When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Biotech and Healthcare Letter

April 25, 2024

Fiat Lux

Featured Trade:

(RACING TO SWAP A GOLDEN GOOSE FOR A NEW FLOCK)

(MRK), (NVO), (LLY), (JNJ), (ABBV), (PFE)

Big pharma usually makes investors smile - fat profits, juicy dividends, and stocks that crush the market.

Lately, though, some of these giants are looking more like grumpy old men. Sure, there are exceptions like Novo Nordisk (NVO) and Eli Lilly (LLY) printing money with their obesity blockbusters.

But what about the rest? Even with Washington breathing down their necks, patent cliffs, and a shaky economy, you'd think these drug titans wouldn't be lagging the market, right? Wrong.

Check out the "Big Eight" top dogs - Johnson & Johnson (JNJ), Merck (MRK), AbbVie (ABBV), Pfizer (PFE), and the rest. Only a few have really delivered the goods in the past five years. AbbVie and Merck have been alright, but the others? They make me want to take a nap.

Now, I'm not saying give up on pharma entirely - there's still money to be made. But you've got to do your homework. Today, let's take a look at Merck.

They raked in $60.1 billion in 2023, making them a heavy hitter. But without their COVID cash machine Lagevrio, growth is...less impressive. Still up, but not setting the world on fire.

The real story is spending - Merck went on a spree, burning through cash on R&D. Why? Their golden goose Keytruda, that $25 billion cancer blockbuster, is facing generic competition soon.

Merck isn't just sitting around waiting for the Keytruda patent cliff either. They're furiously throwing money at new drugs, acquisitions, cancer, heart disease, immune disorders - hoping to find the next Keytruda before the current one fades away. It's like an aging rockstar desperately trying to write another big hit.

But let's be real, finding billion-dollar breakthroughs is a gamble, even for giants like Merck. They've got potential in the pipeline for sure, but it's a long road from the lab to pharmacy shelves. Plenty of drugs flame out along the way.

Looking back, 2023 wasn't a victory parade for Merck. It was more like a mad dash to spend their way out of the looming Keytruda patent cliff. But hey, sometimes you've gotta break a few eggs to make an omelet, right?

Speaking of potential winners, let's talk about those newly approved lung drugs – sotatercept could be a major player.

Merck's vaccine department is looking strong too, with potential blockbusters targeting lung infections and RSV in the pipeline.

Of course, it hasn't all been smooth sailing. That new cough drug, gefapixant, getting rejected by the FDA again? Merck took a hit on that. Still, this biotech’s not giving up. This is a company buying time to build up a whole new arsenal, and the Keytruda cliff might hurt, but they'll come out swinging.

So, let’s forget about that 2023 earnings dip. Merck's forecasting a serious jump in 2024 profits as they dial back the crazy spending. Yes, their balance sheet took a hit, but look at what they're building. They're hunting big deals to bolster that pipeline, and that's a good thing in my book.

Speaking of big moves, Merck's been on a shopping spree. Wall Street might get nervous if they drop another bombshell, but I trust their judgment. These aren't just random buys; this is how they protect their future cash flows. Besides, any short-term drama from a big deal could be a sweet buying opportunity.

And while Merck’s still figuring out which one could be the next big thing, the true star of the show, until that patent cliff arrives, is still Keytruda.

That beast is still growing and could keep going strong for years, especially in early-stage treatments. Plus, that new subcutaneous version of this blockbuster treatment? Talk about extending the gravy train well past the generic competition.

Let's also check out the other horses in this race: sotatercept's early sales numbers, a potential FDA approval for that HER2 drug, the saga of gefapixant's third shot (or not), and the cash potential of V116 and Welireg. Not to mention, juicy updates on that Moderna (MRNA) partnership…Merck’s next months could be packed with surprises.

As for this company’s dividend? Decent track record, but don't expect fireworks after the recent hike. As for buybacks, Merck seems to have...other priorities right now. Those profits are pouring straight into the growth pipeline.

The bottom line: While some of Big Pharma looks pale lately, Merck is still bringing it, share price gains and all. Sure, that gefapixant rejection stings. But Keytruda keeps roaring, and Merck's pipeline is buzzing with potential. I'm not sweating earnings.

