It’s very relaxing writing here in West London, recovering from my injuries.

No air raid alerts, no incoming missiles, no heavy artillery. The people you encounter are upbeat and optimistic, not haggard, sleep-deprived, and war-weary. I just knock out a newsletter and then head for the King’s Head for a pint of Guinness and a fish and chips.

What can be better than that?

With stocks holding up relatively well and bonds in free fall, valuations have befuddled and confused analysts, as well as sent them running for their history books. For the market as a whole, the price earnings yield for stocks how of bonds has dropped to zero for the first time in history. Both are at 5%.

With big tech share prices maintaining flatlines worst case and edging up best case, the debate has reignited as to how expensive these companies can get. The price earnings ratio for the Magnificent Seven has leapt from 29 to 45 this year.

There is an explanation for all of this.

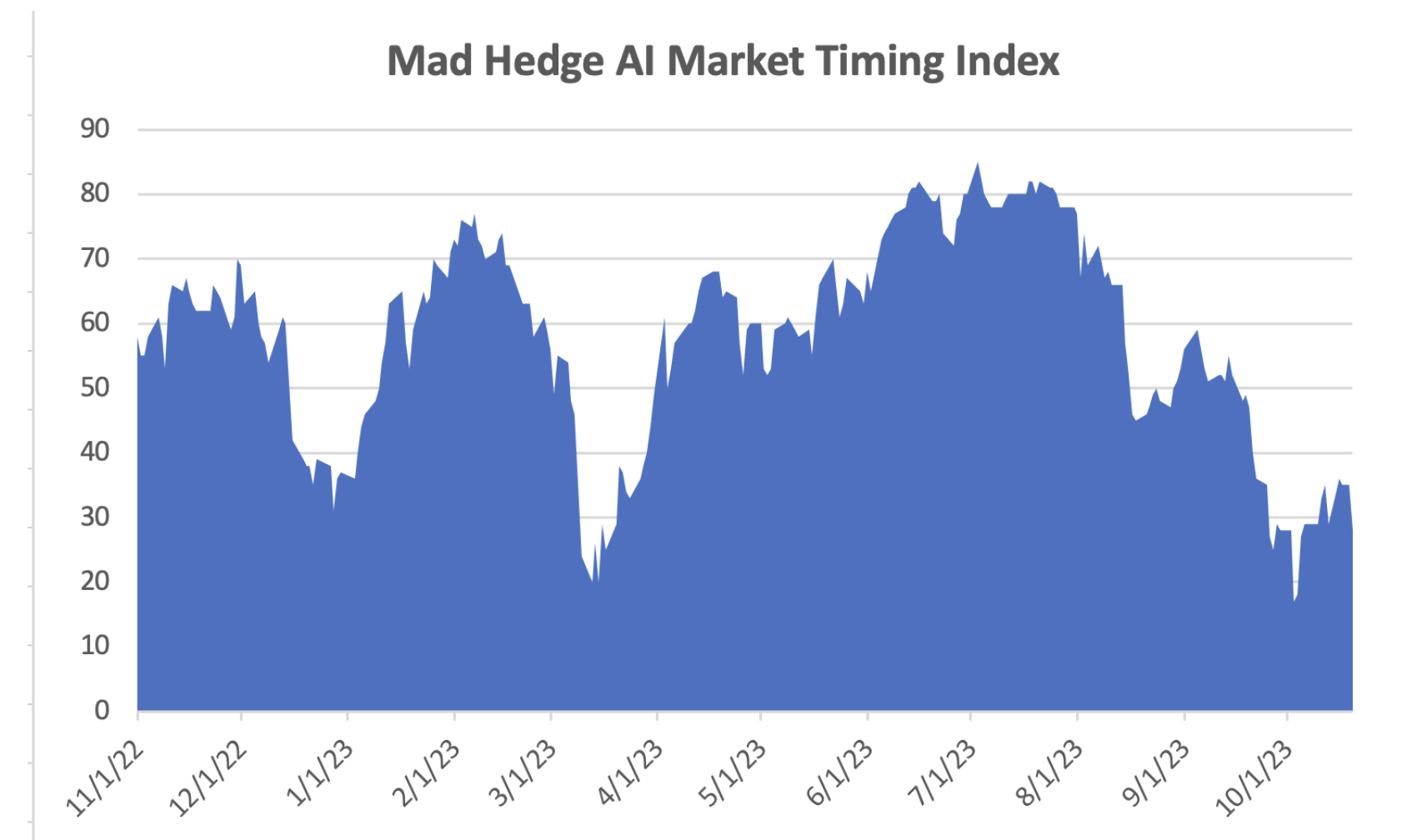

The bottom line is that as long as the economy holds up, so will markets. The US has the only strong major economy in the world, held up by accelerating tech and AI.

That explains why even after a traumatic 2.4% drop in the S&P 500, the Volatility Index has only made it up to 21%. The first read on Q3 GDP is out on Thursday and the consensus forecast at 3.3%, or about the long-term average growth rate for the postwar US economy. The Atlanta Fed has Q3 growth as high as 5.4%.

So the growth is there.

