(THE HOUSING CRISIS IN YOUR FUTURE IS BROUGHT TO YOU BY CLIMATE CHANGE)

December 27, 2023

Hello everyone,

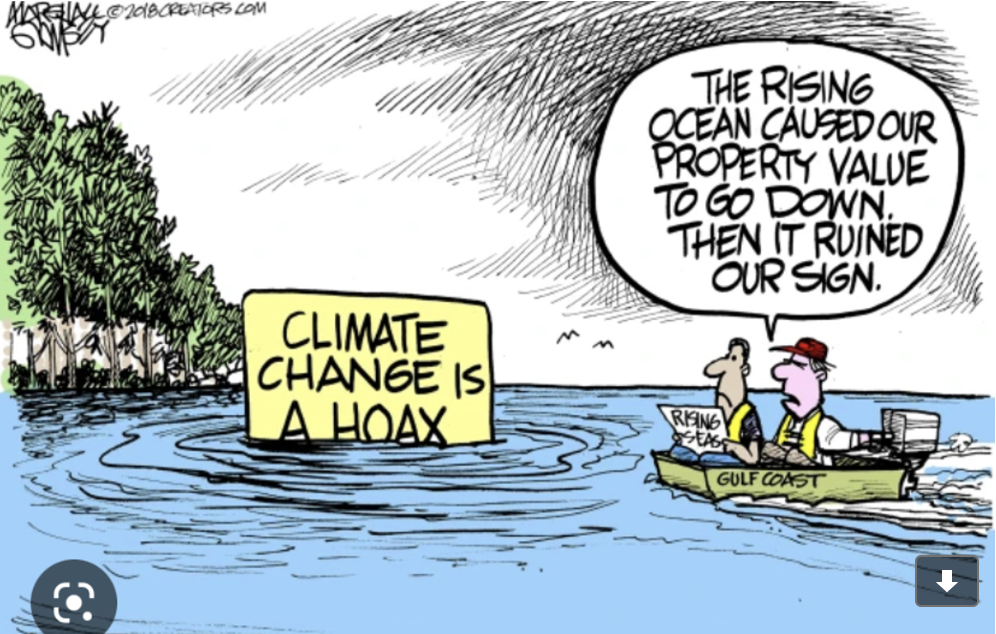

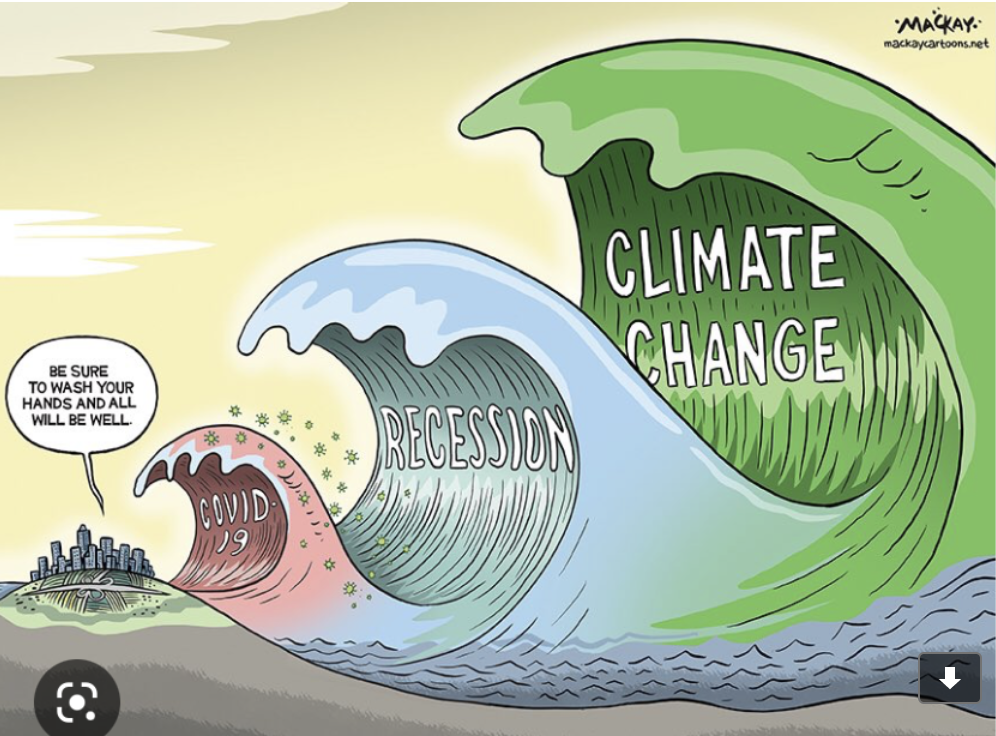

Most of us know about the changing climate. But few of us realize the implications of these changes on housing over the next 30 years and beyond.

