When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

August 3, 2023

Fiat Lux

SPECIAL PRECIOUS METALS ISSUE

Featured Trades:

(WHAT’S UP WITH GOLD?),

(GLD), (UGL), (PPLT), (PLAT), (WPM)

(THE ULTRA BULL CASE FOR GOLD)

CLICK HERE to download today's position sheet.

Mad Hedge Biotech and Healthcare Letter

August 3, 2023

Fiat Lux

Featured Trade:

(A FUTURE-PROOF INVESTMENT)

(UNH), (CI), (HUM), (CNC)

With a staggering market cap of $472 billion and a network reaching scores of policyholders, UnitedHealth Group (UNH) is an undisputed titan in the health insurance industry.

To put this into perspective, its competitors such as Cigna (CI), Humana (HUM), and Centene (CNC) have market caps of $86.42 billion, $56.64 billion, and $36.32 billion, respectively.

However, the past year witnessed a slight dip in UnitedHealth’s share price by 2%, which noticeably lags the broader market's return of 17%.

This raises a question: Is UnitedHealth’s investment appeal dwindling, or is it merely in a brief pause?

One can't discuss the health insurance sector without addressing the brewing storm of growth in its forecast. This sector is expected to welcome a turbocharged surge fuelled by an escalating burden of maladies and an expanding aging population worldwide.

The global landscape is witnessing a steep rise in various chronic afflictions - from cardiovascular and respiratory conditions to neurological disorders, cancer, musculoskeletal diseases, and diabetes. With the world population growing savvier about the financial cushioning health insurance provides, we're staring at a potential boom in this sector.

Take a gander at the numbers: The global health insurance industry was valued at a hefty USD 2.17 trillion in 2022.

Fast forward to 2032, and we're talking about a market swelling to an eye-watering USD 4.37 trillion. And with a projected CAGR of 7.3% from 2023 to 2032, we can safely say the health insurance express isn't slowing down anytime soon.

With this backdrop, let's dive into the compelling aspects of investing in UnitedHealth.

First, let's delve into the favorable aspects of investing in UnitedHealth. The core rationale is simple: healthcare is perennial. As long as human beings exist, healthcare will always be needed.

In the United States, individuals or their employers inevitably need to secure health insurance on a monthly basis. The constant evolution and improvement of healthcare services create a fertile ground for potentially substantial earnings in both the insurance and healthcare delivery sectors.

UnitedHealth, a veritable powerhouse, operates two key divisions - one specializing in health insurance and prescription coverage, and the other focused on healthcare provision. This dual-pronged approach has the potential to create sustained shareholder value.

Finding a flaw in this favorable proposition is challenging, particularly when examining the figures.

The company amassed an impressive $93 billion in revenue in the second quarter of 2023 alone, making it one of the world's largest corporations. It outperformed analysts' predictions of $91 billion, and the earnings per share of $6.14 surpassed Wall Street estimates of $5.99.

Although the company's medical care ratio did increase from 81.5% to 83.2% as expected, this was offset by a robust revenue growth that outpaced the rise in medical and operational costs.

UnitedHealth provides insurance to over 51 million individuals, with an addition of over a million new policyholders in 2023. UnitedHealth's scale allows it to keep costs low, forming a formidable entry barrier for new market contenders.

Moreover, its quarterly revenue experienced a notable 63% increase over the past five years, hinting at significant growth potential. This suggests that UnitedHealth's future growth prospects remain robust.

Straight from the company itself, UnitedHealth anticipates growing its earnings per share (EPS) between 13% and 16% annually. Moreover, the company has shown consistent dividend growth, with an annual increase of 10% since 2010.

This indicates a company that excels in operating its business model over time, suggesting potential stability and growth in both share price and dividends.

One key strategy of UnitedHealth is its diverse portfolio, developed over the years through strategic acquisitions like home health company LHC Group and analytics firm Change Healthcare. This diversity has allowed the company to maintain a growth rate exceeding 10% over the last five years.

UnitedHealth's most significant growth driver remains its premiums, but the company also saw an additional $2 billion in revenue from services and $1.2 billion from product sales last quarter.

