When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Technology Letter

November 13, 2023

Fiat Lux

Featured Trade:

(RIDE THE NVIDIA AND AMD ROLLER COASTER)

(NVDA), (AMD), (ORCL), (GOOGL), (AMZN)

It’s scary when the best chip company in the world rolls out new products.

It’s scary because others can’t compete and they get left further behind.

It’s scary because the high level of technology facilitates another new wave of technological expertise in other companies from the software and hardware side.

These new products are almost always faster, more efficient, and better than the previous products catalyzing a snowball effect that lifts everybody’s revenue.

This type of outstanding performance of late is the reason that made Nvidia (NVDA) into the world’s most valuable chipmaker and they have announced they are updating its H100 artificial intelligence processor, adding more capabilities to a product that has fueled its dominance in the AI computing market.

The new model, called the H200, will get the ability to use high-bandwidth memory, or HBM3e, allowing it to better cope with the large data sets needed for developing and implementing AI.

Amazon’s AWS, Alphabet’s Google (GOOGL) Cloud and Oracle’s (ORCL) Cloud Infrastructure have all committed to using the new chip starting next year.

Winning orders is easy with the outsized brand recognition and type of game changing product on offer.

The current version of the Nvidia processor is already experiencing accelerated demand.

But the product is facing stiffer competition: Advanced Micro Devices (AMD) is bringing its rival MI300 chip to market in the fourth quarter, and Intel Corp. claims that its Gaudi 2 model is faster than the H100.

AMD is another chip company that readers should feel comfortable diversifying into if they don’t feel comfortable putting all eggs into the Nvidia basket.

AMD’s stock is surging towards old highs around $125 and should overtake that soon after the nice rally in the 2nd half of the year.

With the new product, Nvidia is trying to keep up with the size of data sets used to create AI models and services.

Adding the enhanced memory capability will make the H200 much faster at bombarding software synthesizing data.

Large computer makers and cloud service providers are expected to start using the H200 in the second quarter of 2024.

Nvidia got its start making graphics cards for gamers, but its powerful processors have now won a following among data center operators.

That division has gone from being a side business to the company’s biggest moneymaker in less than five years.

Nvidia’s graphics chips helped pioneer an approach called parallel computing, where a massive number of relatively simple calculations are handled at the same time.

That’s allowed it win major orders from data center companies, at the expense of traditional processors supplied by Intel.

The growth helped turn Nvidia into the poster child for AI computing earlier this year — and sent its market valuation soaring.

Nvidia is like a freight train that has left the station.

The stock is up 9 straight days as we cruise into its earnings report on November 21st.

It’s hard to see this earnings report being nothing short of spectacular and Nvidia have become famous for forecasting the unthinkable.

They then go and surpass a high bar and push the envelope further so it’s not a bad idea to buy NVDA before the earnings report.

The speed at which they come out with products is astounding and now being able to boast the best server chip in the tech enterprise community, it just represents yet another powerful part of their stunning array of tech arsenal.

$600 per share is a no-brainer for Nvidia and that will be surpassed in 2024.

“If you don’t understand the details of your business you are going to fail.” – Said Founder and CEO of Jeff Bezos

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

(WHICH NOISE IS THE MARKET LISTENING TO: WARS IN EUROPE & THE MIDDLE EAST OR THE RECESSION DRUMS?)

November 13, 2023

Hello everyone,

Welcome to Monday.

It’s another earnings week, but this time much of the focus will be on retail.

Among the companies scheduled to post their earnings are Target, Walmart, and Home Depot.

The third-quarter earnings season has mostly exceeded expectations. More than 90% of S&P companies have already reported. Of those names, 80% have posted better-than-forecast results.

The earnings/economic agenda for this week:

Monday, November 13, 2023

Australia Consumer Confidence chg.