Merck's got contingencies lined up for the Keytruda patent apocalypse - new drugs, deals, maybe even extending Keytruda itself. They're playing for the long game here. I suggest you buy the dip.

Global Market Comments

April 25, 2024

Fiat Lux

Featured Trade:

(RISK CONTROL FOR DUMMIES) or (THE HEADS I WIN, TAILS YOU LOSE STRATEGY),

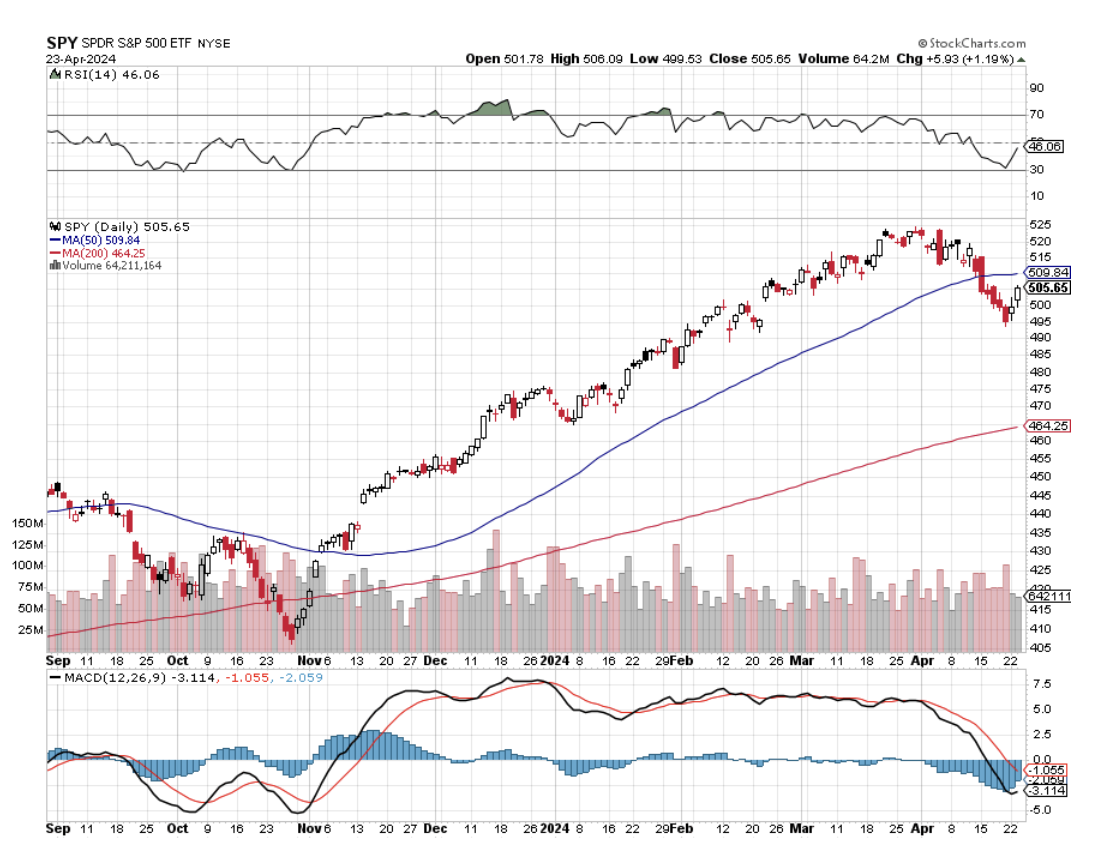

(SPY), (FCX), (NVDA), (TLT)

Whenever I change my positions, the market makes a major move, suffers a “black swan” or reaches a key level, I stress test my portfolio by inflicting various scenarios upon it and analyzing the outcome.

This is common practice and second nature for most hedge fund managers.

In fact, the larger ones will use top-of-the-line mainframes powered by $100 million worth of in-house custom programs to produce a real-time snapshot of their positions in hundreds of imaginable scenarios at all times. This is the sort of thing Ray Dalio used to do.

