Venture capitalist Marc Andreessen posted a manifesto, calling for “techno-optimism” and delivered quite a few bizarre ideas all under the idea that “we are being lied to.”

He starts out his rant by playing the victim as a man whose net worth has surged to around $2 billion and he also doesn’t tell us who is lying to us.

He articulates to his audience that “we are told that technology takes our jobs, reduces our wages, increases inequality, threatens our health, ruins the environment, degrades our society, corrupts our children, impairs our humanity, threatens our future, and is ever on the verge of ruining everything.”

That is quite the doomsday prognosis of technology and sounds like someone who spends too much time watching TikTok videos.

I believe that most US consumers have some idea that technology can be divided into the good, the bad, and the ugly.

Painting the concept of technology as all bad or all good is an attempt to play up the drama of his blog which isn’t quite dramatic.

One of the biggest takeaways from his blog is that Mr. Horowitz has minimal opportunities to communicate with normal American people and because of that, he doesn’t understand what is considered common sense.

Living in a bubble can be dangerous and group think becomes entrenches with the same narrow opinions swiftly rotating through a tight knit circle.

Laughably, Horowitz tries to take the moral high ground saying that “we believe that advancing technology is one of the most virtuous things that we can do.”

I believe he is only saying that because he will have skin in the game and if technology equals high morality, then it would be impossible for a man like Horowitz, in his position, to not double or quadruple his net wealth.

He even double downs on the moral high ground position by giving us a blockbuster quote of “we believe Artificial Intelligence can save lives.”

He, again, paints a sub-sector of technology into a save lives or die proposition.

Technology is more nuanced and it’s blatantly obvious that he is attempting to skew the narrative in which he sees fit so it benefits him.

Horowitz intentionally skips the possibility that AI could be used to kill people out of malice in terms of drones, killer robots, autonomous weapons, nuclear bombs, hypersonic missiles.

He arrives at the conclusion that “the only perpetual source of growth is technology.” Thus, we need this only perpetual growth to makes peoples likes better.

This quote only sounds like he is wants the world to believe that the world cannot function without him and his huge ego.

My opinion is that many of these billionaires have lost the real pulse of the nation and are living too much in an alternative reality that are occupied by other billionaires and their consensus ideas.

This blog almost sounded like a real estate agent telling a buyer that it is a great time to buy a house, even with 10, 20, 30% mortgage rates.

I do believe that technologists like him will never be able to re-establish the moral high ground for at least 2 or 3 generations.

The whole Facebook (META) connecting the world marketing ploy and Airbnb (ABNB) live next to your neighbor because we are all buddy buddy is gone and won’t come back soon.

Selling hopium is old news and I don’t believe the same guys who profited from Facebook will lead the technology innovation races in the next round.

The quality of their ideas has deteriorated and it’s clear that leading technologies like the iPhone is on its last legs.

This manifesto screams desperation. It’s also interesting that he didn’t even mention crypto which he’s a huge investor in.

It’s even more interesting that he is calling for no regulations on technology in which crypto would massively benefits. He intentionally stays away from that central topic.

Technology needs to be re-imagined and by a new set of fresh blood. The old guard has become stale and this manifesto is proof of their desperation that it might be hard for their old ideas to become accepted in a rapidly changing world. They want the era of zero rates to never end.