Previous: 2.9%

Time: 6:30 pm ET

Tuesday, November 14, 2023

Home Depot

Time: before the open

Nu Holdings

US Core Inflation Rate

Previous: 4.1%

Time: 8:30 am ET

Wednesday November 15, 2023

Target

Time: premarket

Palo Alto Networks

Time: after the close

UK Inflation Rate

Previous: 6.7%

Thursday November 16, 2023

US Export Prices

Previous: 0.7%

Time: 8:30 am ET

Walmart

Time: premarket

Friday, November 17, 2023

UK Retail Sales

Previous: -0.9%

Time: 2:00 am ET

Trade Idea: Palo Alto Networks (PANW) $253.51

(Stand aside if you don’t wish to trade during earnings.)

You can choose to trade the short-term trade or the long-term trade or skip the trade completely.

Last quarter: PANW posted earnings that exceeded analyst expectations, sending the stock higher.

This quarter: FactSet data shows analysts expect the network company’s earnings to have jumped 40% year over year. The company has surged 81% this year. History shows that PANW beats earnings estimates 93% of the time, per Bespoke data. The stock also does well on earnings days, averaging a 2.1% gain.

Palo Alto Networks (PANW)

The company has been rapidly introducing new products – 74 in fiscal 2023.

PANW has an 11.22% upside potential based on the analysts’ average price target.

Consensus rating of Strong Buy which is based on 33 buy ratings.

The company has grown sales at an incredible rate over the last 10 years and is expected to maintain strong continued growth.

Trade Idea – PANW $253.51

1/

Buy 1 Dec 15, 2023, PANW 250 call.

Sell 1 Dec 15, 2023, PANW 260 call.

Net Debit: $5.00

Max Profit: $500

Don’t pay more than $5.15.

2/

(Aggressive – 2024 out of the money position)

Buy 1 June 21, 2024, PANW 260 out of the money call.

Sell 1 June 21, 2024, PANW 270 out of the money call.

Net debit @ $4.60.

Max Profit: $540

Max Loss: 460

Don’t pay any more than $4.80.

Keep in mind that these figures may have moved a lot by the time you receive this trade idea. Do your trade research and make sure the risk/reward is in your favor. Also remember if the market pulls back, you may get a better price/entry point.

Update on the market:

S&P 500

The market has rallied nicely. From an Elliott Wave perspective after undergoing a Wave 4 correction, the market is undergoing a climatic 5th Wave advance onto the 4,700’s over coming weeks. The recent rally from the October 27th low of 4,104 is now overbought and any break of 4,350 area would likely trigger a corrective reaction back toward the mid-200’s, before the uptrend resumes.

Gold

Gold’s daily chart shows a developing 5-month inverse head and shoulders continuation pattern. Support lies at around $1910 ($1890 max) for a rally toward key $2,009 resistance (Oct. 27 high). Sustained break above $2,009 will yield an upside target of around $2,200 over the coming weeks/months.

Brent Crude Oil

Resistance is in focus. Unless Brent can clear $84.00 resistance, greater emphasis will be placed on Crude’s classical charting structure, which shows a completed 3-month head and shoulders reversal pattern, with a downside target of around $70.00.

Bitcoin

For all the crypto fans out there, here are my ideas about Bitcoin.

Bitcoin is in a bullish wave structure and could target $40,000/$43,000 over the coming weeks. Support lies around $36,000. My advice would be to take all or some profits as we get toward the 40k handle. After that target has been reached Bitcoin could slide down into the mid-teens – around $16,000.

What’s going on with Oil?

Oil has taken a pounding in the last few weeks. Brent crude was down 3.7% last week and WTI futures lost nearly 4%. These moves come during a shift in focus from immediate fears of the broader Middle East war to worries that the global economy is on the verge of a slowdown. (The stock market obviously didn’t get that memo and has cut through all the noise to rally strongly.) Mixed Chinese data and a rising dollar also gave bears more ammunition to pounce on the crude oil bulls. Additionally, the labor market is slowing, and consumer spending is declining as savings become sparse.

The problem is also one of supply and demand. Saudi Arabia, Russia, and other oil-producing nations have opted to extend their coordinated cuts, but that’s been offset by greater supply elsewhere, particularly in the U.S., where crude oil production hit a record 13.2 million barrels a day in October, according to the Department of Energy data. Higher domestic production weakens the impact of supply disruptions halfway around the world.

