When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

September 26, 2023

Fiat Lux

Featured Trade:

(I’M TAKING OFF FOR UKRAINE AND I NEED YOUR HELP)

(DIAMONDS ARE STILL AN INVESTOR’S BEST FRIEND),

(LAST CHANCE TO ATTEND THE FRIDAY, SEPTEMBER 29 ZERMATT, SWITZERLAND STRATEGY LUNCHEON)

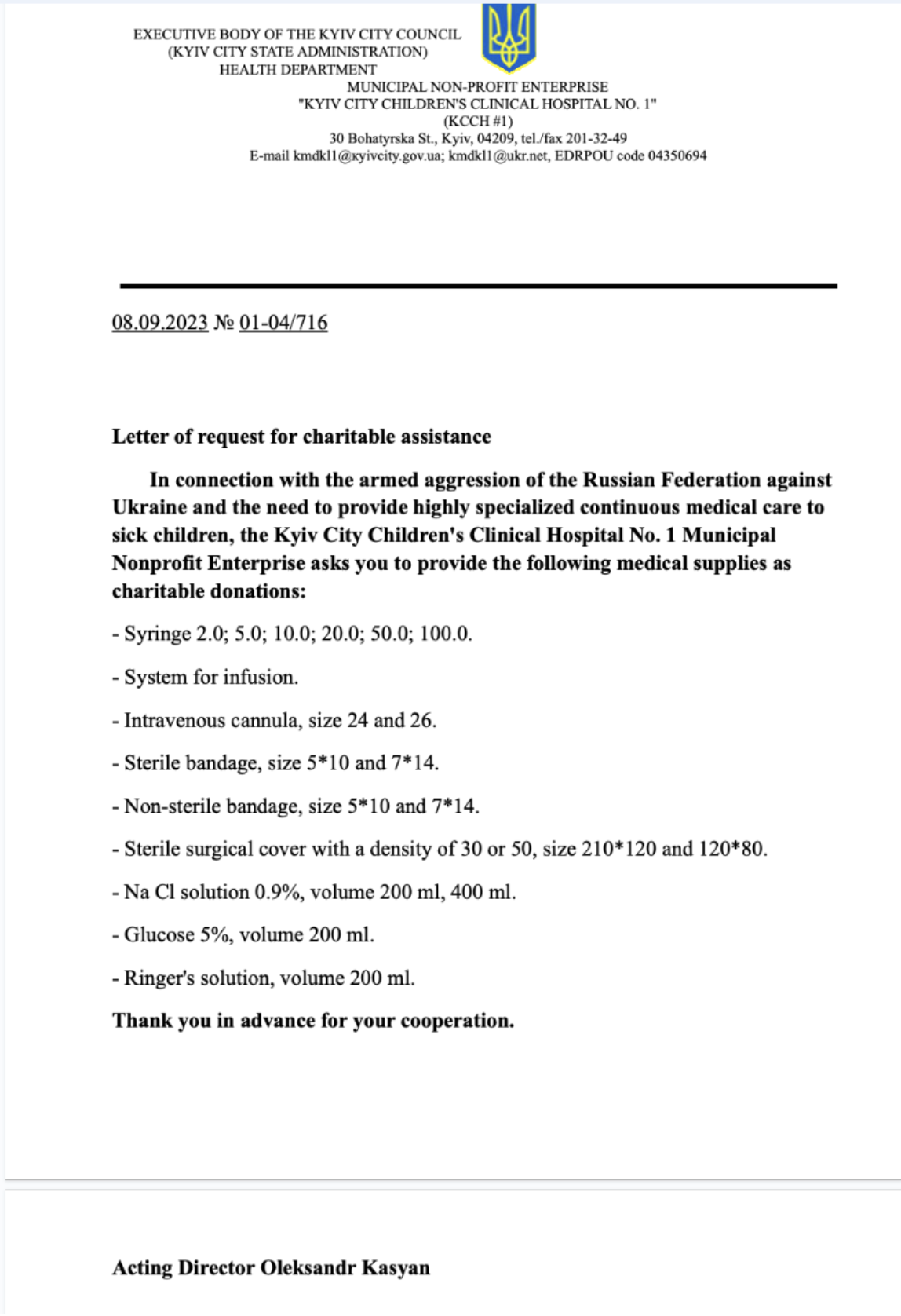

I’ll be escorting American doctors to hospitals and orphanages in embattled Kiev that are rapidly running out of resources. I’ll also be delivering desperately needed supplies that will be handed out after I conduct careful due diligence.

Included in my luggage will be a duffle bag of $10,000 in one-dollar bills. They don’t make change in Ukraine. To see a list of supplies requested please read the letter from the Kyiv City Children’s Hospital No.1 below.

It is in this light that I humbly request that you make a donation to this effort. If you can only afford $20 that’s fine, every little bit helps. If you have made over $1 million as a result of my services over the past year, and I know there are a lot of you, I hope for something more substantial.

Don’t worry about overhead costs. I’ll be covering the $20,000 cost in travel expenses out of my own pocket and donating my own time. The work is its own reward. Rest assured that 100 cents of every dollar you donate will end up on the desk of a hospital administrator in Ukraine.

I’ll be covering the financial markets as usual. The New York Stock Exchange doesn’t open until 5:30 PM Kiev time, so that frees me up during the day to perform my good deeds.

Don’t worry about me, I’ve had a lot of practice at this sort of thing. This is my eighth war (Algeria, Laos, Cambodia, Croatia, Slovenia, Iraq, Kuwait, and now Ukraine). It seems that the bullet with my name on it has never been cast and never will. In any case, with the level of gun violence in the US today, it’s probably safer for me in Ukraine than at home.

In order to make a donation for any amount. Please click here at https://ukraine.madhedgefundtrader.com

Thank you for your generosity.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

If you forgot to buy your loved one a birthday present and spent a week sleeping on the sofa, eating canned food, and cleaning out the cat box, you now have a chance to redeem yourself.

Diamond prices have just taken a steep plunge thanks to competition from the new artificial diamonds.

A revolutionary new way of selling diamonds is offered by Blue Nile (NILE) instantly becoming the 800-pound gorilla in the market.

The company cut costs by keeping inventories low, relying instead on a secretive web of anonymous suppliers. Now, second-generation entrants are snapping at its heels and eating its lunch with polished websites, better service, and lower prices, seducing potential customers with free diamond blogs.

Just for fun, I appraised the diamond I bought for my late wife, which I bought from a Hasidic Jew in an alley off of Manhattan’s West 47th Street. He kept his inventory hidden in an envelope in his sock. How times have changed! The two-carat, VVS1, round-cut diamond that I paid $3,000 for in 1977, would fetch $39,800 today. Great trade!

In fact, the $95 billion a year diamond industry is undergoing radical change by moving online, much the same way as the book, music, and travel industries have gone. Your local neighborhood jewelry store is about to get wiped out or become a quaint relic. As a result, global diamond sales are expected to reach $140 billion by 2030.

The US accounts for about half the world market, so the new frugality will be a challenge. That will be offset by flight to safety purchases by inflation wary Americans, and new demand from the emerging market middle class.

