There comes a time in every trader’s life when it’s time to face harsh reality and admit that you’re just dead wrong.

As much as I thought a I had strong case for the best stocks to move sideways before continuing their upward drive, the markets decided otherwise. One thing I have learned over my half-century of trading is that you never argue with Mr. Market. He is always right.

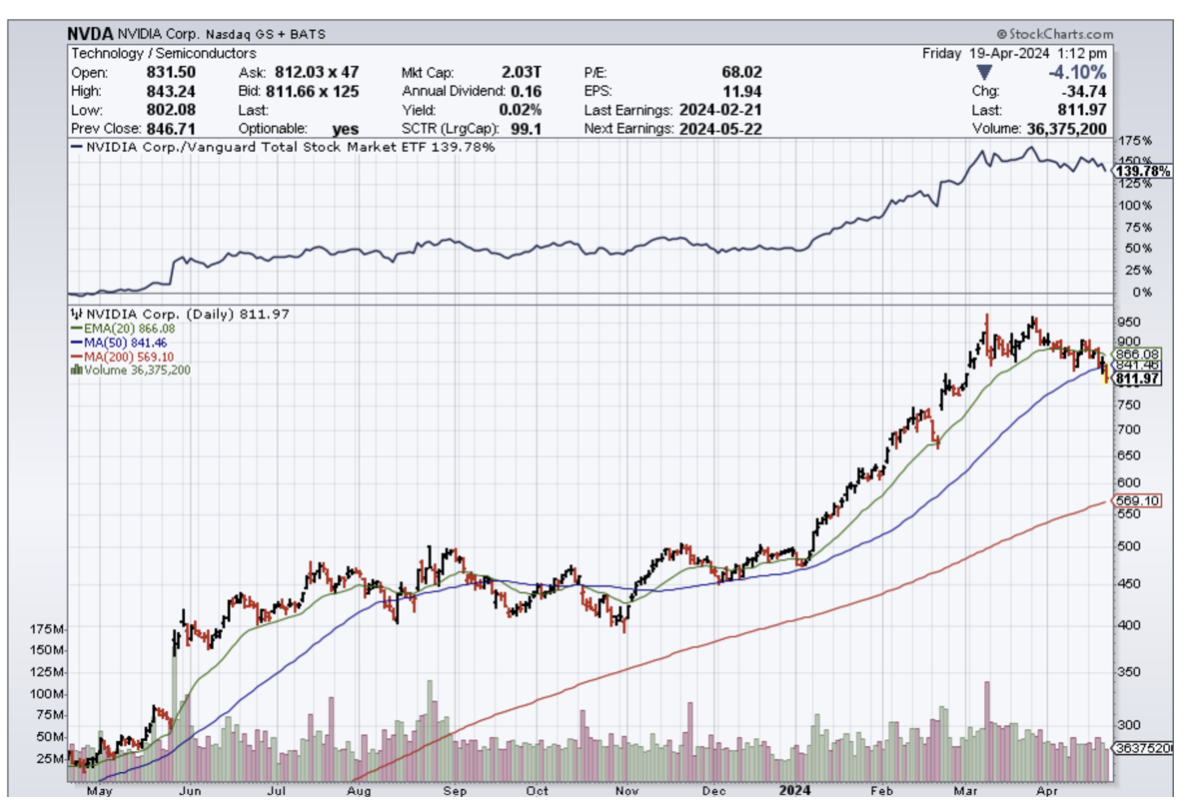

So it was with some dismay that on Friday, I watched NVIDIA (NVDA) shares slice through its 50-day moving average at $840 like a hot knife through butter putting the shares into a free-fall. Virtually the next print was the low of the day at $760, down 10% on the day.

There was no new news about (NVDA). Its prospects look as bright as ever, and there are a series of conferences of earnings reports over the coming month to remind us of that. But sometimes, the market just doesn’t care.

(NVDA) has had a great run, up some 144% since October. During this time, I executed a dozen profitable long-side trades. But when you’re that aggressive you know in advance that the last trade is going to kill you and that is the case today. (NVDA) is falling because of the sheer weight of its price.

New flash: while (NVDA) is still the cheapest big tech stock in the market, cheap stocks can get cheaper as we all know.

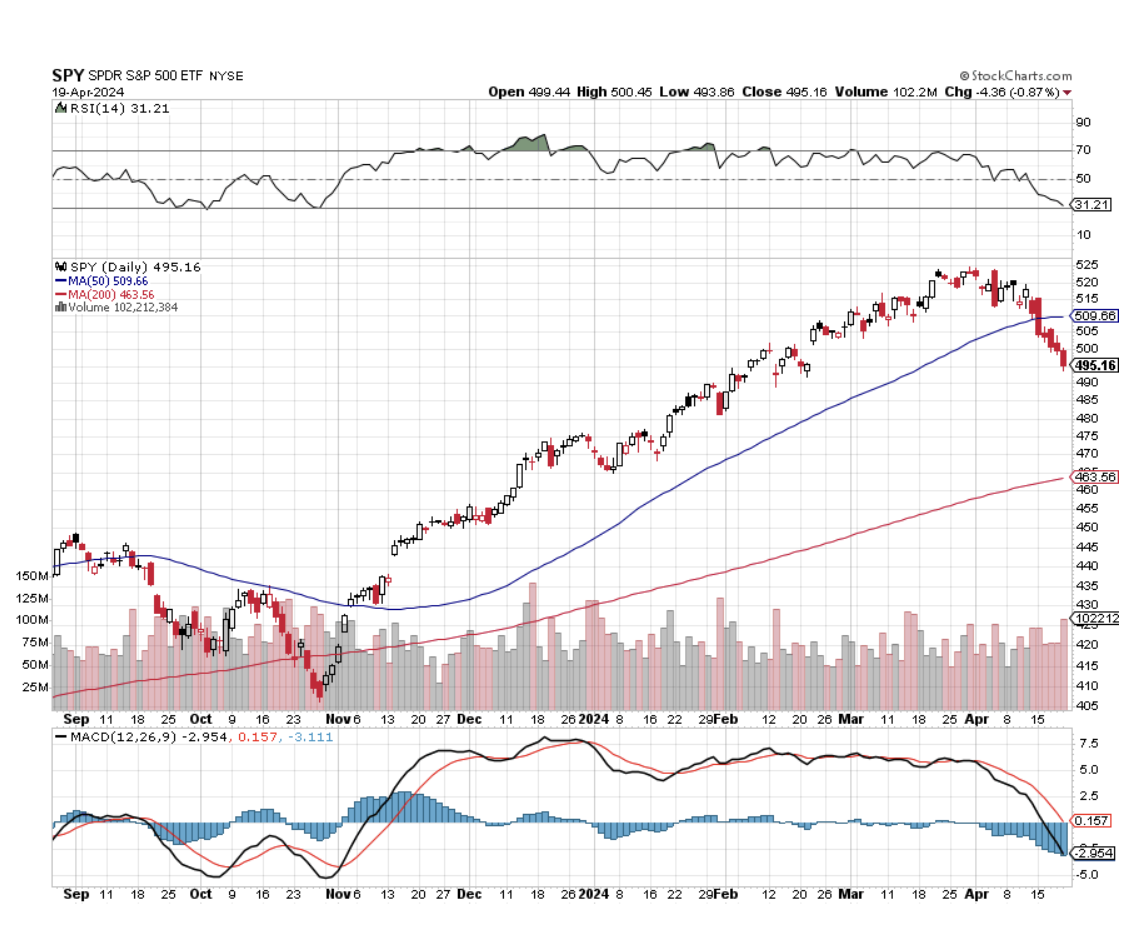

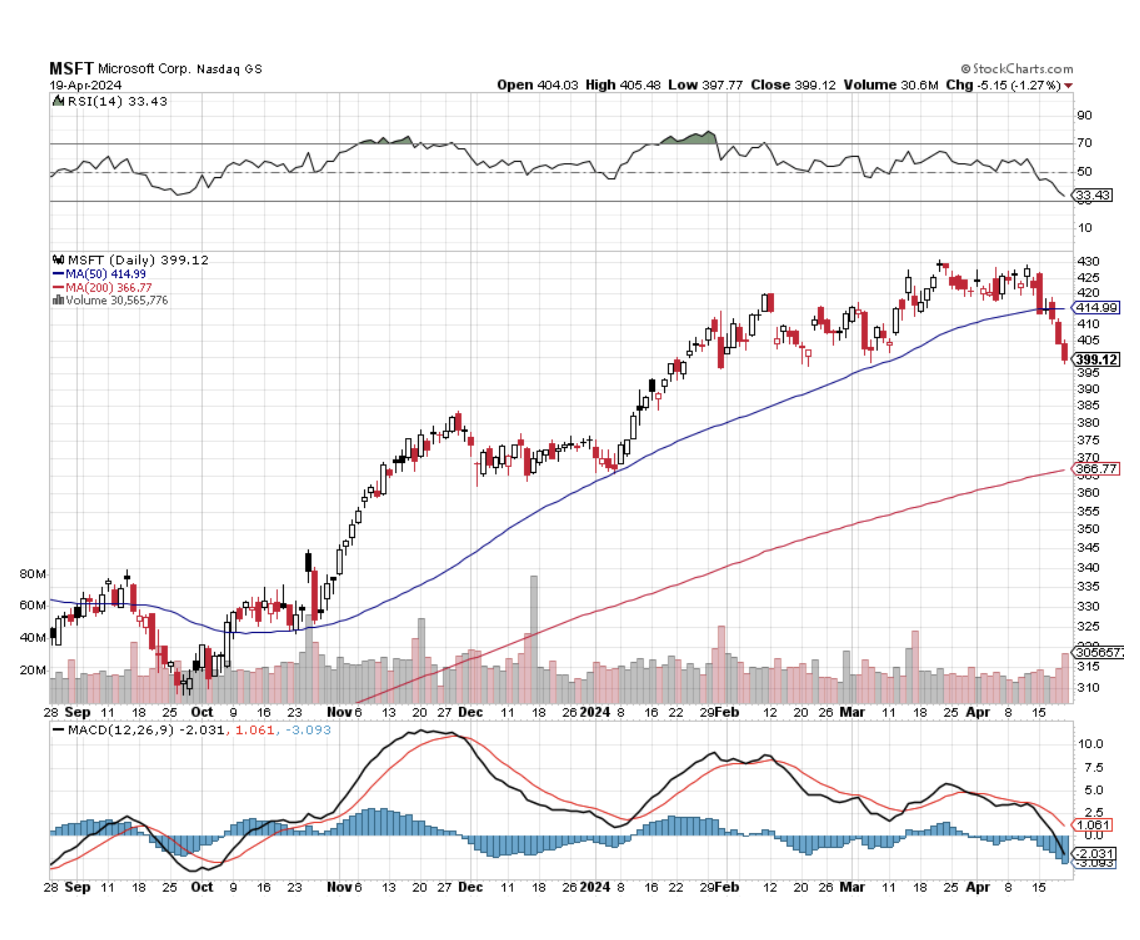

With the advantage of 20/20 hindsight, I should have been paying more attention to the Magnificent Seven 50-day moving averages which have been falling like dominoes. First went Tesla (TSLA) in February and Apple in March. The S&P 500 (SPY) gave it up on Monday and Microsoft (MSFT) on Wednesday. Amazon (AMZN), (META), and (NVDA) were the last to go on Friday.

Sure you can blame the April 19 option expiration when traders were loaded to the hilt with expiring longs with all these stocks they had