Mad Hedge Technology Letter

June 16, 2023

Fiat Lux

Featured Trade:

(THE SKINNY ON AI)

(CRM), (NVDA), (MSFT), ($COMPQ)

Mad Hedge Technology Letter

June 16, 2023

Fiat Lux

Featured Trade:

(THE SKINNY ON AI)

(CRM), (NVDA), (MSFT), ($COMPQ)

(CRM), (NVDA), (MSFT), ($COMPQ)

One misunderstanding about generative artificial intelligence is that it is advertised as the panacea that will cure the economy and global business in one second.

It’s not.

These types of technologies take time to absorb and integrate.

The type of hype surrounding AI feels like every tech company should 100X revenue next year.

That’s not going to happen right away.

It’s obviously going to be an incremental phenomenon instead of a parabolic rise.

People also seem to miss there will be a swath of AI failures that will disappear into the dustbin of history and everything in between.

Just because Nvidia (NVDA) and Microsoft (MSFT) are making hay during this hot money AI investor pandemonium, doesn’t mean all tech companies will.

In the long term, access to high-quality artificial intelligence will unlock a long-term productivity miracle.

The United States economy is suffering from a bout of unproductivity as young workers mostly spend their time perusing Instagram than tangibly delivering results.

Moving a finger is a hard slog these days for Generation Z.

The net result is poorly trending productivity gains.

Productivity growth in the US has been a paltry 1%.

This week alone brought two examples of generative AI's potential for economic output.

First, a new McKinsey study identified 63 generative AI use cases spanning 16 business functions that could unleash $2.6 trillion to $4.4 trillion in economic benefits annually.

The same study found that generative AI could perform each of more than 2,100 detailed work activities such as communicating with others about operational plans.

Generative AI has the potential to change the anatomy of work, augmenting the capabilities of individual workers by automating some of their individual activities.

Current generative AI and other technologies have the potential to automate work activities that absorb 60 to 70 percent of employees’ time today.

Meanwhile, software company Salesforce (CRM) launched its new GPT enterprise products designed to boost worker productivity.

The company introduced "AI Cloud" at a New York City investor day. Salesforce says its AI Cloud product will allow marketers to auto-generate personalized content for customers and developers to auto-generate code.

Salesforce employees also showed off coming AI functions in the workplace collaboration platform Slack.

It’s true that this AI wave is going to be the biggest that anyone has ever seen, but it will take time to get there.

I think there are meaningful lags in AI's impact. And the idea there will be a surge in economic growth in the next seven to ten years because of AI and technology.

It won’t happen in 2 or 3 years.

Goldman Sachs estimated recently that generative AI could expose the equivalent of 300 million jobs globally to automation over the next decade. That's a nice way of saying a person may lose their job to a robot.

AI could also eventually increase the annual global Gross Domestic Product (GDP) by 7%.

There is the thought that AI will make production faster and more voluminous but the quality and understanding will be poor. Just like all those online chat assistants that companies use. If you have a very specific question not covered by the FAQs they just spit back unhelpfulness.

The takeaway is that there will be winners and losers, but it will take time.

In many cases, the outsized winner is someone we have never heard of that brings something new to the table.

A critical part of this investor play is to avoid AI failures as well because there is bound to be a pile of body bags on the way to AI riches.

“AI will probably most likely lead to the end of the world, but in the meantime, there'll be great companies.” – Said Current CEO of OpenAI Sam Altman

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

June 16, 2023

Fiat Lux

Featured Trades:

(THURSDAY, JULY 6 NEW YORK GLOBAL STRATEGY LUNCHEON),

(THE BARBELL PLAY WITH BERKSHIRE HATHAWAY),

(BRK/B)

CLICK HERE to download today's position sheet.

June 16, 2023

(NVDA), (INTC), (MSFT), (AMZN)

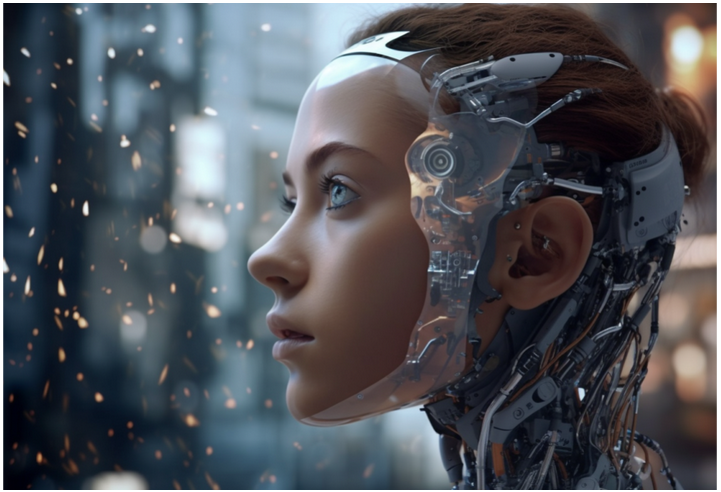

Imagine a world where computers possess the incredible ability to see and understand the visual wonders that surround us.