We could see $70 in Brent Crude before the selling pressure eases.

On the other side of the coin, some analysts argue that the selling pressure is overdone.

Phil Flynn, an energy market analyst at Price Futures Group said virtually everyone in the market right now is short oil futures. He added that “we’re probably the most oversold in a year in the market.”

Flynn points out that there is still a real risk of disruption from the war. Iranian Foreign Minister Hossein Amir-Abdollahian told Qatar’s Sheikh Mohammed bin Abdulrahman Al Thani last Thursday that an expansion of the war in Gaza is “inevitable,” according to Iran’s Press TV.

It’s clear to see, Flynn remarks, that the market has taken out all the risk of any supply disruption so if something does happen, we could see a sharp reversal of prices.

Citi analyst, Maximilian Layton said prices will likely consolidate at current levels for now but noted that there are upside risks on the horizon. OPEC+ meets in two weeks and could take action to defend prices while there’s still a low risk of regional war. There is still a risk of conflict spreading to other parts of the region, notably the risk of Israel-Iran attacks, or the US being drawn into the conflict, and/or imposing tighter sanctions on Iran again.

Speculators might well be behind the swings in oil. Fears of supply interruptions typically spur the oil trade to buy “just in case”. When no supply disruption takes place, the market gets hit with liquidations of these positions, which, without the war, wouldn’t have been bought in the first place.

Analysts point out that the outlook for oil stocks and the commodity itself is for higher prices next year. According to a BCA Research Report from Robert P. Ryan, chief commodity and energy strategist, and Ashwin Shyam, associate editor for commodity and energy strategy, it can be argued that based on supply-demand fundamentals, Brent Crude – the international benchmark – should average $118 a barrel in 2024, up from $80 currently.

Stronger global demand should underpin the market in 2024. UBS’ Global Wealth Management also sees Brent moving higher to the $90 to $100 a barrel range. OPEC expects an increase of two million barrels daily in 2024, while the International Energy Agency forecasts an 800,000 daily move.

BCA Research notes that if the war expands to include Iran and its proxies and drives crude prices above $120, Saudi Arabia and the U.A.E could release up to 2.5 million barrels a day, keeping oil roughly in that range.

BCA advises investors to take positions in the SPDR S&P Oil & Gas Production exchange-traded fund (ticker: XOP).

Cheers,

Jacquie

Global Market Comments

November 13, 2023

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or THE YEAREND RALLY CONTINUES!)

(TSLA), (F), (MSFT), (NLY), (BRK/B), (TLT), (CCJ), (CRM)

Last week saw the best week for stocks in two years. As I expected, big tech led the charge and will continue to do so well into next year. Bonds (TLT) stabilized.

It looks like Mad Hedge followers will get to ring the cash register one more time in 2023!

However, we face a couple of speed bumps this coming week. On Tuesday, we get the Consumer Price Index which will tell us if inflation is well and truly dead….or not. On Wednesday, we get the Producer Price Index. And then on Friday, the US government shuts down for lack of funding.

Oops!

There have been some 92 government shutdowns in the last 50 years. Since then, the Dow Average has rocketed by 60 times.

So, I am not worried about the long-term effect on your retirement portfolio. When voters see the gravy train from Washington cut off, not to mention Social Security checks, military pay, and air traffic controller salaries, Congressmen can suddenly become very agreeable.

The short term is another story.

If House recalcitrance triggers a 500 or 1,000-point swan dive in stocks, you want to pile into the big tech leaders I have been begging you to buy for the past three weeks and fill your boots. And while 2023 was a hell of a year to make money in stocks (Mad Hedge has made only 73% so far in 2023, a three-year low), 2024 is looking much, much better.

Think falling inflation, stabilizing wages, fading interest rates, recovering profits, expanding price earnings multiples, and soaring stocks and bonds. The traditional 60/40 portfolio will come back with a vengeance.

I caught up with my old friend Ron Barron the other day, who I talked into buying Tesla shares in 2014. He got in late, at about $100 a share, or 25 times my own original split-adjusted $2.50 cost. But when you’re running big money as Ron, you can’t afford to buy the kind of wild insane risks that buying Tesla in 2010 entailed.