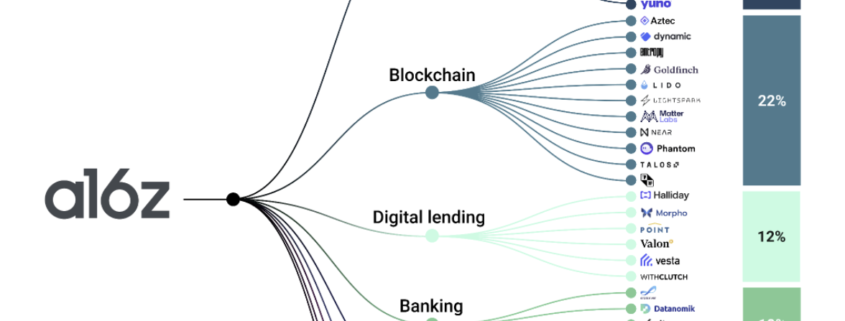

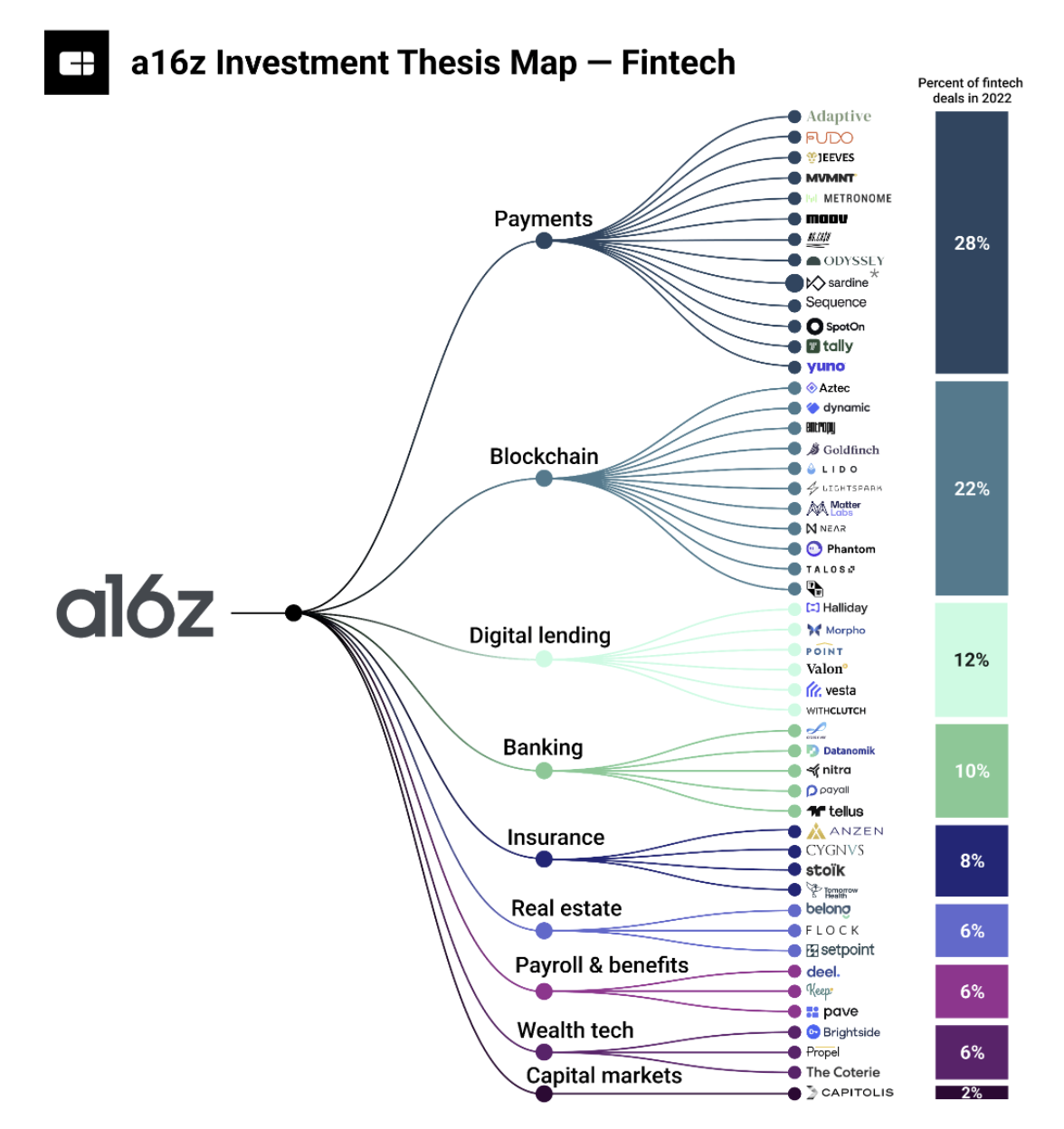

Andreessen Horowitz investments