When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

(AUSTRALIAN RED TAPE IS A REAL SPOILER FOR FOREIGN DATA CENTRE OPERATORS)

June 5, 2024

Hello everyone,

Established data centre operators in Australia have an economic moat. Red tape appears to be preventing foreign data centre owners from operating in Australia.

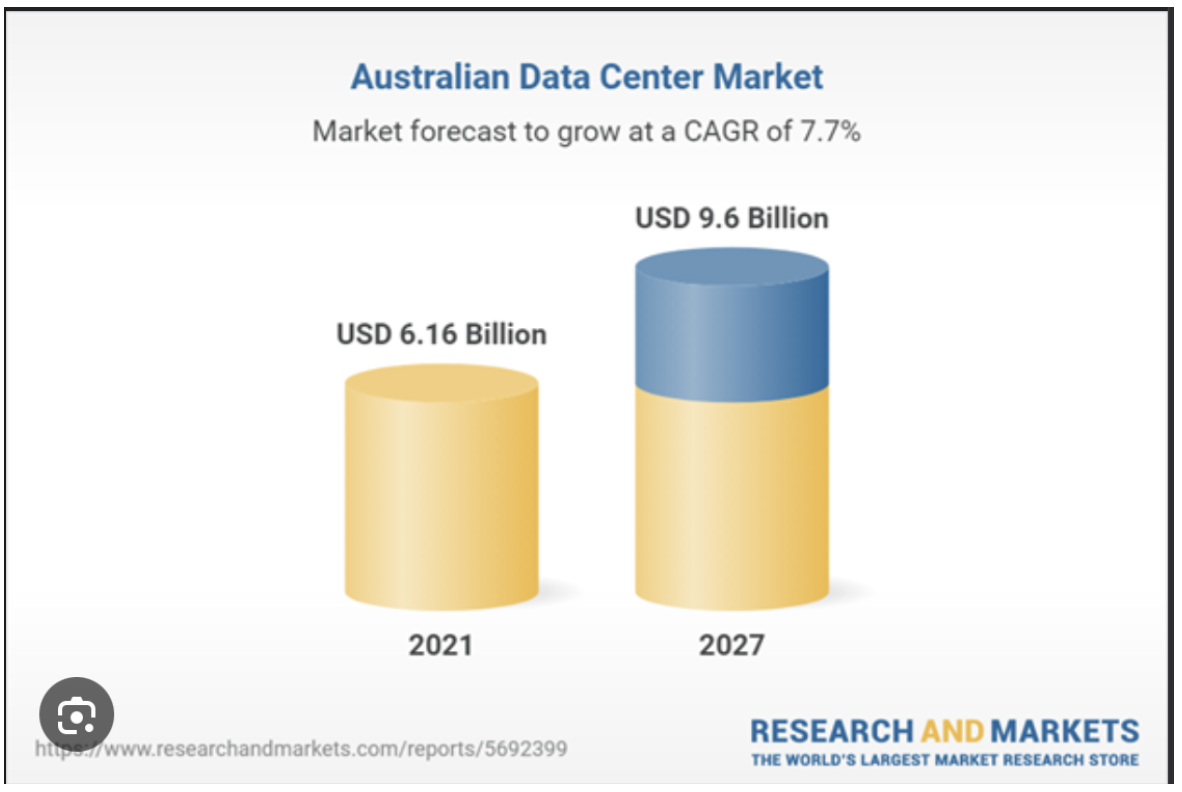

There is a growing appetite for more data storage and management, which is being pushed along by the AI technology revolution. Morgan Stanley points to the fact that Australian companies such as Goodman Group and NextDC have a special home advantage. They are potentially better positioned because they have significant, well-established land banks that hold large value.

Analysts at Morgan Stanley point to the challenging issues global competitors are encountering. Difficulties with working with local councils and utilities are stalling progress, and then there is the cost of development approvals and so on.

That advantage for existing Australian companies will provide attractive opportunities. Morgan Stanley expects data centre operators – the sector as a whole – to grow at a compound annual growth rate of 13% out to 2030.

It’s all good news for Goodman. Analysts at Morgan Stanley see the market pricing in a data centre pipeline of $9 billion, but it puts that figure at more like $20 billion.

Goodman also has significant flexibility with the land bank, where it can sell with approvals or develop the land to client specifications. Land that is developed into data centres is valued at a significant premium to that of typical industrial use, providing an attractive return-on-investment option should the company not want to hold the land long-term.

NextDC has a similar narrative to Goodman, with recent contracts confirmed and international expansion in the pipeline.

This sector has growth written all over it.

(This is an article of interest, not a recommendation to purchase Goodman Group or Next DC).

Natural disasters are a real threat to a large percentage of Australian properties.

Consider this scenario. You have finally purchased your home. And for a while, all is well in your world. Then a natural disaster strikes. Suddenly, everything is not so rosy anymore. Are you insured? If you are insured, will the insurance company cover all costs?