I can.

Ron is now the largest outside shareholder in both Tesla (TSLA) and SpaceX. Tesla is so far ahead of the competition that he expects to hold the shares for the rest of his life. Ford Motors (F) now loses $36,000 for each EV it sells, while Tesla earns a profit of $8,000, down from $15,000 a year ago.

Ford spends $7 billion to build a new factory which generates a miniscule $15 million, or 0.2%. Tesla earns 114% profit on every $7 billion factory it builds.

It's no contest.

During the 1950s, Detroit went all out to earn short-term profits by outsourcing its supply chain. Virtually every one of those third-party companies went bankrupt, irreparably harming their business models. Tesla makes virtually all of its parts in-house, including the Panasonic batteries.

Tesla is learning 100 million miles of data per day from its fleet of 6 million cars. No one else has anything close to this. In 18 months, (TSLA) will have the world’s largest computing ability, which Elon Musk refers to as “Dojo” (karate school in Japanese), which Morgan Stanley estimates will add $500 million to the value of the company.

There are 1.5 billion internal combustion engines in the world that need to be replaced. The present replacement rate is only 80 million cars a year and only 10% of these are EVs. Eventually, 100% will be EVs. Detroit carmakers don’t want to sell EVs because they require no service whereas local dealers make all their money. EVs require no service beyond changing tires every two years,

And while President Biden recently suggested that the UAW targets Tesla for unionization, they don’t have a chance. Tesla workers are by far the highest-paid auto workers in the world with the best benefits. They also own stock, many at my own $2.50 adjusted share cost. Elon was sitting pretty during the recent 46-day UAW nationwide walkout.

Buying Tesla today does not mean you are investing in the achievements of the past, which are formidable. It means that you are buying the new Cybertruck which is rolling out now and offers a new platform with many new technological leaps forward.

More importantly, you are betting on the new $25,000 Model 2 due out in 2025, where Tesla plans to build 5 million a year. Then the EV competition will well and truly be gone.

That makes my $1,000 a share target then $10,000 look extremely modest.

Don’t kid yourself. Tesla can still add to the 35.6% decline it has suffered since July 17. We could go as low as $150, a 50% hickey. This is the most volatile major stock in the market. It always goes down more than you think. But if we do, you want to take a second mortgage out on your home and put it all into Tesla. It’s going up 67 times from there.

I just thought you’d like to know.

So far in November, we are up +7.32%. My 2023 year-to-date performance is still at an eye-popping +73.49%. The S&P 500 (SPY) is up +7.89% so far in 2023. My trailing one-year return reached +74.44% versus +15.78% for the S&P 500.

That brings my 15-year total return to +670.78%. My average annualized return has rocketed to a new all-time high at +51.26%, another new high, some 2.58 times the S&P 500 over the same period.

Some 57 of my 62 trades this year have been profitable.

