 Call spread LEAPS $0.50 $0.89 78%

10/4/2022 (MS) January 2025 $130-$135 Call spread LEAPS $0.50 $0.24 -52%

10/12/2022 (VRTX) January 2025 $430-$440 Call spread LEAPS $1.50 $2.76 84%

11/9/2022 (TLT) January 2024 $95-$100 Call spread LEAPS $2.30 $3.51 53%

11/10/2022 (GOLD) January 2025 $27-$30 Call spread LEAPS $0.25 $0.18 -28%

11/28/2022 (SLV) January 2025 $25-$26 Call spread LEAPS $0.50 $0.22 -56%

12/19/2022 (TSLA) January 2025 $290-$300 Call spread LEAPS $1.50 $2.94 96%

Good luck and good trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

The Sweet Taste of LEAPS

We spend a lot of time looking for systemic risk; in truth, however, it tends to find us,” said Meg McConnell of the New York Fed.

(FURTHER UPSIDE IN TECH IN THE SECOND HALF OF THE YEAR)

June 28, 2023

Hello everyone,

With all the talk about recession, everyone is now wringing their hands anxiously and moving a lot of their funds to cash.

I know cash is a position too. But long term it is not a great place to leave your funds.

Although the return on the cash is attractive now, returns from stocks far outweigh cash in the long run.

Try not to get caught up in the day-to-day movements of the market. It will make your head spin.

And remember, this time of year the market usually takes a rest – just like a lot of people do. So, don’t be surprised if you see a sell-off or consolidation movement.

The second half of 2023 is likely to see a broadening of the tech rally as investors consider the consequences of the $800 billion AI spending wave on the horizon and what it means for the software, chip, hardware, and tech ecosystem over the next year.

We could see tech stocks up in the second half by 10%-15%. The Technology Select SPDR and the Communication Services Select SPDR, which contain most of the AI plays, are up more than 30% in the first half of the year so far.

Favourites going into the second half would have to be Microsoft and Nvidia, which are up 40% and 189%, respectively, so far this year.

From 2024 onwards, the AI boom really kicks in.

In 2024, it is estimated that AI IT budgets could comprise up to 8% - 10% as opposed to 1% in 2023.

Also worth considering are Salesforce and C3.ai.

Have a great week.

Cheers,

Jacquie

Revolutionizing Cancer Diagnosis: How Doctors Harness AI to Detect Cancer

Introduction: In the field of medicine, early and accurate cancer diagnosis can be a matter of life and death. With the advent of artificial intelligence (AI), doctors and researchers have gained a powerful tool to aid in the detection and diagnosis of cancer. By leveraging the capabilities of AI, medical professionals are revolutionizing the way cancer is detected, leading to improved outcomes, faster diagnoses, and ultimately, saving lives.

Enhanced Imaging and Pattern Recognition: One of the primary applications of AI in cancer detection lies in medical imaging. AI algorithms can analyze vast amounts of medical images, such as mammograms, CT scans, MRIs, and histopathological slides, with incredible precision and efficiency. Through deep learning techniques, AI systems can identify subtle patterns and anomalies that may indicate the presence of cancerous cells or tumors.

These algorithms are trained on large datasets, allowing them to recognize patterns that human eyes might overlook. By continuously learning from new data, AI systems become increasingly accurate and proficient at detecting early signs of cancer. This assists radiologists and pathologists in interpreting images, reducing the risk of misdiagnosis and facilitating prompt treatment.

Early Detection and Risk Assessment: Early detection is a crucial factor in cancer treatment success. AI algorithms can aid in the early identification of potential cancer cases by analyzing a wide range of patient data, including medical records, genetic information, lifestyle factors, and even social determinants of health. By scrutinizing this vast array of data, AI systems can assess the risk of developing cancer and provide personalized recommendations for screenings and preventive measures.

Moreover, AI algorithms can assist in identifying specific biomarkers or genetic mutations associated with certain types of cancer. This enables doctors to tailor treatment plans to individual patients, maximizing the effectiveness of therapies while minimizing potential side effects.

Improved Decision Support Systems: Cancer diagnosis and treatment planning require careful analysis of complex data. AI-based decision support systems can help doctors navigate through this intricate process. By integrating patient-specific data, treatment guidelines, and scientific literature, AI algorithms can offer evidence-based recommendations for treatment options, dosage selection, and even prognosis predictions.