All we need now is for bond yields to find their peak. Then we will be in for the yearend rally we have all been waiting for. From that point, you will want to own companies that suffer from rising interest rates. They will see explosive moves and the list is long.

I was walking down one of London’s cobble-stoned lanes the other day when a motorcycle passed by and backfired. I hit the ground, expecting an imminent missile strike. Passerbyes stared at me in awe, thinking an old man just suffered a massive heart attack. I simply got up, brushed myself off, and walked away.

It takes longer to leave a war than I thought.

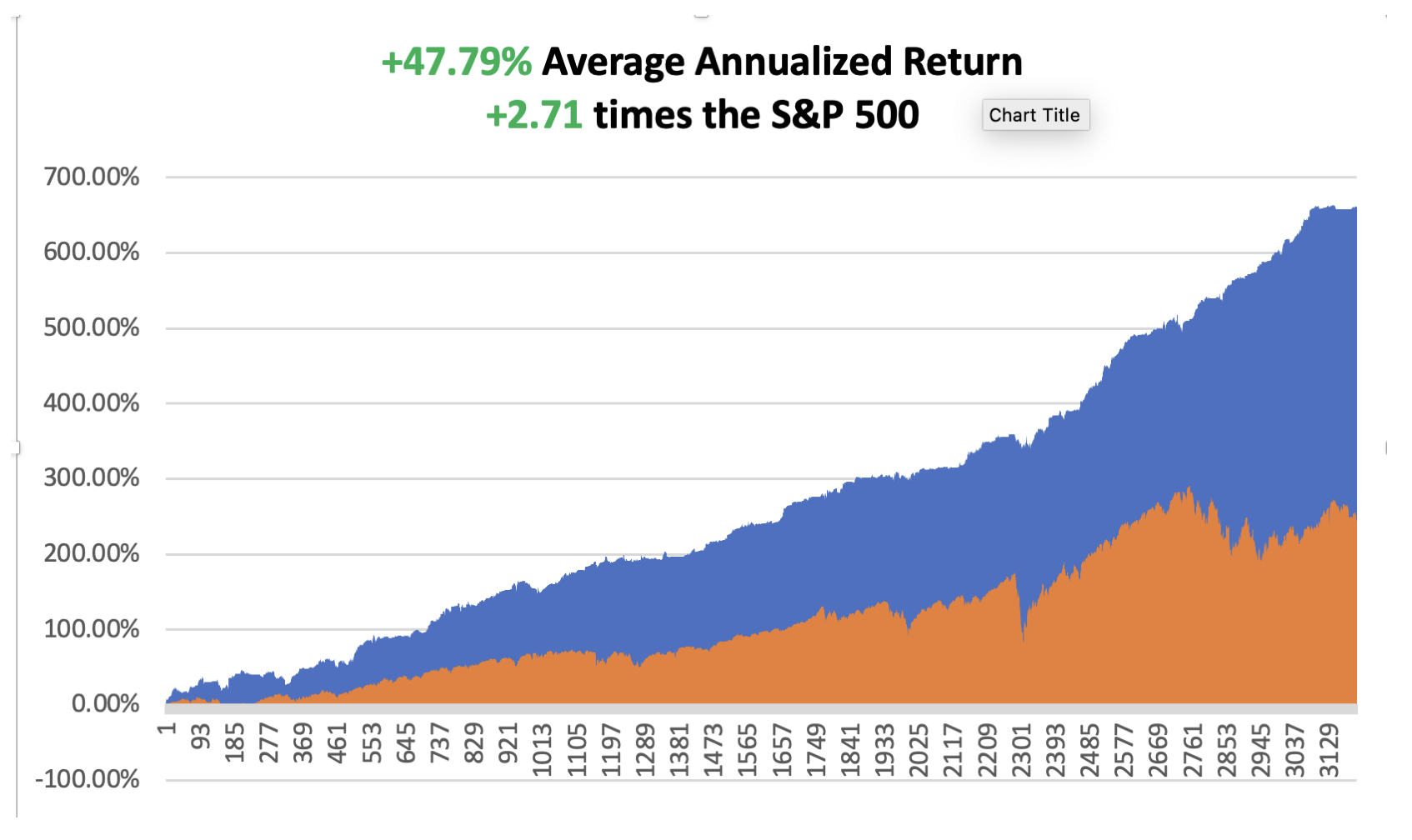

So far in October, we are up +3.14%. My 2023 year-to-date performance is still at an eye-popping +63.94%. The S&P 500 (SPY) is up +10.79% so far in 2023. My trailing one-year return reached +71.56% versus +22.90% for the S&P 500.

That brings my 15-year total return to +661.13%. My average annualized return has returned to +47.79%, another new high, some 2.71 times the S&P 500 over the same period. A short in the bond market was a big help and long positions in Tesla and NVIDIA expired at max profit.

Some 41 of my 46 trades this year have been profitable.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. The economy decarbonizing and technology hyper-accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, October 23, at 8:30 AM EST, the Chicago Fed National Activity Index is out.

On Tuesday, October 24 at 8:30 AM, the S&P Global Flash PMI is released.