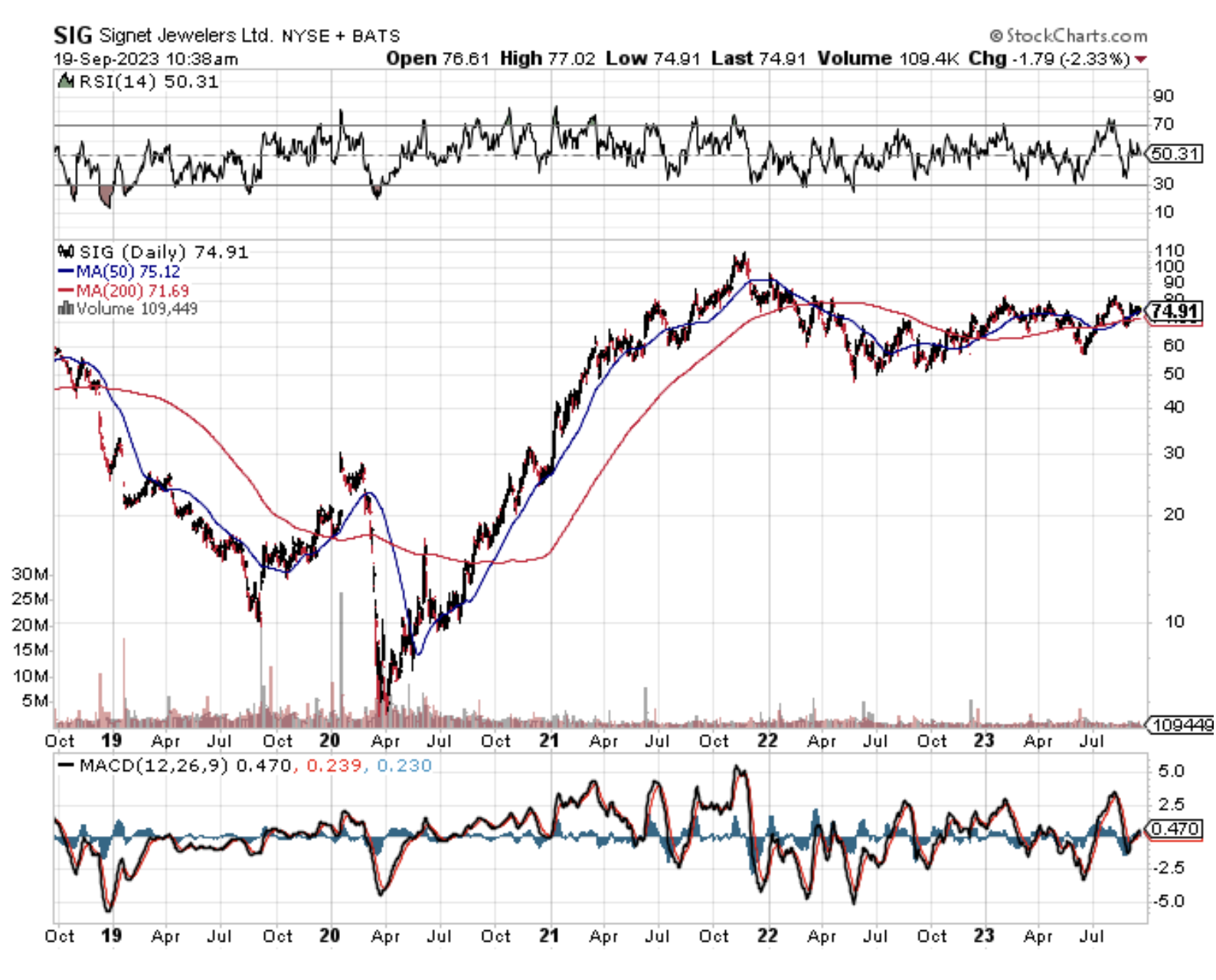

Blue Nile was founded in 1999. It is based in Seattle, Washington. In February 2017, it became a subsidiary of Bain Capital. In 2022, Blue Nile was acquired by Signet Jewelers (SIG), which has seen its stock nearly double from the June lows.

Investment-grade diamonds have been steady earners, gaining an average of 5% a year over the last four decades. To avoid another week on the sofa, you might even think about buying next year’s Valentine’s surprise early.

Like now.

Come join me for the Mad Hedge Fund Trader’s Global Strategy Luncheon, which I will be conducting high in the Alps in Zermatt, Switzerland. The event begins at 12:00 noon on Friday, September 29, 2023.

A three-course meal will be provided and there will be an open discussion on the crucial issues facing investors today will take place. You are welcome to attend in your mountain climbing gear, if necessary. One year, a guest descended from the Matterhorn summit to attend.

I’ll be giving you my up-to-date view on stocks, bonds, foreign currencies, commodities, precious metals, energy, and real estate. And to keep you in suspense, I’ll be throwing a few surprises out there too. Tickets are available for $277.