to dump. The dreaded month of May, when traders go to die, and the summer doldrums are just two weeks away. Algorithms poured gasoline on the fire exaggerating the moves, as they always do. But still, wrong is wrong.

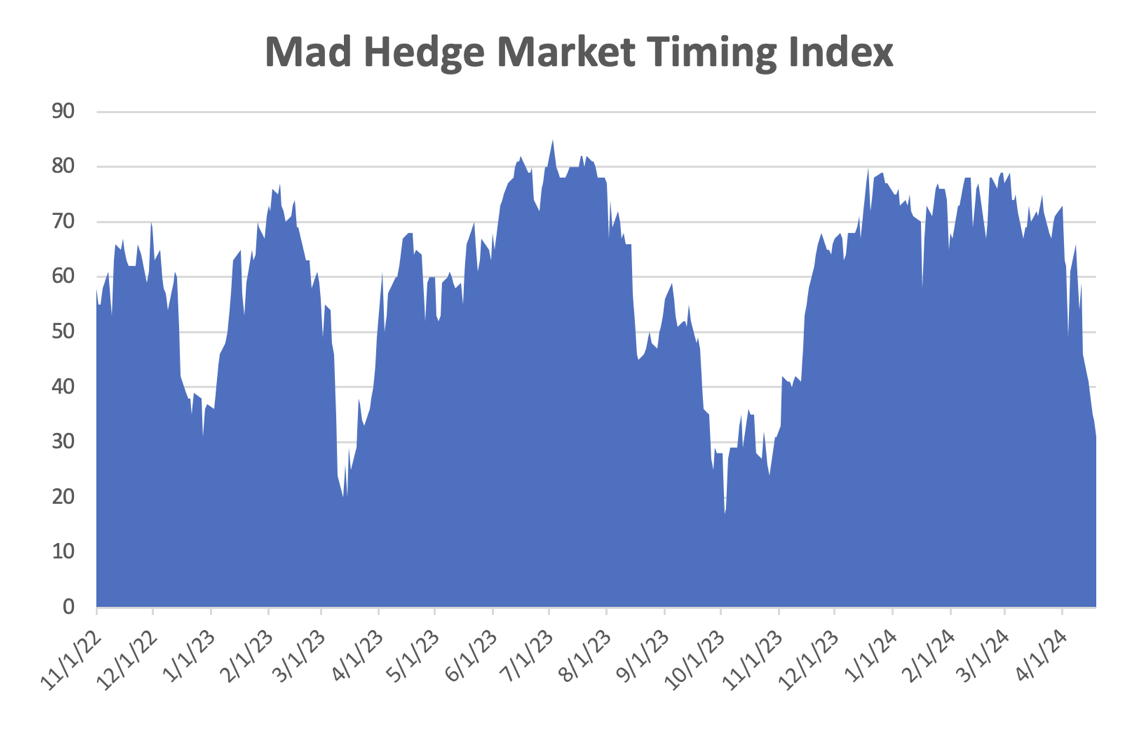

And there’s my mea culpa for 2024. I am human after all. I’m not right all the time, I just act like it. If the horrific market action last week has one silver lining, it’s that it sets up the next great trades, for which there will be many. With my Mad Hedge AI Market Timing Index down to a lowly 31 that may not be far off.