Although it faces potential increases in medical costs, the company's diversified portfolio helps it maintain strong profit growth, with adjusted earnings per share rising 10% to $6.14 year-on-year.

Despite the overall positive outlook, it's worth noting that UnitedHealth's shares have decreased by about 4% this year. While the stock is trading at 23 times trailing earnings, slightly below the healthcare industry average of 25, the company's consistent growth could justify a higher valuation.

Overall, UnitedHealth remains a promising investment in the long run despite some short-term volatility, as it offers a blend of stability and growth. It may well be a stock worth considering for those looking for a long-term hold in the healthcare sector. I suggest you buy the dip.

An AI-powered David is boldly challenging the Goliath in the credit landscape. Upstart (UPST), a groundbreaking fintech player, employs the power of this technology to critically evaluate borrowers, enabling financial establishments to make astute lending determinations.

What makes Upstart's strategy stand out is its gutsy move to outfox Fair Isaac's FICO score - a rating system that's reigned supreme in the credit market for over 30 years. Unlike the traditional method, this company pulls in a variety of aspects like career trajectory, academic background, and other distinct personal markers.

With this innovative approach, Upstart's AI-powered models are able to spread their loan-offering net wider, snagging more borrowers and serving up loans at friendlier rates. This not only trims down the specter of default but also makes it an enticing prospect for investors.

They're not just investing in a company, they're also potentially hitching a ride with a trailblazer aiming to flip the script on how creditworthiness is gauged, possibly shaking the very foundations of the $4 trillion consumer lending industry.

Its cutting-edge AI technology has the power to sift through a staggering 1,600 individual data points pertaining to a loan applicant in less time than it takes to blink. It’s so rapid that 84% of nods of approval are immediate and totally automated, bidding goodbye to the need for meddling human hands.

When you stack this up against the old guard FICO, it’s like comparing a supersonic jet to a horse and buggy. FICO meanders through a mere five core data parameters, and the time it takes for a human assessor to finally stamp their approval can be as long as a drawn-out cricket match.

That said, Upstart's journey in the stock market has seen its fair share of turbulence since its December 2020 IPO.

After debuting at a modest $20, the stock saw an impressive 780% surge by October 2021. However, the market's fickle nature was soon revealed.

By the end of 2022, Upstart had plummeted, losing a staggering 95% of its value. Then, as of July 26, 2023, it rallied, marking a dramatic 390% upswing.

Such dramatic shifts reflect the influence of interest rates and broader economic trends. When interest rates hovered below 1%, borrowing boomed, making Upstart a popular choice among loan seekers.

However, the Federal Reserve's series of interest rate hikes over the past 18 months caused a sharp decline in loan applications, impacting Upstart's fortunes.

In light of these fluctuations, Upstart's financial performance has faced significant challenges. In Q1, revenues fell to $103 million, marking a 67% year-on-year decline.

Loan originations via the platform fell by 78% to $997 million compared to the same period last year.

Net losses also spiked to $129 million, a steep drop from the net income of $32.7 million in Q1 of the previous year.

Despite these worrying trends, investors appear to be displaying unwavering faith in Upstart's future.

This optimism may stem from several positive developments during this period. Notably, Upstart secured an impressive $2 billion in funding for the next 12 months for its loans. In a significant vote of confidence, investment giant Castlelake also agreed to acquire $4 billion of Upstart's consumer loans.

The cash influx will likely encourage banks to approve more loans, while Upstart can avoid bearing these on its balance sheet.

Additionally, borrowers approved by Upstart's AI models experienced 53% fewer defaults than those approved by major U.S. banks at the same rate.

This implies that partnering banks could approve 173% more loans without a corresponding increase in default rates.

While it's exciting to envision Upstart flourishing half a decade from now, showcasing robust revenue growth and remarkable profitability, we must also remember the company's recent, significant downturn. Consequently, any future predictions come with a fair share of risk.

At present, Upstart's price-to-sales ratio stands at 7, reflecting the company's performance. This metric could be justified for a firm demonstrating rapid growth and high efficiency. But given Upstart's recent challenges, it might seem overvalued.

