When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

May 7, 2024

Fiat Lux

Featured Trade:

(A NOTE ON OPTIONS CALLED AWAY),

(GLD), (SLV), (NVDA), (AAPL), (MSFT)

Occasionally, I get a call from Concierge members asking what to do when their short positions options were assigned or called away. The answer was very simple: fall down on your knees and thank your lucky stars. You have just made the maximum possible profit for your position instantly.

We have the good fortune to have FOUR spreads that are deep in the money going into the May 17 option expiration in 8 days. They include:

Risk On

(GLD) 5/$200-$205 call spread 10.00%

(SLV) 5/$21-$23 call spread 10.00%

Risk Off

(NVDA) 5/$980-$990 put spread -10.00%

(MSFT) 5/$430-$440 put spread -10.00%

Total Net Position 0.00%

Total Aggregate Position 40.00%

In the run-up to every options expiration, which is the third Friday of every month, there is a possibility that any short options positions you have may get assigned or called away.

Most of you have short-option positions, although you may not realize it. For when you buy an in-the-money vertical option debit spread, it contains two elements: a long option and a short option.

The short options can get “assigned,” or “called away” at any time, as it is owned by a third party, the one you initially sold the put option to when you initiated the position.

You have to be careful here because the inexperienced can blow their newfound windfall if they take the wrong action, so here’s how to handle it correctly.

Let’s say you get an email from your broker telling you that your call options have been assigned away. I’ll use the example of the in-the-money SPDR Gold Shares SPDR (GLD) May $200-$205 vertical BULL CALL debit spread, which you bought at $4.55 or best.

For what the broker had done in effect is allow you to get out of your call spread position at the maximum profit point 8 trading days before the May 17 expiration date. In other words, what you bought for $4.55 on April 30 is now $5.00!

All have to do is call your broker and instruct them to exercise your long position in your (GLD) May 200 calls to close out your short position in the (GLD) May $205 calls.

This is a perfectly hedged position, with both options having the same expiration date, and the same number of contracts in the same stock, so there is no risk. The name, number of shares, and number of contracts are all identical, so you have no net exposure at all.

Calls are a right to buy shares at a fixed price before a fixed date, and one option contract is exercisable into 100 shares.

To say it another way, you bought the (GLD) at $200 and sold it at $205, paid $4.55 for the right to do so for 13 days, so your profit is $0.45 cents, or ($0.45 X 100 shares X 25 contracts) = $1,125. Not bad for a 13-day defined limited-risk play.

Sounds like a good trade to me.

Callaways most often happen in the run-up to a dividend payout. If you can collect a full monthly or quarterly dividend the day before the stock registration dates by calling away someone’s short option position, why not? If fact, a whole industry of this kind of strategies has arisen in recent years in response to the enormous growth of the options market.

(GLD) and most tech stocks don’t pay dividends so callaways are rare.

Weird stuff like this happens in the run-up to options expirations like we have coming.

A call owner may need to buy a long (GLD) position after the close, and exercising his long May 205 call is the only way to execute it.

Adequate shares may not be available in the market, or maybe a limit order didn’t get done by the market close.

There are thousands of algorithms out there that may arrive at some twisted logic that the calls need to be exercised.

Many require a rebalancing of hedges at the close every day which can be achieved through option exercises.

And yes, options even get exercised by accident. There are still a few humans left in this market to make mistakes.

And here’s another possible outcome in this process.

Your broker will call you to notify you of an option called away, and then give you the wrong advice on what to do about it. They’ll tell you to take delivery of your long stock and then post an additional margin to cover the risk.

Or they will tell you to sell your remaining long option position at whatever price you can get, wiping out most, if not all of your great profit. This generates the maximum commission for your broker.

Either that, or you can just sell your shares on the following Monday and take on a ton of risk over the weekend. This generates a oodles of commission for the brokers but impoverishes you.

There may not even be an evil motive behind the bad advice. Brokers are not investing a lot in training staff these days. It doesn’t pay. In fact, I think I’m the last one they did train 50 years ago.

Avarice could have been an explanation here but I think stupidity and poor training and low wages are much more likely.

Brokers have so many legal ways to steal money that they don’t need to resort to the illegal kind.

This exercise process is now fully automated at most brokers but it never hurts to follow up with a phone call if you get an exercise notice. Mistakes do happen.

Some may also send you a link to a video of what to do about all this.