Your next question is “How far down is down?” In the worst-case scenario, the 200-day moving average is in play for all of these. That is pegged at $463 for the S&P 500, $569 for (NVDA), $377 for (MSFT), $150 for (AMZN), and $308 for (META). (AAPL) and (TSLA) already lost their 200-days a long time ago. In other words, the market is in the process of giving up all its 2024 gains and then some.

Sure, the 200 days are all rising sharply so it's unlikely we’ll hit these dire numbers. Still, it's best to prepare your boss for the worst and then let serendipity work its magic.

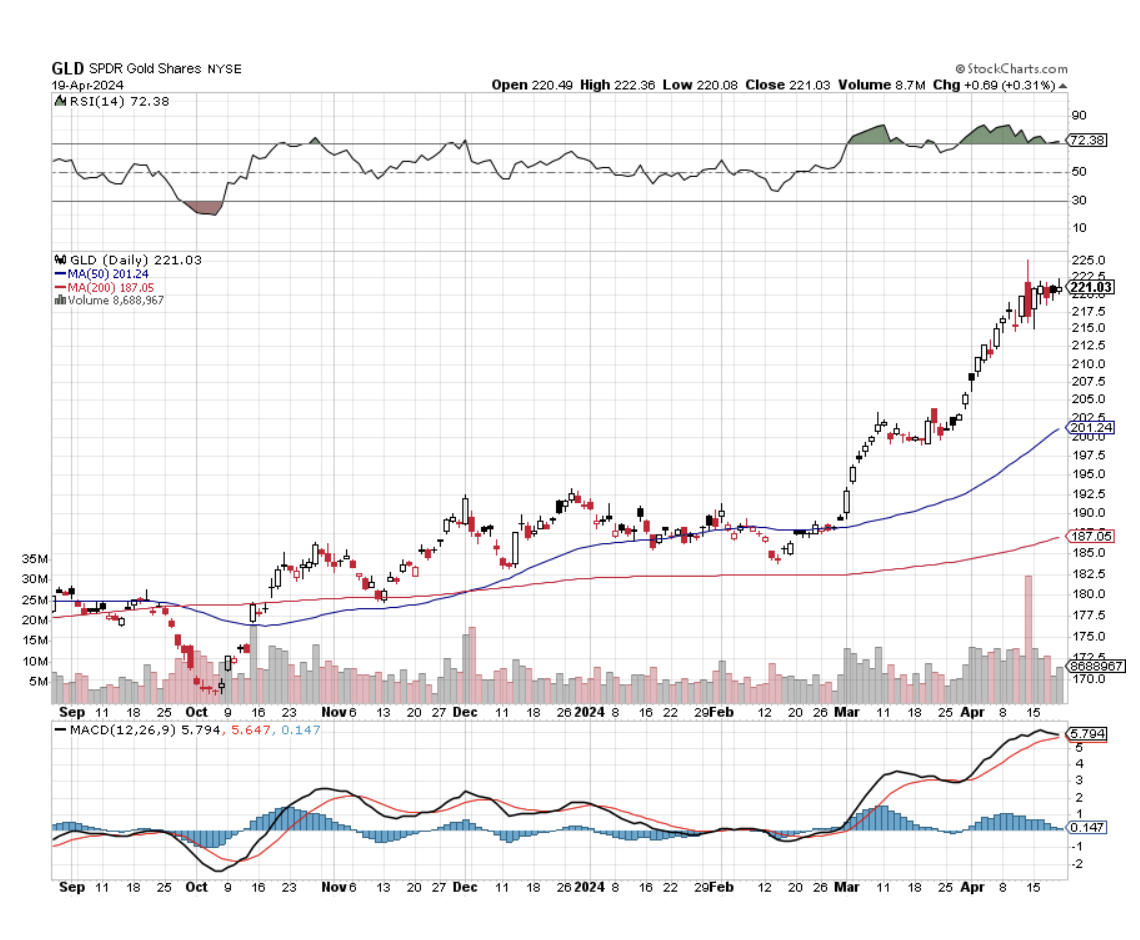

Remarkably, my commodity and precious metal stocks, where I had eight of ten long positions, stuck to the script and moved sideways instead of down. If you throw bad news on a stock and it refuses to fall, you buy the hell out of it. So that will be my next move in the market, once I clean all the mud off my face and pull the arrows out of my rear.