Upstart could prove a valuable addition to a portfolio at the right time. However, given the current inflated stock price, prospective investors might be better off waiting for a more attractive entry point signaled by positive news and more consistent performance.

Mad Hedge Technology Letter

August 2, 2023

Fiat Lux

Featured Trade:

(SPOT ON WITH SPOTIFY)

(SPOT), (AMZN), (APPL)

Many industries have experienced consolidation in the last few years and music streaming has been no exception.

The strong emergence of a few companies running the show has resulted in these same companies wielding extraordinary pricing power.

Spotify (SPOT) has been one of the leading music streaming platforms for years, and when companies harness pricing power, they can raise prices to compensate for higher expenses.

That is exactly what Spotify did recently as their stock sold off on a wider-than-expected loss for the second quarter, even though subscribers surged.

The streaming service posted a net loss of 302 million euros.

Monthly active users (MUAs) beat estimates of 530 million to hit 551 million — a 27% improvement compared to the year-ago period. Net additions of 36 million represented Spotify's largest quarterly net addition performance in its history.

Premium subscribers also surpassed expectations of 217 million, jumping another 17% year over year to hit 220 million.

In its first-quarter report, the company said it expected to add 15 million new monthly active users in Q2, bringing its total to 530 million. It also expected revenue of 3.2 billion euros and to report 217 million paid subscribers in the quarter.

Spotify is continuing to invest in advertising, and its ad-supported revenue grew 12% year over year. The company said podcast advertising revenue growth reaccelerated to more than 30% year over year.

Spotify will increase the price of its Premium subscription offerings by as much as $2, which translates to a 20% rise for some plans.

In the U.S., Spotify’s Premium Individual offering now costs $10.99, up from $9.99, and the price of its Premium Duo plan changed to $14.99, up from $12.99. The company’s Premium Family plan is now priced at $16.99, up from $15.99, and the Student offering costs $5.99, up from $4.99.

Spotify doesn’t expect a drawdown in product demand from the price increase, and let’s face it, most people can handle paying an extra 2 bucks for something they use every day.

Music streaming is definitely close to becoming an industry participated in by just a few for as long as it’s a viable business.

That means Spotify will also have the opportunity to raise subscription prices again in the future.

The licensing issues alone are too much of a hurdle for most companies to get to launch so to really compete takes a high amount of upfront funds and in the world of high interest rates, tech firms can’t fund this type of retread business again.

Spotify isn’t a pure monopoly.

The others involved are Apple Music, Amazon, Tidal, Deezer, and Pandora.

SPOT’s stock has increased by over 85% after the earnings pullback, and at one point they were up over 100%.

Growing subscriptions at 27% is still considered something that a growth company does at a time when growth companies are hard to find.

It doesn’t matter that they aren’t profitable yet, as long as they add more subscribers, which they have strongly indicated they will.

The stock has pulled back from $175 and once the negative shakeout fades away, traders should get into SPOT while they still can.

“Never invest in a business you can't understand.” – Said American Investor Warren Buffett

(INVESTING IN SILVER IS A SMART MOVE FOR THE LONG TERM)

August 2, 2023

Hello everyone,

Let’s look at Silver today.

Silver is one of the many precious metals you can invest in, particularly when you are looking for long-term growth.

Silver isn't just a metal to collect and stow away for the future. It has endless real-life uses, and with those uses — and future, yet undiscovered ones — comes the potential for growth.

Silver is not only a precious metal but also an industrial metal. Silver is used in medical applications, solar panels, batteries, nuclear reactors, semiconductors, touch screens, and more.

It's also a large component in electric vehicles, which have jumped in production and popularity in recent years. By 2025, The Silver Institute estimates that 90 million ounces of silver will be needed for vehicle production.

It's smart to invest in silver if you have the patience to hold it for the long term. With a growing commitment to green infrastructure, clean alternative energy sources, and anticipated growth of EVs, we should only expect the demand for silver to grow from here.