These decision support systems not only provide valuable insights to doctors but also foster interdisciplinary collaboration by offering a platform for medical professionals to share and discuss cases, leading to improved patient care and better treatment outcomes.

Challenges and Future Prospects: While AI holds great promise in cancer detection, several challenges must be addressed. Data privacy, security, and the ethical use of patient information are of utmost importance. Ensuring the transparency and interpretability of AI algorithms is crucial to building trust among medical professionals and patients.

Looking ahead, the future of AI in cancer diagnosis is promising. Continued advancements in AI technologies, including natural language processing and machine learning, will further refine the accuracy and efficiency of cancer detection. Integrating AI with other cutting-edge technologies like genomics and precision medicine will lead to more personalized and targeted cancer treatments.

Conclusion: AI is transforming the landscape of cancer diagnosis by enhancing the capabilities of medical professionals and enabling early detection. With its ability to analyze vast amounts of data, recognize patterns, and offer precise recommendations, AI serves as a valuable tool in the fight against cancer. As AI technologies continue to evolve, doctors and researchers are poised to make even more significant strides in early detection, improved treatment outcomes, and ultimately, saving more lives in the battle against cancer.

More to explore:

A new artificial intelligence tool can accurately identify cancer https://www.theguardian.com/society/2023/apr/30/artificial-intelligence-tool-identify-cancer-ai

Neurosurgeon Develops Artificial Intelligence Device to Diagnose & Treat Brain Cancer Faster

Amgen AI & Data Science

https://www.amgen.com/science/research-and-development-strategy/ai-and-data-science

Ask ChatGPT: ”Describe how the stock market works as if penned by William Shakespeare.”

Act I: The Opening Bell

Enter the bustling scene of the stock market floor, where merchants and traders gather in fervent anticipation. The opening bell tolls, signaling the commencement of the day's spectacle. Bulls and bears, with hopes and fears, engage in a passionate dance of commerce.

Act II: The Players and Their Roles

The stage reveals the diverse cast of characters that shape this financial theater. The brokers, like swift messengers, relay orders from eager investors to the trading floor. Market makers, cunning manipulators of fate, provide liquidity and set the stage for the unfolding drama.

Act III: The Ticker Tape Tapestry

Behold the spectacle of the ticker tape, a ribbon of parchment that unfurls, displaying the ever-changing fortunes of companies. Letters and numbers, like poetic verses, ebb and flow, telling tales of gains and losses. The crowd watches with bated breath as their fortunes rise and fall, guided by whispers of rumors and news.

Act IV: The Bulls and Bears Collide

The mighty bull charges forth, its horns glistening with optimism and enthusiasm. It rallies the crowd, driving prices skyward. But lo, the bear, fierce and cunning, emerges from hibernation. It growls with skepticism, claws slashing downward, causing prices to plummet. The eternal struggle between these creatures shapes the fate of stocks.

Act V: The Market's Fickle Nature

Like a tempestuous lover, the market's mood changes with the wind. Sentiment, a capricious mistress, guides the rise and fall of prices. Fear and greed, the passions that drive human hearts, hold sway over the ebb and flow of financial tides. Wise investors, with steady hands, navigate this treacherous sea, avoiding the sirens of impulse.

Act VI: The Pundits' Chorus

From the sidelines, financial pundits enter the stage, opining with eloquence and grandeur. They paint vivid pictures of prosperity or doom, their words a symphony of persuasion. Yet, their proclamations often fade like whispers, as the market dances to its own tune, heedless of their predictions.

Act VII: The Market's Secrets

Beneath the surface, algorithms and machines hum, shaping the market's destiny. High-frequency traders, like mischievous sprites, exploit fleeting opportunities, their actions a blur of lightning-fast calculations. They arbitrate the tiniest inefficiencies, while human traders strive to keep pace with this mechanical symphony.

Epilogue: The Closing Bell

As the day nears its end, the closing bell tolls, drawing the curtain on the trading floor. The players, weary from the day's exploits, gather their gains and losses, preparing for the next act. The market, an eternal stage, awaits its eager cast to return and resume this captivating drama of wealth and chance.