Those of us who have been trading gold for a long time, I’ve been doing it for 50 years and 60 if you count the Kennedy silver dollars I collected, will tell you that this new bull market in the barbarous relic is a very strange one.

None of the traditional factors that drive gold up are present. Interest rates have lately been rising, not falling. ETF financial demand fell all last year, and much of that money was diverted to Bitcoin. Retail demand, especially from Asia, has also been falling off a cliff. Gold miners have in no way been leading the price of the yellow metal because of their excess leverage as they usually do. But gold has seen a 34% rally off the October low.

Go figure.

It turns out that central bank buying has increased dramatically, especially from China, enough to offset all the other no-shows. The conflict in the Middle East is also drawing in more flight to safety demand. The good news is that the Chinese buying will continue. The bad news is that this might be a precursor to the invasion of Taiwan as it flees the Western financial system.

What does all this mean? When the traditional demand for gold returns, interest rates, ETFs, and retail, the price of gold will move a lot higher. The barbarous relic can easily reach $2,800 this year and possibly $3,000. The miners will play catch up. Buy (GLD) on dips and silver (SLV) as well, which has a lot of catching up to do.

I just thought you’d like to know.

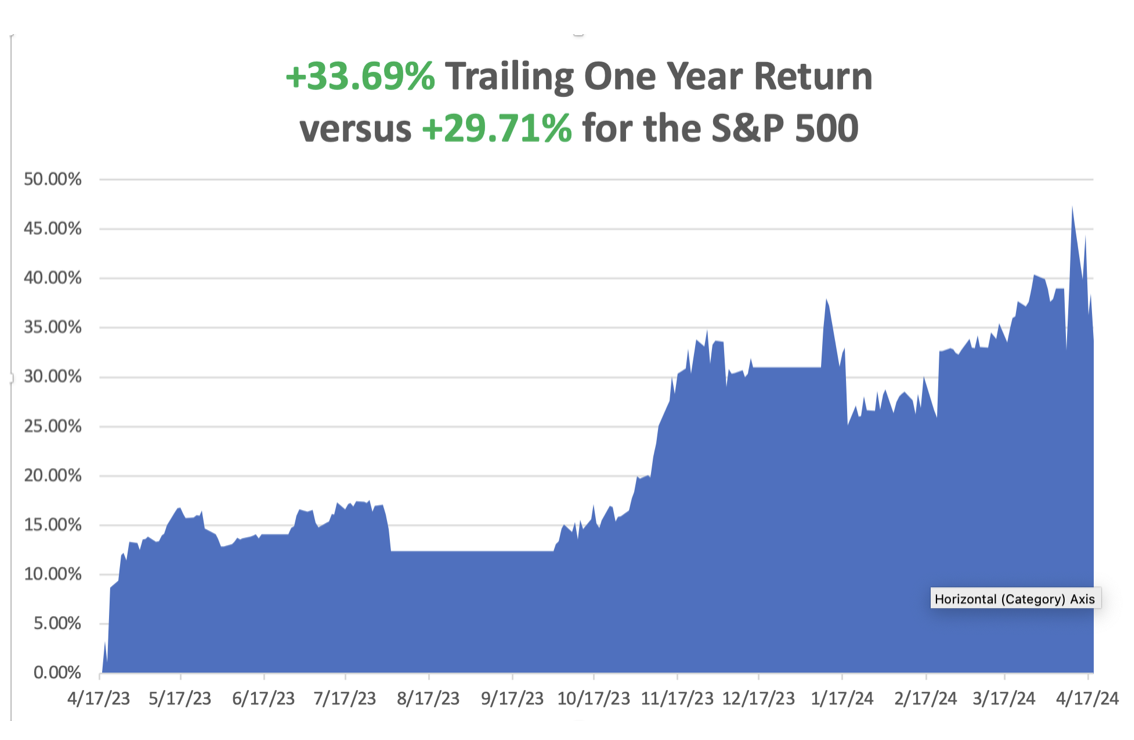

So far in April, we are down a heartbreaking -6.69%. My 2024 year-to-date performance is at +14.47%. The S&P 500 (SPY) is up +2.68% so far in 2024. My trailing one-year return reached +33.69% versus +29.71% for the S&P 500.

