When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

(FINANCIAL LITERACY - SAVING AND INVESTING)

July 31, 2023

Hello everyone,

After Friday’s newsletter about my financial education, I thought I’d explore more about financial literacy.

Becoming financially literate is a skill we can all acquire. There are several principles we must understand to achieve competence.

We must know how to budget.

We must know how to save and invest our money.

We must be able to manage our debt.

We must be able to plan for our financial future.

We must be able to protect our assets through risk management.

We can achieve all of these by building financial knowledge, skills, and behaviour – and by setting realistic financial goals.

Many people say they know how to do all these things, but our behaviour around money seems to be put to the test when we are under pressure or stress or are trying to reach our goals too quickly. Sometimes we think we are fixing a problem simply by throwing money at it, when in fact, it can sometimes make matters worse. How many of us have invested in haste and regretted it later.

Let’s focus on one aspect of financial literacy today – saving and investing our money. In particular, I want to highlight the difference between saving and investing.

When we want to save money, we put it in a bank account where it is readily available and at low risk. so, we can reach our goals. When we invest our money, we are putting it into something specific, maybe an asset, which comes with risk, but it has the potential for higher returns over a longer-term horizon providing us the opportunity to grow our wealth. We are meant to leave this invested money alone, so it will grow.

Let’s see. Do you have a spouse or partner? Do you have a shared bank account? Or do you have separate bank accounts? Can you explain why you have one or the other?

It is important to identify each person’s spending behaviours. What works for one couple may not work for another couple. Using a joint bank account for utility bills is often a good idea as everything is transparent. Having a separate bank account for your own personal spending puts the responsibility back on you regarding how you budget your finances. If you really want to test yourself and know what you are spending your money on, write down in a book where you are spending your money. So put the date, the name of the retailer/business, and the amount. And I mean everything. Cappuccinos included. Do this for a month or more and you will soon get an idea where you can make cuts to your spending.

So, now we know how to save, but how do we invest or what do we invest in?

I’m going to list here the best ways to invest so you can build wealth that lasts.

# Stock ETFs and mutual funds.

# Low-cost index funds.

# Stocks on NYSE & NASDAQ.

# Real estate (or REITS)

# Treasury bills.

# Online savings accounts- they give a higher yield because they don’t have the overhead of a physical bank location.

Always be mindful of “get rich quick” schemes. They are everywhere in the investment world today. It’s vital to conduct your due diligence before you invest your hard-earned money. Do you know of a “get rich quick” scheme or “Ponzi scheme” that you heard about or became aware of?

Wishing you all a wonderful week.

Cheers,

Jacquie

“Formal education will make you a living, self-education will make you a fortune.” - Jim Rohn

Mad Hedge Technology Letter

July 31, 2023

Fiat Lux

Featured Trade:

(THE BEST OF BREED OF THE SECOND TIER)

(ADBE)

Though without the pedigree of tech blue blood such as Apple or Microsoft, Adobe (ADBE) comes close and is at the top end of that second group in Silicon Valley.

Investors need to take notice immediately of ADBE.

They don’t compete on the data center level with Microsoft or Google, but they do have room to expand in their own way through artificial intelligence which offers a wide path to a higher stock price in the short and long term.

ADBE mainly creates artist tools via software that in the future will absorb a big dose of generative artificial intelligence which will make it easier to produce more creative content in minimal time.

It’s safe to say that the chutzpah surrounding generative artificial intelligence (AI) has also overflowed into Adobe.

Ride on the bandwagon while it lasts. This year is turning into a year many will not forget.

It’s true that ADBE’s foray into AI promises to be just the tip of the iceberg in harnessing this powerful set of revenue boosters.

Adobe's Photoshop Generative Fill feature lets users edit and enhance images by just typing in the desired outcome and letting the software perform its magic easily and effortlessly.

Adobe intends to roll this feature out officially in the second half of this year through its new Firefly beta app. Its Illustrator software will also integrate Firefly to enable customers to come up with ideas faster, enhancing the creative process and saving many hours of work.

ADBE has also shown stable earnings growth albeit nothing spectacular.

Revenue came in at $4.8 billion, up 10% year over year for the quarter, while net income stood at $1.3 billion, up nearly 10% year over year.

Free cash flow for the quarter came in at $2 billion, 5.4% higher than the $1.9 billion reported in the prior year.

One big highlight is the profitability of what ADBE does.

Earnings per share are expected to be between $11.15 for the next quarter.

On a down note, ADBE may encounter a stumbling block in its bid to acquire Figma, a cloud-based design platform.

Its $20 billion bid for the software company is being scrutinized by the European Union antitrust regulators. The European Commission will decide whether to clear Adobe's bid by August 7 as it was concerned that the deal may stifle competition.

There is still a great deal of upside to ADBE’s stock and I do believe it is one of the more robust franchises in software paving the way for its Creative Cloud to capitalize on the integration of generative AI functionality into existing workflows.

It’s hard to put an exact number on the level of efficiencies but I do believe artists will show around 50% increased productivity using this new software.

This would translate into multi-thousands of dollars in cost savings for individual content creators who effectively will be able to run a professional artist studio from their own iPhone.

It’s never been a better time to own a brand because to run it and promote it, is easier than ever.

This is why the stock is defying gravity this year, so I predict that ADBE shares will be a lot higher than today a year from now.

Elon Musk is undoubtedly one of the most influential and innovative entrepreneurs of our time. His relentless pursuit of groundbreaking technologies has spanned several industries, from electric vehicles to space exploration. However, one of his most notable endeavors was his involvement in the artificial intelligence research lab, OpenAI. Musk's initial enthusiasm for AI's potential soon turned into a decision to withdraw his support from the organization. In this article, we delve into the reasons behind Elon Musk's departure from OpenAI and explore the implications of his decision.

Elon Musk and the Birth of OpenAI

In 2015, Musk co-founded OpenAI with the mission of ensuring that artificial general intelligence (AGI) benefits all of humanity. AGI refers to highly autonomous systems that can outperform humans in most economically valuable work. Musk and other tech luminaries recognized the immense potential of AGI but also harbored concerns about its unchecked development. They aimed to make AI safe, beneficial, and readily accessible to the broader public, thereby avoiding undue concentration of power.

The Conflict of Interests

As a visionary entrepreneur with multiple ventures under his belt, Elon Musk's involvement with OpenAI was initially seen as a significant boost to the organization. His reputation, financial resources, and strategic insights were invaluable assets for the fledgling AI research lab. However, as the company matured, conflicts of interest emerged.

Musk's primary focus was on his other ventures, such as Tesla and SpaceX, which demanded a considerable portion of his time, energy, and financial resources. These ventures were at critical stages of development, and their success hinged on Musk's undivided attention. As a result, he found it increasingly challenging to allocate the necessary commitment to OpenAI, which required consistent and dedicated leadership.

Differing Philosophies

Another factor contributing to Elon Musk's withdrawal from OpenAI was the divergence of philosophical perspectives on AGI. While Musk had expressed concerns about AGI's potential risks and its need for careful regulation, other members of the OpenAI team held differing opinions. Some believed in more aggressive development and deployment of AI technologies, which led to internal debates and disagreements within the organization.

Musk's vision for OpenAI focused on ensuring AGI's responsible development, transparency, and equitable access. However, as the organization grew, differing opinions on these core principles may have caused tensions and impacted the organization's unified approach.

Regulatory Concerns and Public Perception

Elon Musk is renowned for his willingness to openly voice his opinions and concerns, often to the chagrin of his critics. His candid remarks about AI's potential risks and the need for proactive regulation generated both admiration and controversy. While some praised him for bringing crucial discussions to the forefront, others accused him of fear-mongering and undermining confidence in AI research.

As OpenAI gained prominence in the AI community, Musk's outspoken nature and his association with the organization led to greater scrutiny. This dynamic likely played a role in his decision to distance himself from the organization, as his other ventures could be adversely affected by any public backlash or regulatory repercussions associated with OpenAI's work.