In Australia, many properties are at risk of being severely damaged or lost to a natural disaster. And what makes the situation even worse is the fact that premiums are so high that many have chosen not to insure. On top of that, in some areas that have a high flood risk, insurers may be unlikely to insure your property anyway.

Research shows that half of all Australian homes are at risk of natural disasters. 5.6 million properties are at risk of bushfires, almost 1 million are at risk of floods and thousands more are threatened by coastal erosion.

The NSW suburb of Ballina has the highest flood risk in the country. Victoria’s Upper Yarra Valley has the highest bushfire risk and Queensland’s Surfers Paradise has the biggest coastal erosion threat.

From my research, it seems many Australians are unaware of the dangers and have become very complacent.

QI CORNER

Cheers,

Jacquie

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

June 5, 2024

Fiat Lux

Featured Trade:

(JOIN ME ON CUNARDS QUEEN ELIZABETH FOR MY SATURDAY JUNE 29 ALASKA SEMINAR AT SEA),

(POPULATION BOMB ECHOES)

Come join me in the grand appointments of the Cunard Line’s Queen Elisabeth on an adventurous ten-day cruise through Alaska’s Inside Passage.

The Ship departs from Vancouver, Canada at 10:00 AM on Friday, June 21, 2024 and returns on Monday, July 1. The ship will make day stops at Ketchikan, the Tracy Arm Fjord to view a glacier, Juneau, Haines, the Hubbard Glacier, Sitka, and Victoria. There will be two full days at sea in the North Pacific.

There, I will be conducting the Mad Hedge Fund Trader’s Strategy Luncheon where I will discuss the future of the global financial markets.

I’ll be giving you my up-to-date view on stocks, bonds, currencies, commodities, precious metals, energy, and real estate. I’ll highlight the best long and short opportunities.

And to keep you in suspense, I’ll be tossing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $499 for the seminar only.

Attendees will be responsible for booking their own cabin through Cunard. They offer everything from an inside stateroom from $799 per person to $26,780 for Q1 deluxe two-bedroom apartment with its own gym and two butlers.

Just visit their website by clicking here or call them directly at 800-528-6273 to make your own arrangements. Only reserve cruise number Q420.

The weather this time of year can range from balmy to tempestuous, depending on our luck. A brisk walk three times around the boat deck adds up to a mile. Full Internet access will be available, for a price, to follow the markets.

Two dinners during the voyage will be black tie, so bring two tuxes or formal dresses. Don’t forget to bring your Dramamine and sea legs, although the ten-year-old, 932-foot-long $1 billion ship is so big I doubt you’ll need them.

The event will be held at the ship’s luxurious Owners Suite, the details of which will be emailed to you with your purchase confirmation.

I look forward to meeting you and thank you for supporting my research.

To purchase tickets for this luncheon, please click here or click the BUY NOW! button above.

Pack your portfolios with agricultural plays like Mosaic (MOS) if Dr. Paul Ehrlich is just partially right about the impending collapse of the world’s food supply.

You might even throw in long positions in wheat (WEAT), corn (CORN), soybeans (SOYB), and rice.

It says a lot that when I update a sector report like this and half the companies have disappeared from takeovers (Potash and Agrium), you should take notice.

The never-dull and often controversial Stanford biology professor told me he expects that global warming is leading to significant changes in world weather patterns that will cause droughts in some of the largest food-producing areas, causing massive famines. Food prices will skyrocket, and billions could die.

At greatest risk are the big rice-producing areas in South Asia, which depend on glacial runoff from the Himalayas. If the glaciers melt, this crucial supply of fresh water will disappear.

California faces a similar problem if the Sierra snowpack fails to show up in sufficient quantities, as it has done in five of the last six years.

Rising sea levels displacing 500 million people in low-lying coastal areas is another big problem.

One of the 92-year-old professor’s early books The Population Bomb was required reading for me in college in the 1960s, and I used to drive up from Los Angeles to Palo Alto just to hear his lectures (followed by the obligatory side trip to the Haight-Ashbury).

Other big risks to the economy are the threat of a third-world nuclear war caused by population pressures, and global insect plagues facilitated by a widespread growth of intercontinental transportation and globalization.

And I won’t get into the threat of a giant solar flare frying our electrical grid. That is already well covered on the Internet.

“Super consumption” in the US needs to be reined in where the population is growing the fastest. If the world adopts an American standard of living, we need four more Earths to supply the needed natural resources.

We must raise the price of all forms of carbon, preferably through taxes, but cap and trade will work too. Population control is the answer to all of these problems, which is best achieved by giving women education, jobs, and rights, has already worked well in Europe and Japan, and is now unfolding in Latin America.

All sobering food for thought. I think I’ll skip that Big Mac for lunch.