If any of you are the slightest bit worried or confused by all of this, come out of your position RIGHT NOW at a small profit! You should never be worried or confused about any position tying up YOUR money.

Professionals do these things all day long and exercises become second nature, just another cost of doing business.

If you do this long enough, eventually you get hit. I bet you don’t.

Calling All Options!

(AAPL), (AMZN), (MSFT), (AVGO), (NXPI), (QCOM), (IBM), (GOOGL)

Let's be honest, the Oracle of Omaha isn't exactly known for chasing the latest tech trends.

But when artificial intelligence (AI) came up in an interview in 2023, Buffett called it "extraordinary" – then immediately followed up with a classic dose of skepticism about its overall benefits.

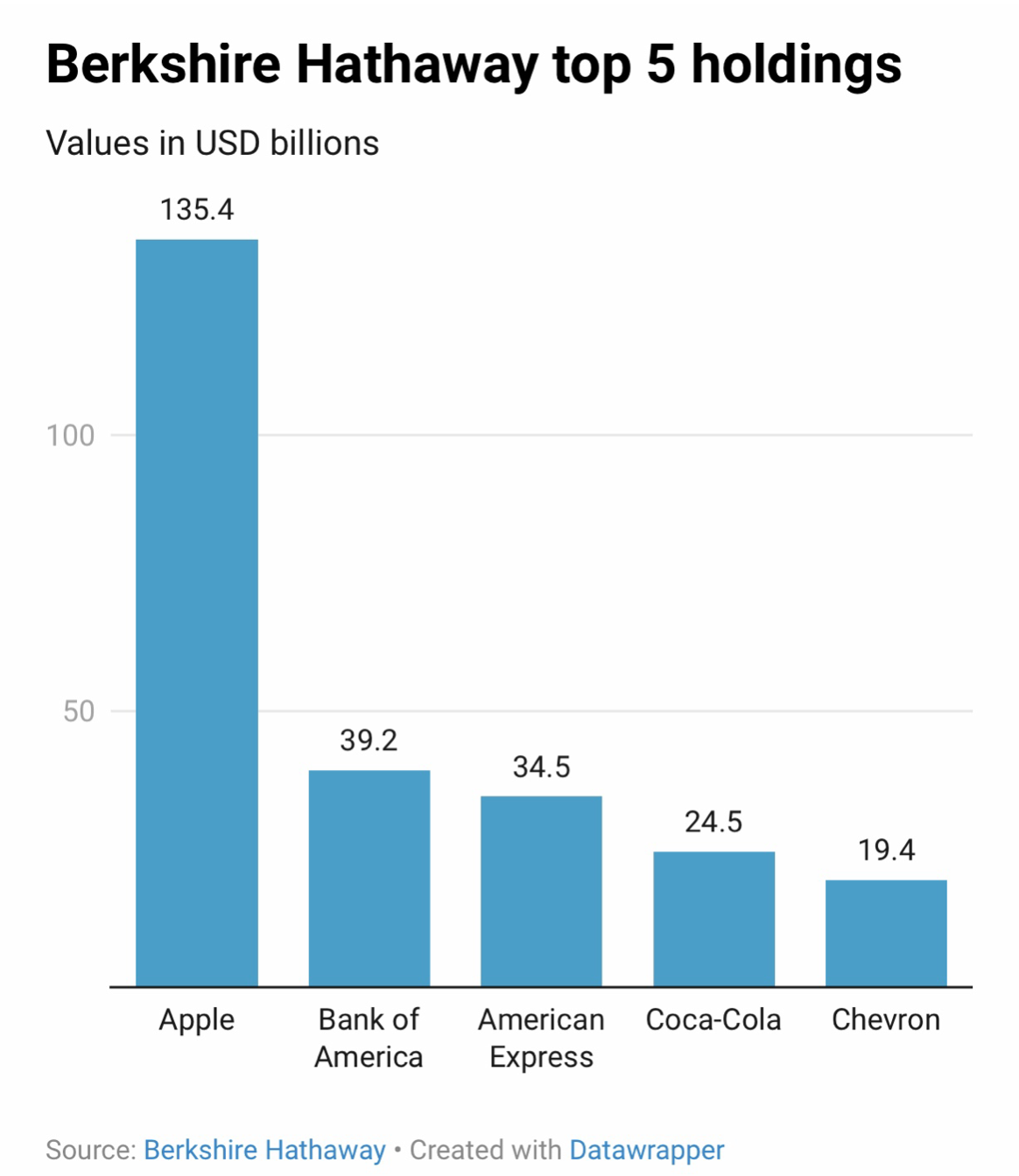

Love it or hate it, Buffett's wallet has already felt the impact of AI. He holds a massive $159 billion position spread across eight AI-related stocks.

And the funny thing is, most of those have been absolute winners this past year.

Let's start with the big fish: Apple (AAPL). We all know Buffett and his sweet tooth for Apple.

That $156.9 billion position makes it Berkshire Hathaway's crown jewel. But with slowing iPhone sales lately, is this really about AI or just an old man's love affair with a familiar brand?

Keep in mind though that the company ain't just about slick gadgets anymore. Rumors are swirling about huge AI upgrades at the June developer conference.

Could Siri start sounding a lot less robotic? Could Apple finally make a splash in the smart home race? We'll find out soon enough.

Then there's Amazon (AMZN), with Berkshire holding a modest $1.8 billion stake. Okay, $1.8 billion isn't exactly pocket change, but it pales compared to Buffett's usual bets.

Still, the fact that he's in on Amazon at all says something. The man hates stuff he doesn't understand, and he's famously admitted missing the boat on this one early.

Why the change of heart? Amazon Web Services (AWS) is where the real AI action is. This cloud computing behemoth powers a vast chunk of the internet and stands to rake in cash as AI tech needs more and more processing muscle.

Buffett might be old school, but he clearly sees the writing on the wall here.

The next is Microsoft (MSFT). I know what you’re going to say. This company isn't technically on Berkshire's books, right? Well, that depends.

His little secret is New England Asset Management (NEAM), a subsidiary that's got a cool $11.6 million tucked away in Microsoft. Sly move, Warren.

Why the hush-hush? It's simple. Microsoft is crushing it with AI. They've woven OpenAI's language models into everything they do, and their Azure cloud is exploding because of it. Companies are scrambling to use that platform to build the next big AI thing.

Another under-the-radar Buffett play is Broadcom (AVGO), again thanks to NEAM. They're holding onto $9.5 million+ worth of this chipmaker.

Now, Broadcom isn't a household name, but it's supplying the nuts and bolts for the AI revolution. They specialize in custom accelerators and the kind of networking infrastructure that makes AI apps actually function at scale.

Heard of their new XPU accelerator? Yeah, it could be the biggest chip ever built for AI.

Another chipmaker that pops up in the NEAM wallet is NXP Semiconductors (NXPI), which has a solid $8.9 million stake. So, is this really a Buffett AI play or just a bet on tech in general?

The answer lies in where NXP gets its bread and butter. Forget smartphones – they're focused on cars, IoT gadgets, and even the infrastructure that connects it all.

Think about it: self-driving cars, smart homes, 5G networks bursting with AI-powered data... that's where NXP could be raking it in.

There’s also Qualcomm (QCOM), often a footnote in discussions of phone tech, is on Buffett's radar as well.

This company might not have seen the same explosive gains as other Buffett-backed AI stocks, but a $8.3 million investment isn't chump change. And that 35% growth? Not bad either.

Besides, we all know Qualcomm as the king of smartphone chips. But they're not sitting on their laurels. They're deep in the AI game and even partnering with tech giants to develop tools that help AI apps run anywhere.

Smart move, considering how fragmented the chip market is. Could be a long-term play by Buffett – definitely one to keep an eye on.

Meanwhile, do you still remember when IBM (IBM) was the king of the AI hype machine? Well, Buffett dumped that stock a while back, but NEAM still holds onto a cool $5 million.

So, is this a "past its prime" play, or does Big Blue still have some AI magic up its sleeve?

Watson, their big AI platform, isn't the headline-grabber it used to be. But don't underestimate the power of established connections – plenty of companies still rely on Watson to get their feet wet with AI. It's not cutting-edge, but it's a reliable workhorse in the AI world.

Finally, Alphabet (GOOGL). Buffett has been kicking himself for missing out on Google – we've heard that story before. At least NEAM has a modest $2.5 million stake, so it's not a complete loss.

Admittedly, Alphabet's had some embarrassing AI misfires lately. But don't write them off just yet. They're still one of the top dogs in AI development.