How to invest in silver

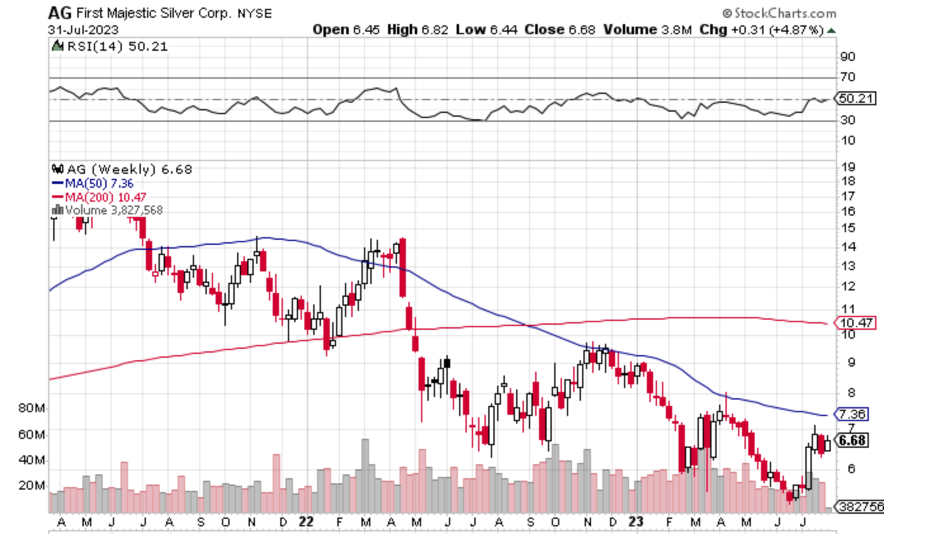

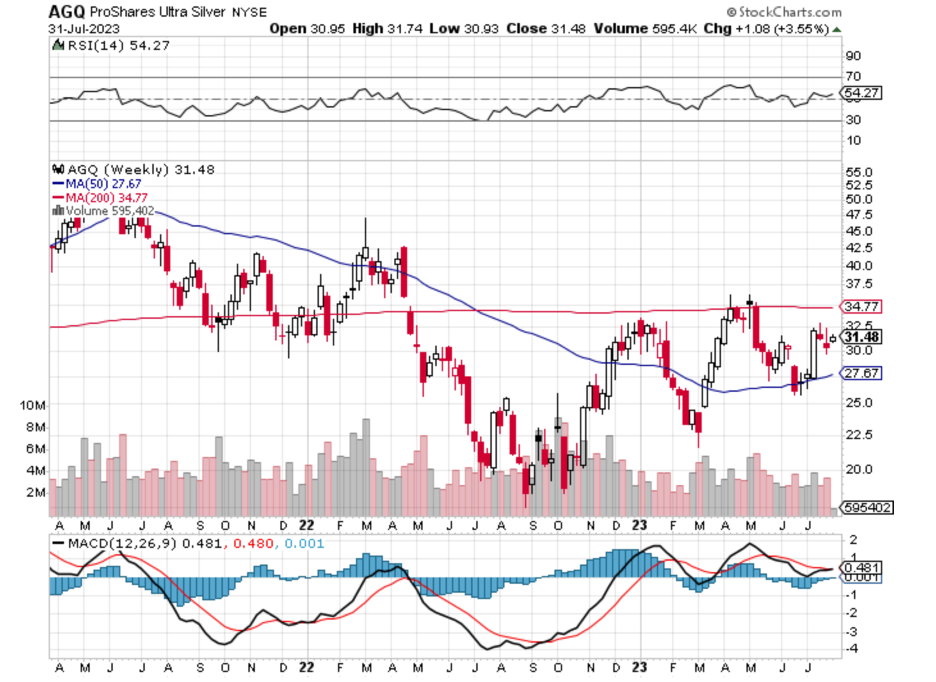

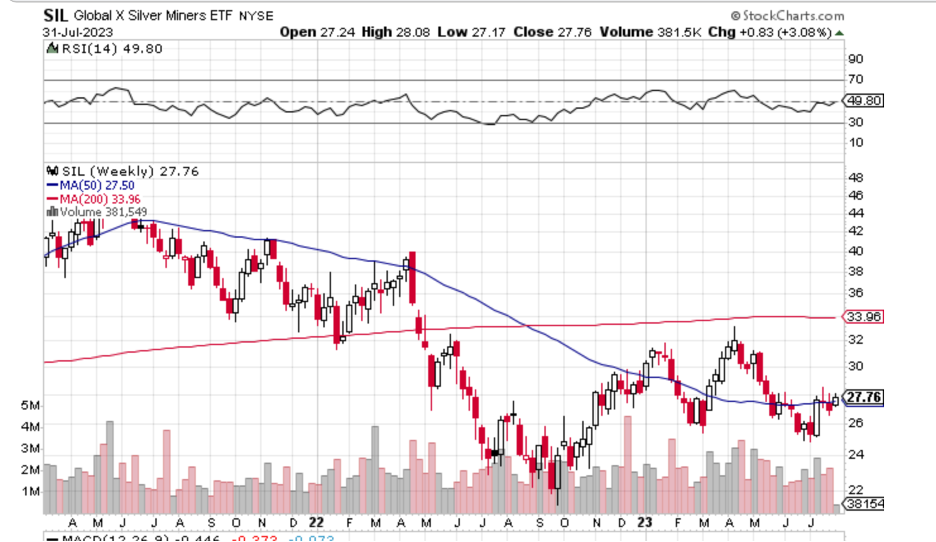

There are many ways to invest in silver. You can purchase silver coins and bullion (just remember you need somewhere to store it). You can also buy stocks in silver mining companies or invest in silver ETFs. Examples of silver stocks and ETFs include WPM (Wheaton Precious Metals), SLV (iShares Silver Trust ETF), SIL (Global X Silver Miners), AGQ (ProShares Ultra Silver), NEM (Newmont Corporation), SVM (Silvercorp Metals), AG (First Majestic Silver Corp.)

You can also open a silver IRA, which allows you to use silver to build your wealth for retirement. These are specialized retirement accounts that must be managed by an IRS-approved custodian. You can only purchase certain coins and bouillon, and they must be stored in an official depository. (There are also gold IRAs if you're interested in investing in gold).

Invest in Silver if you are comfortable with some risk and volatility.

Silver is generally seen as a safe investment, but its value ebbs and flows more than gold does.

In the last year, silver prices have gone as low as $17 an ounce to nearly $26 an ounce. Over the last decade, silver has vacillated even more. Its lowest price was just under $14 per ounce, while it cost almost $28 per ounce at its peak. That's a peak-to-trough difference of 101%.

Still, the volatility can be worth it — at least for investors with patience and good timing.

Invest in Silver if you want to diversify your portfolio.

Silver is also a smart way to diversify your portfolio and offset your exposure to other, riskier assets, such as stocks.