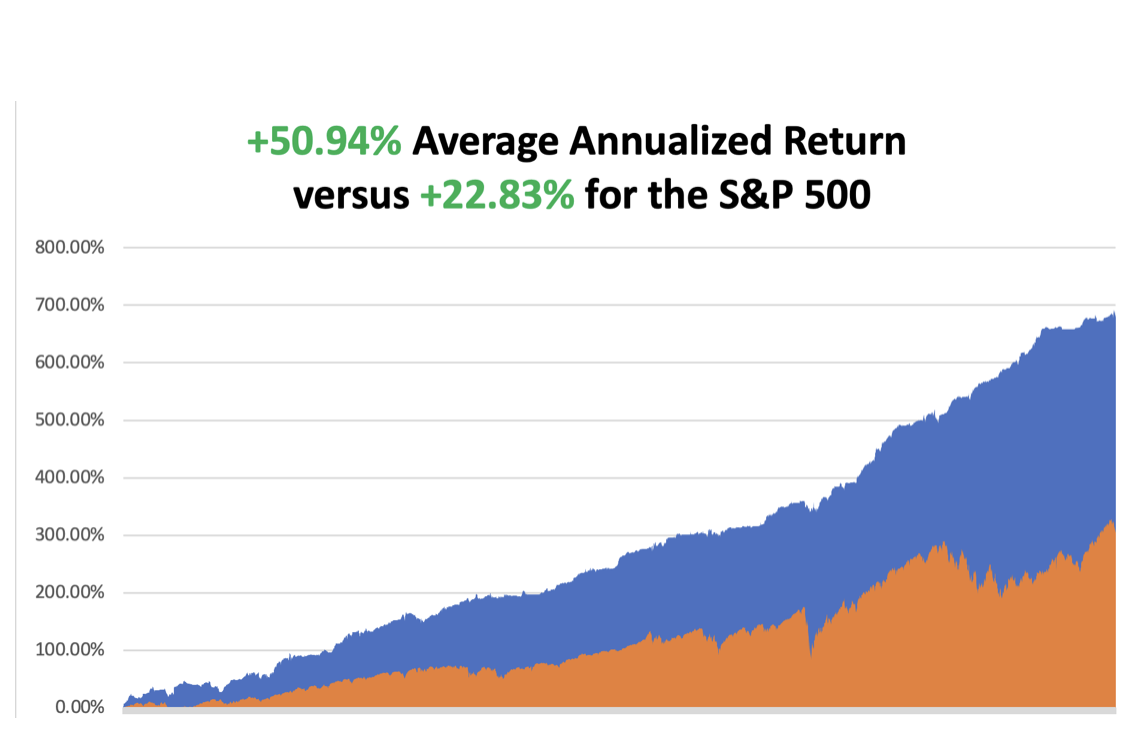

That brings my 16-year total return to +676.63%. My average annualized return has recovered to +50.94.

Some 63 of my 70 round trips were profitable in 2023. Some 20 of 28 trades have been profitable so far in 2024.

I stopped out of my long in Tesla last week at cost, expecting further downside, which happened. A week early the position had been at max profit. I let my April longs expire at a max profit on April 19 in Freeport McMoRan (FCX), Occidental Petroleum, ExxonMobile (XOM), Wheaton Precious Metals (WPM), and Gold (GLD).

That leaves me with my remaining May longs in (TLT) and (FCX) a double long in (NVDA) and 60% in cash.

Volatility Index ($VIX) Hits Six-Month High, on threats of a New Iran War, Oil Supply Cut-offs, and topping stocks. It’s been a long and dry desert crossing, but we are finally back to reach the $20 handle. The volatility trade is back. For a double bonus, the Mad Hedge Market Timing Index also dropped below 50 for the first time since October. Options traders will love it!

Junk Bonds See Biggest Outflows in a Year, as the Federal Reserve’s hawkish approach to inflation makes investors wary, sending yields soaring to 6.33%. Yields won’t peak until the Fed actually cuts rates. Buy (JNK) and (HYG) on dips.

Netflix (NFLX) Adds 9.33 Million New Subscribers, nearly double analyst forecasts, including my five kids who aren’t allowed to share my password anymore. But the shares dropped on weak Q2 guidance. Netflix has rebounded from a slowdown in 2021 and 2022 to grow at its fastest rate since the early days of the coronavirus pandemic. That is due in large part to its crackdown on people who were using someone else’s account. The company estimated more than 100 million people were using an account for which they didn’t pay.

Mortgage Rates Top 7.0% for the first time in 2024, adding dead weight to the housing market. Most borrowers are now taking out adjustable 5/1 ARMS and then praying for a Fed rate cut later this year.

Existing Home Sales Dive by 4.3% in March to 4.19 million units on a sign-contract basis. Inventories rose 4.47% to a 3.2-month supply, up 14% YOY. The median price of an existing home sold in March was $393,500, up 4.8% from the year before. Regionally, sales fell everywhere except in the North, where they rose 4.2% month-to-month. Sales fell hardest in the West, down 8.2%. Prices are highest in the West.

Housing Starts Plunge, down 14.5% in March. Permits for future construction of single-family houses fell to a five-month low. Residential investment rebounded in the second half of 2023 after contracting for nine straight quarters, the longest such stretch since the housing market collapse in 2006. But the recovery appears to be losing steam.