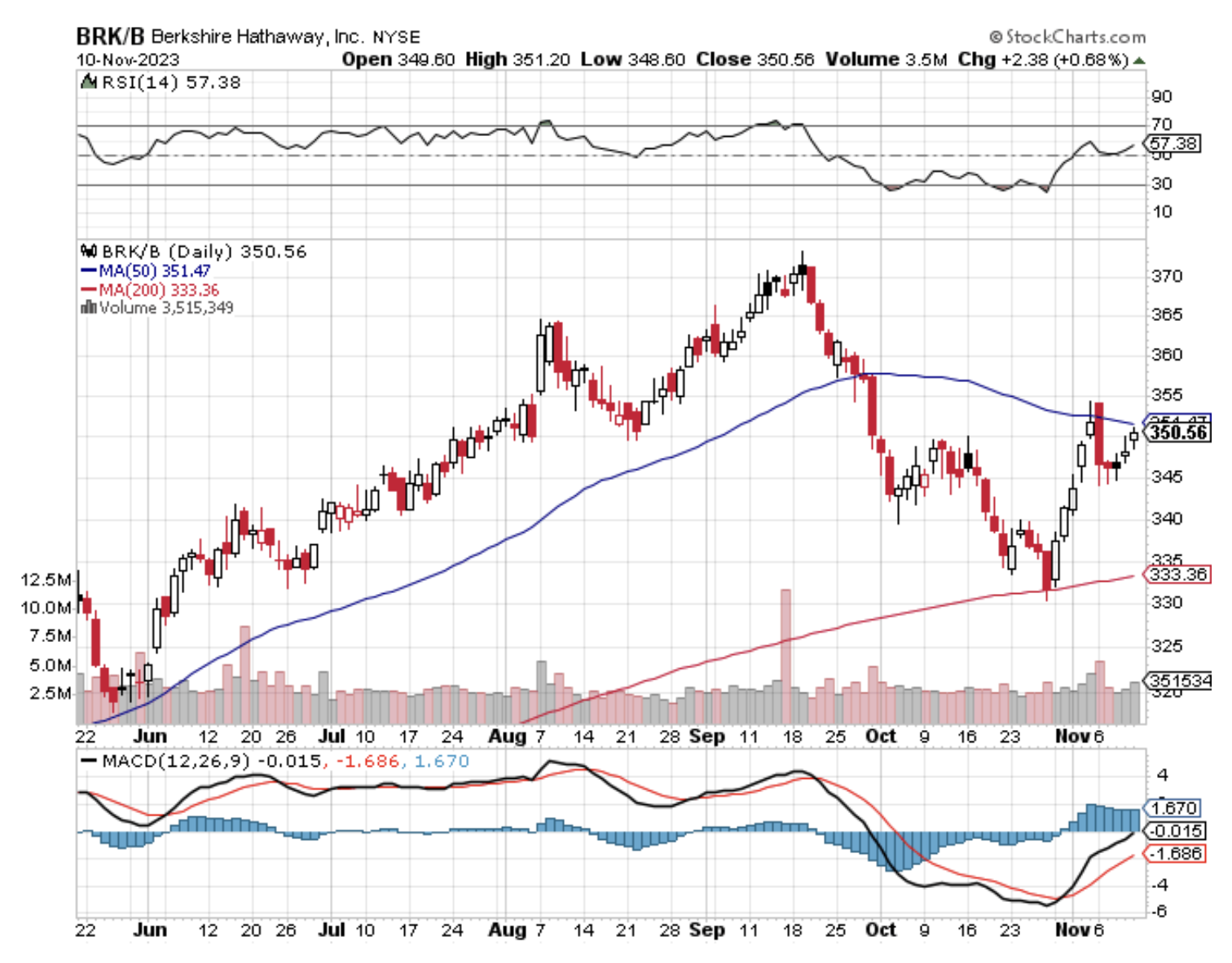

I went pedal to the metal last week, taking profits on my last three November positions in (TLT), (BRK/B), and (NVDA) that maxed out profits and piling in new December longs in (MSFT), (NLY), (BRK/B), (TLT), (CCJ), (CRM). That’s how you hit new all-time highs every day.

Berkshire Hathaway Knocks it Out of the Park, with a 41% gain in operating earnings from companies like BNSF Railroad, Geico, and Precision Castparts. But Warren Buffet was noted more for what he didn’t own than what he did. He unloaded $5 billion worth of global stocks in Q3, taking his cash position up to a record $157 billion. He can now earn a staggering $8.6 billion in interest in the coming year. He explains that stocks never really got cheap this year and high rates were just too attractive. Keep buying (BRK/B) on dips.

China EV Maker BYD is Building its First European Car Factory, in a clear threat to European car makers. They picked Hungary, one of the lowest-waged countries on the continent. BYD (BYDFF) which I recommended back in 2012 after visiting the factory in China is now the largest EV maker there knocking out 250,000 units this year. Is Tesla worried?

Investors Poured $5 Billion into Bond ETFs in October. Institutional investors were happy with the 5.0% yield last month and if they rose, they would simply buy more. It’s another sign that the bottom for all fixed-income prices is at hand. Buy (TLT), (JNK), and (NLY).

China Lends $1.34 Trillion for Belt and Road Initiative, from 2000 to 2001 to dominate Asian and African infrastructure. Good luck getting it back and good luck foreclosing. In the meantime, China suffered its first-ever deficit in foreign direct investment as the West de-risks from the Middle Kingdom.

Oil Hits a four-month low at $75 a Barrel, down 4% as the shine comes off the energy sector. The Gaza boost is gone. Fears of a global economic slowdown are mounting. China’s exports have fallen for six consecutive months, the world’s largest importer. Biden is back in the oil business, provided a floor bid from the Strategic Petroleum Reserve at $79.

Most 2023 Stock Gains Happened in 8 Days, up some 14% since January 1. If you are a day trader, you most likely missed all of this. This is despite stocks going up 113 days versus 102 down days. Making matters more difficult is that only seven stocks accounted for most of the increase. Talk about a narrow market!

A Soft Landing is Now More Likely, says Bank of America CEO Moynihan. Inflation is falling and could lead to Fed interest rate cuts in H2 2024. Stocks and bonds will love it.

NVIDIA is Designing Dumbed Down Chips for China, to bypass government sanctions. It’s an opportunity to recover some lost market share. Keep buying (NVDA) on dips, up 20% in two weeks. It has an impassable moat.

Weekly Jobless Claims dropped from 3,000 to 217,000. It’s still unusually low. Hiring slowed in October as the economy slowed.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age or the next Roaring Twenties. The economy decarbonizing and technology hyper-accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, November 13, bond markets are closed for Veterans Day. I will be leading the local parade wearing my new Medal from the Ukraine Army.

On Tuesday, November 14 at 2:30 PM EST, the Core Inflation Rate is released.

On Wednesday, November 15 at 8:30 AM, the Producer Price Index is published.

On Thursday, November 16 at 8:30 AM, the Weekly Jobless Claims are announced.

On Friday, November 17 at 2:30 PM the US Building Permits are published. At 2:00 PM the Baker Hughes Rig Count is printed.

As for me, few Americans know that 80% of all US air strikes during the Vietnam War originated in Thailand. At their peak in 1969, more US troops were serving in Thailand than in South Vietnam itself.

I was one of those troops.

When I reported to my handlers at the Ubon Airbase in northern Thailand for my next mission, they had nothing for me. They were waiting for the enemy to make their next move before launching a counteroffensive. They told me to take a week off.

The entertainment options in northern Thailand in those days were somewhat limited. Phuket and the pristine beaches of southern Thailand where people vacation today were then overrun by cutthroat pirates preying on boat people who would kill you for your boots.

Life was cheap in Asia in those days, especially your life. Any trip there would be a one-way ticket.

There were the fleshpots of Bangkok and Chang Mai. But I would likely contract some dreadful disease there. I wasn’t really into drugs, figuring whatever my future was, it required a brain. Besides, some people’s idea of a good time there was throwing a hand grenade into a crowded disco. So, I, ever the history buff, decided to go look for The Bridge Over the River Kwai.

Men of my generation knew the movie well, about a company of British soldiers who were the prisoners of bestial Japanese. At the end of the movie, all the key characters die as the bridge is blown up.

I wasn’t expecting much, maybe some interesting wreckage. I knew that the truth in Hollywood was just a starting point. After that, they did whatever they had to do to make a buck.

The fall of Singapore was one of the great Allied disasters at the beginning of WWII. Japanese on bicycles chased Rolls Royce armored cars and tanks the length of the Thai Peninsula. Two British battleships, the Repulse and the Prince of Wales, were sunk due to the lack of air cover with a great loss of life. When the Japanese arrived at Singapore, the defending heavy guns were useless as they pointed out to sea.

Some 130,000 men surrendered, including those captured in Malaysia. There were also 686 American POWs, the survivors of US Navy ships sunk early in the war. Most were shipped north by train to work as slave labor on the Burma Railway.

The Japanese considered the line strategically essential for their invasion of Burma. By building a 258-mile railway connecting Bangkok and Rangoon they could skip a sea voyage of 2,000 miles in waters increasingly dominated by American submarines.