"It can be smart to invest in silver when you're seeking diversification or when you expect inflation or economic turmoil," says Nick Ganesh, manager at Endeavor Metals. "Silver often holds value well under these conditions."

When silver investing isn't wise

Silver can often be a smart investment, but it's not right for everyone.

Don’t invest in Silver if you want a risk-free investment.

One of the biggest silver investment disadvantages is its volatility. While that can often mean big growth, it can mean significant loss if you need to sell at the wrong time.

If you're not prepared to ride out the waves of this volatility, you may want to explore other investment options. If you can ride out the volatility waves, you will do well with Silver in the long term.

Don’t invest in Silver if you're looking for quick returns or dividends.

If quick profits or a regular income stream are what you're looking for, silver won't be of much help.

Silver doesn't provide interest or dividends. So, if you're seeking a steady income stream, other investments might be more suitable. Assets like stocks or bonds may provide better returns.

Don’t invest in Silver if you need easy liquidity.

Silver isn't completely illiquid, but if being able to sell your assets fast and turn them into cash is a priority, it's not the best choice.

Warren Buffett has invested almost 1 billion in Silver. So, if you’re looking for confirmation of the value of Silver as a long-term hold, there it is.

In 10 years’ time, Silver could grow to a minimum value of $150/ounce. If the conditions are right, Silver could reach up to $750/ounce.

Have a great Wednesday.

Cheers,

Jacquie

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.