And those rumors about Apple cozying up to their Gemini AI models? If true, that could be a game-changer.

Now that we've covered the big guys, the underdogs, and a few of Buffett's sneaky side bets in the AI space, here’s the most important question: are they worth your hard-earned cash right now?

Honestly, every single one of these stocks has the potential for solid long-term gains. But if, like me, you think AI is all about that cloud power, there are clear standouts.

The first is Amazon. Its AWS isn't just a side business, it's the engine driving their AI innovations.

Then, there’s Microsoft Azure locked in a fierce battle with AWS, plus they're weaving AI into everything they touch.

And, of course, Alphabet. They may stumble sometimes, but their deep pockets and cutting-edge research mean they'll always be in the game.

Bottom line: There's no magic formula to picking AI winners, even with Buffett's billions backing them. I suggest you buy the dip in the ones I mentioned and keep the rest on your watchlist.

Mad Hedge Technology Letter

May 6, 2024

Fiat Lux

Featured Trade:

(BUFFETT CHIMES IN ON AI)

(BRK/A), (SMCI), (AI), ($UST10Y)

At the once-per-year shareholder meeting for Berkshire Hathaway (BRK/A) in Omaha, Nebraska, the shindig has become a caricature of itself.

A company that does so well, but the leader has self-proclaimed to understand nothing about technology.

It was fascinating to see the Oracle of Omaha Warren Buffett dabble in the cooler talk that is talk about artificial intelligence.

Ironically enough, his pep talk about AI was littered with negatives about the consequences of AI.

Warren Buffett's warning about AI’s potential harm has everything to do with his conservative risk tolerance to not beeline straight to the front of the most modern developments in the tech industry.

He’s late on most stocks but he’s right on them in the end.

It wasn’t too far back when Buffett only would invest in a company as complicated as Coca-Cola, because he famously stated that he doesn’t invest in companies that he doesn’t understand.

Insurance also made Buffett a killing pouring capital into companies like Aflac.

He finally came around to Apple which for better or worse is known as the iPhone company.

His risk tolerance of tech increasing to the almighty smartphone was quite a jump for Buffett that took many years, so don’t expect another leap of faith anytime soon.

In fact, Buffett claiming he doesn’t understand AI too well means there is a lot of capital sitting on the sidelines waiting to enter once they finally do “understand.”

I should also just note the general stockpile of money that has been waiting on the sideline since the Covid-era is enormous.

Any meaningful dip in any meaningful tech company will be met by a torrent of new buying demand.

That’s exactly what happens when the number of great tech companies can be counted on 2 hands.

Almost like what is happening with American restaurants – it’s not that American restaurants are going through a generational renaissance, no, they are packed because so many small restaurants closed after COVID.

Tech is experiencing the same playbook with investor money.

The past 7-12 years have seen the spurring on competition squelched, and the tech industry has never been closer to a full-blown monopoly in some sub-sectors.

Once the bulls get back in control, we are off to the races again, because a few companies move markets now.

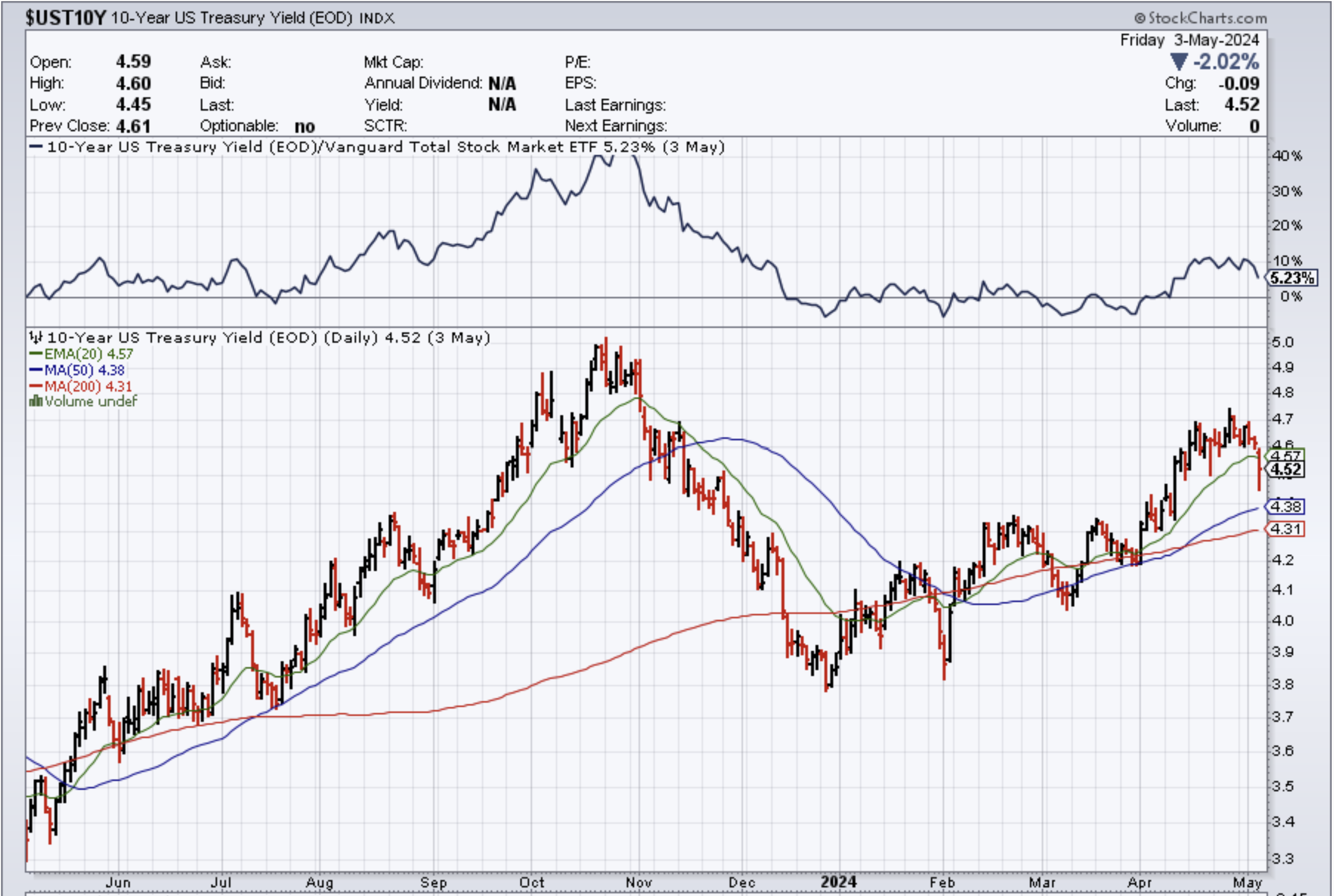

That’s what I believe we are seeing in the short-term with the US 10-year inching up only for Central Bank Fed Chair Jerome Powell to deliver us a monumental dovish speech to the sticky inflation we are seeing in numbers now.

Buffett chose to talk about the darker side of AI and the potential for scamming people.

He said that scamming using AI will become a “growth industry of all time.”

Buffett pointed to the technology’s ability to reproduce realistic and misleading content in an effort to send money to bad actors.

Just because we don’t like it, we cannot write it off or afford it as investors.

Readers must deal with AI and the manifestations of it.

One of the big side effects is that it accelerates the winner-takes-all dynamics of tech.

If I were a newbie investor, Super Micro Computers (SMCI) would be on the radar as a powerful growth stock with bountiful potential and exposure to AI.

More tech companies will fail, and they will fail faster, without a trace of even existing sometimes.

It also puts extreme pressure on tech management to implement AI, lose funding, or lose the momentum the business model.

It almost makes tech management over-reliant on AI to fix any and every mess.

The reality is that there will be a lot of losers from AI and punishes companies that never figure out AI.

It is best to identify them before the stock goes to 0.

I don’t necessarily share the same dark outlook as Buffett and I commend him for doing so well on his performance, but when it comes to technology stocks, he shows up late, but it is better than never showing up.

Man is not free unless government is limited.” – Said Former US President Ronald Reagan

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

(“WOODSTOCK FOR CAPITALISTS” SHOWED BUFFETT IS STILL IN GOOD FORM)

May 6, 2024

Hello everyone.

Week ahead calendar

Monday, May 6

No economic data of note.