China Surprises with Q1 GDP Growth at 5.3%, but who knows how real these numbers really are? They don’t line up with individual data like international trade. Peak China is behind us. Avoid (FXI).

Tariff Wars Heat Up, US President Joe Biden is threatening China again, and this time he wants to triple the China tariff rate on steel and aluminum imports. On Wednesday, the president will visit the United Steelworkers headquarters in Pittsburgh and has vowed his saber-rattling is not just empty threats. His rhetoric on China could make relations between the US and the Middle Kingdom that much frostier as we enter into the heart of the US election race.

Biden Boosts the Cost of Alaska Oil Drilling Leases, from $10,000 to $160,000, the first increase since 1920. There is also a bump in the royalty on extracted oil, from 12.25% to 16.27%. The government is no longer giving away oil found on its land for free. Coddling of the oil companies is over. Oil companies will no longer bid for cheap oil leases with the intention of sitting on them for decades. The US is currently the largest oil (USO) producing country in history at 13 million barrels/day and hardly needs any subsidies, which date back to the Great Depression. Buy energy stocks on dips, like (XOM) and (OXY), which are posting record profits.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age or the next Roaring Twenties. The economy decarbonizing and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, April 22, at 7:00 AM EST, the Chicago Fed National Activity Index is announced.

On Tuesday, April 23 at 8:30 AM, New Home Sales are released.

On Wednesday, April 24 at 2:00 PM, Mortgage applications come out.

On Thursday, April 25 at 8:30 AM, the Weekly Jobless Claims are announced.

On Friday, April 26 at 8:30 AM, Consumer Expectations. At 2:00 PM, the Baker Hughes Rig Count is printed.

As for me, I spent a decade flying planes without a license in various remote war zones because nobody cared.

So, when I finally obtained my British Private Pilot’s License at the Elstree Aerodrome, home of the WWII Mosquito twin-engine bomber, in 1987, it was cause for celebration.

I decided to take on a great challenge to test my newly acquired skills. So, I looked at an aviation chart of Europe, researched the availability of 100LL aviation gasoline in Southern Europe, and concluded that the farthest I could go was the island nation of Malta.

Caution: new pilots with only 50 hours of flying time are the most dangerous people in the world!

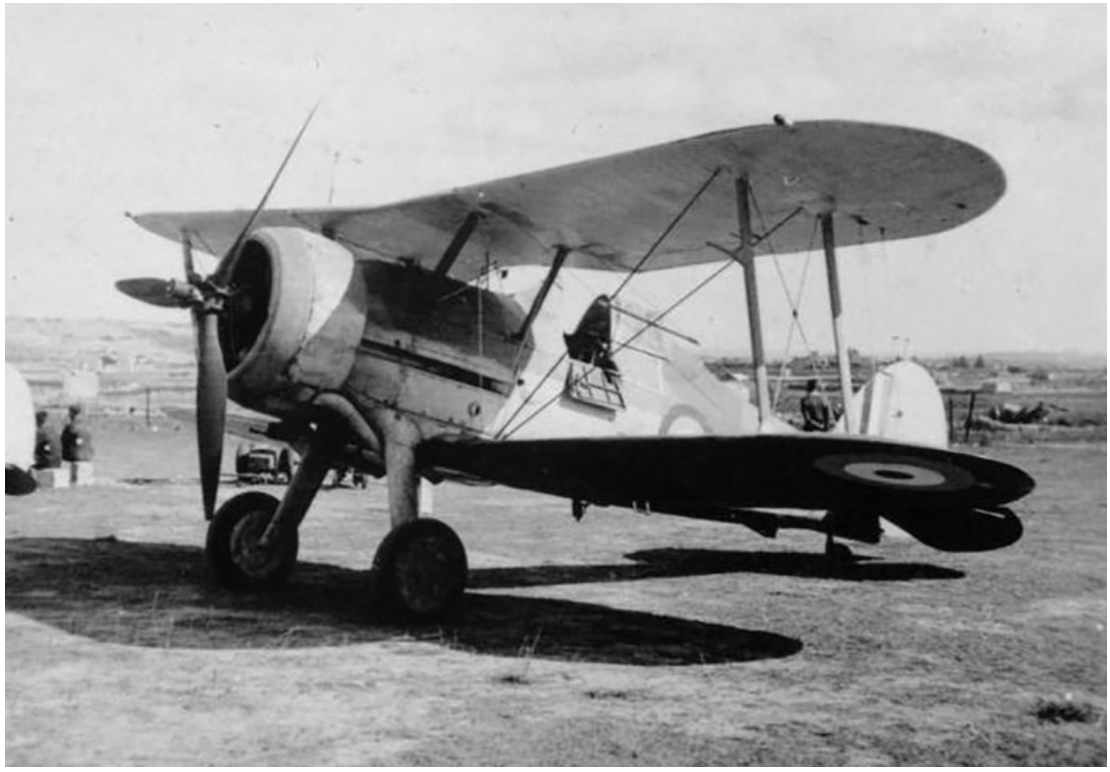

Malta looms large in the history of aviation. At the onset of the Second World War, Malta was the only place that could interfere with the resupply of Rommel’s Africa Corps, situated halfway between Sicily and Tunisia. It was also crucial for the British defense of the Suez Canal.

