When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

August 25, 2023

Fiat Lux

Featured Trades:

(THE NEXT COMMODITY SUPERCYCLE HAS ALREADY STARTED),

(COPX), (GLD), (FCX), (BHP), (RIO), (SIL),

(PPLT), (PALL), (GOLD), (ECH), (EWZ), (IDX)

CLICK HERE to download today's position sheet.

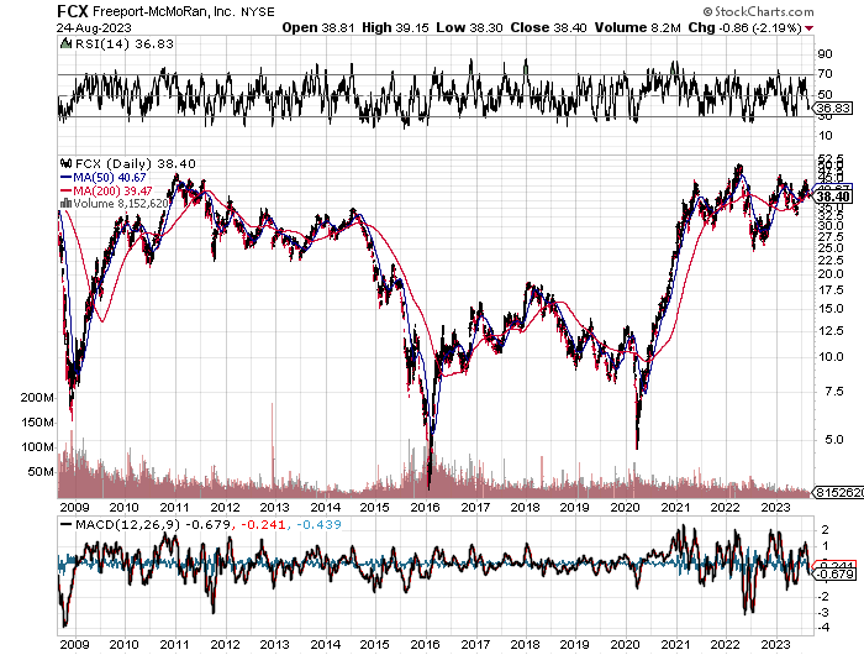

When I closed out my position in Freeport McMoRan (FCX) near its max profit earlier this year, I received a hurried email from a reader if he should still keep the stock. I replied very quickly:

“Hell, yes!”

When I toured Australia a couple of years ago, I couldn’t help but notice a surprising number of fresh-faced young people driving luxury Ferraris, Lamborghinis, and Porsches.

I remarked to my Aussie friend that there must be a lot of indulgent parents in The Lucky Country these days. “It’s not the parents who are buying these cars,” he remarked, “It’s the kids.”

He went on to explain that the mining boom had driven wages for skilled labor to spectacular levels. Workers in their early twenties could earn as much as $200,000 a year, with generous benefits.

The big resource companies flew them by private jet a thousand miles to remote locations where they toiled at four-week on, four-week off schedules.

This was creating social problems, as it is tough for parents to manage offspring who make far more than they do.

The Next Great Commodity Boom has started and, in fact, we are already years into a prolonged supercycle that could stretch into the 2030s.

China, the world’s largest consumer of commodities, is currently stimulating its economy on multiple fronts, to break the back of a Covid hangover.

Those include generous corporate tax breaks, relaxed reserve requirements, government bailouts of financial institutions, and interest rate cuts. Get triggers like the impending moderation of its trade war with the US and it will be off to the races once more for the entire sector.

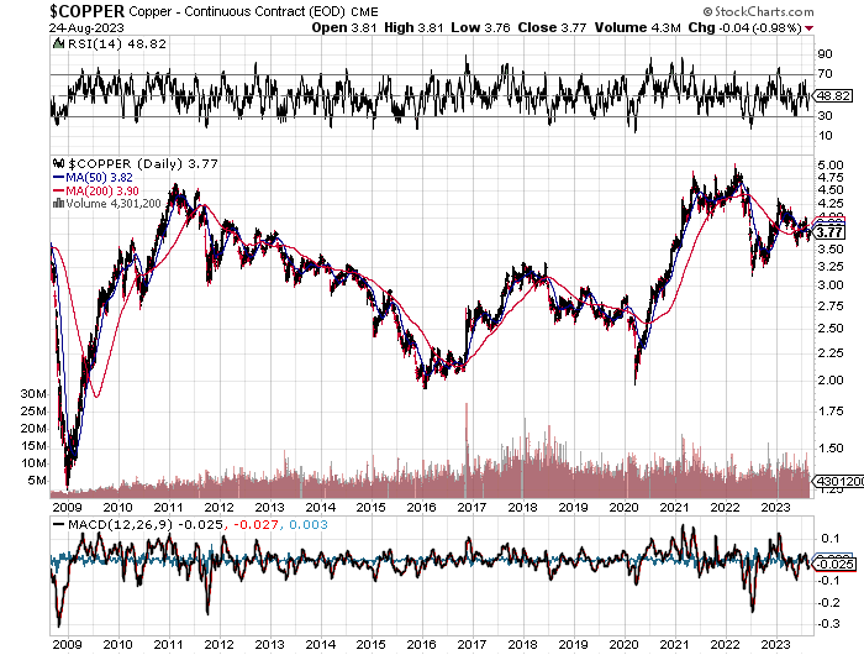

The last bear market in commodities was certainly punishing. From the 2011 peaks, copper (COPX) shed 65%, gold (GLD) gave back 47%, and iron ore was cut by 78%. One research house estimated that some $150 billion in resource projects in Australia were suspended or cancelled.

Budgeted capital spending during 2012-2015 was slashed by a blood-curdling 30%. Contract negotiations for price breaks demanded by end consumers broke out like a bad case of chicken pox.

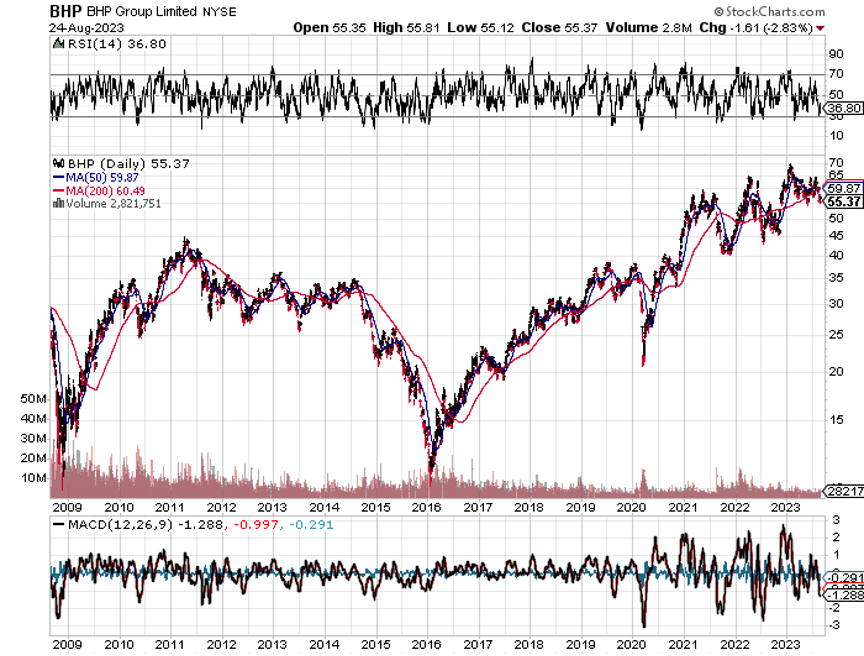

The shellacking was reflected in the major producer shares, like BHP Billiton (BHP), Freeport McMoRan (FCX), and Rio Tinto (RIO), with prices down by half or more. Write-downs of asset values became epidemic at many of these firms.

The selloff was especially punishing for the gold miners, with lead firm Barrack Gold (GOLD) seeing its stock down by nearly 80% at one point, lower than the darkest days of the 2008-9 stock market crash.

You also saw the bloodshed in the currencies of commodity-producing countries. The Australian dollar led the retreat, falling 30%. The South African Rand has also taken it on the nose, off 30%. In Canada, the Loonie got cooked.

The impact of China cannot be underestimated. In 2012, it consumed 11.7% of the planet’s oil, 40% of its copper, 46% of its iron ore, 46% of its aluminum, and 50% of its coal. It is much smaller than that today, with its annual growth rate dropping by more than half, from 13.7% to 3.50% today.

What happens to commodity prices when China recovers even a fraction of the heady growth rates of yore? It boggles the mind.

The rise of emerging market standards of living will also provide a boost to hard asset prices. As China goes, so does its satellite trading partners, who rely on the Middle Kingdom as their largest customer. Many are also major commodity exporters themselves, like Chile (ECH), Brazil (EWZ), and Indonesia (IDX), who are looking to come back big time.