If you want to invest with these guys feel free to do so.

They require a $10-$25 million initial slug of capital, a one-year lock-up, charge a fixed management fee of 2%, and a performance bonus of 20% or more.

You have to show minimum liquid assets of $2 million and sign 100 pages of disclosure documents.

If you have ever sued a previous manager, forget it.

And, oh yes, the best-performing funds have a ten-year waiting list to get in, as with my friend David Tepper. Unless you are a major pension fund like the State of California, they don’t want to hear from you.

Individual investors are not so sophisticated and it clearly shows in their performance, which usually mirrors the indexes with less of a large haircut.

So, I am going to let you in on my own, vastly simplified, dumbed down, the seat of the pants, down-and-dirty style of scenario analysis and stress testing that replicates 95% of the results of my vastly more expensive competitors.

There is no management fee, performance bonus, disclosure document, lock up, or upfront cash requirement. There’s just my token $3,500 a year subscription and that’s it.

To make this even easier for you, you can perform your own analysis in the Excel spreadsheet I post every day in the paid-up members section of Global Trading Dispatch.

You can just download it and play around with it whenever you want, constructing your own best-case and worst-case scenarios. To make this easy, please log into your Mad Hedge Fund Trader, click on “MY ACCOUNT”, then click on Global Trading Dispatch, then Current Positions, and download the Excel spreadsheet for April 25, 2024.

There you will find my current trading portfolio showing:

Current Capital at Risk

Risk On

(NVDA) 5/$710-$720 call spread 10.00%

(TLT) 5/$82-$85 call spread 10.00%

(FCX) 5/$42-$45 call spread 10.00%

Risk Off

(NVDA) 5/$960-$970 put spread -10%

Total Net Position 30.00%

Total Aggregate Position 40.00%

Since this is a “for dummies” explanation, I’ll keep this as simple as possible.

No offense, we all started out as dummies, even me.

I’ll the returns in three possible scenarios: (1) The (SPY) is unchanged at $505 by the May 17 expiration of my front month option positions, which is 15 trading days away, (2) The S&P 500 rises 5.0% to $530 by then, and (3) The S&P 500 falls 5.0% to $480.

Scenario 1 – No Change

The value of the portfolio rises from a 5.07% profit to a 13.00% Profit. My existing longs in (FCX), (TLT), and (NVDA) expire at their maximum profits. So does my one short in (NVDA).

Scenario 2 – S&P 500 rises to $530

You can easily forget about the long positions in (FCX), (TLT), and (NVDA) as they will expire well in the money. If they go up fast enough, I might even take an early profit and roll into a June or July position. Our short in (NVDA) might take some heat. But in the current environment of going into the summer doldrums, there is no way (NVDA) shoots up to a new all-time high, right where our strike prices were set at on purpose. The net of all this is that our portfolio should expire at a maximum profit for the year at up 13.00%.

Scenario 3 – S&P 500 falls to $480

All three of my stocks fall, but not enough for my three call spreads to go out of the money. (FCX) will stay above my stop-out level at $45, (TLT) at $85, and (NVDA) at $720. Obviously, the short in (NVDA) becomes a chipshot. Again, we expire at a maximum profit for the year at up 13.00%.

Up we make money, down we make money, sideways we make money, I like it! This is why I run long/short baskets of options spreads whenever the market allows me. It’s a “Heads I win, tails you lose strategy”.

If the market goes up, I’m looking for stocks to sell. If the market goes down, I'm looking for securities to buy. Boy low, sell high, I’m thinking of patenting the idea.

This is the type of extremely asymmetric risk/reward ratio hedge funds are always attempting to engineer to achieve outsized returns. It is also the one you want after the stock market has risen by 25% a year since the 2020 pandemic.

All that’s really happened is that the world has gone from slightly good to better this year. I can rejigger this balance anytime I want. If I think that a change in the economy or the Fed’s interest rate policy is in the works.

Keep in mind that these are only estimates, not guarantees, nor are they set in stone. Future levels of securities, like index ETF’s are easy to estimate. For other positions, it is more of an educated guess. This analysis is only as good as its assumptions. As we used to do in the computer world, garbage in equals garbage out.