Some 12,000 Allied troops died of malaria, beriberi, cholera, dysentery, or starvation, along with 90,000 impressed Southeast Asian workers. That earned the line the fitting name: “Death Railway.”

The Burma Railway was one of the greatest engineering accomplishments in human history, ranking alongside the Pyramids of Egypt. It required the construction of 600 bridges and viaducts. It crossed countless rivers and climbed steep mountain ranges. The work was all done in 100-degree temperatures with high humidity in clouds of mosquitoes. And it was all done in 18 months.

One of those captured was my good friend James Clavell, who spent the war at Changi Prison, now the location of Singapore International Airport. Every time I land there, it gives me the creeps.

Clavell wrote up his experiences in the best-selling book and movie King Rat. He followed up with the Taipan series set in 19th-century Hong Kong. We lunched daily at the Foreign Correspondents Club of Japan when he researched another book, Shogun, which became a top TV series for NBC.

So I navigated the Thai railway system to find remote Kanchanaburi Province where the famous bridge was said to be located.

My initial surprise was that the bridge was still standing, not destroyed as it was in the film. It was not a bridge made of wood but concrete and steel trestles. Still, you could see the scars of Allied bombing on the foundations, who tried many times to destroy the bridge from the air.

That day, the Bridge Over the River Kwai was a quiet, tranquil, peaceful place. Farmers wearing traditional conical hats made of palm leaves and bamboo strips called “ngob’s,” crossed to bring topical fruits and vegetables to market. A few water buffalo loped across the narrow tracks. The river Kwai gurgled below.

Once a day, a train drove north towards remote locations near the Burmese border where a bloody rebellion by the indigenous Shan people was underway.

The wars seemed so far away.

The only memorial to the war was a decrepit turn-of-the-century English steam engine badly in need of repair. There were no tourists anywhere.

So I started walking.

After I crossed the bridge, it wasn’t long before I was deep in the jungle. The ghosts of the past were ever present, and I swear I heard voices. I walked a few hundred yards off the line and the detritus of the war was everywhere: abandoned tools, rusted-out helmets, and yes, human bones. I didn’t linger because the snakes here didn’t just bite and poison you, they swallowed you whole.

After the war, the Allies used Japanese prisoners to remove the dead for burial in a nearby cemetery, only identified by their dog tags. Most of the “coolies” or Southeast Asian workers were left where they fell.

Today, only 50 miles of the original Death Railway remain in use. The rest proved impossible to maintain, because of shoddy construction, and the encroaching jungle.

There has been talk over the years of rebuilding the Burma Railway and connecting the rest of Southeast Asia to India and Europe. But with Burma, today known as Myanmar, a pariah state, any progress is unlikely.

Maybe the Chinese will undertake it someday.

Every Christmas vacation, when my family has lots of free time, I sit the kids down to watch The Bridge Over the River Kwai. I just wanted to pass on some of my experiences, teach them a little history, and remember my old friend Clavell.

Good Luck and Good Trading

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Walking the Bridge Over the River Kwai in 1976

“The best way to predict the future is to create it.” – Said American Writer Peter Drucker

Artificial intelligence (AI) is rapidly transforming the electric vehicle (EV) industry. From design and manufacturing to autonomous driving and charging infrastructure, AI is poised to revolutionize the way we develop, build, and use EVs.

This article will explore some of the key ways that AI is disrupting the EV industry, and discuss the potential implications of these changes for consumers, businesses, and the environment.

Design and Manufacturing

AI is already being used to design and manufacture EVs more efficiently and effectively. For example, AI-powered algorithms can be used to:

- Optimize battery design for energy density, range, and cost.

- Reduce production costs by automating tasks and optimizing supply chains.

- Improve vehicle performance by designing more efficient motors, powertrains, and aerodynamics.

For example, Tesla uses AI to design and manufacture its batteries. AI helps Tesla to optimize the battery chemistry and structure to get the most energy density and range out of its batteries. AI also helps Tesla to automate the battery manufacturing process, which reduces costs and improves quality.

Another example is the company Waymo, which is developing self-driving cars. Waymo uses AI to design and manufacture its own self-driving hardware and software. This allows Waymo to have greater control over the development and deployment of its self-driving cars.