As a result, Western hedge funds will soon be moving money out of paper assets, like stocks and bonds, into hard ones, such as gold, silver (SIL), palladium (PALL), platinum (PPLT), and copper.

A massive US stock market rally has sent managers in search of any investment that can’t be created with a printing press. Look at the best-performing sectors this year and they are dominated by the commodity space.

The bulls may be right for as long as a decade thanks to the cruel arithmetic of the commodities cycle. These are your classic textbook inelastic markets.

Mines often take 10-15 years to progress from conception to production. Deposits need to be mapped, plans drafted, permits obtained, infrastructure built, capital raised, and bribes paid in certain countries. By the time they come online, prices have peaked, drowning investors in red ink.

So a 1% rise in demand can trigger a price rise of 50% or more. There are not a lot of substitutes for iron ore. Hedge funds then throw gasoline on the fire with excess leverage and high-frequency trading. That gives us higher highs, to be followed by lower lows.

I am old enough to have lived through a couple of these cycles now, so it is all old news for me. The previous bull legs of supercycles ran from 1870-1913 and 1945-1973. The current one started for the whole range of commodities in 2016. Before that, it was down from seven years.

While the present one is short in terms of years, no one can deny how business cycles will be greatly accelerated by the end of the pandemic.

Some new factors are weighing on miners that didn’t plague them in the past. Reregulation of the US banking system is forced several large players, like JP Morgan (JPM) and Goldman Sachs (GS) to pull out of the industry completely. That impairs trading liquidity and widens spreads— developments that can only accelerate upside price moves.

The prospect of falling US interest rates is also attracting capital. That reduces the opportunity cost of staying in raw metals, which pay neither interest nor dividends.

The future is bright for the resource industry. While the gains in Chinese demand are smaller than they have been in the past, they are off of a much larger base. In 20 years, Chinese GDP has soared from $1 trillion to $14.5 trillion.

Some 20 million people a year are still moving from the countryside to the coastal cities in search of a better standard of living and improved prospects for their children.

That is the good news. The bad news is that it looks like the headaches of Australian parents of juvenile high earners may persist for a lot longer than they wish.

Buy all commodities on dips for the next several years.

Mad Hedge Biotech and Healthcare Letter

August 24, 2023

Fiat Lux

Featured Trade:

(FUTUREPROOFING BIOTECH)

(REGN), (SNY), (BAYN), (RHHBY)

The financial landscape of 2023 offers a captivating tableau. While stock market giants, such as the S&P 500 and the Nasdaq Composite, have been garnering attention with their respective 18% and 34% gains, the biotechnology and healthcare domain unfolds a more nuanced story.

When I take a look at this sector, I notice certain ETFs, notably the iShares Biotechnology and the SPDR S&P Biotech, in a decellerative phase. However, the industry's canvas is dotted with companies that are scripting their distinct success stories.

Among these trailblazers is Regeneron Pharmaceuticals (REGN).

Contrary to the broader biotech trend, Regeneron has asserted itself with a commendable 7% growth this year. This is complemented by its sturdy revenue and an impressive EPS trajectory showcased in Q2.

For those not completely familiar with the annals of biotech, the name Regeneron is synonymous with pioneering achievements in therapeutic proteins. Their landmark collaboration with Bayer (BAYN) resulted in the creation of Eylea, a beacon in the anti-VEGF drug realm.

Their story doesn't end there.

Together with Sanofi (SNY), they've masterminded treatments that have potentially revolutionized the way we approach cancer, inflammation, and specific respiratory disorders. A testament to this partnership's prowess is Dupixent, which registered a remarkable $8.68 billion in sales during 2022.

Insider chatter hints at the possibility of these figures ascending to an ambitious $20 billion by the end of this decade.

A retrospective look at Regeneron's journey over the past decade reveals a remarkable story of resilience and growth. Their compound annual growth rate (CAGR) stood at an enviable 24.2% from 2012 to 2022.

When contrasted against the S&P 500's relatively modest 16.3% in the same window, it underscores the vast potential that biologic therapies hold. Moreover, it showcases Regeneron's ability to harness this potential effectively.

Yet, as we look ahead, the landscape is not devoid of challenges.

Enter Roche’s (RHHBY) Vabysmo — a new contender that has begun to question Eylea's unchallenged dominion since its 2022 introduction.

Recognizing this, Regeneron has strategically moved towards bolstering Eylea to ensure it maintains its market presence. These evolving dynamics serve as a reminder that the arena of retinal disease treatments is becoming increasingly competitive.