I’ll be arriving early and leaving late in case anyone wants to have a one-on-one discussion, or just sit around and chew the fat about the financial markets.

The event will be held at a central Zermatt hotel, the details of which will be emailed directly to you with your confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please the BUY NOW! button above or click here.

(AUSTRALIAN RESEARCH IS UNLOCKING THE ENERGY OF THE STARS)

September 25, 2023

Hello everyone.

Students at a leading university in Australia are building a device capable of nuclear fusion – the process that powers stars and could unlock enormous amounts of carbon-free energy on Earth.

The magnet-powered, doughnut-shaped “tokamak” machine will be the first nuclear fusion device designed and built by students and will drive experiments aimed at bringing fusion to a commercial reality. The students will conduct experiments on superheated plasma with the machine to help industry partners accelerate fusion research. One focus will be how the machines handle plasma flares.

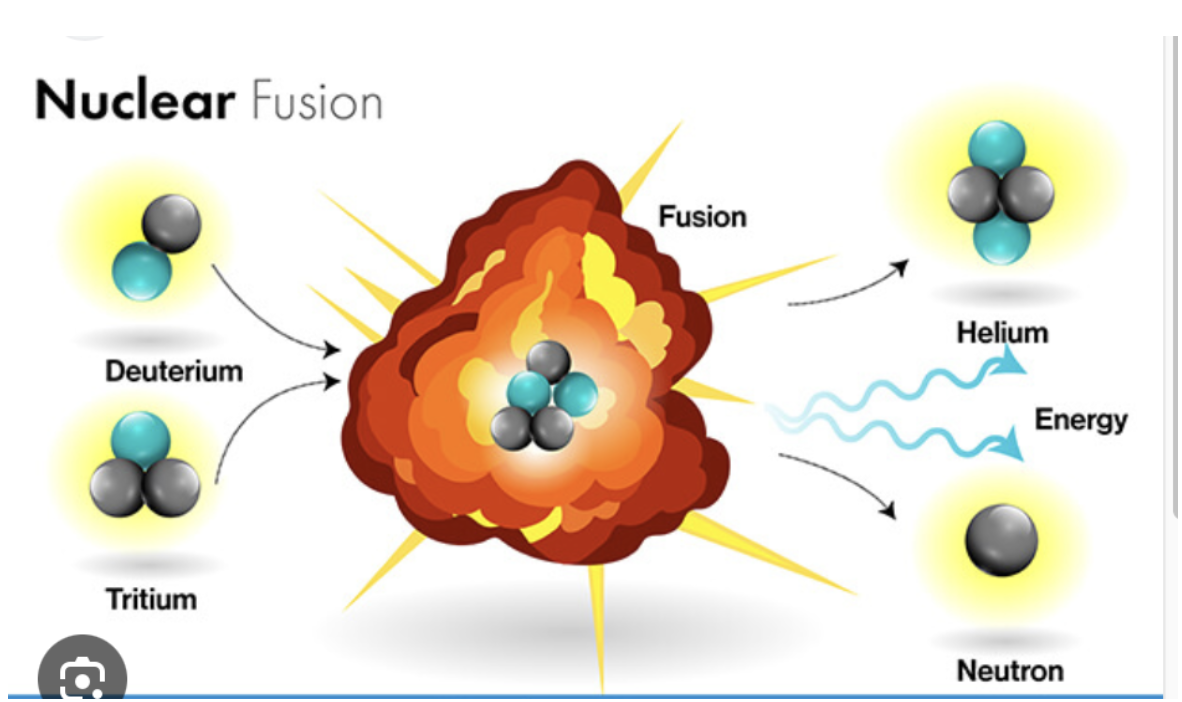

Fusion unleashes four million times the energy of coal, uses hydrogen as fuel, is regarded as safer than fission reactors and produces far less radioactive waste.

Nuclear fusion is the opposite of fission, which powers current reactors by splitting uranium atoms to unleash heat and radiation.

Fusion forces two atomic nuclei together instead. The atoms merge and become a different element, and the leftover atomic mass converts to astronomical amounts of energy.