Is There Room for Me?

“The circulation of confidence is better than the circulation of money,” said President James Madison, America’s fourth president.

Mad Hedge Biotech and Healthcare Letter

June 4, 2024

Fiat Lux

Featured Trade:

(FROM PETRI DISH TO PERSONALIZED PRESCRIPTION)

(RXRX), (SDGR), (RLAY), (EXAI), (ABCL), (AMS: BAI), (NVDA), (IBM), (MSFT)

Remember the last time you had to pop a pill that felt like a one-size-fits-all solution? I sure do. It was for a nagging cough, and while it did the trick, the side effects left me feeling like I'd been hit by a truck.

Turns out, Big Pharma is facing its own kind of side effects. They spend an average of $2.6 billion and over a decade to bring a new drug to market. That's like betting on a long shot at the Kentucky Derby, but with way worse odds.

But what if we could change the game entirely? What if drug discovery wouldn’t solely be about blindly mixing chemicals and hoping for the best.

Instead, picture a super-smart robot scientist, capable of reading millions of pages of medical research in seconds, understanding how different molecules interact, and even predicting which ones might be effective against a disease.

This AI-powered scientist could then design experiments to test those molecules, analyze the results, and even create new molecules from scratch, tailored to specific diseases and individual patients.

That's the promise of autonomous drug discovery.

While we've already seen robots and miniaturization speed up the drug discovery process, AI is taking it to the next level. I’m talking about AI agents running the entire show, from brainstorming biological theories to designing and running experiments, all with barely a human finger lift.

This isn't just about efficiency. It's a veritable gold mine of benefits: costs slashed, development times cut down, success rates skyrocketing, and a productivity boost that could revolutionize personalized medicine. And why does that matter?

Because it means treatments that are more effective, safer, and tailored to your unique genetic makeup, medical history, and lifestyle. Imagine popping a pill that's not just designed to treat your disease, but designed specifically for you. That's the kind of future autonomous drug discovery could deliver.

Imagine a world where your next prescription is fine-tuned to your genetic makeup, your medical history, your lifestyle. Sounds like bespoke tailoring, but for your health.

And this isn't just hype – it's backed by hard numbers. A recent study by McKinsey & Company found that AI-enabled drug discovery could potentially generate up to $50 billion in annual value by 2026.

The study also highlighted that AI could reduce the time required for drug discovery by up to 50%, while also improving the success rate of clinical trials.

These aren’t merely some abstract predictions either. In fact, some companies are already making waves in this new world of drug discovery.

Recursion Pharmaceuticals (RXRX), for example, is at the forefront of these innovations. They've developed a radical new drug discovery platform that combines advanced robotics, experimental biology, and machine learning to rapidly identify potential new treatments for a wide range of diseases.

Forget dusty labs and slow, painstaking research. Recursion's approach is like giving Sherlock Holmes a supercomputer to solve medical mysteries, and the results speak for themselves: over 2,000 novel biological relationships discovered and a mind-boggling 150 terabytes of relatable biological data generated.

That's the equivalent of roughly 30 million songs, all focused on cracking the code of human biology and disease.

Recursion isn't the only player here. A slew of innovative companies are riding the AI wave, reimagining the drug discovery landscape.

Schrödinger (SDGR) is turbocharging the process with AI and computational wizardry, using algorithms to predict how potential drugs will behave in the body before even stepping foot in a lab.