Anticipating the industry's fluid dynamics, Regeneron has exhibited strategic foresight. Their ventures into the realm of immuno-oncology, notably their stalwart, Libtayo, are significant.

They've not stopped there, however.

Their strategic diversification includes incursions into groundbreaking fields like gene therapy, RNA interference, and more. The company's research pipeline, promising an influx of innovative drugs in the near future, showcases its commitment to remaining at the industry's forefront.

A key partnership that's generating interest is Regeneron's association with Intellia Therapeutics (NTLA) in the sphere of gene editing.

This venture is pivotal. Such therapies have the potential to redefine medicine, offering transformative, perhaps even curative, treatments. Their adoption, however, comes with its fair share of challenges.

The industry's somewhat tentative approach towards gene editing, with a preference for licensing and equity stakes rather than outright acquisitions, underscores the nascent and experimental nature of this domain.

In conclusion, Regeneron Pharmaceuticals stands as an epitome of innovation and adaptability in the biotech sector. It amalgamates a rich history of achievements with an ambitious vision for the future.

As the company maneuvers through the intricate maze of opportunities and challenges that the 2020s present, investors ought to approach with both optimism and prudence. In a domain characterized by rapid advancements and uncertainties, Regeneron's journey offers valuable insights.

The upcoming years promise a blend of innovation, challenges, and milestones, and firms like Regeneron are poised to shape this narrative. I suggest you buy the dip.

Global Market Comments

August 24, 2023

Fiat Lux

Featured Trades:

(AN INSIDER’S GUIDE TO THE NEXT DECADE OF TECH INVESTMENT),

(AMZN), (AAPL), (NFLX), (AMD), (INTC), (TSLA), (GOOG), (META)

CLICK HERE to download today's position sheet.

(SUMMARY OF THE GREAT ROTATION – AUGUST 16, 2023 WEBINAR)

August 23, 2023

Hello everyone,

Webinar Title: The Great Rotation

Thursday, September 6: San Diego luncheon.

Performance: -4.70% MTD

Year to Date: 60.8%

Since inception: +657.99%

Trailing one-year return: +92.45%

Average annualized return: +48.15%

Method to My Madness

Rotation underway from Big Tech to industrials, commodities, and energy.

Tech sell-off should be brief/short-term.

Rising interest rate fears are pushing Bonds down.

The Fall may present an excellent window to buy stocks. Make sure precious metals and commodities are at the top of the “buy” list.

Be patient – wait for the set-up.

If you’re interested in SNOWFLAKE wait for a bigger dip.

John’s suggestion – buy TLT LEAPS at 90.

The Global Economy – Bouncing

Nonfarm Payroll drops to 187,000 in June. One year low.

Headline unemployment rate returned to 3.5% - a 50-year low.

Inflation jumps to 0.2% in July and 3.2% YOY.

Rents, education, and insurance (climate change) were higher while used cars were down 1.3% and air fares plunged by 8.1%.

PPI rose 0.3% in July.

Deflation hits China – economy struggling post-COVID.

Stocks – Correction Time

U.S. seeing big equity outflows. Approx. 15b fleeing the market. They believe the party is over for 2023.

Moody’s threatened downgrade of regional banks.

Albermark (ALB) to boost Lithium Production with a new filtering technology at an Arkansas plant to meet exploding demand from EV makers.

Berkshire Hathaway (BRKB) posts record profits up 38%.

Rivian (RIVN) beats, losing only $1.08 a share versus an expected $1.41.

Biden cracks down on tech.

Buy Adobe on dips.

Freeport McMoran (FCX) – looking like a great LEAPS trade at this level.

Keep buying Berkshire (BRKB) on dips.

Emerging Markets (EEM) strong buy here.

BONDS – Probing for a Bottom

The falling interest rates/rising bond prices are delayed after Fitch downgrade and hotter than expected economic growth at 2.40% for Q2.

U.S. Debt downgrade from AAA to AA+ by Fitch rating agency for only the second time in history.

Bonds (TLT) took a hit – but they are still the safest and most liquid investment in the world when held to expiration. Keep buying 90-day T-bills = 5.2% risk-free yield.

Still looking like 3.50% yield by the end of 2023.

Junk Bond ETFs (JNK) and (HYG) still holding up extremely well with a 6.5% yield.

According to John Bonds are still likely to hit $110 by year-end.

Foreign Currencies

Japanese Yen is headed for multi-year lows at 150.

Investors flee to safe-haven short-term investments.