This seemingly futuristic concept is now a reality, thanks to the groundbreaking work of computer vision companies worldwide.

These visionary organizations are revolutionizing the field of artificial intelligence by unlocking the potential for machines to perceive and interpret visual information – just like we humans do.

At the heart of this transformative technology lies deep learning and machine learning, the driving forces behind AI-powered vision. Computer vision companies harness the power of these cutting-edge techniques to train sophisticated models that "teach" computers to make sense of images and videos.

By delving into the depths of deep learning, these companies can construct intricate neural networks with multiple layers.

These networks possess an extraordinary ability to learn and extract intricate features from visual data. They can effortlessly recognize objects, comprehend scenes, and perform a myriad of awe-inspiring tasks such as image classification, object detection, image segmentation, and even facial recognition.

Computer vision companies play a pivotal role in advancing this groundbreaking technology. To date, several publicly traded and start-up organizations are actively involved in AI, specifically in the field of computer vision.

NVIDIA Corporation (NVDA) is the first in line for all things tech-related, creating GPUs (graphics processing units) that are the go-to for AI tasks, specifically computer vision.

Their hardware and software development expertise has produced NVIDIA CUDA, a platform tailored for working with their GPUs.

To top it off, they have also created the NVIDIA TensorRT deep learning inference optimizer that allows for streamlined processing of computer vision tasks.

Basically, NVIDIA TensorRT helps accelerate the performance of AI applications, making them faster and more efficient. Think of it as a speed booster for AI algorithms.

For example, in autonomous driving, TensorRT can process complex data from sensors in real time, allowing cars to quickly recognize objects and make split-second decisions for safe navigation.

In healthcare, it can enhance medical image analysis, enabling faster diagnoses. TensorRT's optimizations save time and resources, making AI applications more practical and accessible in various real-world scenarios.

Another is Intel Corporation (INTC), which offers various AI solutions, such as the Intel Movidius Neural Compute Stick. This USB device enables devices like cameras and drones to analyze images and videos quickly, without relying on an internet connection.

In terms of practical uses, the stick can be utilized in a security camera to identify faces or objects in real time, helping to enhance safety. It can also be used in agricultural drones to assess crop health by analyzing aerial images.

Meanwhile, it’s no secret that Microsoft Corporation (MSFT) has invested significantly in AI and computer vision.

They offer the Azure Cognitive Services platform, which provides ready-to-use artificial intelligence (AI) capabilities for developers to integrate into their applications. This platform allows applications to understand and interpret data from the real world.

For instance, the Azure Cognitive Services platform can analyze images to identify objects or people, transcribe speech into text, understand natural language, and even detect emotions from facial expressions.

These services can then enable developers to build intelligent applications that recognize, understand, and respond to human input, making them useful in scenarios like automated customer support, smart assistants, or sentiment analysis in social media.

Unsurprisingly, Microsoft's computer vision technology is used in various applications, including autonomous vehicles, surveillance systems, and augmented reality.

And, of course, there’s Amazon.com, Inc. (AMZN), which has the Amazon Rekognition service provided by Amazon Web Services (AWS). This platform uses advanced artificial intelligence to analyze images and videos. It can recognize objects, faces, and text, as well as detect emotions and activities in visual content.

In simple terms, Amazon Rekognition is like a smart assistant for images.

For example, imagine you have a security camera system in your home. Amazon Rekognition can automatically detect and alert you if a stranger enters your property. Or, if you have an e-commerce platform, Rekognition can help identify products in images, making it easier to organize and search through your inventory.

Needless to say, the work of computer vision companies is shaping a future where computers can truly "see" and understand the world around us. Fueling their progress are vast datasets brimming with meticulously annotated images and videos.

These datasets serve as the training ground for the intelligent models they create. Through countless iterations, these models grasp the intricacies of visual patterns and relationships, making them formidable "sight-givers" for computers.

Moreover, the impact of AI-powered vision spans numerous industries and domains.

Imagine machines that can analyze medical images with unparalleled precision, unlocking new frontiers in healthcare.