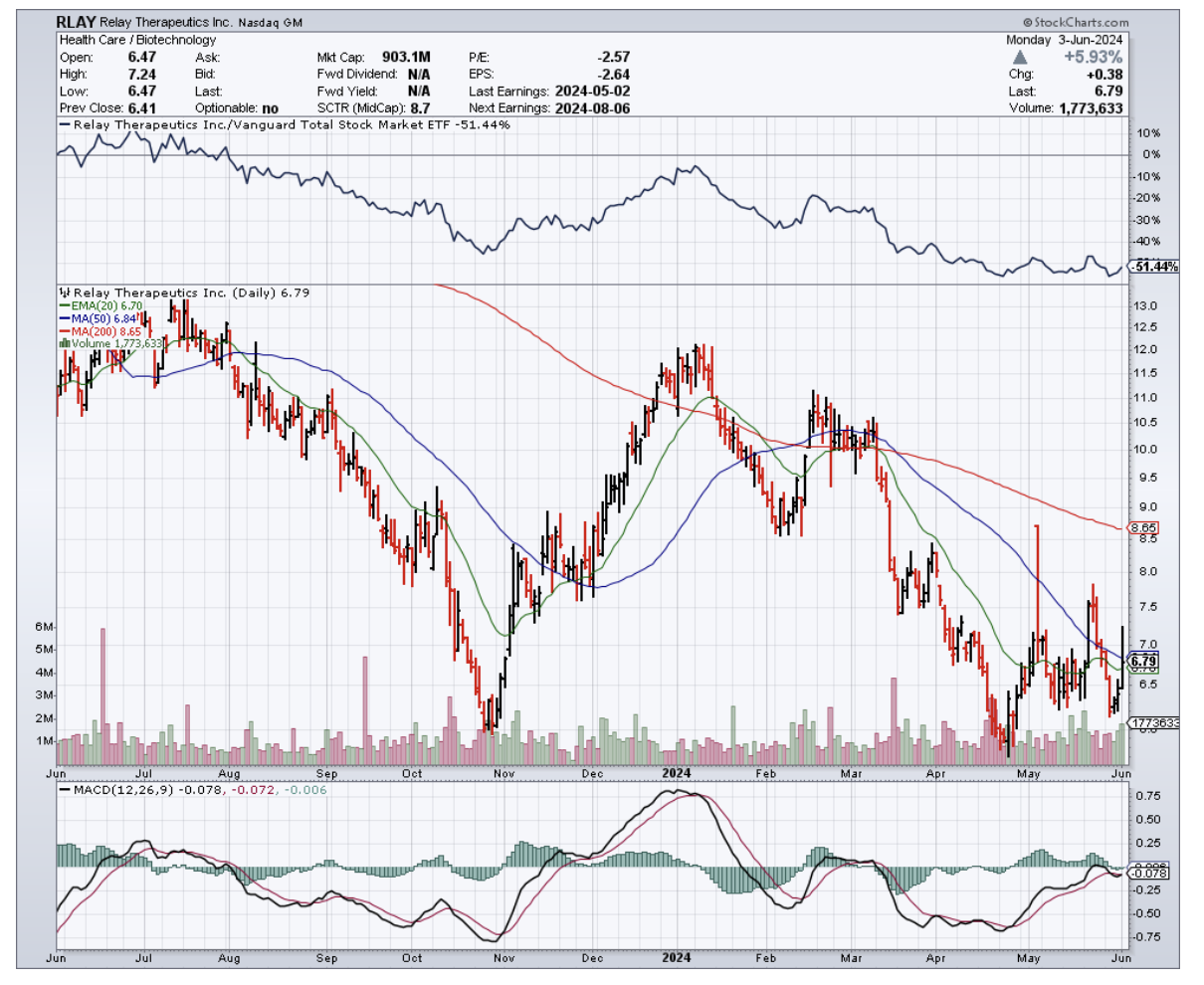

Relay Therapeutics (RLAY) is forging new paths by marrying cutting-edge computation with experimental techniques, focusing on how cancer cells move and change shape to develop targeted therapies.

Exscientia (EXAI), the AI-driven pharmatech company, is designing and discovering new drugs with unprecedented speed, while AbCellera Biologics (ABCL) is harnessing the power of AI and machine learning to decode the secrets of our immune systems, hunting for antibodies that could be developed into life-saving drugs. It’s basically like having a crack team of digital detectives scouring your immune system for clues to fight off diseases.

Meanwhile, BenevolentAI (AMS: BAI) is the top name when it comes to clinical-stage AI drug discovery, using a potent combination of AI, machine learning, and cutting-edge science to unravel the complexities of disease biology and unearth novel treatments. They're not simply content with throwing darts at a target. This company is using AI to pinpoint the bullseye.

But, this AI-powered revolution of the healthcare world isn't happening in a vacuum. It's being supercharged by a tag team of tech titans who are bringing their AI firepower to the table.

Think of it as the Avengers assembling to fight disease, but instead of superpowers, they're armed with algorithms and cloud computing.

Nvidia Corporation (NVDA), IBM Corporation (IBM), and Microsoft Corporation (MSFT) are leading the charge, providing the AI muscle needed to accelerate drug discovery.

Nvidia's Clara Discovery platform, IBM Watson Health, and Microsoft Azure's AI and machine learning services are all being harnessed to build, train, and deploy AI models for a wide range of applications in the biotech and healthcare sectors. It's like having Tony Stark, Bruce Banner, and Thor all working together to create the next medical breakthrough.

And this isn't some wishful thinking. The use of AI in biopharma R&D is projected to skyrocket, growing at a compound annual growth rate of 30% to 40% over the next five years.

Plus, the impact could be huge: AI could potentially boost clinical trial efficiency by 15% to 20% and slash the overall cost of drug development by 10% to 15%. Talk about a win-win situation.

All in all, it’s clear that this AI drug discovery thing isn't just a fad. It's a full-blown revolution that's shaking up the healthcare world as we know it. And while it's still in the early innings, it would be wise to keep a close eye on it. I'm not saying you should throw all your money in right this second, but seriously, put the companies above on your radar.

These are the trailblazers leading the charge into the future of personalized medicine. Who knows, they might just be the ticket to a healthier portfolio—and a healthier you.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.