We know about interest rates and the cost of housing, but what about the relationship between climate and the cost of housing?

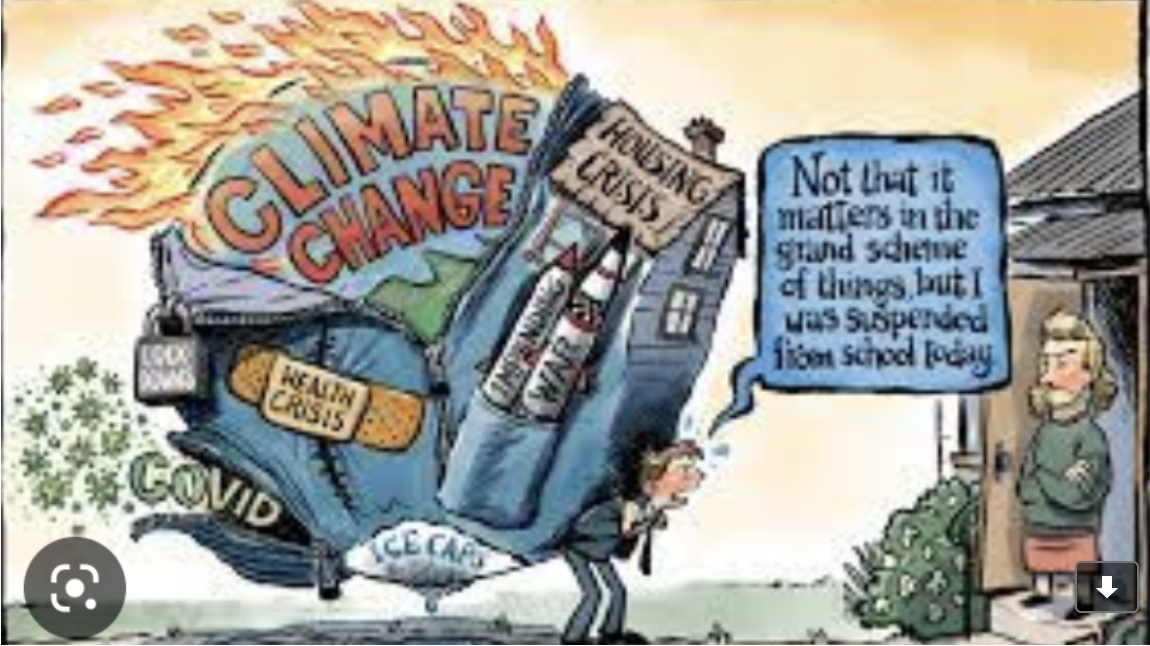

It’s another crisis, which is going to spread its tentacles worldwide. No country will escape.

Dave Burt, CEO of investment research firm DeltaTerra Capital believes an overlooked and unpriced climate risk could see a repeat of a financial crisis in housing, albeit on a smaller scale in relation to the 2008 crisis. But still, it’s a damaging real threat to exposed communities.

Dave Burt was among the few skeptics who recognized the housing market was on the brink of collapse in 2007. He helped two of the protagonists of Michael Lewis’ bestselling book “The Big Short” bet against the mortgage market in the lead-up to the 2008 global financial crisis. As it turned out, they were right and were estimated to have made millions.

Now here in 2023, Burt believes an overlooked climate risk could see history repeating itself.

Burt argues that DeltaTerra Capital’s research suggests that 20% of U.S. homes have “meaningful exposure” to a mispricing issue because of flood risk. If realized, he warned the fallout could resemble the extraordinary correction seen during the global financial crisis.

Even though he says that it could be a quarter the size and magnitude of the GFC, it still would be very damaging to exposed communities. Burt argues that there are cracks starting to appear in terms of the cost of insurance. Think about Hurricane Ian in Florida, for instance. The recovery here was an issue, particularly because this storm surge exposed a flood insurance nightmare for homeowners. We can also think about the people in Lismore, Australia, where the residents have endured about three major floods in 18 months. Some residents have left, never to return. Others have offered their house to the market for around 200k. The only way people will be able to live in these areas again is if the houses are built on stilts, if the community is relocated, or if major feats of engineering are undertaken to protect the town.

I would argue that most people do not lose a lot of sleep over the climate crisis in relation to their portfolio. But a recent study has warned the U.S. housing market could be overvalued by around $200 billion due to unpriced flood risks.

This analysis was published in mid-February in the journal Nature Climate Change. Authored by researchers from the Environmental Defence Fund, the First Street Foundation, and the U.S. Federal Reserve, among others, the study modeled property-level changes in flood risk across the U.S. over the next three decades and warned that low-income households were particularly vulnerable to home value devaluation.

Jeremy Porter, head of climate implications at the First Street Foundation said it is a huge concern because climate risk is not being priced into the housing market. He goes on to say that the costs now or the valuation of homes don’t consider the realization of that actual flood risk, and that’s not taking into account that there seems to be a huge amount of overvaluation attached to properties across the country.

Insufficient climate risk information when purchasing a home poses a significant financial hazard as households could lose a large proportion of their property value overnight.

Eventually, Burt argues, there is going to be some sort of national tipping point where there is some type of bubble that bursts.

Presently, the study said that nearly 15 million U.S. properties face a 1% annual likelihood of flooding, with expected annual damages to residential properties forecast to exceed $32 billion.

In addition, the research also warned the increasing frequency and severity of flooding amid the deepening climate emergency could see the number of U.S. properties exposed to flooding increase by 11% and average annual losses jump by at least 26% by 2050.

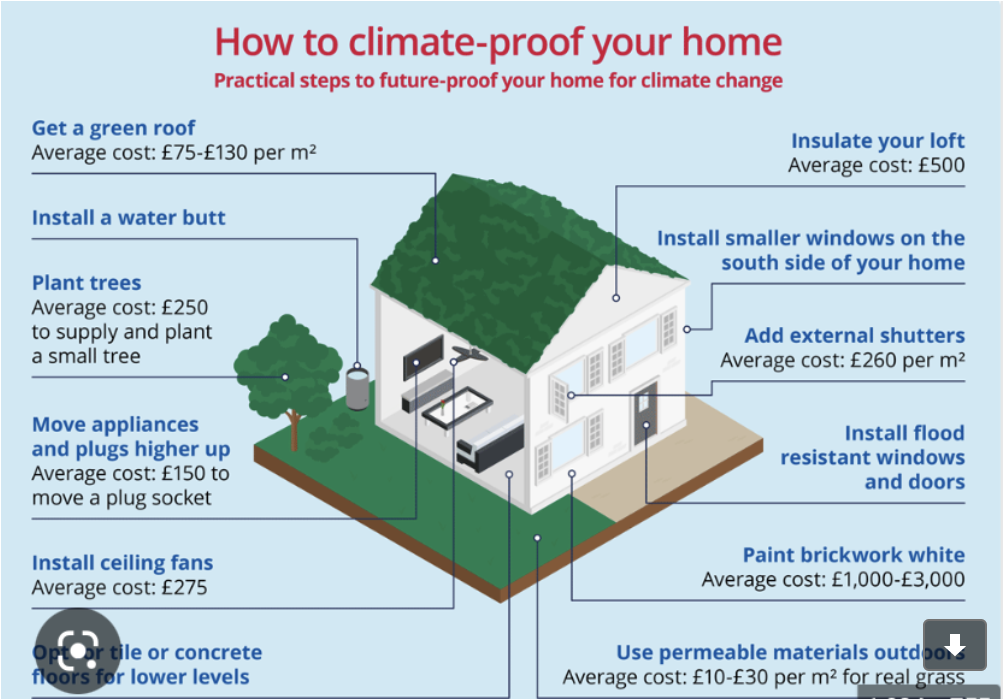

The vacuum in climate-related information when purchasing property needs to be addressed. People need to understand what the climate-related costs are going to look like and rethink their property location if they cannot meet those costs.

Lower-income property owners are most at risk and this, in turn, has the potential to widen the wealth gap in the U.S. and exacerbate inequality.

How will local government tax revenues be affected?

They could be hit quite badly, as the total for municipalities typically relies heavily on property taxes. Having that tied to a physical asset that is exposed to climate change introduces a lot of risk to the stability of that revenue stream according to DeltaTerra Capital research.

This is not just a domestic issue. It is a problem for countries worldwide. And it morphs into a humanitarian crisis when you start looking at the issue through a global lens.

Munich Re, the world’s largest reinsurance company, observed steep economic losses in 2022 as the climate crisis drove more extreme weather events, such as Hurricane Ian in the U.S. and apocalyptic flooding in Pakistan. Reinsurance refers to insurance for insurance companies.

It estimated that these losses amounted to $270 billion last year, of which around $120 billion was covered by insurance. The insured loss total continues a trend of high losses in recent years.

Someone must pay in the end. Whether insured or uninsured, it becomes an increasing economic burden.

So, before you purchase your next property consider the climate cost also.

Be safe and enjoy time with family and/or friends.

Cheers,

Jacque

“The world is reaching the tipping point beyond which climate change may become irreversible. If this happens, we risk denying present and future generations the right to a healthy and sustainable planet – the whole of humanity stands to lose.” - Kofi Annan, Former Secretary-General of the UN.