Autonomous Driving

AI is also playing a major role in the development of autonomous EVs. Self-driving cars rely on AI to perceive their surroundings, make decisions, and control the vehicle.

AI-powered self-driving car systems use a variety of sensors, such as cameras, radar, and ultrasonic sensors, to create a real-time 3D model of the car's surroundings. This model is used to identify other vehicles, pedestrians, and objects on the road. AI then uses this information to make decisions about how to safely navigate the vehicle.

Several companies are developing autonomous EVs, including Tesla, Waymo, and Cruise. These companies are using AI to develop self-driving cars that can operate safely and reliably in a variety of environments.

Charging Infrastructure

AI is also being used to improve EV charging infrastructure. For example, AI can be used to:

- Optimize the placement of charging stations based on traffic patterns and population density.

- Predict demand for charging and allocate resources accordingly.

- Manage the charging grid to ensure that there is enough power to meet demand.

For example, the company ChargePoint uses AI to optimize the placement of its charging stations. ChargePoint uses AI to analyze data on traffic patterns, population density, and vehicle registrations to identify the best locations for new charging stations. This helps to ensure that charging stations are placed where they are most needed.

Another example is the company GridX, which provides AI-powered software solutions for managing the electric grid. GridX's software helps utilities to optimize power generation and distribution, integrate renewable energy sources, and manage demand response programs. This can help to make the electric grid more efficient and reliable, which is essential for supporting the growth of EVs.

Other Applications of AI in the EV Industry

In addition to the key areas discussed above, AI is also being used in a variety of other ways to disrupt the EV industry. For example, AI is being used to:

- Develop new battery technologies with higher energy density and longer lifespans.

- Improve the efficiency of EV motors and powertrains.

- Develop new EV charging systems that are faster and more convenient to use.

- Develop new EV safety features, such as collision avoidance systems and driver monitoring systems.

- Create new EV insurance products and services that are tailored to the unique needs of EV owners.

Implications of AI for the EV Industry

The widespread adoption of AI in the EV industry is expected to have a number of significant implications for consumers, businesses, and the environment.

For consumers, AI is expected to make EVs more affordable, accessible, and user-friendly. For example, AI-powered battery technologies and EV charging systems could help to reduce the cost of EVs and make them more convenient to charge. AI-powered self-driving cars could also make EVs more accessible to people with disabilities and other mobility challenges.

For businesses, AI is expected to create new opportunities for innovation and growth. For example, companies that develop AI-powered EV technologies and services could position themselves well to capitalize on the growing EV market.

For the environment, AI is expected to help reduce greenhouse gas emissions and improve air quality. For example, AI-powered EV charging systems could help to make the electric grid more efficient and reliable, which could support the integration of more renewable energy sources. AI-powered EV safety features could also help to reduce traffic accidents and fatalities.

Overall, the widespread adoption of AI in the EV industry is expected to have a number of positive implications for consumers, businesses, and the environment.

Challenges and Opportunities

While AI has the potential to transform the EV industry in many positive ways, there are also some challenges that need to be addressed. One challenge is the development of ethical guidelines for the use of AI in EVs. For example, it is important to ensure that AI-powered self-driving cars are programmed to make decisions that are consistent with human values, such as protecting life and minimizing harm.

Another challenge is the need to ensure that AI-powered EV technologies and services are accessible to everyone. For example, it is important to develop affordable AI-powered EV charging systems and self-driving cars. It is also important to ensure that AI-powered EV technologies and services are designed to meet the needs of people with disabilities and other minority groups.

Despite the challenges, AI presents a number of significant opportunities for the EV industry. By embracing AI, the EV industry can become more innovative, efficient, and sustainable. AI can also help to make EVs more affordable and accessible to everyone, which could accelerate the transition to a clean energy economy.

Conclusion

The EV industry is at a crossroads. AI has the potential to transform the EV industry in many positive ways, but it is important to address the challenges and opportunities associated with AI adoption. By working together, consumers, businesses, and policymakers can ensure that AI is used to create a more sustainable and equitable EV industry.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.