Any strength in U.S.$ will be temporary.

Look for new dollar lows by the end of 2023.

Buy FXE, FXB, and FXA on dips. Avoid FXY.

Energy and Commodities – Reborn Again

Natural Gas soars to a new 2023 high and accomplished an upside breakout on all charts. European gas prices have just jumped 40%. An Australian strike shut down an LNG export facility.

Oil may break out to $100.

China expects LNG Price Spike later this year due to coming supply shortages and a recovering economy.

Exxon Mobile Corp. (XOM) –LEAPS territory.

Precious Metals – Take a Hit.

No Fed Action to lower rates undercuts precious metals. Interest rate rises in Europe and Australia aren’t helping either.

Gold is headed for $3000 by 2025.

New drivers are soon to be falling interest rates and the demise of crypto. Silver is the better play with a higher beta.

Russia and China are also stockpiling gold to sidestep international sanctions. A severe short squeeze in copper is developing, leading to a massive price spike later in 2023.

Real Estate – Coming Back

Home Mortgage rates hit a 22-year high at 7.24%. The existing home market and new home market is on fire in anticipation of the coming rate fall.

Rising rents still the big input into the Fed’s inflation calculation.

Case Shiller rose by 0.7% in May.

We are at the beginning of a decade-long demographic-driven bull market in residential real estate.

Economic growth and market performance should improve in 2023, but things may get worse before they get better. So, there may be some strong cross currents ahead.

Cheers,

Jacquie

Mad Hedge Technology Letter

August 23, 2023

Fiat Lux

Featured Trade:

(LOSING THE EDGE)

(PTON), (NVDA), (MSFT)

It’s looking like mission impossible for Peloton (PTON) who, if some might remember, was the darling of the lockdowns a few years ago.

This is really a story of making hay while the sun is shining because the sun has decided to tuck itself behind clouds indefinitely to the chagrin of PTON.

I have posted a few negative critiques of PTON because it’s accurate to distill the company down to an iPad on a stationary bike which charges for an expensive subscription.

The fact is once the world opened up, people stopped using PTON products and happily decided to go back to their old routines like visiting fully serviced gyms or exercising outside.

Even the consumers who decided to quit working out altogether are most likely traveling the world spending their PTON subscription money at a pizza joint in Italy.

The downdraft all came to a head today when PTON dropped yet another disastrous earnings report and their stock is down 23% at the time of this writing.

They whined about the decline in paying subscribers and said the cost of an equipment recall was denting its profit.

The fitness-equipment company cautioned that it expected to have negative cash flow in each of the next two quarters as it keeps fighting high inventory levels, and another sequential drop in subscribers.

Chief Executive Barry McCarthy played down the crashing stock price by explaining that the stock market isn’t in sync with the actual business and doubled down by emphasizing the company has its best days ahead of itself.

The New York company also said it is back to purchasing more bike and tread inventory, as it is in a more normalized inventory position than a year ago.

Peloton has struggled with its pricing strategy and recently further lowered the prices for its treadmill and rower by about 14% and 6%, respectively.

Peloton had told investors that it was looking to stem losses and start generating cash flow from its operations after slashing jobs and restructuring its business.

In the latest quarter, the company reported a negative cash flow of $74 million, weighed down by a legal settlement.

Peloton expects to end the September quarter with paying connected fitness subscribers of 2.95 million to 2.96 million, down from three million as of the end of the June quarter.

It has already received about 750,000 requests for replacement seat posts, ahead of internal expectations, and has been able to fulfill 340,000 of them.

Revenue for the fiscal fourth quarter ended June 30 fell 5% to $642.1 million.

Peloton’s average monthly connected fitness churn was 1.4% in the quarter, increasing from a 1.1% churn in the prior quarter, as a result of the company’s bike-seat-post recall.

This cautionary tale dovetails accurately with my wider thesis of smaller brand-named tech companies losing the war against the tech behemoths.

One little misstep and the inner problems are magnified and PTON has numerous issues under the hood of the car.

The CEO hyping up the company is a fool’s game because the writing is on the wall for this product.

There is no competitive advantage in their product and I believe subscriptions and hardware will continue to fall off a cliff.

Investors should head to higher water and look at premium names like Nvidia or Microsoft.

These types of companies possess strategic footholds in the leading technologies in the world and I can’t say the same for PTON.

PTON will continue to trend into the dustbin of history and don’t get fooled into this stock reversing any time soon.

Avoid this stock like the plague.

"The rich invest in time, the poor invest in money." – Said American Investor Warren Buffett

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.