Focus on Tesla and SpaceX

Tesla and SpaceX, two of Musk's most prominent ventures, were at critical junctures of their development during the period in question. Tesla was accelerating the production of electric vehicles, striving to make them more affordable and accessible to the mass market. Similarly, SpaceX was making significant strides in space exploration, with ambitious goals of colonizing Mars.

These ventures required Musk's undivided attention and resources, leaving little room for substantial involvement with OpenAI. Musk's decision to withdraw from the organization likely stemmed from his desire to prioritize the success and impact of Tesla and SpaceX, given the enormous potential they held for transforming industries and shaping the future.

New Horizons

Elon has since created a new startup called x.AI which aims to “Understand the nature of the universe” but will try to avoid the direct impacts he feared from OpenAI. With this new company, he brings people from OpenAI, Google Research, Microsoft Research, and DeepMind together with some pretty big names in the industry like Igor Babuschkin, Manuel Kroiss, Yuhuai (Tony) Wu, Christian Szegedy, Jimmy Ba, Toby Pohlen, Ross Nordeen, Kyle Kosic, Greg Yang, Guodong Zhang, and Zihang Dai. He hopes his new approach to AI in this company will side-step the "societal-scale risks associated with AI".

Conclusion

Elon Musk's departure from OpenAI was a complex decision influenced by a convergence of factors, including conflicts of interest, differing philosophical viewpoints, regulatory concerns, and his intense focus on Tesla and SpaceX. While his departure might have created some uncertainties for OpenAI, the organization has continued its mission with other dedicated leaders and researchers.

Elon Musk's journey is a testament to the challenges and complexities of navigating the dynamic world of AI research and technology entrepreneurship. Regardless of his departure, his contributions to the AI landscape and beyond remain profound, and his determination to shape the future through innovative endeavors continues to inspire generations to come.

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

July 31, 2023

Fiat Lux

Featured Trades:

(PROGRESS REPORT FROM EUROPE - PART TWO)

CLICK HERE to download today's position sheet.

I love walking around Saint Marks Square in Venice.

You have five different bands playing classical music all at the same time, the musicians dressed in white dinner jackets. Couples holding hands are enjoying the high point of their lives, making out in every corner. African immigrants are selling odd flying toys. The line at the gelato stand is a mile long.

I’ve been doing this since 1968, and my grandfather before me in 1917, and every year it’s just as intoxicating.

Only the clouds of pigeons are gone from the old days, poisoned by the Commune of Venice out of existence. I guess they were a health hazard.

The three-hour bus trip to Cortina d’Ampezzo was nothing less than hair-raising. The driver tore along roads that were maybe four inches wider than the bus, with precipitous 500-foot drops over the side. As we rose into the Dolomites, the scenery became increasingly impressive.

There used to be a cog railway that made this route the famous “Blue Train.” It was torn down in 1963 when it could no longer compete with the automobiles of a rising Italian middle class and is now a bike path. When this happened in Switzerland the government poured in massive subsidies to keep the trains running, which are now major tourist draws.