On Wednesday, October 25 at 2:30 PM, the New Home Sales are published.

On Thursday, October 26 at 8:30 AM, the Weekly Jobless Claims are announced. The US GDP Growth Rate is revised.

On Friday, October 27 at 8:30 AM, Personal Income & Spending are published. At 2:00 PM the Baker Hughes Rig Count is printed.

As for me, you know you’re headed into a war zone the moment you board the train in Krakow, Poland. There are only women and children headed for Kiev, plus a few old men like me. Men of military age have been barred from leaving the country. That leaves about 8 million to travel to Ukraine from Western Europe to visit spouses and loved ones.

After a 15-hour train ride, I arrived at Kiev’s Art Deco station. I was met by my translator and guide, Alicia, who escorted me to the city’s finest hotel, the Premier Palace on T. Shevchenka Blvd. The hotel, built in 1909, is an important historic site as it was where the Czarist general surrendered Kiev to the Bolsheviks in 1919. No one in the hotel could tell me what happened to the general afterwards.

Staying in the best hotel in a city run by Oligarchs does have its distractions. That’s to the war occupancy was about 10%. That didn’t keep away four heavily armed bodyguards from the lobby 24/7. Breakfast was well populated by foreign arms merchants. And for some reason, there were always a lot of beautiful women hanging around.

The population is definitely getting war-weary. Nightly air raids across the country and constant bombings take their emotional toll. Kiev’s Metro system is the world’s deepest and at two cents a ride the cheapest. It where the government set up during the early days of the war. They perform a dual function as bomb shelters when the missiles become particularly heavy.

My Look Out Ukraine has duly announced every incoming Russian missile and its targeted neighborhood. The buzzing app kept me awake at night so I turned it off. The missiles themselves were nowhere near as noisy.

The sound of the attacks was unmistakable. The anti-aircraft drones started with a pop, pop, pop until they hit a big 1,000-pound incoming Russian cruise missile, then you heard a big kaboom! Disarmed missiles that were duds are placed all over the city and are amply decorated with colorful comments about Putin.

The extent of the Russian scourge has been breathtaking with an an epic resource grab. The most important resource is people to make up for a Russian population growth that has been plunging for decades. The Russians depopulated their occupied territory, sending adults to Siberia and children to orphanages to turn them into Russians. If this all sounds medieval, it is. Some 19,000 Ukrainian children have gone missing since the war started.

Everyone has their own atrocity story, most too gruesome to repeat here. Suffice it to say that every Ukrainian knows these stories and will fight to the death to avoid the unthinkable happening to them.

It will be a long war.

Touring the children’s hospital in Kiev is one of the toughest jobs I've ever undertaken. Kids are there shredded by shrapnel, crushed by falling walls, and newly orphaned. I did what I could to deliver advanced technology, but their medical system is so backward, maybe 30 years behind our own, that it couldn’t be employed. Still, the few smiles I was able to inspire made the trip worth it.

The hospital is also taking the overflow of patients from the military hospitals. One foreign volunteer from Sweden was severely banged up, a mortar shell landing yards behind him. He had enough shrapnel in him to light up an ultrasound and had already been undergoing operations for months.

To get to the heavy fighting, I had to take another train ride a further 15 hours east. You really get a sense of how far Hitler overreached in Russia in WWII. After traveling by train for 30 hours to get to Kherson, Stalingrad, where the German tide was turned, is another 700 miles east!

I shared a cabin with Oleg, a man of about 50 who ran a car rental business in Kiev with 200 vehicles. When the invasion started, he abandoned the business and fled the country with his family because they had three military-aged sons. He now works a minimum wage job in Norway and never expects to do better.

What the West doesn’t understand is that Ukraine is not only fighting the Russians but a Great Depression as well. Some tens of thousands of businesses have gone under because people save during war and also because 20% of their customer base has fled.

I visited several villages where the inhabitants had been completely wiped out. Only their pet dogs remained alive, which roved in feral starving packs. For this reason, my major issued me my own AK47. Seeing me heavily armed also gave the peasants a greater sense of security.

It’s been a long time since I’ve held an AK, which is a marvelous weapon. But it’s like riding a bicycle. Once you learn, you never forget.

I’ve covered a lot of wars in my lifetime, but this is the first fought by Millennials. They post their kills on their Facebook pages. Every army unit has a GoFundMe account where donors can buy them drones, mine sweepers, and other equipment.

Everyone is on their smartphones all day long killing time and units receive orders this way. But go too close to the front and the Russians will track your signal and call in an artillery strike. The army had to ban new Facebook postings from the front for his exact reason.

Ukraine has been rightly criticized for rampant corruption which dates back to the Soviet era. Several ministers were rightly fired for skimming off government arms contracts to deal with this. When I tried to give $3,000 to the Children’s Hospital, they refused to take it. They insisted I send a wire transfer to a dedicated account to create a paper trail and avoid sticky fingers.

I will recall more memories from my war in Ukraine in future letters, but only if I have the heart to do so. They will also be permanently posted on the home page at www.madhedfefundtrader.com under the tab “War Diary”.

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader