Looking for a financial to add to your tech-heavy portfolio?

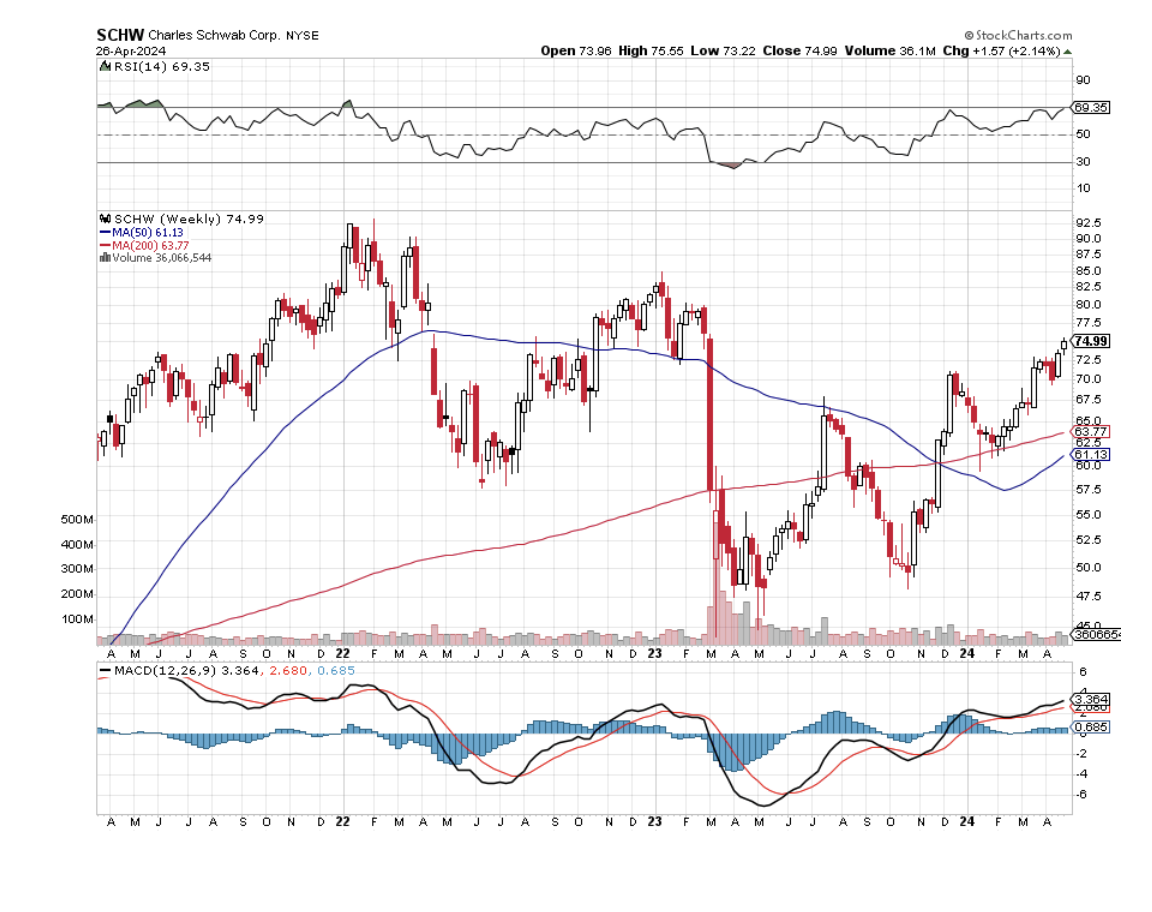

I think the nimble investor can pick up shares of online broker Charles Schwab (SCHW) and gain an outsized return.

That’s assuming that the current correction in the stock market remains in single digits, and doesn’t explode into a full-blown bear market.

There are many things that can go right with (SCHW).

Of the major online brokers, Charles Schwab pays the highest tax rate. With the least amount of international business, it is unable to hide billions of dollars tax-free offshore, as do (GS), (MS), (BAC), and (C).

It therefore pays the highest tax rate of the major financials and will be the most to benefit from any tax cut, if and when that ever happens.

Big funds have been soaking up the stock all year.

That leads to the second play. With the smallest amount of international earnings, the company will suffer the least from a coming weak US dollar.

With 90-day US Treasury bill ticking at 5.39% this morning, the greenback will almost certainly remain strong for a few more months. Once the cuts start, look out below.

Since financials are the one sector most sensitive to interest rates, (SCHW) should do well when rates fall.

At a 4.70% ten-year yield, we are closer to the bottom in all fixed-income yields than the 2020 top at 0.32%.

Personally, I don’t think the ten-year will go any lower than 5.10% in this cycle.

Here is the fourth reason to pick up some (SCHW).

When my New American Golden Age resumes, stock markets will rise threefold and volumes will explode.

The retail investor will make a long-awaited return to investing in equities.

Ever wonder why your online brokers keep disappearing?

Why TradeMonster get taken over by Option House, which then was swallowed by E-Trade?

It’s the major players making bets that financials will become the top-performing sector of the next decade. Always follow the big money.

This makes Charles Schwab a takeover target.

And if Schwab doesn’t get bought out, it will benefit from reason number six, a huge concentration of the industry that will finally allow commissions to RISE instead of fall, as they have over the last four decades.

Reduced competition always leads to higher profits. If you’re not convinced look no further than the airline business.

Charles Schwab originally sprang from a well-written newsletter from the 1960s and is now both a bank and brokerage firm, based in San Francisco, California.

It was founded in 1971 by Charles R. Schwab and was one of the earliest discount brokerage houses. It is now one of the largest brokerage firms in the United States.

The company provides services for individuals and institutions that are investing online.

(SCHW) offers an electronic trading platform for the trade of common stocks, preferred stocks, futures contracts, exchange-traded funds, options, mutual funds, and fixed-income investments.

It also provides margin lending and cash management services. The company also provides services through registered investment advisers.

It is not cheap, with a price-earnings multiple of 31, but it does offer a dividend of 1.33%.

This is a market that is all about expensive stocks getting more expensive, which cheap stocks (retail) get cheaper.

(SCHW) total market capitalization stood at $110 billion at the end of trading yesterday.

Of course, there’s the seventh reason to buy the shares of Charles Schwab.

I have the box next to the one owned by (SCHW) founder and CEO Charles Schwab himself at the San Francesco Opera House.

At the intermission for the season opener for Puccini’s Turondot, I asked him what he thought about the price of his shares here.

All he would say was “I’m not selling”, and gave me a wink.

The last time I bet on a wink like that, I got a double in the shares.

That’s good enough for me.