Mad Hedge Technology Letter

June 28, 2023

Fiat Lux

Featured Trade:

(REGULATION HEATS UP)

(AMZN), (MSFT), (GOOGL), (NVDA)

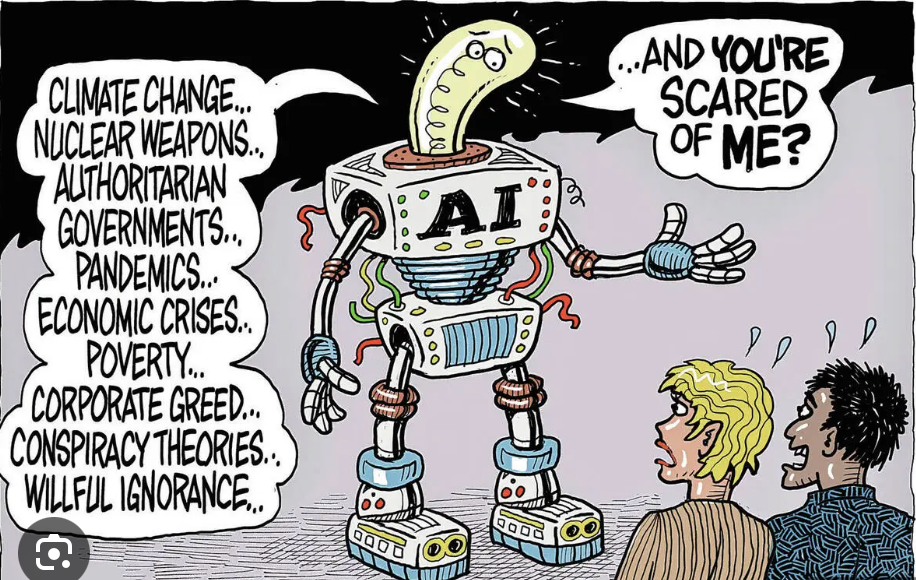

Silicon Valley has gone from the least regulated industry to trending the other way. On a global scale, draconian regulations are rearing their ugly head to really stymy places like China and artificial intelligence.

The European Union just rolled out a slew of proposed regulations on AI that could hamper its ability to embed itself in many tech companies.

The net result is highly bullish for Silicon Valley companies minus the chip companies that are experiencing revenue cuts.

When rules tighten, the entrenched benefit disproportionately and this could trigger a continuation of the tech rally that has been blistering hot this year.

Inversely, it will become even more difficult for start-ups to become unicorns, because they suffer more at smaller sizes to digest the higher amount of regulation that mature tech companies never faced.

Much of this is occurring at the highest level as the White House is considering new restrictions on exports of artificial intelligence chips to China, potentially adding to a list of banned semiconductor technology from Nvidia, Advanced Micro Devices, and other US companies.

The U.S. Department of Commerce could prohibit shipments of chips from Nvidia and others to customers in China as soon as early next month.

Nvidia, which produces graphics chips that drive the technology behind OpenAI Inc’s ChatGPT and Alphabet Inc’s Bard chatbots, is one of those chip companies that could see a slide in revenue in the short term.

Across the pond where governments are specialists at regulation, the European Parliament has approved draft legislation to regulate AI-powered technology.

The Act applies to anyone who creates and disseminates AI systems in the EU, including foreign companies such as Microsoft, Google, and OpenAI.

As outlined in the Act, EU lawmakers seek to limit or prohibit AI technology they classify as unacceptable or high risk.

It’s a little vague who will be deemed high risk but in the crosshairs are technologies such as predictive policing systems and real-time, and remote biometric identification systems.

Silicon Valley cash cows can function without these intrusive elements.

The AI Act would give the European government the authority to levy heavy fines on AI companies that do not abide by its rules.

Financial penalties may be steeper than GDPR penalties, amounting to €40 million or an amount equal to up to 7% of a company’s worldwide annual turnover, whichever is higher.

Beyond the government’s power to enforce the Act, European citizens would have the power to file complaints against AI providers they believe are in breach of the Act.

European officials expect to reach a final agreement on the rules by the end of 2023 after spending years developing the legislation. Such swift and consistent momentum to regulate technology in Europe stands in stark contrast to the United States, where lawmakers are still grappling with initial regulatory steps.

If passed, the Act is expected to become law by 2025 at the earliest.

It’s a lot easier for tech firms to operate in the Wild West when there are no rules, but if there are rules, it’s better than American tech has already built cash cows to keep the party moving right along.

It’s true there won’t be much competition and possibly an oligarchy, but it will translate into much higher share prices for the likes of Apple, Tesla, Meta, Microsoft, Google, and Amazon.

“Done is better than perfect.” – Former Facebook Worker Sheryl Sandberg

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.