It’s the same reaction that erupts in the sun’s core. In essence, nuclear fusion would bottle the power of a star.

Merging two atoms is difficult because the positive nuclei repel each other, like the same end of two magnets. The crushing gravity and immense heat of stars overcomes this repulsion and forces atoms to fuse.

A tokamak achieves fusion with magnets that whip hydrogen plasma (a charged gas) around a circular vessel and heat the gas to between 100 and 300 million degrees.

With experiments well under way, the next step will be to engineer the hardware that can maintain constant, safe, commercially viable fusion power that makes up for the massive amounts of energy used to blast a laser or fire up a tokamak. The target is to achieve 500 to 1000% more energy.

Experts say the technology won’t be developed quickly enough to help decarbonize energy grids and stop the climate crisis. Nonetheless, fusion energy could define how we power civilisation in the second half of this century. Most experts expect the technology to become commercially viable in 15-20 years.

There are endless possibilities with this technology. We need to prepare ourselves for a new nuclear society.

Nuclear fusion could transform our world as early as 2030 if research and funding are poured into this area.

A happy week to you all.

Cheers

Jacquie

(NVDA), (AAPL), (U), (S), (GOOGL), (MSFT), (AMZN)

In the technology sector, a continually advancing influence creates significant impacts on the stock market—a domain characterized by dynamic shifts and projections that feel almost sentient.

AI is the driving force behind these notable shifts. This era, heralded by the transformative potential of this emerging technology, serves as a lighthouse, illuminating the seemingly endless possibilities and evolving the very fabric of our economic ecosystem.

The stock market has long been a space of unpredictability, characterized by its erratic fluctuations and complex patterns. However, advancements in AI are progressively decoding these intricate layers, bringing clarity and foresight into market behaviors.

So far, NVIDIA (NVDA) is one of the pivotal figures in this technological evolution.

Recognized as the “Godfather of AI,” the company’s staggering success in the first and second quarters has catapulted its market value to an astonishing $1.17 trillion, a monumental leap from its previous $760 billion.

Such a crescendo mirrors the immense potential of AI, rendering it the quintessential harbinger of a new epoch. In this symphonic realm, a fervor for this emerging technology entices other big names in the industry, steering historic rallies.

Aside from NVIDIA, the excitement surrounding AI has also driven other tech giants like Apple (AAPL) over the $3 trillion mark and contributed to the Nasdaq Composite's historic rally, resulting in its most successful first half of the year with a 40%-plus year-to-date gain.

Needless to say, AI has proven not just to be a passing melody but rather a transformative beginning that outlines the future of businesses and consumer landscapes. This change in the financial tune surpasses previous predictions, indicating a harmonious rise in worldwide investments in AI.

In fact, global spending on AI has exceeded initial forecasts, surpassing the predicted $300 billion. The growth rate for AI-centric systems is projected at 27% from 2022 to 2026, with AI expenditures representing a substantial 25% share in 2023.

Notably, the rising notes of this symphonic evolution are not confined to technological giants; they expand, embracing companies like Unity Software Inc. (U) and SentinelOne (S), each contributing a unique rhythm to the AI concerto.

Unity Software, with its $14.58 billion market capitalization, is providing a multifaceted platform focused on immersive, real-time 3D tools and services. It has fostered collaborations with tech giants like Google (GOOGL), Microsoft (MSFT), and Amazon (AMZN). Meanwhile, its recent collaboration with Apple’s Vision Pro headset is anticipated to catalyze innovative endeavors in AI.

SentinelOne, on the other hand, with a market capitalization of $5.22 billion, is scripting a new narrative in cybersecurity, emphasizing autonomous technology and real-time AI-powered enterprise threat prevention, detection, and response. While the AI landscape is filled with innovations by newcomers, potential regulatory impediments and risks play a role in this ever-evolving symphony.

However, like every innovative field, AI also has its highs and lows.

The skyrocketing growth and exhilarating rallies in AI are interlaced with inherent risks, encapsulating volatile price swings, fluctuating interest rates, and potential regulatory barricades. The intricate interplay between investment prices and their underlying values is generating apprehensions regarding a potential bubble in the sector.