Professionals who may want to take this out a few iterations can make further assumptions about market volatility, options implied volatility or the future course of interest rates. Keep the number of positions small to keep your workload under control. I never have more than ten. Imagine being at Goldman Sachs and doing this for several thousand positions a day across all asset classes.

Once you get the hang of this, you can start projecting the effect on your portfolio of all kinds of outlying events. What if a major world leader is assassinated? Piece of cake. How about another 9/11? No problem. Oil at $150 a barrel? That’s a gimme. What if there is an Israeli attack on Iranian nuclear facilities? That might take you all of two minutes to figure out. The Federal Reserve launches a surprise interest rate rise? I think you already know the answer.

The bottom line here is that the harder I work, the luckier I get.

Favorite headline of the day: "Greece Offers to Pay Back Debt With Giant Horse."

WASHINGTON, April 24, 2024 – In a world where financial crimes are becoming increasingly sophisticated, information technology (IT) leaders and AI experts will gather in Washington DC next month for the 2024 AI Training Summit for Financial Investigators. This timely event, to be held at the National Press Club on May 15th and 16th, aims to empower investigators with the latest artificial intelligence (AI) tools and techniques to combat complex financial fraud, money laundering, and other illicit activities.

The Growing Impact of AI on Financial Investigations

Artificial intelligence is rapidly transforming the field of financial investigations. AI-powered algorithms can analyze vast datasets, uncover hidden patterns, and detect anomalies that would be difficult, if not impossible, for humans to identify. This enhanced ability to process information is revolutionizing how investigators approach cases, leading to faster and more accurate identification of fraudulent activities.

Summit Highlights

The 2024 AI Training Summit will bring together thought leaders from government, industry, and academia to share cutting-edge knowledge and strategies for leveraging AI in financial investigations. Key topics include:

- Harnessing Big Data for Fraud Detection: Experts will discuss techniques for using AI to analyze large volumes of financial data to identify suspicious transactions, red flags, and high-risk entities.

- AI-Driven Pattern Recognition: Deep dives into machine learning algorithms and how they can uncover hidden patterns and connections that might indicate fraudulent behavior.

- Visualizing Financial Data: Innovative approaches to using data visualization with AI, turning complex financial information into easily understandable patterns, aiding investigators.

- Anti-Money Laundering (AML) Solutions: Exploring AI solutions tailored to detecting and preventing money laundering activities.

- Cybersecurity and AI: Addressing the intersection of cybersecurity and AI in financial investigations, with a focus on protecting sensitive data and mitigating cyber threats.

- Ethical Considerations: Discussions around the ethical implications of AI in investigations, ensuring transparency, fairness, and accountability in algorithmic decision-making.

Keynote Speakers and Panelists

The summit will feature keynote presentations and panel discussions from leading experts, including:

- Patricia Delafuente, Data Scientist, NVIDIA: Ms. Delafuente will provide insights into the latest advancements in AI for complex financial data analysis, including the use of GPUs (graphical processing units) to accelerate machine learning workloads.

- Sanjeev Pulapaka, Director of Technology Solutions, Amazon Web Services (AWS): Mr. Pulapaka will highlight the potential of cloud-based AI solutions for scaling financial investigations while maintaining the highest security standards.

- Members of Federal Government Investigative Units: Officials from agencies such as the FBI, FinCEN (Financial Crimes Enforcement Network), and the SEC (Securities and Exchange Commission) will share real-world case studies and best practices for AI-powered financial investigations.

Transforming the Investigator’s Toolkit

The AI Training Summit for Financial Investigators isn't just about exploring theory. It's designed to provide practical guidance and actionable takeaways. Attendees will participate in hands-on workshops, learning how to:

- Build AI models: Understanding the core principles of training AI models for specific financial investigation tasks.

- Evaluate AI solutions: Exploring criteria for assessing the effectiveness and suitability of different AI tools for financial investigations.

- Implement AI responsibly: Developing strategies for integrating AI into existing investigative workflows while addressing ethical and security considerations.

Visit https://aisummit.link/ to learn more about the upcoming event in May.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.