Earnings: Loews, Spirit Airlines, Tyson Foods, BioNTech, Hims & Hers, Vertex Pharmaceuticals, Lucid Group, Palantir Technologies, Simon Property Group, Aecom, Microchip Technology, Rocket lab, Goodyear Tire, Flavours & Fragrances, Marriott Vacations, Noble Corp., Vornado Realty, Coty, Bell Ring Brands, Cabot

Tuesday, May 7

3:00 pm Consumer Credit (March)

Earnings: UBS, BP, Nintendo, Squarespace, Kenvue, Aramark, Gogo, Energizer, Tempur Sealy, Bloomin’ Brands, Crocs, Datadog, Duke Energy, Rockwell Automation, Spirit AeroSystems, TransDigm, Expeditors, Nikola, Walt Disney, Ferrari, Global Foundries, NRG Energy, Perrigo, Electronic Arts, Cirrus Logic, iRobot, Redfin, Lyft, TripAdvisor, Adaptive Biotech, Arista Networks, Dutch Bros., Kyndryl, Marqeta, Oddity Tech, Olo, Sonos, Toast, Upstart Holdings, Virgin Galactic, Twilio, IAC/InterActive, Match Group, McKesson, Rivian Automative, Brighthouse, Occidental Petroleum, Assurant, Angi, Kinross Gold, Astera Labs, Diamond Offshore, Reddit.

Wednesday, May 8

10:00 a.m. Wholesale inventories (March)

Earnings: Anheuser-Busch InBev, Edgewell Personal Care, Embraer, Elanco Animal Health, United Parks & Resorts, ODP, Emerson Electric, Brookfield, New York Times, Performance Food Group, Reynolds Consumer Products, Shopify, Teva Pharma, Uber Technologies, Brink’s Tegna, Hain Celestial, Choice Hotels, Dine Brands, Liberty Broadband, Affirm Holdings, Fox Corp., Cushman & Wakefield, Liberty Media, Valvoline, Arm Holdings, Airbnb, Robinhood, Beyond Meat, Bumble, Kodiak Gas Services, NuSkin, SolarEdge Technologies, TKO Group, Vizio, AMC Entertainment, Cheesecake Factory, News Corp., Toyota Motors, Celanese, Instacart, Klaviyo.

Thursday, May 9

8:30 a.m.

Continuing jobless claims

8:30 a.m. Initial claims

Earnings: Nissan, Cedar Fair, Six Flags, Yeti, Hanesbrands, Planet Fitness, Sally Beauty, Tapestry, US Foods, Warby Parker, Krispy Kreme, Hyatt Hotels, Warner Bros, Discovery, Roblox, Viatris, Papa John’s, Hilton Grand Vacations, Warner Music Group, Solventum, DropBox, Akamai, Figs, Sweetgreen, Unity Software, Yelp, Synaptics, H&R Block, Iamgold, Fidelis Insurance, GenDigital, Savers Value Village.

Friday, May 10

10:00 a.m. Michigan sentiment (May)

2:00 p.m. Treasury budget (April)

Earnings: Honda Motor, AMC Networks.

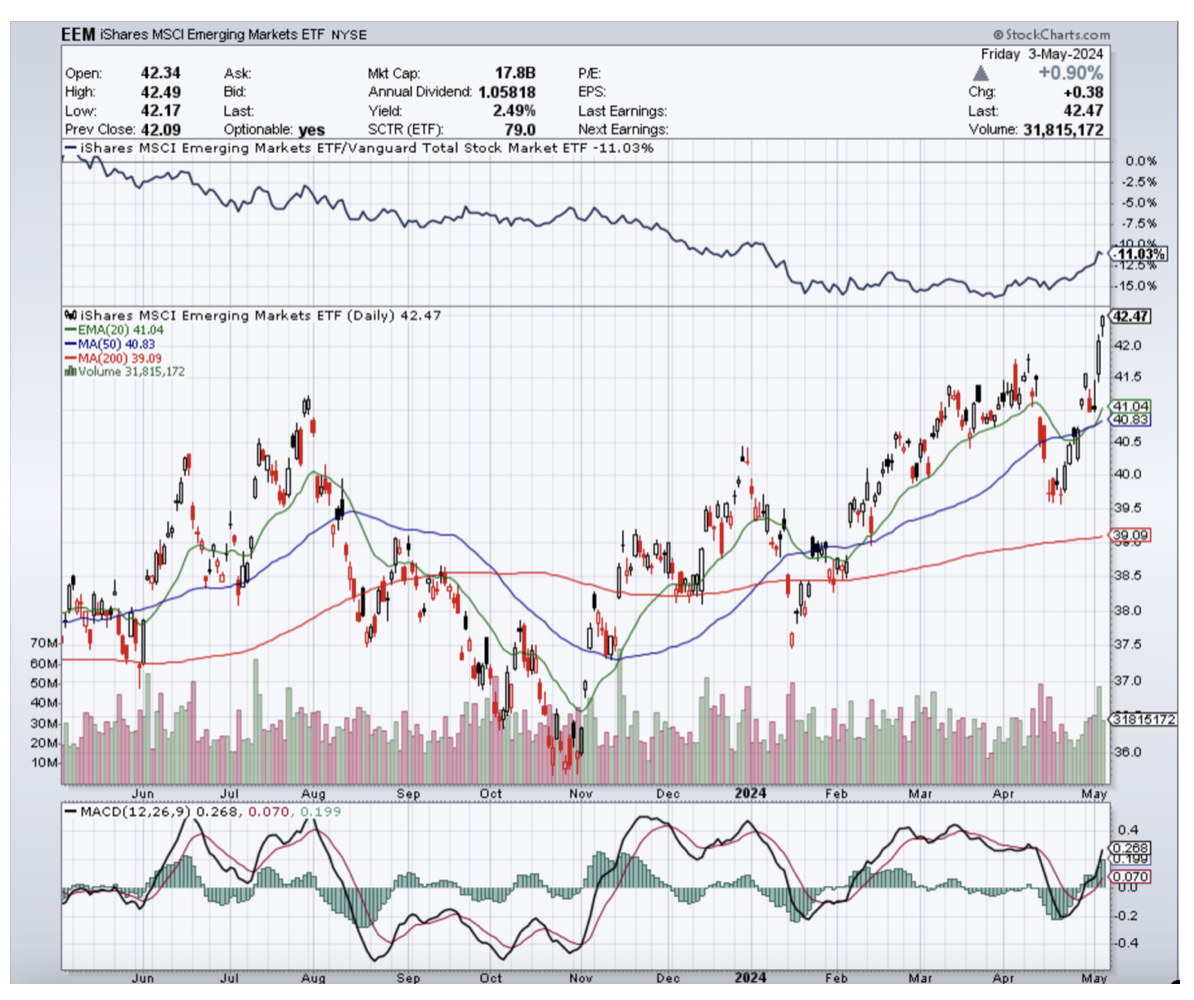

Maybe time to start looking at Emerging Markets.

The weaker than expected employment numbers last Friday marked the first sign this year that we may just see some interest rate movement in the form of cuts toward the latter part of this year.

And if we do see a lower rate environment on the horizon, one area that will be boosted is emerging markets.

Emerging market equities are at attractive valuations presently; earnings growth too has started to accelerate.

Start looking at this ETF:

(EEM)iShares MSCI Emerging Markets ETF

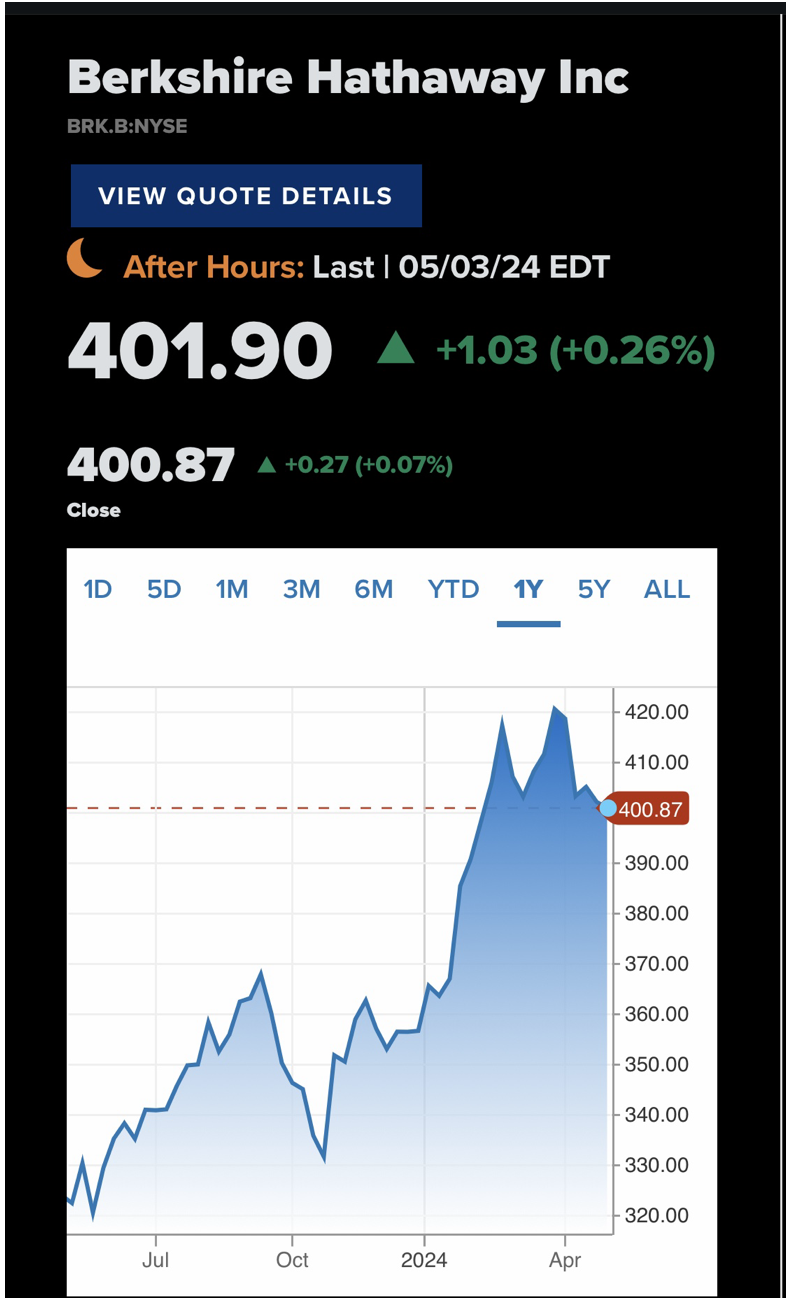

Continue scooping up some Berkshire Hathaway stock.

Berkshire Hathaway’s annual general meeting on Saturday, May 4, has been dubbed “Woodstock for Capitalists.”

Analysts have a $472 price target on class B shares, and this suggest nearly 18% upside from last Thursday’s close.

I listened to several hours of the meeting and the topics covered included climate change, succession planning, artificial intelligence, the sale of a chunk of Apple shares (around 13%) - 115 million shares.

The company has approximately $200billion in cash. Greg Abel will make investing decisions for Berkshire Hathaway when Buffett passes.

Buffett spoke of “scamming” as a growth industry, which will be enabled by AI. While he didn’t see AI as all bad, he did note that the potential for AI to manipulate videos and images - to extract money from people - poses enormous harm to those who are unsophisticated in critically evaluating these types of media.

One of the best lessons from Charlie Munger.

Patience.

Munger was well known for waiting – not only when it came to building wealth, but for finding attractive investing opportunities.

In his words: “We wait for no-brainers. We’re not trying to do the difficult things. And we have the patience to wait.”

When it came to investing in what he viewed as great companies, Munger shared Buffett’s view that your best move as an investor is holding for the long term.

In Buffett’s words: “When we own portions of outstanding businesses with outstanding managements, our favourite holding period is forever.”

Warren Buffett’s insights about life.

“If you are lucky in life, make sure others in life are lucky too.”

“Be kind and the world will be better off.”

Market Update:

S&P500

It’s possible that this correction is completed to enable the resumption of uptrend in a Wave 5 advance towards the next upside target at around 5,450. If the 5th wave has begun, then support at 5,060/5,011 should now hold.

We must be aware, though that there is still risk of a final sell-off toward the low/mid 4,800’s, before the uptrend is ready to resume.

The Bigger Picture outlook remains bullish. The 5,735 mark is the potential target over the coming months.

Gold

Gold has been undergoing a 4th wave correction. A sustained break above $2,350 resistance will represent the resumption of uptrend for rally back toward the area of $2,430.

The Bigger Picture outlook remains bullish, with the next upside target at around $2,530.

Bitcoin

Bitcoin has been undergoing a 4th wave correction, and this might be completed now.

Support lies around the $59,500 level. If this area holds, we should now see rallies on to the next resistance areas at $67,240 and $73,794 levels.

Bitcoin’s bullish structure remains in place.

QI Corner

Cheers

Jacquie

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.