When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

May 6, 2024

Fiat Lux

Featured Trade:

(NONE)

While swimming with the hammerhead sharks off a rocky outcrop near the Galapagos Islands in the South Pacific, John Thomas swallowed too much seawater and suffered from too much sun. He collected aloe vera leaves around his house, crushed them, and rubbed the juice over his face. It is now working its magic. Western sun blocks are no match for the equatorial sun.

Our regular service resumes tomorrow.

AI Revolutionizes Card Issuance: Survey Highlights Transformation for Financial Institutions

A groundbreaking survey conducted by the World Economic Forum (WEF) and the Cambridge Centre for Alternative Finance (CCAF) has revealed the rapidly evolving landscape of card issuance within the financial services industry. Artificial intelligence (AI) is poised to play a pivotal role in this transformation, driving changes in customer experience, operational efficiency, and even the fundamentals of how financial institutions underwrite risk.

The Rise of AI in Financial Services

The WEF-CCAF survey, entitled Transforming Paradigms: A Global AI in Financial Services Survey, offers crucial insights into the adoption of AI within the sector. The study surveyed 151 respondents from 33 countries, encompassing both incumbent financial institutions and disruptive FinTech companies. The results paint a compelling picture of the expanding use of AI for various financial services, with card issuance being a prime area of impact.

One key takeaway from the survey is that financial institutions are increasingly turning to AI to revamp their card offerings. AI-powered algorithms are being used to personalize credit lines, rewards programs, and even the physical design of cards. This enhanced personalization offers tremendous potential for improving customer acquisition, retention, and overall satisfaction.

Smarter Underwriting and Risk Assessment

Traditionally, card issuance decisions have relied heavily on historical credit data and standardized risk models. But AI is reshaping these processes, enabling financial institutions to make more informed and nuanced decisions. By analyzing massive datasets, including alternative data sources like social media activity and spending patterns, AI algorithms can build more comprehensive customer profiles. This, in turn, allows for more refined risk assessments, expanding card access to individuals who might have been excluded by conventional underwriting models.

The WEF-CCAF survey indicates that financial institutions are also leveraging AI for enhanced fraud detection. AI-powered systems can analyze transaction patterns in real-time, identifying anomalies and potential fraudulent activity with far greater accuracy than legacy systems. This heightened security not only protects institutions from financial losses but crucially builds consumer trust in digital financial services.

Streamlining Operations and Enhancing Customer Service

The impact of AI on card issuance extends far beyond customer-facing enhancements. Financial institutions are utilizing AI to streamline their back-end operations, leading to increased efficiency and cost savings. For instance, AI-powered chatbots can handle routine customer inquiries, freeing up human agents to focus on more complex issues. In addition, intelligent process automation (IPA) can be used to automate tasks like application processing, account management, and dispute resolution.

Challenges and Considerations

While the survey highlights the potential benefits of AI in card issuance, it also acknowledges the challenges that financial institutions face in its implementation. The report cites several hurdles including:

- Data Quality and Access: High-quality data is the backbone of any effective AI application. However, many institutions struggle with data silos, inconsistencies, and limitations in data access.

- Talent Acquisition: AI requires specialized skill sets. Attracting and retaining data scientists, machine learning engineers, and AI experts can be a significant challenge.

- Regulatory Uncertainty: The regulatory landscape around AI is still evolving. Financial institutions must navigate potential regulatory hurdles around explainability, bias, and compliance to ensure their AI systems are transparent and fair.

Charting the Future of Card Issuance

Looking ahead, the WEF-CCAF survey suggests that AI's transformative impact on card issuance will only accelerate. Here are some key trends to watch:

- Hyper-Personalization: AI will drive a shift towards hyper-personalized card offerings, tailored to an individual's specific needs, preferences, and financial behaviors.

- Embedded Finance: Card issuance will become more deeply integrated with digital ecosystems. Expect to see cards embedded within popular e-commerce platforms, social media apps, and other digital services.

- AI-as-a-Service: Cloud-based AI solutions will make it easier for smaller financial institutions to access cutting-edge AI capabilities without the need for large in-house investments.

- Responsible AI: There will be an increasing focus on developing explainable, transparent, and ethical AI systems to ensure that AI-powered card issuance decisions are fair and unbiased.

Mad Hedge Technology Letter

May 3, 2024

Fiat Lux

Featured Trade:

(ARE 8% RATES GOOD FOR TECH?)

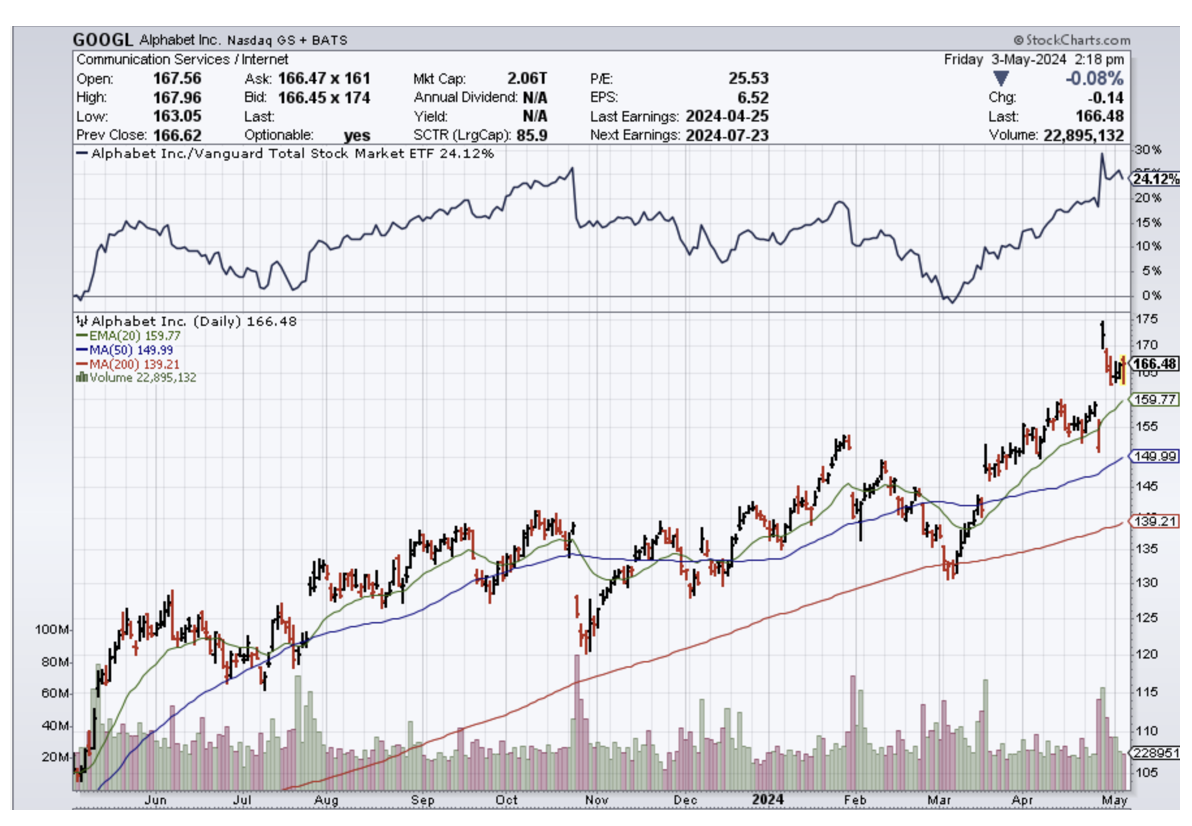

(GOOGL), (AAPL), (JPM)

Although much of the mass media ignores some of these dire reports issued by some prominent finance guys, I have taken notice.

I’m not here to scare you.

Everything will work out fine.

It was only just lately that one of the most public-facing US bankers, Jamie Dimon, delivered us a future warning that could mean bad results for many tech companies.

I won’t say that every tech company will be ripped to shreds, there are still a few that are head and shoulders above the rest and could withstand heavy shelling.

But 8% rates is a world that could spook tech investors.

It just goes to show that some numbers floating around are starting to come into the realm of possibility even if the probabilities are quite low.

Dimon’s thesis centered on “persistent inflationary pressures” and unless you’re an ostrich with your head in the ground, prices haven’t come down for most stuff that we buy including software and tech gadgets.

Rates close to 10% would kill many golden gooses in various industries and I do believe a world of rates that high would really put the sword to the throat of many tech companies.

If that happened, kiss the tech IPO market goodbye and just be happy that we squeezed into Reddit this year.

More often than not, American tech companies are gut-punched when there is a global growth slowdown because many of these companies extract revenue from everywhere.

They are so big that they have to unearth every stone in far-flung places to keep the growth narrative chugging along.

The unemployment rate remains below 4% and businesses, but a world of 8% interest rates would mean another 50% downsizing of tech staff and a rockier path to profits.

Amidst heightened global uncertainty, what has the technology sector delivered to us lately?

Shareholder returns.

Google rolled out the carpet for its first-ever dividend.

Apple increased its dividend by announcing a new $110 billion share repurchase plan.

What is my takeaway here?

Has Apple run out of bullets here so much so that a share buyback is better to do than give its clients a new product?

They do this also because they can afford to and many tech companies would view this as a luxury.

However, there will come a time where the market will demand a new killer product and that day is inching forward.

How do I know that?

iPhone sales are down 10% in the first 3 months of 2024 and that is absolutely awful.

Even if the market looks through these terrible numbers, the day of reckoning inches up, and when it comes, not even a shareholder buyback will massage the stock higher.

Like a magician, this earnings season was a great escape for tech, and I question how many more earnings seasons will they get a pass for.

In a scenario of 8% interest rates, 95% of tech stocks would drop and a few heavyweights would be forced to carry the load. Psychologically, it would scare off the incremental tech investor and that is the bigger problem.

There is only so far the can is able to get kicked down the road.

In the short term, I would be inclined to buy on the dip after we can digest this mediocre earnings season, but at some point, this “bad news is good news” will disappear with the wind.

Man is not free unless government is limited.” – Said Former US President Ronald Reagan

SUMMARY OF JOHN’S MAY 1, 2024, WEBINAR)

May 3, 2024

Hello everyone,

TITLE: Digestion Time

TRADE ALERT PERFORMANCE:

2024 YTD: +14.61%

Since inception: +690.24%

Average annualized return: +51.77% for 16 years

PORTFOLIO REVIEW:

Risk On:

NVDA 5/$710-$720 call spread

TLT 5/$82-$85 call spread

META 5/$360-$370 call spread

GLD 5/$200-$205 call spread

Risk Off:

NVDA 5/$960-$970 put spread.

NVDA 5/$980-$990 put spread.

MSFT 5/$430 - $440 put spread.

AAPL 5/$185-$195 put spread.

THE METHOD TO MY MADNESS:

A short-term top for all risk assets is in.

However, the downside is limited to 5%-8% with $8 trillion in cash on the sidelines and a further $26.8 trillion in short-term US treasury bills.

Technology stocks won’t crash, just have a sideways ‘time’ correction.

All economic data is globally slowing, except for the US, with the only good economy in the world.

Interest rates are higher for longer.

Buy stocks and bonds but only after substantial dips.

THE GLOBAL ECONOMY – STAGFLATION:

Personal Consumption Expenditures (PCE) come in warm for March, up 2.8% YOY, the same as for February. Service prices led.

GDP Bombs for Q1, at a 1.6% annualized rate. US economic growth slid to an almost two-year low last quarter.

Leading economic indicators drop 0.3% versus 1.1% expected after increasing by 0.2% in February.

Tariff wars heat up. US President Joe Biden is threatening China again and this time he wants to triple the China tariff rate on steel and aluminum imports.

China surprises with Q1 GDP growth at 5.3%, but John questions the validity of the numbers.

US Retail Sales come in hot, up 0.7% in March.

STOCKS – CORRECTION TIME:

Big Tech crashes, with all the Mag’ 7 breaking 50-day MA’s.

Meta crashes 15% sparking a selloff in big tech stocks after the social media giant signaled its costly bet on AI would take years to pay off.

Volatility Index ($VIX) hits six six-month high, on threats of a new Iran war, oil supply cut-offs, and topping stocks.

Next stop = 200-day moving averages.

If those hold this is just a correction. If they don’t, the bear market is back.

Short sellers pocketed record profits last week, on the technology crash and volatility explosion, raking in $10 billion. (NVDA) shorts accounted for $3 billion of this.

Airlines make contingency plans for new aircraft. United Airlines cut its aircraft-delivery expectations for the year as its main supplier of airplanes Boeing has signaled a slower production schedule.

BONDS – NO 2024 RATE CUTS:

Biggest Treasury Bill Auction in History is a huge success, at $69 billion for a two-year paper with a 4.898% yield.

That is almost a risk-free government guarantee 10% yield in two years.

Another $70 billion of five-year notes sold the next day.

Half of this is going to foreign investors and central banks.

Faith in America and the US$ remains strong.

Passage of the Ukraine aid bill was probably a help.

Junk Bonds see the biggest outflows in a year, as the Federal Reserve’s hawkish approach to inflation makes investors wary, sending yield soaring to 6.33%. Buy (JNK) and (HYG on dips.

FOREIGN CURRENCIES – 40 YEAR YEN LOWS:

Japanese yen collapses to 160.

Bank of Japan intervened, boosting the currency temporarily. Avoid (FXY)

Chinese Yuan remains weak. International trade is collapsing.

Declining exports, collapsing foreign investment, and minimal population growth, it all add up to a weaker Chinese currency.

Higher for Longer rates mean higher for longer greenback.

Falling interest rates = falling USD$.

ENERGY AND COMMODITIES:

Oil and Gas M&A hits record in Q1, hinting that the new bull market in oil may extend.

U.S. oil and gas deals hit a record $51 billion in the first quarter.

BHP makes a $39 billion bid for Agnico Eagle (AEM), to create the world’s largest copper producer.

Activist Elliot takes a run at mining giant Anglo American, accumulating a $1 billion stake. BHP is also making a takeover bid here.

Biden boosts the cost of Alaska Oil Drilling Leases, from $10,000 to $160,000, the first increase since 1960. There is also a bump in the royalty on extracted oil, from 12.25% to 16.27%.

The US is currently the largest oil-producing country in history at 13 million barrels/day and hardly needs any subsidies.

Buy energy stocks on dips, like (XOM) and (OXY), which are posing record profits.

PRECIOUS METALS – GEOPOLITICAL FEARS:

Gold hanging on to all-time highs, up 34.25% since October.

Central bank buying is accelerating, especially from China.

Gold is also being dragged up by the global commodity boom.

Traditional demand for gold has been absent until now.

ETF and jewelry demand fell in 2023.

Their return is what will take gold up to $3000 in 2025.

Silver is also starting to outperform.

REAL ESTATE – RATES BUZZ KILL:

Mortgage rates soar to 7.25%, bringing new applications to a grinding halt. In one shot the market has gone for six Fed rate cuts in 2024 to zero.

March New Home Sales Jump by 8.1% when only 1.1% expected, to 693,000.

The median price of a new home sold fell to $430,700.

Existing home sales dive by 4.3% in March to 4.19 million units.

Housing starts plunge, down 14.5% in March.

TRADE SHEET:

Stocks – buy dips.

Bonds – buy dips.

Commodities – buy dips.

Currencies – sell dollar rallies, buy currencies.

Precious metals – buy dips.

Energy – buy dips.

Volatility – buy $12.

Real Estate – buy dips.

NEXT STRATEGY WEBINAR:

Wednesday, May 15 @ 12 EST from Incline Village, Nevada.

Cheers,

Jacquie

Global Market Comments

May 3, 2024

Fiat Lux

Featured Trade:

(MAY 1 BIWEEKLY STRATEGY WEBINAR Q&A),

(TSLA), (TLT), (GOLD), (GLD), (WPM), (NVDA), (OXY), (XOM)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.