The recently introduced Digital Markets Act by the European Commission also highlights the complexities and potential regulatory challenges intrinsic to AI.

Still, the future is exciting. AI's convergence with industries creates a contrasting yet harmonious tomorrow for human intelligence.

The combination of human intelligence and machine learning is creating innovative solutions across various industries, leading to improved efficiency and reduced costs, especially in today's tight job market. The exciting intersection of AI and the technology sector is highlighted by analysts raising their estimates in the past 90 days, indicating that it is a promising avenue for significant returns. As the journey of AI comes to an end, it is evident that it is a continuous process of number-crunching, producing melodious tunes of progress and innovation.

The continuous advancement of technology and market phenomena is not just an arrangement of numbers but rather a symphony of progress. AI is the transformative potential that weaves patterns of progress in this grand tapestry of economic evolution, sculpting a glorious future with unparalleled eloquence and harmony.

The influence of AI is not fleeting but is a transformative force, impacting various sectors and molding our world, representing a seamless integration of intelligence and innovation. It reverberates through every industry, shaping our world in its melody, and creates a harmonious confluence of intelligence and innovation.

Mad Hedge Technology Letter

September 25, 2023

Fiat Lux

Featured Trade:

(JOSTLING FOR THE FUTURE OF TECH)

(AMZN), (ANTHROPIC), (CRM), (MSFT)

Amazon AMZN will invest $4 billion in artificial intelligence company Anthropic.

This is a company competing with ChatGPT.

It’s just another chess move in what could symbolize as the beginning of the war in generative artificial intelligence.

I do believe this could be the last iteration of the internet as humans know it because the next big “upgrade” will be uploaded into the physical human itself.

That is what developments in companies like Neuralink are telling us.

It’s not surprising that many of the big tech firms are taking strategic bets on the future of artificial intelligence.

This trend mirrors the past seminal trends where the end game turns into a winner-takes-all sweepstakes.

I am not going to sit here and say this will be better for the consumer on the internet as a whole, it mostly won’t.

This next iteration of the internet will become cloudier because consumers won’t know who is a chatbot and who isn’t.

The critical takeaway here is that the internet will become less smooth for consumers, but absolutely great for the few technology firms that harness generative artificial intelligence to build revenue.

Even chatbots are on record for not knowing who is a chatbot or who is a human.

What does that mean?

Soon, we will see chatbots talking to chatbots for money.

No humans needed.

In this case, big tech earnings revenue for their chatbot capabilities will explode and the ones that do it best with harvest the most contracts.

That is terrible for certain platforms that rely on authentic human interaction like online dating.

For some subsectors like cybersecurity, computers will be fighting computers and whoever has the best AI software will win out.

Amazon now has real skin in the game and the deal includes Anthropic using its custom chips to build and deploy its AI software.

Amazon also agreed to incorporate Anthropic’s technology into products across its business.

People familiar with the deal said Amazon has committed to an initial $1.25 billion investment in two-year-old Anthropic, a number that could grow to $4 billion over time depending on certain conditions.

This is peanuts for a company as rich as Amazon.

Google invested more than $300 million in Anthropic in May. Salesforce (CRM) has also invested in a series of AI startups, including Anthropic and OpenAI rival Cohere.

Amazon, which runs the largest cloud-computing business, has been shifting its strategy somewhat in backing AI startups.

Large language models, the algorithms that power chatbots such as ChatGPT require huge amounts of capital to build and train, and startups spend that money largely on cloud-computing costs. Of the billions of dollars that OpenAI has raised from Microsoft (MSFT), much of it has been spent on the tech giant’s AI business Azure.

Despite the excitement and investment in AI, it still makes up only a fraction of the revenue flowing into cloud-computing businesses.

All this is right now is positioning as the real revenue payout is much later down the road and I am talking years.

Whoever acquires the best pieces of the AI infrastructure now and sets the rules of the road, will basically box out everyone else.

Amazon has now clearly thrown their hat in the ring.

Trade AMZN in the short-term and hold for the long-term.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.