So, Malta was mercilessly bombed, at first by Mussolini’s Regia Aeronautica, and later by the Luftwaffe. By April 1942, the port at Valletta became the single most bombed place on earth.

Initially, Malta had only three obsolete 1934 Gloster Gladiator biplanes to mount a defense, still in their original packing crates. Flown by volunteer pilots, they came to be known as “Faith, Hope, and Charity.”

The three planes held the Italians at bay, shooting down the slower bombers in droves. As my Italian grandmother constantly reminded me, “Italians are better lovers than fighters.” By the time the Germans showed up, the RAF had been able to resupply Malta with as many as 50 infinitely more powerful Spitfires a month, and the battle was won.

So Malta it was.

The flight school only had one plane they could lend me for ten days, a clapped-out, underpowered single-engine Grumman Tiger, which offered a cruising speed of only 160 miles per hour. I paid extra for an inflatable life raft.

Flying over the length of France in good weather at 500 feet was a piece of cake, taking in endless views of castles, vineyards, and bright yellow rapeseed fields. Italy was a little trickier because only four airports offered avgas, Milan, Rome, Naples, and Palermo. Since Italy had lost the war, they never experienced a postwar aviation boom as we did.

I figured that if I filled up in Naples, I could make it all the way to Malta nonstop, a distance of 450 miles, and still have a modest reserve.

Flying the entire length of Italy at 500 feet along the east coast was grand. Genoa, Cinque Terra, the Vatican, and Mount Vesuvius gently passed by. There was a 1,000-foot-high cable connecting Sicily with the mainland that could have been a problem, as it wasn’t marked on the charts. But my US Air Force charts were pretty old, printed just after WWII. But I spotted them in time and flew over.

When I passed Cape Passero, the southeast corner of Sicily, I should have been able to see Malta, but I didn’t. I flew on, figuring a heading of 190 degrees would eventually get me there.

It didn’t.

My fuel was showing only a quarter tank left and my concern was rising. There was now no avgas anywhere within range. I tried triangulating VORs (very high-frequency omnidirectional radar ranging).

No luck.

I tried dead reckoning. No luck there either.

Then I remembered my WWII history. I recalled that returning American bombers with their instruments shot out used to tune in to the BBC AM frequency to find their way back to London. Picking up the Andrews Sisters was confirmation they had the right frequency.

It just so happened that buried in my pilot’s case was a handbook of all European broadcast frequencies. I looked up Malta, and sure enough, there was a high-powered BBC repeater station broadcasting on AM.

I excitedly tuned in to my Automatic Direction Finder.

Nothing. And now my fuel was down to one-eighth tanks and it was getting dark!

In an act of desperation, I kept playing with the ADF dial and eventually picked up a faint signal.

As I got closer, the signal got louder, and I recognized that old familiar clipped English accent. It was the BBC (I did work there for ten years as their Tokyo correspondent).

But the only thing I could see were the shadows of clouds on the Mediterranean below. Eventually, I noticed that one of the shadows wasn’t moving.

It was Malta.

As I was flying at 10,000 feet to extend my range, I cut my engines to conserve fuel and coasted the rest of the way. I landed right as the sun set over Africa.

While on the island, I set myself up in the historic Excelsior Grand Hotel. Malta is bone dry and has almost no beaches. It is surrounded by 100-foot cliffs. I paid homage to Faith, the last of the three historic biplanes, in the National War Museum in Valetta.

The other thing I remember about Malta is that CIA agents were everywhere. Muammar Khadafy’s Libya was a major investor in Malta, recycling their oil riches, and by the late 1980s owned practically everything. How do you spot a CIA agent? Crewcut and pressed, creased blue jeans. It’s like a uniform. What they were doing in Malta I can only imagine.

Before heading back to London, I had to refuel the plane. A truck from air services drove up and dropped a 50-gallon drum of avgas on the tarmac along with a pump. Then they drove off. It took me an hour to hand pump the plane full.

My route home took me directly to Palermo, Sicily to visit my ancestral origins. On takeoff to Sardinia, wind shear flipped my plane over, caused me to crash, and I lost a disk in my back.

But that is a story for another day.

Who says history doesn’t pay!

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

“Faith”

The Andrews Sisters

Spitfire

Grumman Tiger