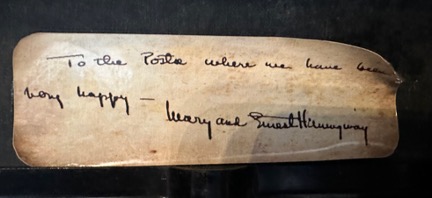

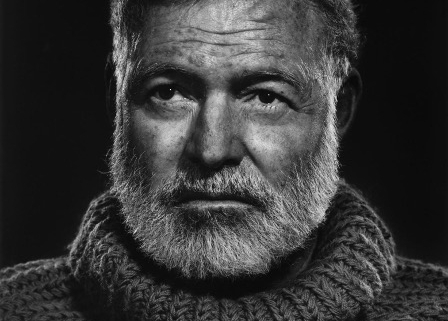

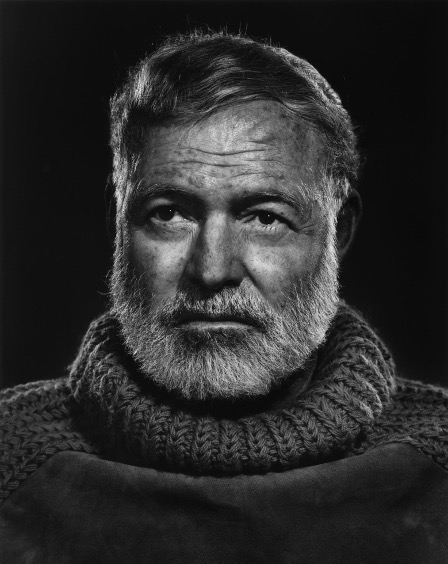

Once in Cortina, I checked into a suite that Earnest Hemmingway occupied for several months. He left behind a battered Royal portable typewriter which I used to send you a trade alert. Hopefully, some writing skills rubbed off on me.

I made the pilgrimage to Cortina to find the grave of my great uncle, a first lieutenant in the Italian army who died here in WWI. I hired a guide who took me along the front lines, and we picked up spent bullets and rifle parts at every turn. Abandoned telephone lines and barbed wire still dangled from the trees after 106 years.

On another day, I made the pilgrimage to the top of Little Lagazuoi, a massive 2,000-foot stone edifice turned into a fortress by the Austrian defenders. It is riddled with miles of tunnels so they could fire down on the Italians with devastating effect. Two reenactors dressed as Austrian and Italian soldiers gave me some local history and even let me inspect their guns.

After a week my story had gotten out and the whole town was looking for the grave of my lost lieutenant. But no luck. Out of one million Italian soldiers lost in the Great White War there we only 10,000 graves. The rest are missing in action.

On my free day, I decided to climb the most challenging of the surrounding Dolomite peaks, the Grand Torri of the Cinque Torri, or “Five Towers”. My guide interviewed me carefully first to make sure I was not just another American who had gone insane and was going to take him down with him.

My experience?

The Matterhorn seven times, Mt. Fuji in Japan four times, Mt. Whitney in California twice, and oh yes, Mt Everest, but only up to 22,000 feet where I ran out of oxygen. “Then let’s climb the Grand Torri,” said Stefano, my guide, with enthusiasm.

I have not engaged in technical rock climbing for 50 years. But it’s just like riding a bicycle, you never forget, right? Well, maybe. One problem is that I had gained 40 pounds since the last time I climbed.

Two hours later found me outfitted with a helmet, harness, and a heavy 80-foot rope clinging to a bump the size of a grape on a shear limestone face 200 feet off the ground. Stefano shouted that there was a better handhold a meter to the right. I couldn’t see it because of the curvature of the mountain face, so Stefano said “Jump”. Jump I did, and miraculously my bare hand caught the alleged outcrop.

The really hilarious thing is that while I was doing this a crowd of hikers accumulated at the base. Every time I made a death-defying leap they applauded and shouted “Bravo.”

How embarrassing!

After nine pitches we made it to the summit. I took plenty of pictures and videos along the way. But to do so I had to hold my iPhone 14 pro in my teeth while I switched from holding the rope with my right hand to my left. At a certain point, I decided I had enough video for the day and quit while I was ahead of the game and still possessed a phone.

Getting down was yet another challenge. Abseiling requires quite a leap of faith as you must lean back perpendicular to the mountain and then walk down backward as Stefano paid out a rope. One slip can lead to disaster. But an hour later I was back at the bar sharing a celebratory beer with my guide.

The next day, I rented a car and drove across the Italian Alps on the narrowest roads imaginable. But that is a story for another day.

TO BE CONTINUED.

Sending a Trade Alert from Earnest Hemingway’s Typewriter

WWI Italian Bunker

Spent Austrian Bullet

Rifle Inspection

Machine Gun Nest

My Guide Stefano

Was this Such a Great Idea?

Made it to the Top

The Celebratory Beer

“In order to write about life first you must live it,” said the great American novelist, Earnest Hemingway.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.