Picture autonomous vehicles that navigate our roads, powered by the ability to perceive and comprehend their surroundings.

Envision retail stores where computers seamlessly identify products and enable cashier-less transactions. The possibilities are endless.

With computer vision at the helm, the future is teeming with opportunities. From manufacturing to agriculture, surveillance to augmented reality, the visual realm is ripe for transformation. These computer vision companies drive this revolution, propelling us into an era where machines possess the extraordinary power of sight.

Mad Hedge Biotech and Healthcare Letter

June 15, 2023

Fiat Lux

Featured Trade:

(A WINNING GAME PLAN)

(PFE)

Ever tuned into "The Price is Right?" That's not just a television game show entertaining millions across the nation. It's also an unwritten rule in the world of investment.

Buying at the right price sets the average apart from the pros; it's the secret sauce that tips the scales in favor of handsome returns.

Bargain hunting in the stock market is not unlike fishing in a lake brimming with opportunities. Yet, not every catch is worthy.

Some are just slippery eels, deceiving with their alluring glow. But once in a while, you reel in the big ones, the blue whales of opportunities.

In the biotechnology and healthcare world, only a handful of names offer promising opportunities cloaked in bargain price tags, waiting to be embraced for the long haul.

One of them is Pfizer (PFE).

The past year was a blockbuster for Pfizer, all thanks to its sizzling COVID-19 vaccine that not just saved lives but also sent its sales soaring to an enviable $100 billion.

Yet, ironically, investors seem to be catching a cold, given the bearish sentiment surrounding Pfizer lately.

Pfizer’s stock has experienced a bruising blow, slumping by roughly 25% since 2023 started. The stock is precariously hovering around its 52-week low, with its low price-to-earnings multiple under 8, mirroring the market's deep skepticism.

At almost 11.7 times forward earnings, the valuation sits comfortably below the towering S&P 500, the robust healthcare sector, and the buzzing pharmaceutical industry.

So, what's putting the brakes on Pfizer's race?

The pharmaceutical behemoth is grappling with dwindling revenues and profits courtesy of diminishing COVID-19 sales. Patent expiration is another boogeyman looming on the horizon.

Pfizer's top hitters, namely Eliquis, Ibrance, Vyndaqel, Xeljanz, and Xtandi, are on the cusp of losing their patent shield. But Pfizer isn't sitting idle, staring at the cliff.

The company is all set to face this challenge, with acquisitions headlining its battle strategy. Over the past years, Pfizer has added multiple feathers to its cap, including Biohaven Pharmaceuticals, Arena Pharmaceuticals, Global Blood Therapeutics, ReViral, and, most recently, the $43 billion acquisition of biotech Seagen.

Pfizer's eyes are firmly on the oncology prize, and its calculated acquisitions could set it up for a long-term growth trajectory, mitigating the impact of the COVID slump and the upcoming patent crisis.

While 2023 might look bleak for Pfizer's COVID-19 vaccine, Comirnaty, the company is hopeful for a sunny spell in 2025 with the proposed launch of its combo COVID-flu vaccine. In addition, its COVID-19 antiviral therapy, Paxlovid, is expected to make a strong comeback next year.

Admittedly, the patent expiry of key products is a concern, but Pfizer's new product launches up to mid-2024 are predicted to compensate for these losses, promising robust annual revenues by 2030.

The business deals in the pipeline are also projected to bring in an additional $25 billion in annual revenue by 2030.

On top of these, Pfizer's financial health is hardy, thanks to a couple of years of potent free cash flow. As of April 2, it boasted a hefty $20 billion in cash and short-term investments. The financial muscle ensures Pfizer can continue its acquisition spree if needed.

More importantly, Pfizer continues to shower its shareholders with an enticing dividend yield of over 4.1%.

As Pfizer forges ahead on its quest for growth and diversification, now might be the perfect time to hitch a ride, particularly considering its bargain price and a sizeable safety margin for investors.

Pfizer is a hidden gem in the current landscape, with its undervalued shares and a strategy bolstered by a series of strategic acquisitions.

As the acquisitions simmer down, expect a redirection of investment returns towards shareholders, potentially lifting the stock's sentiment and price. Meanwhile, the solid dividend growth will keep investors anchored in a fluctuating FED environment.

Overall, Pfizer presents a captivating prospect for long-term investors looking to reel in the big fish. I suggest you take advantage of the dip.

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

June 15, 2023

Fiat Lux

Featured Trades:

(GET READY TO TAKE A LEAP BACK INTO LEAPS),

(AAPL),

(TESTIMONIAL)

CLICK HERE to download today's position sheet.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.